|

市场调查报告书

商品编码

1911476

日本网路安全市场:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Japan Cybersecurity - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

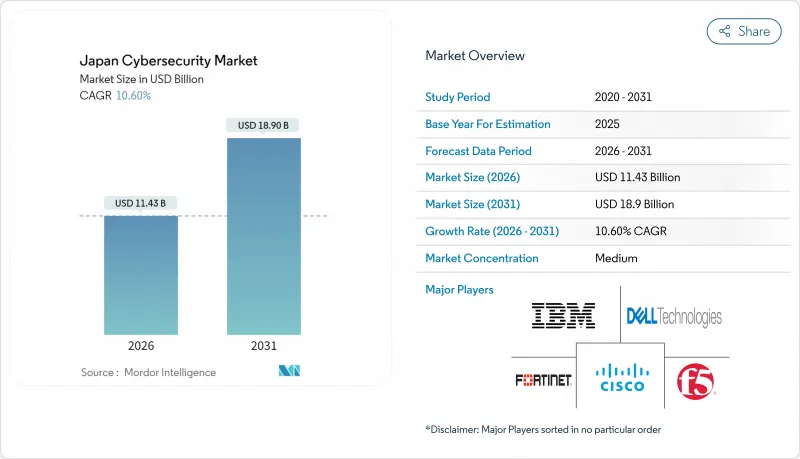

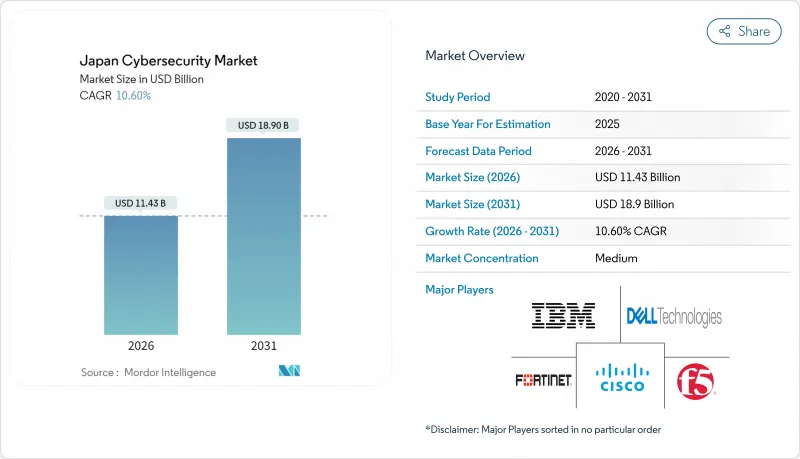

预计到 2025 年,日本网路安全市场规模将达到 103.4 亿美元,到 2026 年将成长至 114.3 亿美元,到 2031 年将成长至 189 亿美元,预测期(2026-2031 年)的复合年增长率为 10.60%。

这一增长得益于公共和私人部门的支出,这些支出优先用于加强主权安全能力、推进零信任实施时间表以及加速云端迁移。其他驱动因素包括东京证券交易所强制要求揭露网路风险、人工智慧驱动的威胁升级以及5G智慧工厂的推广。政府透过数位机构增加资本支出,以及诸如2025年大阪-关西世博会等区域性计划,将扩大高阶威胁侦测平台和託管服务的需求基础。由于主要企业将合规专业知识与整合平台结合,以抵御全球供应商的竞争,市场竞争仍然温和。

日本网路安全市场趋势与洞察

日本政府在数位机构成立后资本支出激增

2021年数位机构的成立标誌着一个转捩点。 2025年,国防费用将增加至8.5兆日元,网路安全基础设施的专案预算拨款也将从军事计划扩展到云端平台、电子签章系统和供应链安全标准等领域。采购法规将强制要求遵守严格的加密和事件回应标准,这将刺激企业对即将推出的政府云端上运作的自主解决方案的需求。

关键基础设施零信任强制指南(将于2026年实施)

2024年10月,日本金融厅(FSA)发布了177项规定,要求银行、保险公司和支付服务提供者加强身分验证管理,建立第三方风险监控系统和持续监控系统。日本经济产业省(METI)的平行评级架构将这些义务扩展至供应链合作伙伴,加速了製造业和能源领域的零信任试点计画。早期采用者报告称,风险控制速度更快,审核成本更低,从而加快了其引进週期。

网路安全人才严重短缺推高了安全营运中心(SOC)服务成本。

经济产业省估计,目前约有11万名从业人员缺口,迫使服务供应商提高安全营运中心(SOC)的工时费并延长部署等待时间。语言障碍和基于工作年限的招募做法阻碍了海外人才的快速引进。计画中的培训计画旨在2030年将认证专业人员的数量增加到5万人,但预计未来十年薪资上涨的压力将持续存在。

细分市场分析

截至2025年,解决方案领域占据了日本网路安全市场份额的59.27%,这主要得益于整合了端点、云端和身分保护功能的套件。大规模买家倾向于选择整合式主机,以减轻人员配置压力并简化合规性审核。虽然网路防火墙和入侵防御系统仍然占据较大份额,但成长重心正转向软体定义控制和人工智慧驱动的分析。随着零信任目标的逐步实现,身分和存取管理工具正迅速普及。日本本土厂商FFRI报告称,由于国内软体需求旺盛,其营业利润成长了64.1%。

预计到2031年,资安管理服务,尤其是MDR(威胁侦测与回应)和SOC即服务(安全营运中心即服务),将以13.62%的复合年增长率快速成长。买家指出,人才短缺和全天候监控的需求是推动成长的主要因素。专业服务、风险评估、穿透测试和合规性映射也正经历类似的成长。日本系统整合商正与超大规模资料中心业者服务供应商合作,签订包含云端取证的事件回应服务包。整体趋势是从一次性授权转向经常性业务收益,从而提高客户黏着度和深化资料共用。

由于采用订阅模式和弹性扩展的优势,到2025年,云端解决方案将占据日本网路安全市场54.90%的份额。联合身分识别服务和持续补丁管线能够跟上人工智慧增强型威胁带来的快速变化。政府的云端政策,包括一项725亿日圆的国内设施计划,进一步凸显了云端迁移的迫切性。金融机构正根据金融厅的指南,将保险箱应用程式迁移到强化型虚拟私有云端,这些方针允许在基于风险的管理下使用云端服务。

在资料居住和超低延迟要求至关重要的领域,尤其是在国防和关键基础设施领域,本地部署仍将继续。混合环境将作为一种可行的桥樑而扩展,敏感资料隔离在私有丛集集中,而分析工作负载则位于公共云端中。供应商正在透过提供涵盖 Kubernetes、虚拟机器和传统伺服器的单一策略引擎来应对这一需求。在跨环境实施统一资产清单后,客户回馈驻留时间缩短,回滚速度加快。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 日本政府在数位机构成立后资本投资激增

- 关键基础设施强制零信任准则(到2026年)

- 生成式人工智慧扩大了企业范围内的攻击面

- 智慧工厂(尤其是中部地区)5G专用网路采用现状

- 东京证券交易所网路风险揭露规则推动支出成长

- 为2025年大阪关西世博会实现传统营运技术现代化

- 市场限制

- 网路安全人才严重短缺推高了安全营运中心(SOC)服务成本。

- 多层流通结构正在推高中小型企业解决方案的价格。

- 保守的企业文化阻碍了零信任理念的普及。

- 儘管有经济产业省的补贴,小型企业基础仍分散。

- 关键法规结构评估

- 产业价值链分析

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 主要用例和案例研究

- 宏观经济因素对市场的影响

- 投资分析

第五章 市场区隔

- 报价

- 解决方案

- 应用程式安全

- 云端安全

- 资料安全

- 身分和存取管理

- 基础设施保护

- 综合风险管理

- 网路安全设备

- 端点安全

- 其他解决方案

- 服务

- 专业服务

- 託管服务

- 解决方案

- 透过部署模式

- 本地部署

- 云

- 按最终用户行业划分

- BFSI

- 卫生保健

- 资讯科技和电信

- 工业与国防

- 製造业

- 零售与电子商务

- 能源与公共产业

- 製造业

- 其他终端用户产业

- 按最终用户公司规模划分

- 中小企业

- 大公司

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Trend Micro Inc.

- NEC Corporation

- NTT Security Holdings

- Fujitsu Ltd.

- Cisco Systems Inc.

- IBM Corporation

- Dell Technologies Inc.

- Fortinet Inc.

- Palo Alto Networks

- Check Point Software Tech.

- CrowdStrike Holdings

- Rapid7 Inc.

- Secure Brain Corporation

- Macnica Networks Corp

- LAC Co., Ltd.

- FFRI Security, Inc

- Cyberreason Inc.(JP)

- SoftBank Technology Corp.

- NS Solutions Corp.

- Hitachi Systems Ltd.

第七章 市场机会与未来展望

The Japan cybersecurity market was valued at USD 10.34 billion in 2025 and estimated to grow from USD 11.43 billion in 2026 to reach USD 18.9 billion by 2031, at a CAGR of 10.60% during the forecast period (2026-2031).

The uplift rests on public-private spending that prioritizes sovereign security capabilities, zero-trust adoption timelines, and rapid cloud migration. Mandatory cyber-risk disclosures on the Tokyo Stock Exchange, AI-driven threat escalation, and 5G-enabled smart-factory rollouts add further momentum. Heightened government capital expenditure channeled through the Digital Agency, coupled with region-specific projects such as the Osaka-Kansai Expo 2025, enlarges the demand pool for advanced threat-detection platforms and managed services. Competitive intensity remains moderate as domestic champions defend share against global suppliers by bundling compliance knowledge with integrated platforms.

Japan Cybersecurity Market Trends and Insights

Japanese Government CAPEX Surge Post-Digital Agency Formation

The 2021 launch of the Digital Agency signalled an inflection point. National defence outlays climbed to 8.5 trillion yen in 2025, and explicit earmarks for cybersecurity infrastructure moved well beyond military projects into cloud platforms, electronic signature systems, and supply-chain security criteria.Procurement rules now require compliance with stringent encryption and incident-response benchmarks, stimulating enterprise demand for sovereign solutions that can reside on forthcoming government clouds.

Mandatory Zero-Trust Guidelines for Critical Infrastructure by 2026

The Financial Services Agency issued a 177-point rule set in October 2024 that forces banks, insurers, and payment operators to harden identity controls, third-party risk oversight, and continuous monitoring regimes. Parallel grading frameworks from METI extend the obligation to supply-chain partners, accelerating zero-trust pilots in manufacturing and energy corridors. Early adopters report shorter containment times and audit cost reductions, reinforcing the adoption cycle.

Acute Cyber-Talent Shortage Inflating SOC Service Costs

METI estimates a gap of roughly 110,000 practitioners, forcing providers to raise hourly SOC tariffs and elongate onboarding queues. Language barriers and seniority-based hiring norms hinder quick relief from overseas recruitment. Planned training programs aim to lift the pool of certified experts to 50,000 by 2030, yet wage inflation is likely to persist into the next decade.

Other drivers and restraints analyzed in the detailed report include:

- Generative-AI-Driven Attack Surface Expansion Across Enterprises

- 5G Private-Network Roll-outs in Smart Factories, Especially Chubu

- Conservative Corporate Culture Slows Zero-Trust Adoption

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions retained 59.27% of Japan cybersecurity market share in 2025 thanks to integrated suites that bundle endpoint, cloud, and identity safeguards. Large buyers gravitate to unified consoles that alleviate head-count constraints and simplify compliance audits. Network firewalls and intrusion-prevention systems still occupy sizeable allocations, yet growth tilts toward software-defined controls and AI-powered analytics. Identity and access management tools saw a sharp uptake as zero-trust milestones came into view, with domestic vendor FFRI reporting 64.1% operating-profit growth on sovereign software demand.

Managed security lines, particularly MDR and SOC-as-a-service, post the fastest 13.62% CAGR through 2031. Buyers cite the talent deficit and round-the-clock monitoring needs as catalysts. Professional services, risk assessments, penetration testing, and compliance mapping-ride the same wave. Domestic system integrators partner with hyperscalers for incident-response retainers that embed cloud forensics. The overarching shift pivots from one-off licences to recurring service revenue, deepening stickiness and data-sharing depth.

Cloud options captured 54.90% of the Japan cybersecurity market size in 2025 on the strength of subscription economics and elastic scaling. Federated ID services and continual patch pipelines answer the speed-of-change demanded by AI-enhanced threats. Government cloud directives, including a 72.5 billion-yen domestic facility programme, reinforce migration urgency. Financial operators align with FSA guidance that permits cloud use under risk-based controls, prompting institutions to shift vault applications to hardened virtual private clouds.

On-premise installations persist where data-residency or ultra-low-latency requirements prevail, notably in defence and critical infrastructure. Hybrid estates grow as a pragmatic bridge, with sensitive data fenced in private clusters while analytic workloads sit in public clouds. Vendors respond by offering single policy engines that span Kubernetes, virtual machines, and legacy servers. Customers report lower dwell times and quicker rollback after adopting unified asset inventories across environments.

The Japan Cybersecurity Market Report is Segmented by Offering (Solutions, and Services), Deployment Mode (On-Premise, and Cloud), End-User Vertical (BFSI, Healthcare, IT and Telecom, Industrial and Defense, Manufacturing, Retail and E-Commerce, Energy and Utilities, Manufacturing, and Others), and End-User Enterprise Size (SMEs, and Large Enterprises). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Trend Micro Inc.

- NEC Corporation

- NTT Security Holdings

- Fujitsu Ltd.

- Cisco Systems Inc.

- IBM Corporation

- Dell Technologies Inc.

- Fortinet Inc.

- Palo Alto Networks

- Check Point Software Tech.

- CrowdStrike Holdings

- Rapid7 Inc.

- Secure Brain Corporation

- Macnica Networks Corp

- LAC Co., Ltd.

- FFRI Security, Inc

- Cyberreason Inc. (JP)

- SoftBank Technology Corp.

- NS Solutions Corp.

- Hitachi Systems Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Japanese Government CAPEX Surge Post-Digital Agency Formation

- 4.2.2 Mandatory Zero-Trust Guidelines for Critical Infrastructure by 2026

- 4.2.3 Generative-AI-Driven Attack-Surface Expansion Across Enterprises

- 4.2.4 5G Private-Network Roll-outs in Smart-Factories, Especially Chubu

- 4.2.5 Tokyo Stock Exchange Cyber-Risk Disclosure Rules Boost Spending

- 4.2.6 Legacy OT Modernisation Ahead of Osaka-Kansai Expo 2025

- 4.3 Market Restraints

- 4.3.1 Acute cyber-talent shortage inflating SOC service costs

- 4.3.2 Multi-tier Channel Structure Inflating SME Solution Pricing

- 4.3.3 Conservative Corporate Culture Slows Zero-Trust Adoption

- 4.3.4 Fragmented SME Base Despite METI Subsidies

- 4.4 Evaluation of Critical Regulatory Framework

- 4.5 Industry Value Chain Analysis

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Key Use Cases and Case Studies

- 4.9 Impact on Macroeconomic Factors of the Market

- 4.10 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Offering

- 5.1.1 Solutions

- 5.1.1.1 Application Security

- 5.1.1.2 Cloud Security

- 5.1.1.3 Data Security

- 5.1.1.4 Identity and Access Management

- 5.1.1.5 Infrastructure Protection

- 5.1.1.6 Integrated Risk Management

- 5.1.1.7 Network Security Equipment

- 5.1.1.8 Endpoint Security

- 5.1.1.9 Other Solutions

- 5.1.2 Services

- 5.1.2.1 Professional Services

- 5.1.2.2 Managed Services

- 5.1.1 Solutions

- 5.2 By Deployment Mode

- 5.2.1 On-Premise

- 5.2.2 Cloud

- 5.3 By End-User Vertical

- 5.3.1 BFSI

- 5.3.2 Healthcare

- 5.3.3 IT and Telecom

- 5.3.4 Industrial and Defense

- 5.3.5 Manufacturing

- 5.3.6 Retail and E-commerce

- 5.3.7 Energy and Utilities

- 5.3.8 Manufacturing

- 5.3.9 Other End-User Vertical

- 5.4 By End-User Enterprise Size

- 5.4.1 Small and Medium Enterprises (SMEs)

- 5.4.2 Large Enterprises

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Trend Micro Inc.

- 6.4.2 NEC Corporation

- 6.4.3 NTT Security Holdings

- 6.4.4 Fujitsu Ltd.

- 6.4.5 Cisco Systems Inc.

- 6.4.6 IBM Corporation

- 6.4.7 Dell Technologies Inc.

- 6.4.8 Fortinet Inc.

- 6.4.9 Palo Alto Networks

- 6.4.10 Check Point Software Tech.

- 6.4.11 CrowdStrike Holdings

- 6.4.12 Rapid7 Inc.

- 6.4.13 Secure Brain Corporation

- 6.4.14 Macnica Networks Corp

- 6.4.15 LAC Co., Ltd.

- 6.4.16 FFRI Security, Inc

- 6.4.17 Cyberreason Inc. (JP)

- 6.4.18 SoftBank Technology Corp.

- 6.4.19 NS Solutions Corp.

- 6.4.20 Hitachi Systems Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment