|

市场调查报告书

商品编码

1911824

欧洲摩托车市场份额分析、行业趋势、统计数据和成长预测(2026-2031)Europe Two-Wheeler - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

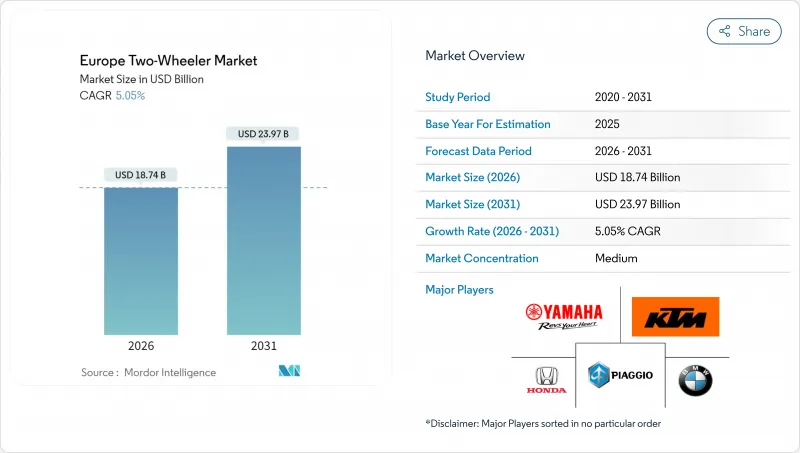

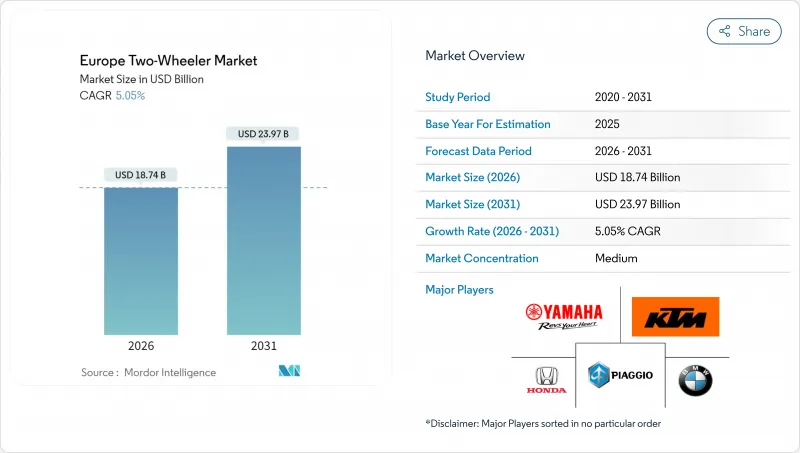

欧洲摩托车市场预计将从 2025 年的 178.4 亿美元成长到 2026 年的 187.4 亿美元,预计到 2031 年将达到 239.7 亿美元,2026 年至 2031 年的复合年增长率为 5.05%。

这一成长势头得益于欧5+排放标准的实施、蓬勃发展的配送经济以及欧盟对区域电池供应网路的资助。摩托车凭藉其在高速公路上的多功能性保持主导地位,而Scooter则在人口密集的城市中心占据一席之地。透过电池更换网路降低前期成本,以及都市区清洁空气区对内燃机车型的更严格监管,正推动电动动力系统从利基市场走向主流市场。价格两极化日益加剧:售价低于1000美元的入门级Scooter继续吸引着广泛的消费群体,而售价高于3001美元的高端电动机车则经历了最快的增长,这主要得益于追求互联功能、安全技术和订阅式驱动系统的骑行者对更换的需求。市场竞争较为温和,老牌企业依赖经销商网路和品牌资产,而专业电动摩托车製造商则利用直销通路和模组化软体更新来缩短车型週期。

欧洲摩托车市场趋势与洞察

电子商务配送车队快速扩张,需要总拥有成本(TCO)低的摩托车。

网路购物的兴起使摩托车成为最后一公里物流的核心组成部分。亚马逊在欧洲的配送合作伙伴网路规模庞大,截至2024年已超过13,000家。车队采购商优先考虑坚固的车架、远端资讯处理系统和可更换电池等特性,以最大限度地减少停机时间。由于总拥有成本超过购买价格,建议零售价较高的电动Scooter也受到青睐。配送公司纷纷下达包含服务合约的大额订单,迫使原始设备製造商(OEM)提供模组化电池组和预测性维护应用程式介面(API)。这种商业性模式的转变使需求不再局限于休閒骑乘者,有助于在经济放缓期间增强欧洲摩托车市场的韧性。

欧盟5+排放过渡引发购车领先准备与车型更新换代

欧盟5+排放法规迫使製造商加快引擎升级和电气化进程,导致消费者在价格上涨前抢购旧款车型,造成暂时的购买冻结。在清理旧款库存的同时,原始设备製造商(OEM)也在推广符合欧盟5+排放标准的高阶车型,并享受暂时的利润提升,这将有助于未来电动车型的资金筹措。该法规对主流的126-150cc等级车型影响尤为显着,促使製造商快速更新换代,并刺激了对符合排放标准的废气后处理系统的需求。经销商报告称,在2025年新规生效前,展示室客流量有所增加,这不仅提振了短期销量,也加速了向零排放产品的长期转型。

锂现货价格的波动会影响电动车製造商建议零售价的稳定性。

2024年碳酸锂价格的波动迫使製造商在每月调整价格和承受利润率压力之间做出选择。虽然避险协议可以缓解部分价格飙升,但小规模、专注于特定领域的电动车製造商由于财务基础薄弱,面临生产延误的风险。电池化学研发正在探索富锰正极材料以减少锂的使用量,但预计实用化要到2026年或更晚才能实现。

细分市场分析

2025年,摩托车将占欧洲两轮车市场的81.02%,这反映了其在通勤和休閒旅行方面的多功能性。引擎效率的提高和安全电子设备的进步使其在爱好者中保持了高人气,而高端探险和运动车型则推高了平均售价。儘管基数较小,但Scooter的复合年增长率仍达到7.9%,这主要得益于大都会圈拥堵费、停车位短缺以及电子商务配送需求的成长。电动Scooter在都市区车队竞标占据主导地位,因为简化的动力系统减少了维修停机时间,并增强了商业性优势。製造商正瞄准没有车库插座的公寓居住者,推出可拆卸电池的Scooter。随着越来越多的城市限制高排放气体区域,Scooter的註册量正从传统的南欧市场扩展到德国和北欧国家,从而缩小了与摩托车销售的差距。

到2025年,内燃机摩托车仍将占据欧洲摩托车市场90.86%的份额,这得益于现有的基础设施和久经考验的可靠性。符合欧盟5+排放标准的引擎在降低排放气体的同时,并未牺牲高速公路性能,因此能够满足乡村和旅行骑行者的需求。电动车将保持9.14%的市场份额,但由于充电网路的扩展和换电站的增加,其复合年增长率将达到6.88%。随着都市区对符合低排放气体标准的内燃机摩托车征收越来越多的课税甚至禁止其通行,电动车正逐渐成为城市通勤和配送工作的主流选择。包含能源、保险和维护的订阅套餐可以抵消高成本。快速充电桩的缺乏减缓了电动车在农村地区的普及速度,但计画中的欧盟替代燃料走廊有望从2027年起缩小这一差距。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章:主要产业趋势

- 人口和都市化

- 人均GDP(购买力平价)和可支配所得中位数

- 消费者在汽车购买和交通上的支出(CVP)

- 燃油价格

- 摩托车和汽车贷款利率及融资管道

- 摩托车普及率和车辆拥有量

- 经销商和服务网路密度

- 摩托车贸易及收入(进口/出口)

- 电气化现况(基础设施和电力)

- 电池组价格和化学成分组合

- 电池更换站(网路密度和利用率)

- 新车型管线和OEM覆盖范围

- 价值炼和组装能力的在地化

- 法律规范

- 车辆标准、安全性和道路适行性

- 整车/散装/半散的关税、增值税(VAT) 和在地采购含量 (LC) 法规

- 电气化、能源与环境政策

- 摩托车计程车、送货车辆和资金筹措的相关规定

第五章 市场情势

- 市场概览

- 市场驱动因素

- 在过渡到欧盟5+排放标准后,领先购买和车型更新将进行。

- 电子商务配送车队快速扩张,需要总拥有成本(TCO)低的两轮车。

- 电池更换经营模式降低了都市区用户的电动车初始成本

- 年轻一代偏好订阅制的旅行服务

- OEM模组化平台支援六个月的车型週期

- 根据欧盟净零排放产业法案为区域电池供应链网路提供资金

- 市场限制

- 25岁以下骑士的保险费很高

- 加强对主要城市共享Scooter使用的限制

- 锂现货价格的波动会影响电动车製造商建议零售价的稳定性。

- 经销商网路整合会降低本地服务取得途径。

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 产业间竞争

第六章 市场规模及成长预测(价值及数量)

- 按车辆类型

- 摩托车

- Scooter

- 透过推广

- 内燃机(ICE)

- 电

- 按引擎排气量/马达输出功率

- 内燃机(ICE)

- 110cc或以下

- 111-125 cc

- 126-150 cc

- 151-200 cc

- 201-250 cc

- 250-350 cc

- 350-500 cc

- 500cc或以上

- 电

- 最大功率 1.0kW

- 1.1~3.0 kW

- 3.1~5.0 kW

- 5.0度或以上

- 内燃机(ICE)

- 按价格范围

- 低于1000美元

- 1000-1500美元

- 1501-2000美元

- 2001-3000美元

- 3001-5000美元

- 超过5000美元

- 最终用户

- B2C

- B2B

- 共乘/摩托车出租车/租赁/旅游

- 配送/物流

- 企业和小型企业车队

- 其他(政府/机构、非政府组织)

- 销售管道

- 在线的

- 离线

- 地区

- 德国

- 法国

- 义大利

- 西班牙

- 英国

- 荷兰

- 瑞典

- 波兰

- 奥地利

- 比利时

- 挪威

- 捷克共和国

- 葡萄牙

- 希腊

第七章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- BMW Motorrad

- Ducati Motor Holding SpA

- Harley-Davidson Inc.

- Honda Motor Co., Ltd.

- KTM AG

- Piaggio and C. SpA

- Royal Enfield(Eicher Motors)

- Suzuki Motor Corporation

- Triumph Motorcycles Ltd

- Yamaha Motor Co., Ltd.

- Niu Technologies

- Yadea Group Holdings Ltd

- Zero Motorcycles Inc.

- Kawasaki Motors Ltd

- Peugeot Motocycles

第八章:市场机会与未来展望

- 閒置频段与未满足需求评估

第九章:执行长面临的关键策略挑战

The Europe two-wheeler market is expected to grow from USD 17.84 billion in 2025 to USD 18.74 billion in 2026 and is forecast to reach USD 23.97 billion by 2031 at 5.05% CAGR over 2026-2031.

Momentum stems from Euro 5+ emission enforcement, the fast-growing delivery economy, and EU funding for local battery supply chains. Motorcycles are leading because of their highway versatility, while scooters are gaining ground in dense urban cores. Electric propulsion moves from niche to mainstream as battery-swap networks lower upfront cost and urban clean-air zones tighten rules on internal-combustion models. Price polarization grows: sub-USD 1,000 entry scooters sustain mass appeal, yet premium electric bikes above USD 3,001 post the sharpest gains as riders trade up for connectivity, safety tech, and subscription-ready drivetrains. Competition is moderate; legacy brands rely on dealer reach and brand equity, whereas electric specialists exploit direct-to-consumer channels and modular software updates to shorten model cycles.

Europe Two-Wheeler Market Trends and Insights

Rapid Expansion of E-Commerce Delivery Fleets Demanding Low-TCO 2Ws

Online shopping's rise places two-wheelers at the heart of last-mile logistics; Amazon's network of over 13,000 European delivery partners in 2024 typifies the scale. Fleet buyers favor robust frames, telematics, and battery-swap readiness to minimize downtime. Total cost of ownership now eclipses sticker price, making electric scooters preferable despite higher MSRP. Delivery operators lock in bulk orders with service contracts, pressuring OEMs to provide modular battery packs and predictive maintenance APIs. This commercial pivot diversifies demand beyond leisure riders and supports the European two-wheeler market's resilience during economic slowdowns.

Euro 5+ Emission Shift Triggering Pre-Buy and Model Refresh

Euro 5+ standards compel manufacturers to upgrade engines and accelerate electric programs, causing a short-lived pre-buy surge as riders lock in older models before price rises. OEMs clear legacy inventory while pushing premium Euro 5+ offerings, enjoying temporary margin lifts that help bankroll future electric lines. The regulation particularly influences the dominant 126-150 cc class, prompting rapid model cycles and fueling demand for compliant exhaust after-treatment systems. Dealers report elevated showroom traffic ahead of the 2025 enforcement window, reinforcing near-term volume but advancing the long-term shift toward zero-tailpipe-emission products.

Lithium-Spot-Price Volatility Hitting EV MSRP Stability

Lithium carbonate swung in 2024, forcing manufacturers either to re-price monthly or absorb margin hits. Hedging contracts mitigate some spikes, but smaller electric specialists lack balance-sheet heft, threatening production delays. Battery chemistry R&D seeks manganese-rich cathodes to reduce lithium intensity, yet commercialization lies beyond 2026.

Other drivers and restraints analyzed in the detailed report include:

- EU Net-Zero Industry Act Funding Local Battery Supply Chains

- OEM Modular Platforms Enabling 6-Month Model Cycles

- High Insurance Premiums for Below 25-Year-Old Riders

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Motorcycles controlled 81.02% of the European two-wheeler market share in 2025, reflecting their versatility for commuting and leisure touring. Continuous engine efficiency gains and safety electronics keep loyalists invested, while premium adventure and sport models lift average selling prices. Scooters, although smaller in base, deliver an 7.9% CAGR thanks to congestion charges, parking scarcity, and e-commerce courier demand in megacities. Electric scooters lead urban fleet tenders because simplified drivetrains trim service downtime, reinforcing their commercial edge. Manufacturers market detachable-battery scooters targeting apartment dwellers who lack garage outlets. As more cities restrict high-emission zones, scooter registrations broaden beyond traditional Southern European strongholds into Germany and the Nordics, closing the gap with motorcycle volumes.

Internal-combustion engines retain 90.86% of the European two-wheeler market share in 2025, buoyed by legacy infrastructure and proven reliability. Euro 5+ engines post cleaner emissions without compromising highway performance, keeping demand alive among rural and touring riders. Though with only an 9.14% share, electric variants post a 6.88% CAGR as charging grids densify and battery-swap nodes proliferate. Urban policies increasingly tax or ban low-Euro-class ICE bikes, making electric the default for city commuting and delivery jobs. Subscription bundles that wrap energy, insurance, and maintenance offset upfront battery premiums. Rural adoption lags as fast chargers remain sparse, but planned EU alternative-fuels corridors may narrow the divide after 2027.

The Europe Two-Wheeler Market Report is Segmented by Vehicle Type (Motorcycles and Scooters), Propulsion (ICE and Electric), Engine Capacity/Motor Power (Up To 110cc, and More), Price Band (Up To USD 1, 000, and More), End User (B2C and B2B), Sales Channel (Online and Offline), and by Country. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- BMW Motorrad

- Ducati Motor Holding S.p.A.

- Harley-Davidson Inc.

- Honda Motor Co., Ltd.

- KTM AG

- Piaggio and C. SpA

- Royal Enfield (Eicher Motors)

- Suzuki Motor Corporation

- Triumph Motorcycles Ltd

- Yamaha Motor Co., Ltd.

- Niu Technologies

- Yadea Group Holdings Ltd

- Zero Motorcycles Inc.

- Kawasaki Motors Ltd

- Peugeot Motocycles

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Key Industry Trend

- 4.1 Population and Urbanization Rate

- 4.2 GDP per Capita (PPP) and Median Disposable Income

- 4.3 Consumer Spend on Vehicle Purchase/Transport (CVP)

- 4.4 Fuel Prices

- 4.5 Interest Rate for 2-Wheeler/Auto Loans and Credit Access

- 4.6 2-Wheeler Penetration and Parc

- 4.7 Dealer/Service Network Density

- 4.8 Two-Wheeler Trade and Revenue (Imports/Exports)

- 4.9 Electrification Readiness (Infrastructure and Power)

- 4.10 Battery Pack Price and Chemistry Mix

- 4.11 Battery Swapping Stations (Network Density and Utilization)

- 4.12 New Model Pipeline and OEM Coverage

- 4.13 Value-Chain Localization and Assembly Capacity

- 4.14 Regulatory Framework

- 4.14.1 Vehicle Standards, Safety and Roadworthiness

- 4.14.2 CBU/CKD/SKD Duties, VAT and Local-Content Rules

- 4.14.3 Electrification, Energy and Environmental Policy

- 4.14.4 Rules for Bike-Taxi, Delivery Fleets and Financing

5 Market Landscape

- 5.1 Market Overview

- 5.2 Market Drivers

- 5.2.1 Euro 5+ Emission Shift Triggering Pre-Buy and Model Refresh

- 5.2.2 Rapid Expansion of E-Commerce Delivery Fleets Demanding Low-TCO 2Ws

- 5.2.3 Battery-Swap Business Models Lowering Up-Front EV Cost for Urban Users

- 5.2.4 Youth Preference for Subscription-Based Mobility Services

- 5.2.5 OEM Modular Platforms Enabling 6-Month Model Cycles

- 5.2.6 EU Net-Zero Industry Act Funding Local Battery Supply Chains

- 5.3 Market Restraints

- 5.3.1 High Insurance Premiums for Below 25-Year-Old Riders

- 5.3.2 Tightened Shared-Scooter Caps in Tier-1 Cities

- 5.3.3 Lithium-Spot-Price Volatility Hitting EV MSRP Stability

- 5.3.4 Dealer Network Consolidation Reducing Rural Service Access

- 5.4 Value / Supply-Chain Analysis

- 5.5 Regulatory Landscape

- 5.6 Technological Outlook

- 5.7 Porter's Five Forces

- 5.7.1 Threat of New Entrants

- 5.7.2 Bargaining Power of Suppliers

- 5.7.3 Bargaining Power of Buyers

- 5.7.4 Threat of Substitutes

- 5.7.5 Industry Rivalry

6 Market Size and Growth Forecasts (Value (USD) and Volume (Units))

- 6.1 By Vehicle Type

- 6.1.1 Motorcycles

- 6.1.2 Scooters

- 6.2 By Propulsion

- 6.2.1 Internal Combustion Engine (ICE)

- 6.2.2 Electric

- 6.3 By Engine Capacity / Motor Power

- 6.3.1 Internal Combustion Engine (ICE)

- 6.3.1.1 Up to110 cc

- 6.3.1.2 111-125 cc

- 6.3.1.3 126-150 cc

- 6.3.1.4 151-200 cc

- 6.3.1.5 201-250 cc

- 6.3.1.6 250-350 cc

- 6.3.1.7 350-500 cc

- 6.3.1.8 Above 500 cc

- 6.3.2 Electric

- 6.3.2.1 Up to 1.0 kW

- 6.3.2.2 1.1-3.0 kW

- 6.3.2.3 3.1-5.0 kW

- 6.3.2.4 Above 5.0 kW

- 6.3.1 Internal Combustion Engine (ICE)

- 6.4 By Price Band

- 6.4.1 Up to USD 1,000

- 6.4.2 USD 1,000-1,500

- 6.4.3 USD 1,501-2,000

- 6.4.4 USD 2,001-3,000

- 6.4.5 USD 3,001-5,000

- 6.4.6 Above USD 5,000

- 6.5 By End User

- 6.5.1 B2C

- 6.5.2 B2B

- 6.5.2.1 Ride-Hail / Bike-Taxi / Rental / Tourism

- 6.5.2.2 Delivery and Logistics

- 6.5.2.3 Corporate and SME Fleets

- 6.5.2.4 Others (Government and Institutional, NGO)

- 6.6 Sales Channel

- 6.6.1 Online

- 6.6.2 Offline

- 6.7 Geography

- 6.7.1 Germany

- 6.7.2 France

- 6.7.3 Italy

- 6.7.4 Spain

- 6.7.5 United Kingdom

- 6.7.6 Netherlands

- 6.7.7 Sweden

- 6.7.8 Poland

- 6.7.9 Austria

- 6.7.10 Belgium

- 6.7.11 Norway

- 6.7.12 Czech Republic

- 6.7.13 Portugal

- 6.7.14 Greece

7 Competitive Landscape

- 7.1 Market Concentration

- 7.2 Strategic Moves

- 7.3 Market Share Analysis

- 7.4 Company Profiles (Includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 7.4.1 BMW Motorrad

- 7.4.2 Ducati Motor Holding S.p.A.

- 7.4.3 Harley-Davidson Inc.

- 7.4.4 Honda Motor Co., Ltd.

- 7.4.5 KTM AG

- 7.4.6 Piaggio and C. SpA

- 7.4.7 Royal Enfield (Eicher Motors)

- 7.4.8 Suzuki Motor Corporation

- 7.4.9 Triumph Motorcycles Ltd

- 7.4.10 Yamaha Motor Co., Ltd.

- 7.4.11 Niu Technologies

- 7.4.12 Yadea Group Holdings Ltd

- 7.4.13 Zero Motorcycles Inc.

- 7.4.14 Kawasaki Motors Ltd

- 7.4.15 Peugeot Motocycles

8 Market Opportunities and Future Outlook

- 8.1 White-Space and Unmet-Need Assessment