|

市场调查报告书

商品编码

1665373

电子商务软包装市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测E-commerce Flexible Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

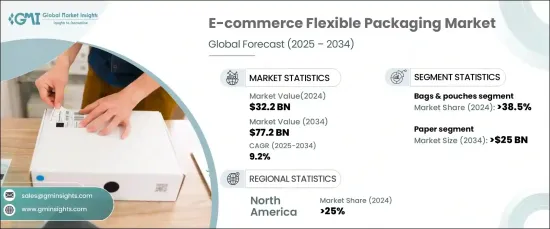

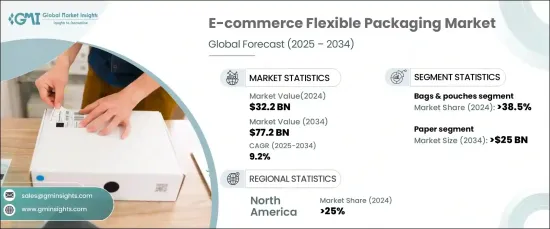

2024 年全球电子商务软包装市场价值为 322 亿美元,预计 2025 年至 2034 年期间将以 9.2% 的复合年增长率强劲增长。日益增强的环保意识也推动了永续材料的采用,例如可生物降解的塑胶和可重复使用的包装选择,为产业塑造更绿色的未来。

根据产品类型,市场分为袋子和小袋、胶带、包装和薄膜、邮寄袋和其他。其中,袋子和小袋占据主导地位,到 2024 年将占有 38.5% 的份额。越来越多的公司开始采用可回收和可生物降解的袋子等环保选择,以实现永续发展目标并吸引有环保意识的消费者。这些材料还透过提供客製化机会来支持品牌推广,同时最大限度地减少对环境的影响,使其成为当代电子商务企业的理想选择。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 322亿美元 |

| 预测值 | 772亿美元 |

| 复合年增长率 | 9.2% |

根据材料,市场分为塑胶、纸张和铝箔。预计纸张产业将以惊人的 10.5% 的复合年增长率成长,到 2034 年将达到 250 亿美元。纸质包装因可生物降解、可回收、来自可再生资源而受到好评,兼具强度和多功能性。它在企业中越来越有吸引力的原因在于它适用于包装服装、化妆品和食品等多种产品,兼具功能性和视觉吸引力,可增强品牌知名度。

2024 年,北美电子商务软包装市场将占据 25% 的份额,美国将成为主要的成长贡献者。美国对防篡改、儿童安全、永续包装解决方案的需求不断增长,推动了该行业的快速扩张。消费者对产品安全和环境责任意识的增强促使企业采用可回收塑胶和可生物降解材料。此外,环境进步国家的监管框架正在鼓励合规包装设计的创新,进一步推动该地区的市场成长。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 中断

- 未来展望

- 製造商

- 经销商

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 消费者对轻盈、耐用的包装解决方案的偏好日益增加

- 越来越多人采用纸质解决方案取代传统塑料

- 政府法规提倡使用可回收和可生物降解的包装材料

- 电子商务物流营运中越来越注重减少包装浪费

- 电子商务产业快速扩张

- 产业陷阱与挑战

- 电子商务运输过程中软包装的耐久性问题

- 部分软包装产品生命週期短

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按产品类型,2021-2034 年

- 主要趋势

- 包包和小袋

- 胶带

- 包装和薄膜

- 邮寄者

- 其他的

第 6 章:市场估计与预测:按材料,2021 年至 2034 年

- 主要趋势

- 塑胶

- 纸

- 铝箔

第 7 章:市场估计与预测:按最终用途产业,2021 年至 2034 年

- 主要趋势

- 食品和饮料

- 药品

- 消费品

- 个人护理和化妆品

- 服装和配件

- 居家产品

- 其他的

- 消费性电子产品

- 其他的

第 8 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Amcor

- Berry Global

- Coveris

- DCG Tech

- Dow

- DS Smith

- Georgia-Pacific

- Mondi

- Noissue

- Novolex

- PolyExpert

- ProAmpac

- Sealed Air

- Smurfit Kappa

- Stora Enso

- TC Transcontinental

- Thimm Group

- WestRock

The Global E-Commerce Flexible Packaging Market was valued at USD 32.2 billion in 2024 and is projected to experience robust growth at a CAGR of 9.2% from 2025 to 2034. The surging demand for lightweight, durable, and customizable packaging solutions is fueling market expansion as businesses aim to optimize shipping efficiency and elevate customer satisfaction. Growing environmental awareness is also driving the adoption of sustainable materials, such as biodegradable plastics and reusable packaging options, shaping a greener future for the industry.

The market is categorized by product type into bags and pouches, tapes, wraps and films, mailers, and others. Among these, the bags and pouches segment dominates with a 38.5% share in 2024. Its popularity stems from its versatility, cost-effectiveness, and ability to efficiently package a wide range of products. Companies are increasingly turning to eco-friendly options, such as recyclable and biodegradable bags, to achieve sustainability goals and appeal to environmentally conscious consumers. These materials also support branding efforts by offering customization opportunities while minimizing environmental impact, making them an ideal choice for contemporary e-commerce businesses.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $32.2 Billion |

| Forecast Value | $77.2 Billion |

| CAGR | 9.2% |

Based on material, the market is segmented into plastics, paper, and aluminum foil. The paper segment is expected to grow at an impressive CAGR of 10.5%, reaching USD 25 billion by 2034. This surge is driven by the rising preference for eco-conscious packaging solutions that align with global sustainability initiatives. Paper packaging, celebrated for being biodegradable, recyclable, and derived from renewable sources, combines strength with versatility. Its growing appeal among businesses stems from its suitability for packaging diverse products such as apparel, cosmetics, and food, delivering both functionality and visual appeal for enhanced brand recognition.

North America e-commerce flexible packaging market captured a 25% share in 2024, with the U.S. emerging as a key growth contributor. The rapid expansion of the sector in the U.S. is fueled by increasing demand for tamper-evident, child-resistant, and sustainable packaging solutions. Heightened consumer awareness about product safety and environmental responsibility is prompting companies to adopt recyclable plastics and biodegradable materials. Additionally, regulatory frameworks in environmentally progressive states are encouraging innovation in compliant packaging designs, further driving market growth in the region.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Disruptions

- 3.1.3 Future outlook

- 3.1.4 Manufacturers

- 3.1.5 Distributors

- 3.2 Profit margin analysis

- 3.3 Key news & initiatives

- 3.4 Regulatory landscape

- 3.5 Impact forces

- 3.5.1 Growth drivers

- 3.5.1.1 Increasing consumer preference for lightweight, durable packaging solutions

- 3.5.1.2 Growing adoption of paper-based solutions as an alternative to traditional plastics

- 3.5.1.3 Government regulations promoting recyclable and biodegradable materials in packaging

- 3.5.1.4 Increasing focus on reducing packaging waste in e-commerce logistics operations

- 3.5.1.5 Rapid expansion of E-commerce industry

- 3.5.2 Industry pitfalls & challenges

- 3.5.2.1 Durability concerns for flexible packaging during e-commerce transportation

- 3.5.2.2 Short lifecycle of some flexible packaging products

- 3.5.1 Growth drivers

- 3.6 Growth potential analysis

- 3.7 Porter’s analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion & Kilo Tons)

- 5.1 Key trends

- 5.2 Bags & pouches

- 5.3 Tapes

- 5.4 Wraps and films

- 5.5 Mailers

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Material, 2021-2034 (USD Billion & Kilo Tons)

- 6.1 Key trends

- 6.2 Plastics

- 6.3 Paper

- 6.4 Aluminum foil

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Billion & Kilo Tons)

- 7.1 Key trends

- 7.2 Food & beverages

- 7.3 Pharmaceuticals

- 7.4 Consumer goods

- 7.4.1 personal care & cosmetics

- 7.4.2 apparel and accessories

- 7.4.3 household products

- 7.4.4 others

- 7.5 Consumer electronics

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion & Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Amcor

- 9.2 Berry Global

- 9.3 Coveris

- 9.4 DCG Tech

- 9.5 Dow

- 9.6 DS Smith

- 9.7 Georgia-Pacific

- 9.8 Mondi

- 9.9 Noissue

- 9.10 Novolex

- 9.11 PolyExpert

- 9.12 ProAmpac

- 9.13 Sealed Air

- 9.14 Smurfit Kappa

- 9.15 Stora Enso

- 9.16 TC Transcontinental

- 9.17 Thimm Group

- 9.18 WestRock