|

市场调查报告书

商品编码

1721547

冷藏冰淇淋商品市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Refrigerated Ice Cream Merchandise Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

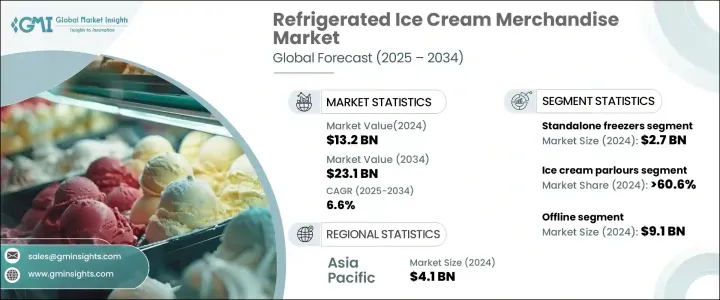

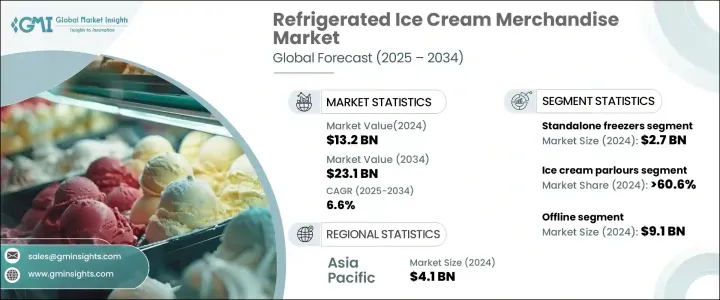

2024 年全球冷藏冰淇淋商品市场价值为 132 亿美元,预计到 2034 年将以 6.6% 的复合年增长率成长,达到 231 亿美元。产业专家指出,消费者的生活方式正在发生巨大变化,随着可支配收入的增加和日常生活日益忙碌,对冷冻甜点的需求也不断增长。随着消费者寻求便捷的享受方式,冰淇淋已巩固了其作为各个年龄层的热门选择的地位。这种日益增长的需求转化为对高效且外观吸引人的製冷设备的需求增加,这些製冷设备可以将冷冻食品保持在最佳温度,同时提升零售体验。

零售商和食品服务提供者正在将冷藏冰淇淋商品作为吸引顾客和维持产品品质的策略工具。这些冷冻装置对于保持质地、风味和浓稠度至关重要,确保冰淇淋产品以理想的状态送达消费者手中。随着超市、便利商店和特色冰淇淋店的兴起,零售业迅速扩张,对可靠、节能的製冷解决方案的需求比以往任何时候都更加强烈。现在,店内行销策略通常以这些单位为中心,因为它们既是储存解决方案,也是销售点行销资产。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 132亿美元 |

| 预测值 | 231亿美元 |

| 复合年增长率 | 6.6% |

独立式冷冻机作为最广泛使用的冷藏冰淇淋设备,在市场上处于领先地位,到 2024 年将创造 27 亿美元的收入。预测显示,2025 年至 2034 年期间的复合年增长率将达到 6.9%。这些设备使零售商能够储存和展示大量冰淇淋产品,同时将其保持在理想的食用温度。它们的设计强调可及性和便利性,因此在超市、便利商店和特色甜点店等人流量大的零售场所特别受欢迎。

冰淇淋店也被证明是市场成长的主要贡献者,到 2024 年将占据 60% 的主导份额。这些门市致力于透过提供独特的风味、季节性品种和优质的手工製作选项来提升顾客体验。客製化和口味创新正在成为关键卖点,吸引更广泛、更具实验性的消费者群体。许多店面也投资了兼作展示功能的高端冷冻设备,创造了一个沉浸式互动环境,鼓励衝动购买和品牌忠诚度。

从区域来看,2024 年亚太地区冷藏冰淇淋商品市场占全球收入的 31.3%。由于城市化、消费者偏好的转变以及可支配收入的提高,中国、印度和日本等国家的冰淇淋消费量正在快速增长。异国风味和优质产品在该地区越来越受欢迎,进一步刺激了对先进冷藏设备的需求。

这个不断发展的市场的关键参与者包括 Frigoglass SAIC、Thermo King Corporation、Lennox International Inc.、联合技术公司、Beverage-Air Corporation、Carrier Corporation、Metalfrio Solutions SA、AHT Cooling Systems GmbH 和 Mafirol SA。这些公司正在投资环保、节能技术,同时提供可客製化的冷冻解决方案,以满足不同客户的需求。与零售连锁店和食品服务提供商的合作正在帮助他们加强分销网络并提高产品在全球范围内的知名度。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 定价分析

- 技术与创新格局

- 重要新闻和倡议

- 监管格局

- 製造商

- 经销商

- 衝击力

- 成长动力

- 冰淇淋消费量增加

- 冰淇淋店数量不断增加

- 酒店业蓬勃发展

- 技术进步

- 产业陷阱与挑战

- 季节性需求波动

- 物流挑战

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依类型,2021-2034

- 主要趋势

- 独立式冷冻机

- 立式冷冻柜

- 立式冷冻柜

- 展示柜

- 垂直展示柜

- 水平展示柜

- 弧形玻璃展示柜

- 多层展示柜

- 冰淇淋沾酱柜

- 冰淇淋盒

- 速冻机

- 组合单位

- 其他(新奇、便携等)

第六章:市场估计与预测:依冷媒类型,2021-2034

- 主要趋势

- 氟碳化合物

- 无机

- 碳氢化合物

第七章:市场估计与预测:依产能,2021-2034

- 主要趋势

- 低(最高 250L)

- 中型(250-500公升)

- 高(500L以上)

第八章:市场估计与预测:依价格区间,2021-2034

- 主要趋势

- 低(最高 1000 美元)

- 中(1000-2000美元)

- 高(2000 美元以上)

第九章:市场估计与预测:依最终用途,2021-2034

- 主要趋势

- 冰淇淋店

- 餐厅和咖啡馆

- 其他(个别店舖等)

第 10 章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 在线的

- 离线

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十二章:公司简介

- AHT Cooling Systems GmbH

- Ali Group SpA

- Beverage-Air Corporation

- Blue Star Limited

- Carrier Corporation

- Dover Corporation

- Frigoglass SAIC

- Hussmann Corporation

- Lennox International Inc.

- Liebherr Group

- Mafirol SA

- Metalfrio Solutions SA

- Thermo King Corporation

- United Technologies Corporation

- Vestfrost Solutions

The Global Refrigerated Ice Cream Merchandise Market was valued at USD 13.2 billion in 2024 and is estimated to grow at a CAGR of 6.6% to reach USD 23.1 billion by 2034. Industry experts are pointing to a dynamic shift in consumer lifestyles, with growing demand for frozen desserts driven by rising disposable incomes and increasingly hectic routines. As consumers seek convenient indulgence options, ice cream has cemented its position as a popular choice across age groups. This growing appetite is translating into heightened demand for efficient and visually appealing refrigeration units that keep frozen treats at their optimal temperature while enhancing the retail experience.

Retailers and foodservice providers are turning to refrigerated ice cream merchandise as a strategic tool to attract customers and maintain product quality. These refrigeration units are essential for preserving texture, flavor, and consistency, ensuring that ice cream products reach consumers in ideal condition. With the retail landscape expanding rapidly-thanks to the rise in supermarkets, convenience stores, and specialty ice cream parlors-the need for reliable, energy-efficient refrigeration solutions is stronger than ever. In-store merchandising strategies now often center around these units, as they double up as both storage solutions and point-of-sale marketing assets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.2 Billion |

| Forecast Value | $23.1 Billion |

| CAGR | 6.6% |

Standalone freezers are leading the charge as the most widely used refrigerated ice cream units, generating USD 2.7 billion in revenue in 2024. Forecasts indicate a strong 6.9% CAGR between 2025 and 2034. These units allow retailers to store and showcase large volumes of ice cream products while keeping them at the ideal serving temperature. Their design emphasizes accessibility and convenience, making them especially popular across high-traffic retail locations such as supermarkets, convenience stores, and specialty dessert shops.

Ice cream parlors are also proving to be major contributors to market growth, accounting for a dominant 60% share in 2024. These outlets are focusing on elevating the customer experience by offering unique flavor profiles, seasonal varieties, and premium, artisanal options. Customization and flavor innovation are becoming key selling points, appealing to a wider, more experimental consumer base. Many parlors are also investing in high-end refrigeration units that double as display features, creating an immersive and interactive environment that encourages impulse purchases and brand loyalty.

In regional terms, the Asia Pacific Refrigerated Ice Cream Merchandise Market accounted for 31.3% of global revenue in 2024. Countries like China, India, and Japan are seeing a rapid rise in ice cream consumption due to urbanization, evolving consumer preferences, and higher disposable incomes. Exotic flavors and premium offerings are gaining popularity in the region, further fueling demand for advanced refrigerated units.

Key players in this evolving market include Frigoglass S.A.I.C., Thermo King Corporation, Lennox International Inc., United Technologies Corporation, Beverage-Air Corporation, Carrier Corporation, Metalfrio Solutions S.A., AHT Cooling Systems GmbH, and Mafirol S.A. These companies are investing in eco-friendly, energy-efficient technologies while offering customizable refrigeration solutions to cater to diverse client needs. Collaborations with retail chains and food service providers are helping them strengthen distribution networks and boost product visibility worldwide.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.4.3 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.3 Pricing analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Manufacturers

- 3.8 Distributors

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing ice cream consumption

- 3.9.1.2 Growing number of ice cream parlors

- 3.9.1.3 Growing hospitality sector

- 3.9.1.4 Technological advancements

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Seasonal demand fluctuations

- 3.9.2.2 Logistics challenges

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Standalone freezers

- 5.2.1 Chest freezer

- 5.2.2 Upright freezer

- 5.3 Display cases

- 5.3.1 Vertical display cases

- 5.3.2 Horizontal display cases

- 5.3.3 Curved glass display cases

- 5.3.4 Multi-deck display cases

- 5.4 Ice cream dipping cabinets

- 5.5 Gelato cases

- 5.6 Blast freezers

- 5.7 Combo units

- 5.8 Others (Novelty, Portable, etc.)

Chapter 6 Market Estimates & Forecast, By Refrigerant Type, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Fluorocarbons

- 6.3 Inorganic

- 6.4 Hydrocarbons

Chapter 7 Market Estimates & Forecast, By Capacity, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Low (upto 250L)

- 7.3 Medium (250-500L)

- 7.4 High (above 500L)

Chapter 8 Market Estimates & Forecast, By Price Range, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Low (upto 1000$)

- 8.3 Mid (1000$-2000$)

- 8.4 High (above 2000$)

Chapter 9 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Ice cream parlors

- 9.3 Restaurants and cafes

- 9.4 Others (Individual stores, etc.)

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Online

- 10.3 Offline

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 AHT Cooling Systems GmbH

- 12.2 Ali Group S.p.A.

- 12.3 Beverage-Air Corporation

- 12.4 Blue Star Limited

- 12.5 Carrier Corporation

- 12.6 Dover Corporation

- 12.7 Frigoglass S.A.I.C.

- 12.8 Hussmann Corporation

- 12.9 Lennox International Inc.

- 12.10 Liebherr Group

- 12.11 Mafirol S.A.

- 12.12 Metalfrio Solutions S.A.

- 12.13 Thermo King Corporation

- 12.14 United Technologies Corporation

- 12.15 Vestfrost Solutions