|

市场调查报告书

商品编码

1773447

葡萄酒及葡萄汁市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Wine and Grape Must Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

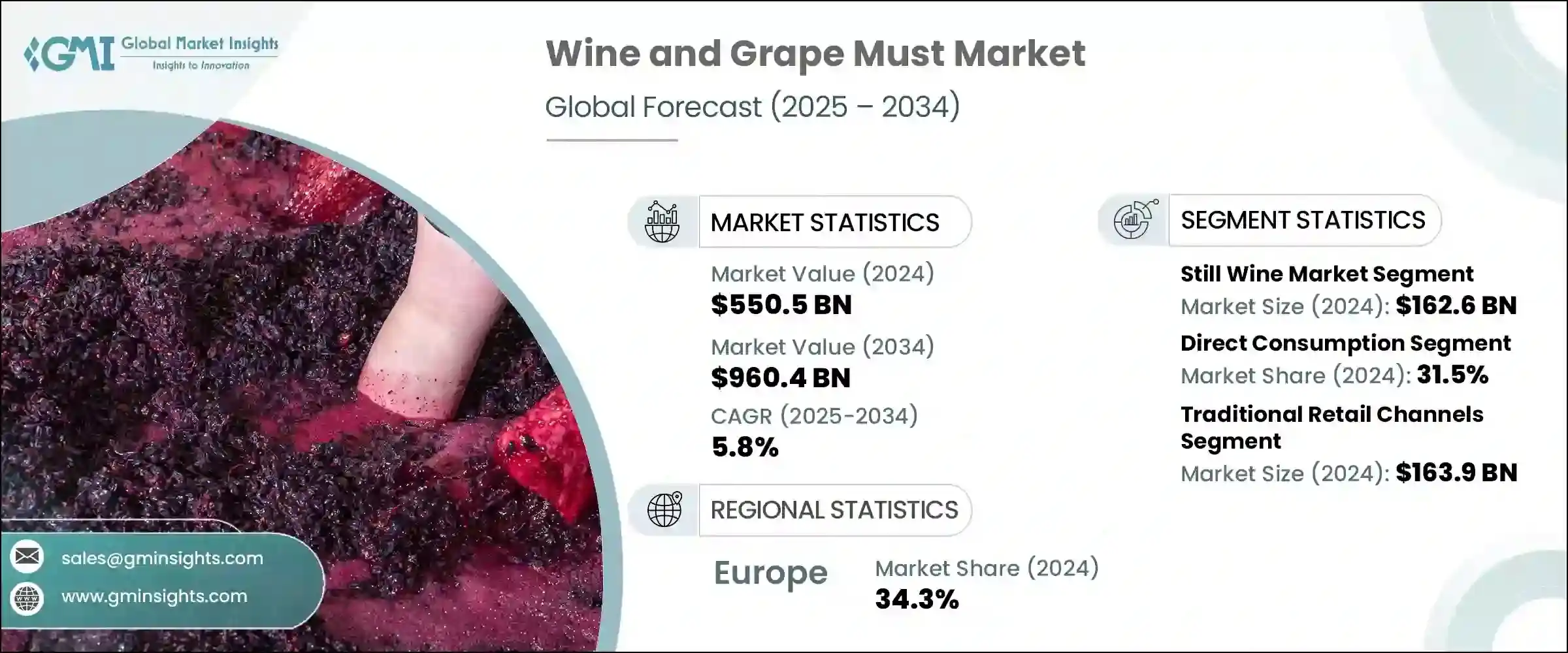

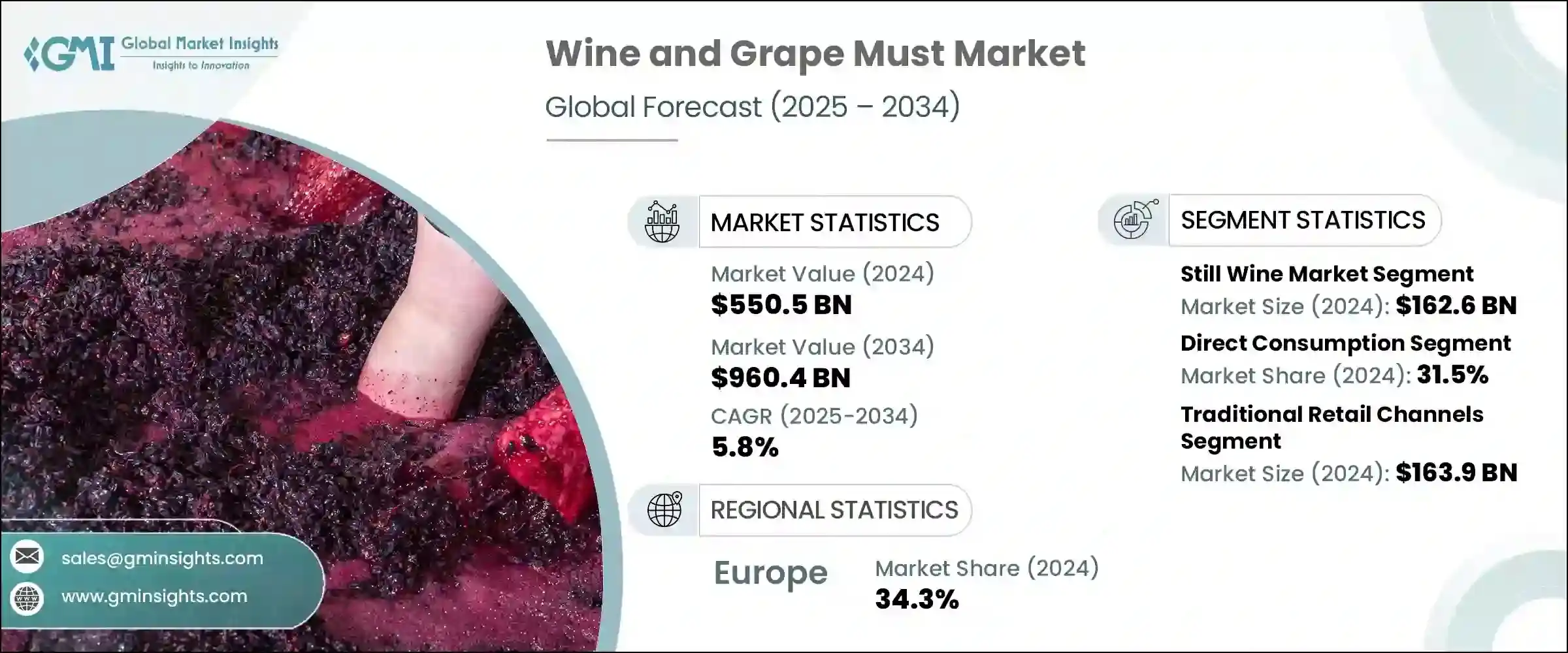

2024年,全球葡萄酒和葡萄汁市场规模达5,505亿美元,预计到2034年将以5.8%的复合年增长率成长,达到9,604亿美元。全球对高品质手工葡萄酒的强劲需求持续推动市场扩张,越来越多的消费者青睐优质、永续生产的饮品。不断发展的葡萄栽培技术和更强的气候适应能力提高了葡萄的产量和品质,支撑了该领域的持续成长。随着消费者越来越注重健康和环保的生活方式,他们对有机、生物动力和本地酿造的葡萄酒表现出更强的偏好。

线上零售和直销通路的影响力日益增强,使得优质葡萄酒和葡萄汁比以往任何时候都更容易获得,进一步加速了全球市场的成长。此外,罐装和可回收瓶装等创新包装形式也吸引了注重永续发展的买家,它们在提升便利性的同时,也减少了对环境的影响。由于买家追求每一口都能获得真实的体验,真实性、清洁标籤趋势和地理特色如今已成为主要卖点。这种直接消费趋势正在重塑品牌与终端用户的沟通方式,提供更个人化和透明的互动体验。消费者对优质、可追溯性和所有接触点可持续性的期望正引领市场的转型。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 5505亿美元 |

| 预测值 | 9604亿美元 |

| 复合年增长率 | 5.8% |

2024年,静态葡萄酒市场产值达1,626亿美元,占29.5%。随着人们对具有地理特色、有机、可持续且拥有引人入胜背景故事的葡萄酒的需求不断增长,该市场将继续蓬勃发展。气泡酒也越来越受欢迎,尤其是在发展中地区,在那里它被视为奢华和庆典的象征,与消费者追求的消费趋势相契合。加强型葡萄酒仍然是爱好者的热门选择,这得益于人们对传统葡萄酒以及与精酿鸡尾酒文化和高级餐饮相关的高端选择重新燃起的兴趣。

直接消费领域在2024年占31.5%,预计到2034年将以5.2%的复合年增长率成长。随着越来越多的消费者青睐新鲜、天然生产且加工程度最低的葡萄酒和葡萄汁,这种消费模式正日益受到青睐。葡萄酒和葡萄汁在更广泛的食品和饮料应用领域的需求显着增长,其独特的口味和天然的健康益处在烹饪和功能性产品中得到充分发挥。随着消费者对食品和饮料成分的关注度不断提高,自然发酵和清洁标章产品在各个品类中都越来越具有吸引力。

2024年,欧洲葡萄酒及葡萄汁市场占34.3%的市占率。该地区凭藉其长期以来的优质声誉以及致力于生产具有地理标誌和有机认证的葡萄酒的承诺,仍然保持着全球领先地位。气候驱动的葡萄栽培实践和地理特色进一步提升了欧洲葡萄酒的吸引力。在北美,永续性和小批量创新是关键驱动力,对葡萄的需求也在成长,尤其是在以健康为导向的产品系列中。在其他地区,东南亚、南美和中国的市场正在迅速扩张,将古老的传统与创新技术结合,以促进产量和消费量的双重成长。区域多样性正成为该行业全球成长的标誌。

影响全球葡萄酒和葡萄汁产业竞争态势的关键参与者包括富邑葡萄酒集团 (Treasury Wine Estates)、葡萄酒集团 (The Wine Group)、嘉露酒庄 (E. & J. Gallo Winery)、星座集团 (Constellation Brands, Inc.) 和保乐力加 (Pernod Ricard)。葡萄酒和葡萄产业的公司正加大对永续生产实践、高端产品开发和直接消费者关係的投资。他们强调可追溯性和真实性,以迎合那些重视原产地、有机认证和自然方法的挑剔受众。各大品牌正在利用数位平台和电子商务打造个人化体验,让消费者更容易获得独家产品。向新兴市场的策略性扩张使公司能够挖掘新的客户群,而包装的持续创新则有助于实现环保目标。许多公司也正在加强围绕地域遗产和酿酒传统的故事叙述,以与受众建立更牢固的情感联繫。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 按产品

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利态势

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 静止葡萄酒市场

- 红葡萄酒部分

- 优质红酒

- 中檔红酒

- 超值红酒

- 白葡萄酒部分

- 优质白葡萄酒

- 中檔白酒

- 超值白葡萄酒

- 桃红葡萄酒部分

- 红葡萄酒部分

- 气泡酒市场

- 香槟与优质气泡酒

- 普罗塞克和中檔气泡酒

- 超值气泡酒

- 加强葡萄酒市场

- 波特酒与雪莉酒

- 苦艾酒和开胃酒

- 其他加强葡萄酒

- 葡萄汁市场

- 新鲜葡萄汁

- 浓缩葡萄汁

- 精馏浓缩葡萄汁

- 有机葡萄汁

- 特色和替代葡萄酒产品

- 有机和生物动力葡萄酒

- 低醇和无醇葡萄酒

- 罐装和替代包装

- 自有品牌葡萄酒

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 直接消费

- 现场消费(餐厅、酒吧、饭店)

- 场外消费(零售、超商)

- 直接面向消费者的销售

- 食品饮料产业应用

- 料酒和烹饪应用

- 饮料混合和调味

- 食品加工和製造

- 工业应用

- 医药和营养保健用途

- 化妆品和个人护理应用

- 化学和工业加工

- 葡萄汁的具体应用

- 酿酒和发酵

- 食品和糖果业

- 保健食品和补充剂製造

- 传统和文化用途

第七章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 传统零售通路

- 超市和大卖场

- 葡萄酒专卖店

- 便利商店

- 百货公司

- 本地通路

- 餐厅和高级餐厅

- 酒吧和酒馆

- 饭店及餐饮业

- 酒吧和品酒室

- 直销通路

- 酒厂直接面向消费者

- 葡萄酒俱乐部和订阅

- 酒窖门销售

- 葡萄酒旅游和品酒体验

- 电子商务与数位管道

- 线上葡萄酒零售商

- 市场平台

- 行动应用程式

- 社群商务

- 批发和分销

- 传统三层系统

- 专业葡萄酒经销商

- 进出口通路

- 经纪人网络

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- E. & J. Gallo Winery

- Constellation Brands, Inc.

- Treasury Wine Estates

- Pernod Ricard

- The Wine Group

- Castel Group

- Accolade Wines

- Caviro Group

- Freixenet Group

- Changyu Pioneer Wine Company

- Great Wall Wine Company

- Dynasty Fine Wines Group

- Suntory Holdings

- Sapporo Holdings

The Global Wine and Grape Must Market was valued at USD 550.5 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 960.4 billion by 2034. Strong global demand for high-quality and artisanal wine continues to drive market expansion, as more consumers gravitate toward premium, sustainably produced beverages. Evolving viticulture techniques and improved climate adaptability have enhanced both yield and grape quality, supporting consistent growth in this space. Consumers are showing stronger preferences for organic, biodynamic, and locally crafted options, driven by an increasing shift toward health-aware and environmentally responsible lifestyles.

The rising influence of online retail and direct-to-consumer distribution channels has made premium wine and grape must more accessible than ever, further accelerating growth across global markets. In addition, innovative packaging formats such as cans and recyclable bottles are appealing to sustainability-minded buyers, enhancing convenience while reducing environmental impact. Authenticity, clean-label trends, and regional character are now major selling points, as buyers seek genuine experiences with every sip. This direct consumption trend is reshaping how brands connect with end-users, offering a more personalized and transparent engagement. The market's transformation is being led by consumer expectations for premium quality, traceability, and sustainability across all touchpoints.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $550.5 Billion |

| Forecast Value | $960.4 Billion |

| CAGR | 5.8% |

In 2024, the still wine segment generated USD 162.6 billion, claiming a 29.5% share. This segment continues to thrive as demand rises for regionally distinct, organic, and sustainable selections with compelling backstories. Sparkling wine is also gaining popularity, especially in developing regions, where it is seen as a symbol of luxury and celebration, aligning with aspirational consumer trends. Fortified wine remains a niche favorite among enthusiasts, supported by renewed interest in heritage varieties and high-end options connected to craft cocktail culture and fine dining.

The direct consumption segment represented a 31.5% share in 2024 and projected to grow at a CAGR of 5.2% through 2034. This mode of consumption is experiencing increased traction as more consumers favor wines and grape must that are fresh, naturally produced, and minimally processed. There is a notable surge in demand for wine and grape must in broader food and beverage applications, where their unique taste profiles and natural health-enhancing qualities leveraged in culinary and functional products. As consumers become more aware of what goes into their food and drinks, naturally fermented and clean-label offerings are becoming more attractive across categories.

Europe Wine and Grape Must Market held a 34.3% share in 2024. The region remains a global leader due to its long-established reputation for quality and its commitment to producing wines with geographic identity and organic certification. Climate-driven viticultural practices and regional storytelling further enhance the appeal of European wines. In North America, sustainability and small-batch innovation are key drivers, while demand for grapes is growing, especially in wellness-oriented product lines. Elsewhere, markets in Southeast Asia, South America, and China are rapidly expanding, combining age-old traditions with innovative technology to grow both production and consumption. Regional diversity is becoming a hallmark of the industry's global growth.

Key players shaping the competitive dynamics of the Global Wine and Grape Must Industry include Treasury Wine Estates, The Wine Group, E. & J. Gallo Winery, Constellation Brands, Inc., and Pernod Ricard. Companies within the wine and grape sector are increasingly investing in sustainable production practices, premium product development, and direct consumer relationships. Emphasis is placed on traceability and authenticity to cater to a discerning audience that values origin, organic certification, and natural methods. Brands are leveraging digital platforms and e-commerce to create personalized experiences, making it easier for consumers to access exclusive products. Strategic expansion into emerging markets allows companies to tap into new customer bases, while continuous innovation in packaging supports environmental goals. Many are also enhancing storytelling around regional heritage and winemaking traditions to build stronger emotional connections with their audiences.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Application

- 2.2.4 Distribution channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Still wine market

- 5.2.1 Red wine segment

- 5.2.1.1 Premium red wine

- 5.2.1.2 Mid-range red wine

- 5.2.1.3 Value red wine

- 5.2.2 White wine segment

- 5.2.2.1 Premium white wine

- 5.2.2.2 Mid-range white wine

- 5.2.2.3 Value white wine

- 5.2.3 Rose wine segment

- 5.2.1 Red wine segment

- 5.3 Sparkling wine market

- 5.3.1 Champagne and premium sparkling

- 5.3.2 Prosecco and mid-range sparkling

- 5.3.3 Value sparkling wine

- 5.4 Fortified wine market

- 5.4.1 Port and sherry

- 5.4.2 Vermouth and aperitifs

- 5.4.3 Other fortified wines

- 5.5 Grape must market

- 5.5.1 Fresh grape must

- 5.5.2 Concentrated grape must

- 5.5.3 Rectified concentrated grape must

- 5.5.4 Organic grape must

- 5.6 Specialty and alternative wine products

- 5.6.1 Organic and biodynamic wines

- 5.6.2 Low and No-alcohol wines

- 5.6.3 Canned and alternative packaging

- 5.6.4 Private label wines

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Direct consumption

- 6.2.1 On-premise consumption (restaurants, bars, hotels)

- 6.2.2 Off-premise consumption (retail, supermarkets)

- 6.2.3 Direct-to-consumer sales

- 6.3 Food and beverage industry applications

- 6.3.1 Cooking wine and culinary applications

- 6.3.2 Beverage blending and flavoring

- 6.3.3 Food processing and manufacturing

- 6.4 Industrial applications

- 6.4.1 Pharmaceutical and nutraceutical uses

- 6.4.2 Cosmetic and personal care applications

- 6.4.3 Chemical and industrial processing

- 6.5 Grape must specific applications

- 6.5.1 Winemaking and fermentation

- 6.5.2 Food and confectionery industry

- 6.5.3 Health food and supplement manufacturing

- 6.5.4 Traditional and cultural uses

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Traditional retail channels

- 7.2.1 Supermarkets and hypermarkets

- 7.2.2 Specialty wine stores

- 7.2.3 Convenience stores

- 7.2.4 Department stores

- 7.3 On-premise channels

- 7.3.1 Restaurants and fine dining

- 7.3.2 Bars and pubs

- 7.3.3 Hotels and hospitality

- 7.3.4 Wine bars and tasting rooms

- 7.4 Direct sales channels

- 7.4.1 Winery direct-to-consumer

- 7.4.2 Wine clubs and subscriptions

- 7.4.3 Cellar door sales

- 7.4.4 Wine tourism and tasting experiences

- 7.5 E-commerce and digital channels

- 7.5.1 Online wine retailers

- 7.5.2 Marketplace platforms

- 7.5.3 Mobile applications

- 7.5.4 Social commerce

- 7.6 Wholesale and Distribution

- 7.6.1 Traditional three-tier system

- 7.6.2 Specialized wine distributors

- 7.6.3 Import/Export channels

- 7.6.4 Broker networks

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.3.7 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 E. & J. Gallo Winery

- 9.2 Constellation Brands, Inc.

- 9.3 Treasury Wine Estates

- 9.4 Pernod Ricard

- 9.5 The Wine Group

- 9.6 Castel Group

- 9.7 Accolade Wines

- 9.8 Caviro Group

- 9.9 Freixenet Group

- 9.10 Changyu Pioneer Wine Company

- 9.11 Great Wall Wine Company

- 9.12 Dynasty Fine Wines Group

- 9.13 Suntory Holdings

- 9.14 Sapporo Holdings