|

市场调查报告书

商品编码

1871187

基于DNA的客製化维生素配方市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)DNA-Based Customized Vitamin Formulations Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

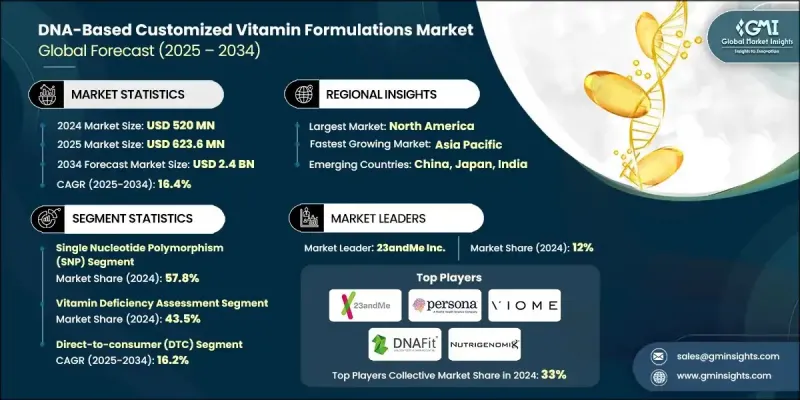

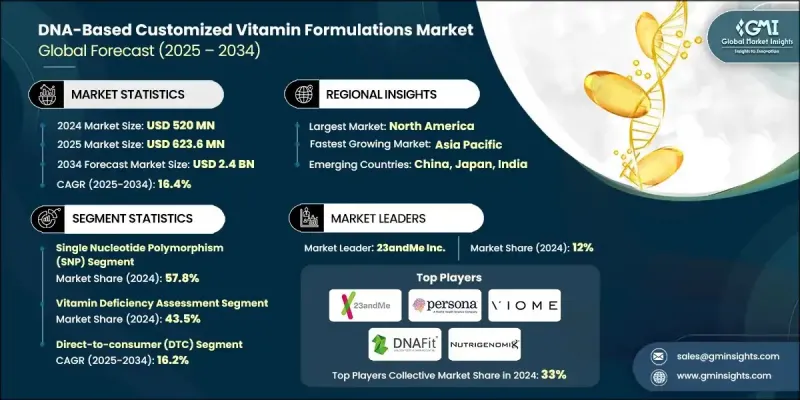

2024 年全球 DNA 客製化维生素配方市场价值为 5.2 亿美元,预计到 2034 年将以 16.4% 的复合年增长率增长至 24 亿美元。

基因检测技术的进步和消费者对个人化健康意识的日益增强推动了这一市场的成长,而慢性病的高发也使得量身定制的营养方案成为可能。儘管目前仍属于小众领域,但它正与更广泛的个人化营养市场同步扩张。价格亲民且易于取得的基因检测吸引了新的消费者,而新兴地区数位健康基础设施的快速发展也蕴藏着巨大的潜力。从基因检测到营养补充剂配送和健康追踪,端到端的个人化营养平台创造了高端产品和服务,并带来了交叉销售的机会。全球数百万成年人都在服用膳食补充剂,在将基因资讯融入预防保健策略、营养规划和整体生活方式优化的健康生态系统的支持下,该市场仍有巨大的成长空间。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 5.2亿美元 |

| 预测值 | 24亿美元 |

| 复合年增长率 | 16.4% |

单核苷酸多态性 (SNP) 检测市场占有率为 57.8%,预计到 2034 年将以 14.9% 的复合年增长率成长。 SNP 分析具有成本效益高、临床验证有效且能高度精确地将遗传变异与营养代谢联繫起来等优点。随着技术的成熟、变异谱的不断扩展以及解读方法的改进,基于 SNP 的方法在以消费者为中心的营养市场中持续获得青睐。

2024年,维生素缺乏评估市场占43.5%的份额,预计2025年至2034年将以16.1%的复合年增长率成长。维生素缺乏评估能够深入了解个体在营养吸收和利用方面的遗传倾向,是预防性健康方案的基础。消费者和医疗保健提供者对影响维生素水平的遗传因素的认识不断提高,推动了预测性和精准营养规划的普及。

预计到2024年,北美基于DNA的客製化维生素配方市占率将达到44.2%。该地区受益于先进的医疗保健基础设施、较高的消费者意识以及有利的监管环境。消费者对直接基因检测的接受度推动了该类产品的普及,预防性健康方法也日益融入临床实践。此外,个人化营养新创公司获得的大量风险投资进一步加速了市场成长。

全球DNA客製化维生素配方市场的主要公司包括Persona Nutrition、Rootine、Viome Life Sciences、GenoPalate、Habit(金宝汤公司)、Nutrigenomix Inc.、23andMe Inc.、Care/of、Season Health、InsideTracker、DNAfit(Prenetics)、Bioniq、Map/of、Season Health、InsideTracker、DNAfit(Prenetics)、Bioniq、Mapmygenome、XC。这些公司致力于拓展产品线、整合先进的基因检测技术并利用人工智慧驱动的营养洞察。与医疗保健机构、健身平台和健康生态系统的合作有助于提升信誉度和客户覆盖率。直销模式和数位化平台则增强了使用者参与度和便利性。行销重点强调个人化、预防性健康益处以及经科学验证的建议,以建立信任。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 慢性病盛行率上升

- 消费者健康意识的增强

- 技术进步与成本降低

- 产业陷阱与挑战

- 监管复杂性和合规要求

- 有限的临床验证

- 市场机会

- 人工智慧与机器学习集成

- 穿戴式装置融合

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 依技术类型

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依技术类型划分,2021-2034年

- 主要趋势

- 单核苷酸多态性(SNP)

- 下一代定序(NGS)

- 微阵列技术

- 实时PCR

第六章:市场估算与预测:依应用领域划分,2021-2034年

- 主要趋势

- 维生素缺乏评估

- 代谢健康优化

- 运动表现提升

- 抗老与长寿支持

第七章:市场估计与预测:依配销通路划分,2021-2034年

- 主要趋势

- 直接面向消费者(DTC)

- 医疗保健提供者

- 零售药局

- 专业营养品店

第八章:市场估算与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- 23andMe Inc.

- Persona Nutrition

- Viome Life Sciences

- DNAfit (Prenetics)

- Nutrigenomix Inc.

- Rootine

- InsideTracker

- GenoPalate

- Care/of

- Habit (Campbell Soup Company)

- Season Health

- Bioniq

- Xcode Life

- Mapmygenome

- Avesthagen

The Global DNA-Based Customized Vitamin Formulations Market was valued at USD 520 million in 2024 and is estimated to grow at a CAGR of 16.4% to reach USD 2.4 Billion by 2034.

The growth is fueled by advancements in genetic testing technologies and rising consumer awareness of personalized health, driven in part by the prevalence of chronic diseases that benefit from tailored nutritional approaches. Although still a niche sector, it is expanding alongside the broader personalized nutrition market. Affordable and accessible genetic testing has attracted new consumers, while digital health infrastructure growth in emerging regions offers untapped potential. End-to-end personalized nutrition platforms, from genetic testing to supplement delivery and health tracking, create premium offerings and cross-selling opportunities. With millions of adults consuming dietary supplements globally, the market has considerable room for expansion, supported by wellness ecosystems that integrate genetic insights into preventive health strategies, nutrition planning, and overall lifestyle optimization.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $520 Million |

| Forecast Value | $2.4 Billion |

| CAGR | 16.4% |

The single-nucleotide polymorphism (SNP) testing segment held a 57.8% share and is projected to grow at a CAGR of 14.9% through 2034. SNP analysis is cost-effective, clinically validated, and highly precise in linking genetic variants to nutrient metabolism. With mature technology, growing variant panels, and improved interpretation methods, SNP-based approaches continue to gain traction in consumer-focused nutrition markets.

The vitamin deficiency assessment segment held 43.5% share in 2024 and is expected to grow at a CAGR of 16.1% from 2025 to 2034. Assessing vitamin deficiencies provides critical insights into an individual's genetic predisposition for nutrient absorption and utilization, forming the backbone of preventive health protocols. Rising awareness of the genetic factors influencing vitamin status drives adoption among consumers and healthcare providers seeking predictive and accurate nutrition planning.

North America DNA-Based Customized Vitamin Formulations Market held a 44.2% share in 2024. The region benefits from advanced healthcare infrastructure, high consumer awareness, and a supportive regulatory environment. Acceptance of direct-to-consumer genetic testing has driven adoption, and preventive health approaches are increasingly integrated into clinical practice. Strong venture capital funding for personalized nutrition startups further accelerates market growth.

Key companies in the Global DNA-Based Customized Vitamin Formulations Market include Persona Nutrition, Rootine, Viome Life Sciences, GenoPalate, Habit (Campbell Soup Company), Nutrigenomix Inc., 23andMe Inc., Care/of, Season Health, InsideTracker, DNAfit (Prenetics), Bioniq, Mapmygenome, Xcode Life, and Avesthagen. Companies in the DNA-Based Customized Vitamin Formulations Market focus on expanding product offerings, integrating advanced genetic testing, and leveraging AI-driven nutrition insights. Partnerships with healthcare providers, fitness platforms, and wellness ecosystems improve credibility and customer access. Direct-to-consumer sales models and digital platforms enhance user engagement and convenience. Marketing efforts emphasize personalization, preventive health benefits, and scientifically validated recommendations to build trust.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology type

- 2.2.3 Application

- 2.2.4 Distribution channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising chronic disease prevalence

- 3.2.1.2 Consumer health consciousness growth

- 3.2.1.3 Technology advancement & cost reduction

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Regulatory complexity & compliance requirements

- 3.2.2.2 Limited clinical validation

- 3.2.3 Market opportunities

- 3.2.3.1 AI & machine learning integration

- 3.2.3.2 Wearable device convergence

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By technology type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Technology Type, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Single nucleotide polymorphism (SNP)

- 5.3 Next-generation sequencing (NGS)

- 5.4 Microarray technology

- 5.5 Real-time PCR

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Vitamin deficiency assessment

- 6.3 Metabolic health optimization

- 6.4 Athletic performance enhancement

- 6.5 Aging & longevity support

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Direct-to-consumer (DTC)

- 7.3 Healthcare providers

- 7.4 Retail pharmacies

- 7.5 Specialty nutrition stores

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 23andMe Inc.

- 9.2 Persona Nutrition

- 9.3 Viome Life Sciences

- 9.4 DNAfit (Prenetics)

- 9.5 Nutrigenomix Inc.

- 9.6 Rootine

- 9.7 InsideTracker

- 9.8 GenoPalate

- 9.9 Care/of

- 9.10 Habit (Campbell Soup Company)

- 9.11 Season Health

- 9.12 Bioniq

- 9.13 Xcode Life

- 9.14 Mapmygenome

- 9.15 Avesthagen