|

市场调查报告书

商品编码

1871206

针对特定年龄层的个人化营养市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Age-Specific Personalized Nutrition Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

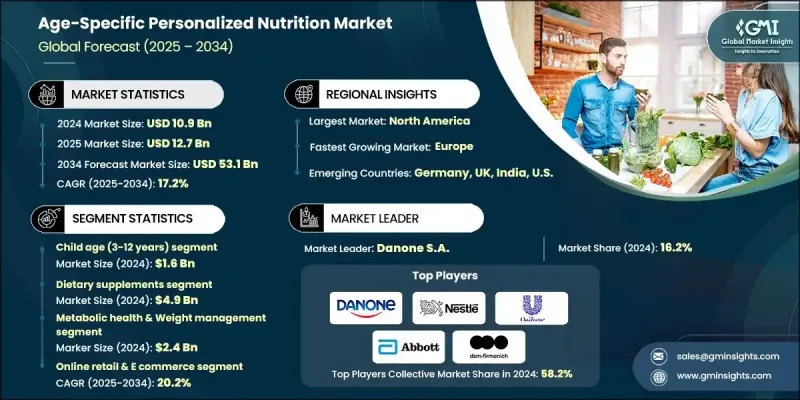

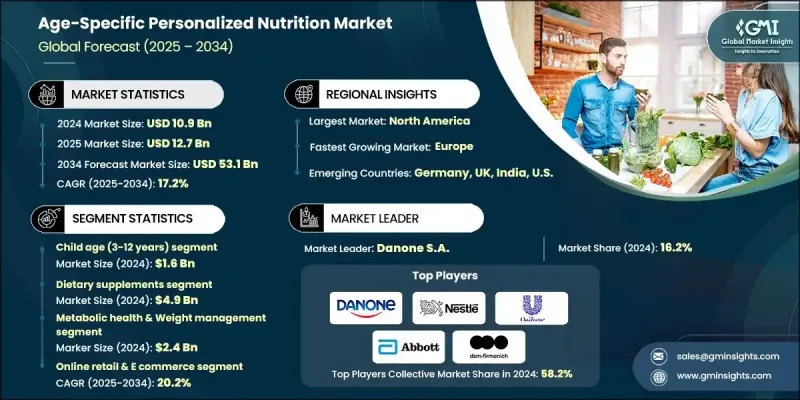

2024 年全球特定年龄层个人化营养市场价值为 109 亿美元,预计到 2034 年将以 17.2% 的复合年增长率增长至 531 亿美元。

人们越来越意识到饮食、生活方式与长期健康结果之间的联繫,这推动了各年龄层对个人化营养解决方案的需求。世界卫生组织(WHO)的数据显示,全球近74%的死亡与非传染性疾病有关,凸显了预防性医疗保健措施的紧迫感。消费者越来越多地采用客製化营养计画来增强免疫力、提高能量水平并维持整体代谢健康。营养基因组学领域的蓬勃发展和生物技术的进步正在重塑基于年龄和生理特征的个人化营养方案。美国国立卫生研究院(NIH)资助的遗传学和微生物组研究正在帮助我们揭示基因如何影响营养代谢和吸收。基因检测和基于微生物组的评估使个人能够制定符合自身生物组成的个人化饮食计划,从而进一步推进精准营养和个人化健康管理的理念。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 109亿美元 |

| 预测值 | 531亿美元 |

| 复合年增长率 | 17.2% |

美国疾病管制与预防中心(CDC)和世界卫生组织等卫生机构持续强调营养在降低肥胖、糖尿病和心血管疾病风险的重要作用。世界各国政府都在加大对营养教育、更清晰的食品标籤和公共卫生措施的投入,以鼓励更健康的饮食习惯和生活方式选择。这些措施正在推动消费者对个人化营养产品和服务的认知度和接受度不断提高,以满足他们对针对性健康解决方案的需求。

2024年,代谢健康和体重管理市场规模预计将达24亿美元。该市场的成长主要受肥胖率上升、糖尿病病例增加以及生活方式相关的代谢紊乱等因素的推动。消费者正转向个人化饮食计划、营养补充剂和数位健康平台,以维持健康的体重水平并改善代谢功能。将人工智慧和穿戴式装置融入营养监测,可以即时追踪代谢活动,从而为寻求更佳健康结果的用户提供更精准、数据驱动且更易于获取的个人化营养计画。

2024年,膳食补充剂市场规模预计将达49亿美元。消费者对便利高效的营养输送系统的需求日益增长,推动了该领域的扩张。针对特定年龄层和健康需求(包括免疫、代谢和认知健康)的个人化补充剂正迅速普及。 DNA和微生物组检测与人工智慧驱动的推荐系统相结合,正在革新补充剂的配方和剂量精准度,确保消费者获得与其独特生理需求高度匹配的个人化产品。

预计到2024年,北美地区针对特定年龄层的个人化营养市场将占据44.6%的份额,其中美国在健康和保健方面的消费者支出领先。美国先进的生物技术基础设施、广泛的数位健康解决方案以及慢性病的高发生率正在加速个人化营养的普及。消费者越来越倾向于选择以科学为基础、技术驱动的健康产品来管理长期健康。此外,美国有利的监管环境以及消费者对实证营养的坚定信心也推动了该市场透过电子商务和传统零售通路的强劲成长。

塑造年龄特异性个人化营养市场格局的关键企业包括:Kerry Group PLC、Herbalife Nutrition Ltd.、Nutrigenomix、Viome Life Sciences、Bioniq、DSM-Firmenich、Unilever PLC、Zeon Lifesciences Ltd.、Abbott、Bright Green Partners、Amway Corporation、Glanbia PLC、Zeon Lifesciences Ltd.、Abbott、Bright Green Partners、Amway Corporation、Glanbia PLC、Nestle SAone 和 PLC SAone SAone SAone。这些市场领导者正在实施一系列策略,以加强其全球影响力。许多企业正大力投资研发,以推动营养基因组学技术的发展,并增强数据驱动的产品客製化能力。与生物技术公司和数位健康新创企业的策略合作,正在扩大获取基因和微生物组资讯的机会,从而实现更精准的营养规划。此外,各企业也致力于推出以人工智慧为基础的平台和订阅模式,以提高用户参与度和留存率。拓展产品组合,推出针对特定年龄层的客製化营养补充品和功能性食品,仍是其核心策略之一。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 各年龄层的健康意识日益增强

- 营养基因体学的技术进步

- 更加重视预防性医疗保健

- 产业陷阱与挑战

- 个人化解决方案成本高昂

- 各区域的监管复杂性

- 市场机会

- 人工智慧与数位健康平台的整合

- 对预防性医疗保健和长寿产品的需求日益增长

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 年龄组

- 产品类型

- 应用

- 配销通路

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依年龄组别划分,2021-2034年

- 主要趋势

- 怀孕前及怀孕年龄

- 婴儿年龄(0-2岁)

- 儿童年龄(3-12岁)

- 青少年时期(13-18岁)

- 成年年龄(19-64岁)

- 老年人(65岁以上)

第六章:市场估算与预测:依产品类型划分,2021-2034年

- 主要趋势

- 功能性食品和饮料

- 强化果汁

- 乳製品替代品

- 营养强化零食

- 能量与健康饮料

- 膳食补充剂

- 维生素和矿物质

- 草本及植物萃取物

- 益生菌和益生元

- 胺基酸和蛋白质补充剂

- 代餐产品

- 即饮奶昔

- 营养棒

- 控制卡路里的餐食

- 其他

第七章:市场估计与预测:依应用领域划分,2021-2034年

- 主要趋势

- 代谢健康与体重管理

- 低热量代餐

- 脂肪代谢促进剂

- 富含膳食纤维的功能性食品

- 个人化宏量营养素计划

- 消化系统和肠道健康

- 益生菌和益生元混合物

- 发酵食品

- 酵素补充剂

- 基于微生物组的饮食计划

- 骨骼和关节健康

- 钙和维生素D补充剂

- 胶原蛋白饮料

- 葡萄糖胺和软骨素产品

- 抗发炎营养保健品

- 认知健康

- 益智补品

- 富含 Omega-3 和 DHA 的食品

- 增强大脑功能的饮料

- 草本记忆增强剂

- 免疫健康

- 维生素C和锌配方

- 抗氧化剂混合物

- 草本免疫力补品

- 针对不同年龄层的免疫支持奶昔

- 心血管健康

- Omega-3脂肪酸补充剂

- 降低胆固醇的营养

- 血压控制公式

- 抗氧化功能饮料

- 运动与健身营养

- 蛋白粉和蛋白棒

- 胺基酸和支链胺基酸配方

- 水合和电解质饮料

- 恢復和耐力补充剂

- 皮肤、头髮和美容营养

- 胶原蛋白和生物素补充剂

- 抗氧化剂和维生素E混合物

- 水合及提升肌肤弹性

- 抗衰老营养保健品

第八章:市场估算与预测:依配销通路划分,2021-2034年

- 主要趋势

- 线上零售与电子商务

- 超市和大型超市

- 药局和药局

- 专业营养品店

- 其他的

第九章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十章:公司简介

- Nutrigenomix

- Viome Life Sciences

- Nestle SA

- Danone SA

- Abbott

- DSM-Firmenich

- Unilever PLC

- Herbalife Nutrition Ltd.

- Amway Corporation

- Glanbia PLC

- Bright Green Partners

- Bioniq

- Zeon Lifesciences Ltd

- Kerry Group PLC

The Global Age-Specific Personalized Nutrition Market was valued at USD 10.9 Billion in 2024 and is estimated to grow at a CAGR of 17.2% to reach USD 53.1 Billion by 2034.

The increasing awareness of the connection between diet, lifestyle, and long-term health outcomes is driving demand for tailored nutrition solutions across all age groups. According to the World Health Organization (WHO), nearly 74% of global deaths are linked to non-communicable diseases, underscoring the urgent need for preventive healthcare measures. Consumers are increasingly adopting customized nutrition plans to enhance immunity, improve energy levels, and maintain overall metabolic health. The growing field of nutrigenomics and advancements in biotechnology are reshaping how nutrition is personalized based on age and physiology. Ongoing research funded by the National Institutes of Health (NIH) into genetics and microbiomes is helping uncover how genes affect nutrient metabolism and absorption. The use of genetic testing and microbiome-based assessments enables individuals to create diet plans tailored to their biological composition, further advancing the concept of precision nutrition and personalized health management.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.9 Billion |

| Forecast Value | $53.1 Billion |

| CAGR | 17.2% |

Health authorities such as the Centers for Disease Control and Prevention (CDC) and the World Health Organization continue to emphasize the vital role of nutrition in reducing obesity, diabetes, and cardiovascular risks. Governments worldwide are investing in nutrition education, clearer food labeling, and public health initiatives to encourage healthier dietary habits and lifestyle choices. These initiatives are driving greater awareness and adoption of personalized nutrition products and services among consumers seeking targeted wellness solutions.

The metabolic health and weight management segment accounted for USD 2.4 Billion in 2024. This segment's growth is fueled by rising obesity rates, increasing cases of diabetes, and lifestyle-related metabolic disorders. Consumers are turning toward individualized diet plans, nutritional supplements, and digital health platforms to maintain healthy weight levels and improve metabolic function. The integration of artificial intelligence and wearable devices into nutrition monitoring allows for real-time tracking of metabolic activity, resulting in more accurate, data-driven, and accessible personalized nutrition plans for users seeking better health outcomes.

The dietary supplements segment generated USD 4.9 Billion in 2024. The growing consumer demand for easy and effective nutrient delivery systems is boosting this segment's expansion. Personalized supplements targeting specific age groups and health needs, including immune, metabolic, and cognitive health, are witnessing rapid adoption. The use of DNA and microbiome testing combined with AI-driven recommendation systems is revolutionizing supplement formulation and dosage precision, ensuring that consumers receive highly individualized products aligned with their unique biological requirements.

North America Age-Specific Personalized Nutrition Market captured 44.6% share in 2024, with the United States leading in consumer spending on health and wellness. The country's advanced biotechnology infrastructure, widespread use of digital health solutions, and high prevalence of chronic conditions are accelerating the adoption of personalized nutrition. Consumers are increasingly turning to science-backed and technology-enabled health products to manage long-term wellness. The U.S. also benefits from a favorable regulatory environment and strong consumer confidence in evidence-based nutrition, driving robust growth through both e-commerce and traditional retail channels.

Key companies shaping the Age-Specific Personalized Nutrition Market landscape include Kerry Group PLC, Herbalife Nutrition Ltd., Nutrigenomix, Viome Life Sciences, Bioniq, DSM-Firmenich, Unilever PLC, Zeon Lifesciences Ltd., Abbott, Bright Green Partners, Amway Corporation, Glanbia PLC, Nestle S.A., and Danone S.A. Leading companies in the Age-Specific Personalized Nutrition Market are implementing a range of strategies to strengthen their global presence. Many are investing heavily in research and development to advance nutrigenomic technologies and enhance data-driven product customization. Strategic collaborations with biotechnology firms and digital health startups are expanding access to genetic and microbiome insights for more precise nutrition planning. Companies are also focusing on launching AI-based platforms and subscription-based models to improve user engagement and retention. Expanding product portfolios with tailored supplements and functional foods designed for specific age groups remains a core strategy.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Age Group

- 2.2.3 Product Type

- 2.2.4 Application

- 2.2.5 Distribution Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising health consciousness across age groups

- 3.2.1.2 Technological advancements in nutrigenomics

- 3.2.1.3 Increased focus on preventive healthcare

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of personalized solutions

- 3.2.2.2 Regulatory complexity across regions

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of ai and digital health platforms

- 3.2.3.2 Growing demand for preventive healthcare and longevity products

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation Landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 Age Group

- 3.7.3 Product Type

- 3.7.4 Application

- 3.7.5 Distribution Channel

- 3.8 Future market trends

- 3.9 Technology and Innovation Landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Age Group, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Pre-conception & maternal age

- 5.3 Infant age (0-2 years)

- 5.4 Child age (3-12 years)

- 5.5 Teenager age (13-18 years)

- 5.6 Adult age (19-64 years)

- 5.7 Elderly age (65+ years)

Chapter 6 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Functional foods & beverages

- 6.2.1 Fortified juices

- 6.2.2 Dairy alternatives

- 6.2.3 Nutrient-enriched snacks

- 6.2.4 Energy & wellness drinks

- 6.3 Dietary supplements

- 6.3.1 Vitamins & minerals

- 6.3.2 Herbal & botanical extracts

- 6.3.3 Probiotics & prebiotics

- 6.3.4 Amino acids & protein supplements

- 6.4 Meal replacement products

- 6.4.1 Ready-to-drink shakes

- 6.4.2 Nutrition bars

- 6.4.3 Calorie-controlled meals

- 6.5 Other

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Metabolic health & Weight management

- 7.2.1 Calorie-controlled meal replacements

- 7.2.2 Fat metabolism enhancers

- 7.2.3 Fiber-rich functional foods

- 7.2.4 Personalized macronutrient plans

- 7.3 Digestive & Gut health

- 7.3.1 Probiotic & Prebiotic blends

- 7.3.2 Fermented foods

- 7.3.3 Enzyme supplements

- 7.3.4 Microbiome-based diet plans

- 7.4 Bone & joint health

- 7.4.1 Calcium & vitamin D supplements

- 7.4.2 Collagen-based drinks

- 7.4.3 Glucosamine & chondroitin products

- 7.4.4 Anti-inflammatory nutraceuticals

- 7.5 Cognitive health

- 7.5.1 Nootropic supplements

- 7.5.2 Omega-3 & DHA Enriched Foods

- 7.5.3 Brain function enhancing drinks

- 7.5.4 Herbal memory boosters

- 7.6 Immune health

- 7.6.1 Vitamin C & Zinc formulations

- 7.6.2 Antioxidant blends

- 7.6.3 Herbal immunity tonics

- 7.6.4 Age-specific immune support shakes

- 7.7 Cardiovascular health

- 7.7.1 Omega-3 fatty acid supplements

- 7.7.2 Cholesterol reduction nutrition

- 7.7.3 Blood pressure control formulas

- 7.7.4 Antioxidant functional beverages

- 7.8 Sports & fitness nutrition

- 7.8.1 Protein powders & bars

- 7.8.2 Amino acid & BCAA Formulas

- 7.8.3 Hydration & electrolyte drinks

- 7.8.4 Recovery & Endurance supplements

- 7.9 Skin, hair & Beauty nutrition

- 7.9.1 Collagen & Biotin supplements

- 7.9.2 Antioxidant & Vitamin E blends

- 7.9.3 Hydration & Skin elasticity boosters

- 7.9.4 Anti-aging nutraceuticals

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Online retail & E-commerce

- 8.3 Supermarkets & hypermarkets

- 8.4 Pharmacies & drugstores

- 8.5 Specialty nutrition stores

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Nutrigenomix

- 10.2 Viome Life Sciences

- 10.3 Nestle S.A.

- 10.4 Danone S.A.

- 10.5 Abbott

- 10.6 DSM-Firmenich

- 10.7 Unilever PLC

- 10.8 Herbalife Nutrition Ltd.

- 10.9 Amway Corporation

- 10.10 Glanbia PLC

- 10.11 Bright Green Partners

- 10.12 Bioniq

- 10.13 Zeon Lifesciences Ltd

- 10.14 Kerry Group PLC