|

市场调查报告书

商品编码

1876643

抗菌(酵素法)蛋白水解物市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Antimicrobial (Enzymatic) Protein Hydrolysates Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

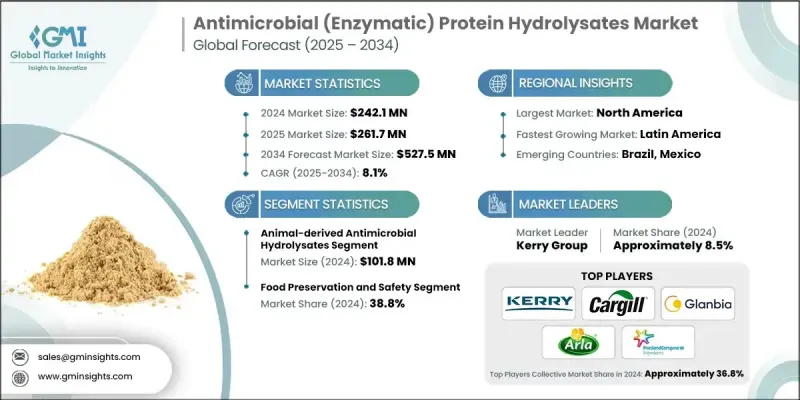

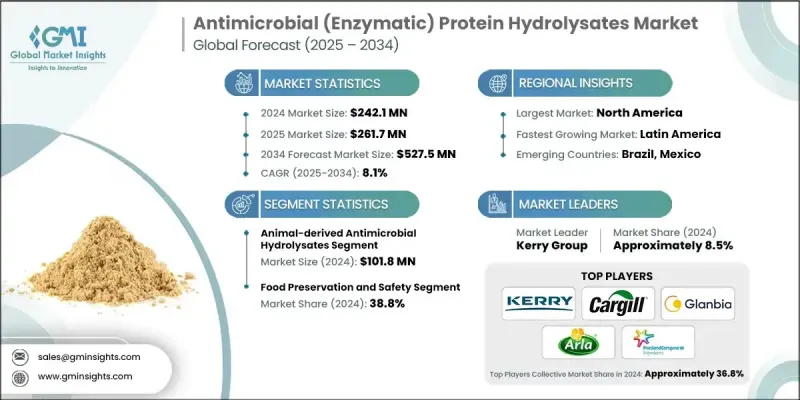

2024 年全球抗菌(酵素法)蛋白水解物市值为 2.421 亿美元,预计到 2034 年将以 8.1% 的复合年增长率增长至 5.275 亿美元。

随着食品生产商和消费者转向符合「清洁标籤」理念的天然保鲜方案,市场动能日益强劲。酵素改质水解物因其有助于保持产品新鲜度且不损害营养完整性,正越来越多地被选为合成防腐剂的替代品。全球对抗生素抗药性的日益关注也推动了这一趋势,促使人们更加需要不会导致抗生素滥用的抗菌工具。这些水解物在食品和健康相关应用中能够有效控制微生物,使其完美契合不断变化的监管和安全要求。人们对健康和保健的日益关注也推动了市场需求,因为如今的消费者寻求兼具功能性和生物活性的成分,使其用途超越了基本的保鲜功能。随着业界重心转向能够提升产品安全性和品质的天然来源解决方案,抗菌蛋白水解物有望在食品、营养及相关领域中广泛应用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2.421亿美元 |

| 预测值 | 5.275亿美元 |

| 复合年增长率 | 8.1% |

2024年,动物源抗菌水解物市场规模达1.018亿美元,预计2025年至2034年将以7.8%的复合年增长率成长。由于其强大的胜肽活性和良好的监管认可,这类产品在食品保鲜、临床营养和膳食补充剂配方中的应用持续增长。这些水解物通常由牛奶、肉类或鸡蛋等蛋白质来源製成,因其抗菌潜力而备受青睐,尤其适用于需要兼顾安全性和增强生物活性的高蛋白即食产品。

2024年,食品保鲜和安全应用领域创造了9,370万美元的市场规模,预计到2034年将以7.4%的复合年增长率成长。该领域主要利用蛋白质水解物来抑制乳製品、加工食品、饮料和方便食品中的微生物生长。由于製造商用天然来源的胜肽替代品取代了合成防腐剂,因此蛋白质水解物的使用符合清洁标籤的要求,有助于延长保质期并保持成分清单的透明度。

2024年,北美抗菌(酵素法)蛋白水解物市场规模达8,470万美元。由于消费者日益重视清洁标籤的食品保鲜理念和严格的食品安全合规要求,该地区对酵素法蛋白水解物的应用正在不断增长。该地区拥有众多功能性食品和营养保健品生产商,这有利于兼具抗菌和营养特性的生物活性胜肽的广泛应用。减少化学防腐剂使用的监管压力也促使食品公司采用酶法蛋白水解物,同时,对生物技术和蛋白质加工的投资不断提升产品质量,提高成分分析的准确性,并增强食品和医疗保健行业的规模化生产能力。

参与抗菌(酵素法)蛋白水解物市场的主要公司包括嘉吉公司、格兰比亚公司、菲仕兰配料公司、阿拉食品配料公司、凯瑞集团等。这些公司正致力于透过多种策略来巩固其市场地位。许多公司正加大对先进酵素法加工技术的投资,以提高胜肽的纯度、效力和稳定性。各公司正拓展与食品製造商、营养保健品品牌和生技合作伙伴的合作,以加速跨多个领域的应用开发。提供清洁标籤配方支援、客製化抗菌解决方案和增强功能特性仍然是其核心优先事项。此外,各公司也正在增加研发投入,以寻找具有卓越抗菌性能的新型生物活性胜肽。扩大生产规模、改善监管合规性以及加强全球分销网络有助于提升竞争力。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基准估算和计算

- 基准年计算

- 市场估算的关键趋势

- 初步研究和验证

- 原始资料

- 预测模型

- 研究假设和局限性

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 天然食品防腐剂需求不断成长

- 日益严重的抗生素抗药性问题

- 提高健康和保健意识

- 在功能性食品领域不断拓展的应用

- 产业陷阱与挑战

- 高昂的生产和加工成本

- 监理复杂性和审批挑战

- 保质期有限和稳定性问题

- 市场机会

- 乳製品废水资源化利用

- 人工智慧驱动的胜肽发现

- 化妆品领域的新兴应用

- 植物性蛋白质来源的扩张

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 副产品

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(註:仅提供重点国家的贸易统计)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品类型划分,2021-2034年

- 主要趋势

- 动物源性抗菌水解物

- 乳蛋白水解物

- 乳清蛋白水解物

- 酪蛋白水解物

- 鱼蛋白水解物

- 肉类蛋白水解物

- 蛋清蛋白水解物

- 植物源抗菌水解物

- 大豆蛋白水解物

- 小麦蛋白水解物

- 豆类蛋白质水解物

- 谷物蛋白水解物

- 种子蛋白质水解物

- 海洋来源的抗菌水解物

- 鱼类副产品水解物

- 藻类蛋白水解物

- 海藻蛋白水解物

- 甲壳类动物壳水解物

- 微生物来源的抗菌水解物

- 细菌发酵产物

- 真菌水解物

- 酵母衍生胜肽

第六章:市场估算与预测:依应用领域划分,2021-2034年

- 主要趋势

- 食品保藏与安全

- 天然防腐剂

- 抗菌涂层

- 活性包装解决方案

- 延长保存期限

- 营养补充品

- 运动营养

- 临床营养

- 婴儿配方奶粉

- 膳食补充剂

- 功能性食品

- 动物饲料和宠物食品

- 生长促进剂

- 抗生素替代品

- 消化系统健康支持

- 增强免疫系统

- 医药和医疗保健

- 治疗性胜肽

- 伤口护理产品

- 口腔护理应用

- 局部抗菌剂

- 化妆品和个人护理

- 抗菌製剂

- 保养品

- 护髮应用

- 抗衰老解决方案

第七章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第八章:公司简介

- Kerry Group

- Cargill Inc.

- Glanbia plc

- Arla Foods Ingredients

- FrieslandCampina Ingredients

- DSM-Firmenich

- ADM (Archer Daniels Midland)

- AMCO Proteins

- Kemin Industries

- Titan Biotech

- BRF Ingredients

- Constantino & C Spa

- Crescent Biotech

- Aker Biomarine

- Biomega Group

- Essentia Protein Solutions

The Global Antimicrobial (Enzymatic) Protein Hydrolysates Market was valued at USD 242.1 million in 2024 and is estimated to grow at a CAGR of 8.1% to reach USD 527.5 million by 2034.

Market momentum is growing as food manufacturers and consumers shift toward natural preservation solutions that align with clean-label expectations. Enzyme-modified hydrolysates are being chosen more frequently as alternatives to synthetic preservatives because they help maintain product freshness without compromising nutritional integrity. This trend is supported by rising global concern surrounding antibiotic resistance, which has elevated the need for antimicrobial tools that do not contribute to antibiotic overuse. These hydrolysates provide effective microbial control in food and health-related applications, making them a strong fit for evolving regulatory and safety requirements. Increasing interest in health and wellness is also boosting demand, as today's consumers seek ingredients that offer both functional and bioactive benefits, expanding their relevance beyond basic preservation. With industry emphasis shifting toward naturally derived solutions that enhance product safety and quality, antimicrobial protein hydrolysates are poised for strong adoption across food, nutrition, and allied sectors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $242.1 Million |

| Forecast Value | $527.5 Million |

| CAGR | 8.1% |

The animal-derived antimicrobial hydrolysates segment was valued at USD 101.8 million in 2024 and is expected to grow at a 7.8% CAGR from 2025 to 2034. Their uptake continues to increase across food preservation, clinical nutrition, and supplement formulations due to strong peptide activity and favorable regulatory acceptance. These hydrolysates are commonly produced from protein sources such as milk, meat, or eggs and are valued for their antimicrobial potential in high-protein and ready-to-eat products requiring both safety and enhanced bioactivity.

The food preservation and safety application segment generated USD 93.7 million in 2024 and will grow at a 7.4% CAGR through 2034. This segment relies on protein hydrolysates to help inhibit microbial growth in dairy items, processed foods, beverages, and convenience meals. Their use supports clean-label requirements as manufacturers replace synthetic preservatives with naturally sourced peptide-based alternatives that help extend shelf life and maintain transparency in ingredient listings.

North America Antimicrobial (Enzymatic) Protein Hydrolysates Market generated USD 84.7 million in 2024. Adoption is increasing in the region due to heightened emphasis on clean-label preservation and strict food safety compliance. The area benefits from a strong presence of functional food and nutraceutical producers, supporting expanded use of bioactive peptides that offer combined antimicrobial and nutritional properties. Regulatory pressure to reduce chemical preservative use is also prompting food companies to incorporate enzymatic hydrolysates, while investments in biotechnology and protein processing continue to refine product quality, improve profiling accuracy, and enhance scalability across food and healthcare industries.

Major companies participating in the Antimicrobial (Enzymatic) Protein Hydrolysates Market include Cargill Inc., Glanbia plc, FrieslandCampina Ingredients, Arla Foods Ingredients, Kerry Group, and others. Companies in the Antimicrobial (Enzymatic) Protein Hydrolysates Market are focusing on several strategies to strengthen their presence. Many are channeling investments into advanced enzymatic processing technologies to improve peptide purity, potency, and consistency. Firms are expanding collaborations with food manufacturers, nutraceutical brands, and biotechnology partners to accelerate application development across multiple sectors. Emphasis on clean-label formulation support, tailored antimicrobial solutions, and enhanced functional profiles remains a core priority. Companies are also increasing R&D spending to identify novel bioactive peptides with superior antimicrobial properties. Scaling production capabilities, improving regulatory alignment, and enhancing global distribution networks help reinforce competitiveness.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product Type

- 2.2.3 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for natural food preservatives

- 3.2.1.2 Growing antibiotic resistance concerns

- 3.2.1.3 Increasing health and wellness awareness

- 3.2.1.4 Expanding applications in functional foods

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production and processing costs

- 3.2.2.2 Regulatory complexity and approval challenges

- 3.2.2.3 Limited shelf life and stability issues

- 3.2.3 Market opportunities

- 3.2.3.1 Dairy wastewater valorization

- 3.2.3.2 AI-driven peptide discovery

- 3.2.3.3 Emerging applications in cosmetics

- 3.2.3.4 Plant-based protein sources expansion

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Million, Kilo Tons)

- 5.1 Key trends

- 5.2 Animal-derived antimicrobial hydrolysates

- 5.2.1 Milk protein hydrolysates

- 5.2.2 Whey protein hydrolysates

- 5.2.3 Casein hydrolysates

- 5.2.4 Fish protein hydrolysates

- 5.2.5 Meat protein hydrolysates

- 5.2.6 Egg protein hydrolysates

- 5.3 Plant-derived antimicrobial hydrolysates

- 5.3.1 Soy protein hydrolysates

- 5.3.2 Wheat protein hydrolysates

- 5.3.3 Legume protein hydrolysates

- 5.3.4 Cereal protein hydrolysates

- 5.3.5 Seed protein hydrolysates

- 5.4 Marine-derived antimicrobial hydrolysates

- 5.4.1 Fish by-product hydrolysates

- 5.4.2 Algae protein hydrolysates

- 5.4.3 Seaweed protein hydrolysates

- 5.4.4 Crustacean shell hydrolysates

- 5.5 Microbial-derived antimicrobial hydrolysates

- 5.5.1 Bacterial fermentation products

- 5.5.2 Fungal hydrolysates

- 5.5.3 Yeast-derived peptides

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million, Kilo Tons)

- 6.1 Key trends

- 6.2 Food preservation and safety

- 6.2.1 Natural preservatives

- 6.2.2 Antimicrobial coatings

- 6.2.3 Active packaging solutions

- 6.2.4 Shelf-life extension

- 6.3 Nutritional supplements

- 6.3.1 Sports nutrition

- 6.3.2 Clinical nutrition

- 6.3.3 Infant formula

- 6.3.4 Dietary supplements

- 6.3.5 Functional foods

- 6.4 Animal feed and pet food

- 6.4.1 Growth promoters

- 6.4.2 Antibiotic alternatives

- 6.4.3 Digestive health support

- 6.4.4 Immune system enhancement

- 6.5 Pharmaceutical and healthcare

- 6.5.1 Therapeutic peptides

- 6.5.2 Wound care products

- 6.5.3 Oral care applications

- 6.5.4 Topical antimicrobials

- 6.6 Cosmetics and personal care

- 6.6.1 Antimicrobial formulations

- 6.6.2 Skin care products

- 6.6.3 Hair care applications

- 6.6.4 Anti-aging solutions

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million, Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.4.6 Rest of Asia Pacific

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.5.4 Rest of Latin America

- 7.6 Middle East & Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

- 7.6.4 Rest of Middle East & Africa

Chapter 8 Company Profiles

- 8.1 Kerry Group

- 8.2 Cargill Inc.

- 8.3 Glanbia plc

- 8.4 Arla Foods Ingredients

- 8.5 FrieslandCampina Ingredients

- 8.6 DSM-Firmenich

- 8.7 ADM (Archer Daniels Midland)

- 8.8 AMCO Proteins

- 8.9 Kemin Industries

- 8.10 Titan Biotech

- 8.11 BRF Ingredients

- 8.12 Constantino & C Spa

- 8.13 Crescent Biotech

- 8.14 Aker Biomarine

- 8.15 Biomega Group

- 8.16 Essentia Protein Solutions