|

市场调查报告书

商品编码

1885826

有机蛋白水解物市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Organic Protein Hydrolysates Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

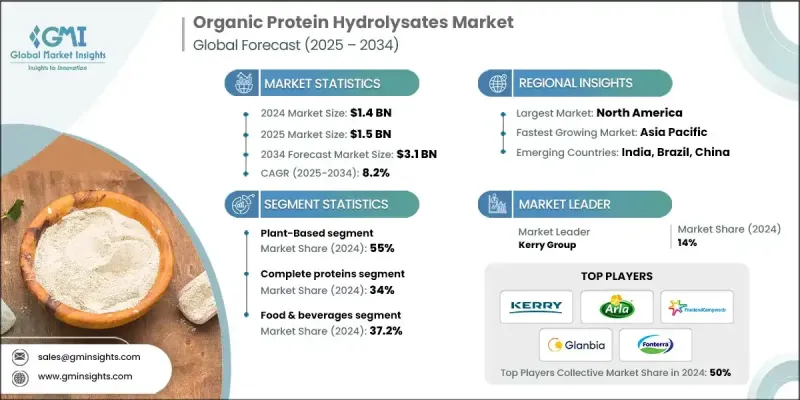

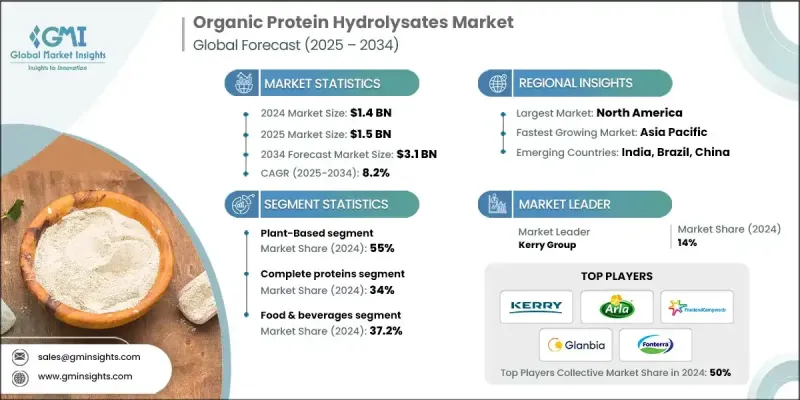

2024 年全球有机蛋白水解物市场价值为 14 亿美元,预计到 2034 年将以 8.2% 的复合年增长率增长至 31 亿美元。

随着有机营养、高蛋白饮食趋势和个人化营养的融合,市场对水解有机蛋白的需求正在加速成长,这推动了多个消费和工业领域对水解有机蛋白的需求。水解有机蛋白的生物活性、较低的致敏性和更高的吸收率持续推动产品开发,并支撑其高端定价。随着全球市场向更浓缩、更专业的蛋白质形式转变,预计功能性食品和加工食品中对水解有机蛋白的应用将更加广泛。人们对健康日益增长的兴趣、有机生物基原料使用量的增加以及运动、医疗和生活方式营养的增长,都增强了水解蛋白的吸引力。有机农业监管的支持,加上酵素加工技术的进步,正在扩大生产能力。由于对较温和、较易消化的蛋白质来源的需求,水解有机蛋白在婴幼儿营养和特殊医学营养领域的渗透率也不断提高。这些因素共同巩固了全球有机蛋白水解物的长期发展动能。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 14亿美元 |

| 预测值 | 31亿美元 |

| 复合年增长率 | 8.2% |

2024年,植物基原料市占率达到55%,预计到2034年将以8%的复合年增长率成长。随着製造商不断拓展原料组合,涵盖新的植物和海洋来源,以实现客製化的胺基酸组成和功能特性,该品类将持续成长。在北美和欧洲市场,对永续性的关注、非基因定位以及消费者对负责任采购的偏好仍然十分强劲。

2024年,完整蛋白质市占率达到34%,预计到2034年将以8.6%的复合年增长率成长。对完整氨基酸谱和先进功能特性的需求正在推动蛋白质类型的差异化。乳製品来源的蛋白质在临床和运动营养领域仍然占据主导地位,而胶原蛋白成分在註重运动和美容的领域保持强劲势头。市场正逐步转向更专业的胜肽配方,旨在实现精准的健康定位和基于智慧财产权的产品宣称。

2024年北美有机蛋白水解物市场规模为4.28亿美元,预计2034年将达到9.52亿美元。该地区受益于成熟的有机营养文化、运动和宠物产品领域的强劲需求,以及愿意为高品质、清洁标籤蛋白买单的消费者群体。美国以其在健康和营养领域的快速创新而闻名,并持续扩大有机蛋白水解物在各类产品中的商业化应用,尤其是在高性能和临床应用领域。

有机蛋白水解物市场的主要活跃企业包括:Arla Foods Ingredients、Kerry Group、FrieslandCampina Ingredients、Glanbia Nutritionals、Hilmar Ingredients、Fonterra Co-operative Group、Lactalis Ingredients、A. Costantino & CSptea、Essen Protein Solutions、VITA. Lyle、ADM (Archer Daniels Midland)、Cargill、Ingredion Incorporated、Roquette Freres、Symrise、Gelita AG 和 Weishardt Group。全球有机蛋白水解物市场的企业正透过有针对性的创新、策略性的产品组合拓展和加工能力的提升来增强其竞争优势。许多企业正在投资先进的酵素技术,以开发针对特定健康和性能需求的差异化胜肽谱。此外,各企业也拓展原料来源,纳入更广泛的植物和动物蛋白,以满足不同的应用和监管要求。与配方师和营养品牌进行策略合作有助于加快产品上市进程,并支持专业产品的开发。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 对清洁标籤、有机蛋白质的需求不断增长

- 运动、婴幼儿、临床营养方面的成长

- 酵素加工技术的进步

- 产业陷阱与挑战

- 与传统蛋白质相比,生产成本高昂

- 原料供应有限,需进行认证

- 市场机会

- 拓展至有机生物刺激剂及农业营养领域

- 植物基和无过敏原配方趋势

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 按来源

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)

(註:贸易统计仅针对重点国家提供)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依来源划分,2021-2034年

- 主要趋势

- 植物性

- 大豆

- 小麦

- 豌豆

- 米

- 玉米

- 油籽(例如,葵花籽、菜籽)

- 其他植物来源

- 动物性

- 牛奶(酪蛋白、乳清蛋白)

- 蛋

- 肉类和家禽

- 鱼类和海洋

- 胶原蛋白和明胶

- 其他来源

第六章:市场估算与预测:依蛋白质类型划分,2021-2034年

- 主要趋势

- 完全蛋白质(包含所有必需胺基酸)

- 不完全蛋白质

- 胶原蛋白和明胶蛋白

- 酪蛋白和乳清蛋白

- 特种/功能性蛋白质(生物活性胜肽、客製化混合物)

第七章:市场估计与预测:依应用领域划分,2021-2034年

- 主要趋势

- 食品和饮料

- 功能性食品

- 运动营养与性能产品

- 婴幼儿及临床营养

- 烘焙和糖果

- 乳製品及乳製品替代品

- 肉类替代品和肉製品

- 饮料(即饮饮料、粉状饮料、冰沙)

- 零食和方便食品

- 动物营养

- 宠物食品(狗粮、猫粮及其他)

- 水产饲料(鱼、虾及其他)

- 牲畜饲料(家禽、猪、反刍动物)

- 特种饲料和高性能饲料

- 农业与作物营养

- 生物刺激剂和植物生长促进剂

- 叶面喷洒

- 土壤改良剂

- 种子处理

- 化妆品及个人护理

- 保养

- 护髮

- 营养美容/由内而外的美丽

- 药品和营养保健品

- 膳食补充剂

- 医学与临床营养

- 药物传输与特殊製剂

- 工业及其他应用

第八章:市场估算与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- Arla Foods Ingredients

- Kerry Group

- FrieslandCampina Ingredients

- Glanbia Nutritionals

- Hilmar Ingredients

- Fonterra Co-operative Group

- Lactalis Ingredients

- A. Costantino & CSpA

- Essentia Protein Solutions

- VITAMINAS, SA (Bioiberica Group)

- Armor Proteines

- AMCO Proteins

- Tate & Lyle

- ADM (Archer Daniels Midland)

- Cargill

- Ingredion Incorporated

- Roquette Freres

- Symrise

- Gelita AG

- Weishardt Group

The Global Organic Protein Hydrolysates Market was valued at USD 1.4 billion in 2024 and is estimated to grow at a CAGR of 8.2% to reach USD 3.1 billion by 2034.

Demand is accelerating as organic nutrition, high-protein dietary trends, and personalized nutrition converge, increasing the need for hydrolyzed organic proteins across multiple consumer and industrial segments. Their bioactive characteristics, reduced allergenic potential, and improved absorption rates continue to drive product development and support premium pricing. Broader adoption within functional and processed foods is expected as the global market shifts toward more concentrated and specialized protein formats. Rising interest in wellness, increased use of organic bio-based inputs, and growth in sports, medical, and lifestyle nutrition have strengthened the appeal of hydrolysates. Regulatory backing for organic agriculture, combined with advancements in enzymatic processing, is expanding production capabilities. Penetration is also rising in infant, pediatric, and medical nutrition due to the need for gentler and easier-to-digest protein sources. These factors collectively reinforce long-term momentum for organic protein hydrolysates worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $3.1 Billion |

| CAGR | 8.2% |

The plant-based sources segment held a 55% share in 2024 and will grow at an 8% CAGR through 2034. The category continues to grow as manufacturers broaden their raw material portfolios across new botanical and marine sources to achieve customized amino acid compositions and functional characteristics. Sustainability concerns, non-GMO positioning, and consumer preference for responsible sourcing remain particularly strong across North American and European markets.

The complete proteins segment held a 34% share in 2024 and is expected to grow at an 8.6% CAGR through 2034. Demand for full amino acid profiles and advanced functional attributes is shaping protein-type differentiation. Dairy-derived proteins remain dominant in clinical and performance nutrition, while collagen-based ingredients maintain strong traction in mobility and beauty-focused segments. The market is gradually shifting toward more specialized peptide formulations aimed at targeted health positioning and intellectual property-based product claims.

North America Organic Protein Hydrolysates Market generated USD 428 million in 2024 to reach USD 952 million by 2034. The region benefits from a mature organic nutrition culture, strong adoption in sports and pet products, and a consumer base willing to pay for high-quality, clean-label proteins. The United States, known for rapid innovation in health and nutrition, continues to expand the commercialization of organic protein hydrolysates across diverse product categories, especially in advanced performance and clinical applications.

Key companies active in the Organic Protein Hydrolysates Market include Arla Foods Ingredients, Kerry Group, FrieslandCampina Ingredients, Glanbia Nutritionals, Hilmar Ingredients, Fonterra Co-operative Group, Lactalis Ingredients, A. Costantino & C. S.p.A., Essentia Protein Solutions, VITAMINAS, S.A. (Bioiberica Group), Armor Proteines, AMCO Proteins, Tate & Lyle, ADM (Archer Daniels Midland), Cargill, Ingredion Incorporated, Roquette Freres, Symrise, Gelita AG, and Weishardt Group. Companies in the Global Organic Protein Hydrolysates Market are strengthening their competitive positioning through targeted innovation, strategic portfolio expansion, and improved processing capabilities. Many are investing in advanced enzymatic technologies to create differentiated peptide profiles tailored for specific health and performance needs. Firms are also expanding raw material sourcing to include a broader mix of plant and animal proteins to serve diverse applications and regulatory preferences. Strategic collaborations with formulators and nutrition brands help accelerate go-to-market pathways and support specialized product development.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Source

- 2.2.3 Protein Type

- 2.2.4 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for clean-label, organic proteins

- 3.2.1.2 Growth in sports, infant, clinical nutrition

- 3.2.1.3 Advances in enzymatic processing technologies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production costs versus conventional proteins

- 3.2.2.2 Limited raw material availability and certification

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into organic biostimulants and agrinutrition

- 3.2.3.2 Plant-based and allergen-free formulation trends

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By Source

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Source, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Plant-Based

- 5.2.1 Soy

- 5.2.2 Wheat

- 5.2.3 Pea

- 5.2.4 Rice

- 5.2.5 Corn

- 5.2.6 Oilseeds (e.g., sunflower, rapeseed)

- 5.2.7 Other plant sources

- 5.3 Animal-Based

- 5.3.1 Milk (casein, whey)

- 5.3.2 Egg

- 5.3.3 Meat & Poultry

- 5.3.4 Fish & Marine

- 5.3.5 Collagen & Gelatin

- 5.4 Other sources

Chapter 6 Market Estimates and Forecast, By Protein Type, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Complete Proteins (all essential amino acids)

- 6.3 Incomplete Proteins

- 6.4 Collagen & Gelatin Proteins

- 6.5 Casein & Whey Proteins

- 6.6 Specialty / Functional Proteins (bioactive peptides, tailored blends)

Chapter 7 Market Estimates and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food & Beverages

- 7.2.1 Functional Foods

- 7.2.2 Sports Nutrition & Performance Products

- 7.2.3 Infant & Clinical Nutrition

- 7.2.4 Bakery & Confectionery

- 7.2.5 Dairy & Dairy Alternatives

- 7.2.6 Meat Analogs & Meat Products

- 7.2.7 Beverages (RTD, powdered drinks, smoothies)

- 7.2.8 Snacks & Convenience Foods

- 7.3 Animal Nutrition

- 7.3.1 Pet Food (dogs, cats, others)

- 7.3.2 Aquafeed (fish, shrimp, others)

- 7.3.3 Livestock Feed (poultry, swine, ruminants)

- 7.3.4 Specialty & Performance Feeds

- 7.4 Agriculture & Crop Nutrition

- 7.4.1 Biostimulants & Plant Growth Promoters

- 7.4.2 Foliar Sprays

- 7.4.3 Soil Amendments

- 7.4.4 Seed Treatments

- 7.5 Cosmetics & Personal Care

- 7.5.1 Skin Care

- 7.5.2 Hair Care

- 7.5.3 Nutricosmetics / Beauty-from-within

- 7.6 Pharmaceuticals & Nutraceuticals

- 7.6.1 Dietary Supplements

- 7.6.2 Medical & Clinical Nutrition

- 7.6.3 Drug Delivery & Specialty Formulations

- 7.7 Industrial & Other Applications

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Arla Foods Ingredients

- 9.2 Kerry Group

- 9.3 FrieslandCampina Ingredients

- 9.4 Glanbia Nutritionals

- 9.5 Hilmar Ingredients

- 9.6 Fonterra Co-operative Group

- 9.7 Lactalis Ingredients

- 9.8 A. Costantino & C. S.p.A.

- 9.9 Essentia Protein Solutions

- 9.10 VITAMINAS, S.A. (Bioiberica Group)

- 9.11 Armor Proteines

- 9.12 AMCO Proteins

- 9.13 Tate & Lyle

- 9.14 ADM (Archer Daniels Midland)

- 9.15 Cargill

- 9.16 Ingredion Incorporated

- 9.17 Roquette Freres

- 9.18 Symrise

- 9.19 Gelita AG

- 9.20 Weishardt Group