|

市场调查报告书

商品编码

1885797

下一代蛋白质水解物市场机会、成长驱动因素、产业趋势分析及预测(2025-2034)Next-Generation Protein Hydrolysates Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

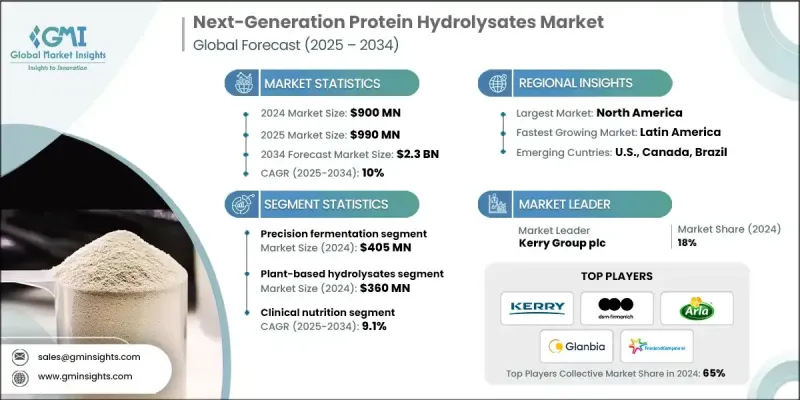

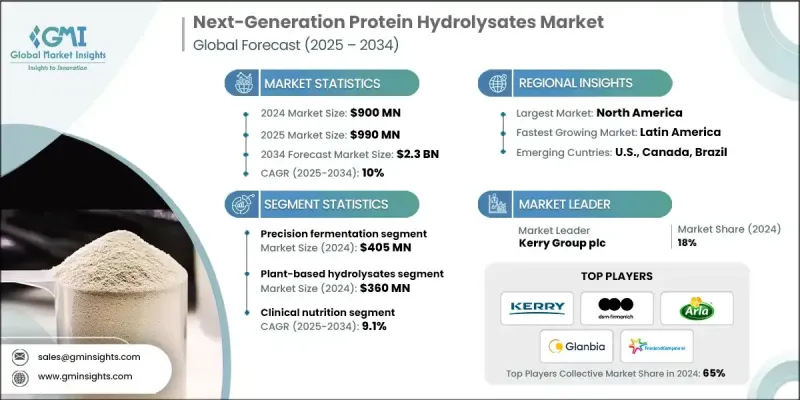

2024 年全球新一代蛋白质水解物市场价值为 9 亿美元,预计到 2034 年将以 10% 的复合年增长率增长至 23 亿美元。

随着消费者和医疗保健从业者越来越追求符合自身代谢需求、饮食敏感性和特定营养方案的成分组合,对个人化营养的需求正在加速产品普及。全球范围内不断扩展的预防性健康计划和数位指导的饮食系统,促使人们在个人化配方中添加快速吸收的胜肽成分。日益增强的健康意识和功能性食品的流行,持续推动市场的发展。多个地区的国家报告都强调了蛋白质强化食品和饮料的持续增长,这为水解物创造了机会,因为它们具有高消化率和低致敏性。品牌正在将这些胜肽成分添加到即饮配方、营养饮料、强化零食和临床膳食产品中,以吸引註重健康和清洁标籤的消费者。对自我保健投入的增加以及消费者更容易在零售通路获得富含蛋白质的食品,都为这一转变提供了支持。精准发酵技术的进步也影响市场发展,它能够实现胜肽结构的一致性、更高的纯度和更强的生物活性,同时降低对不稳定的传统原料的依赖。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 9亿美元 |

| 预测值 | 23亿美元 |

| 复合年增长率 | 10% |

2024年,精准发酵市场规模达4.05亿美元。该方法占据相当大的市场份额,因为生产商依赖其生产均一、功能性强且吸收性能优异的胜肽产品。此方法的可扩展性、降低批次差异以及与清洁标籤规范的兼容性,使其成为医疗营养、运动营养配方和特殊蛋白质等领域的首选途径。

2024年,植物性水解物市场规模达3.6亿美元。由于开发商致力于满足消费者对低致敏性、可持续和清洁标籤蛋白日益增长的需求,该市场占据了相当大的份额。丰富的豆类、豌豆、小麦和大米水解物产品组合能够实现高效生产,并支持为生活方式饮料、运动产品和代谢营养品量身定制氨基酸组成。其快速商业化的中性风味和高溶解性产品正在增强成熟品牌和新兴品牌的纯素食和弹性素食产品线。

预计到2024年,北美新一代蛋白水解物市场将占据38%的份额,其中美国贡献了大部分。成熟的营养品产业、对临床营养解决方案的强劲需求以及众多运动营养和性能营养公司的涌现,共同推动了市场成长。用于医疗饮食(尤其是老年人和术后復健族群)的水解蛋白的进步,进一步促进了市场的发展。此外,人们对易于消化、适合敏感族群的「清洁标籤」蛋白的需求日益增长,也进一步巩固了市场扩张。

新一代蛋白水解物市场的主要参与者包括格兰比亚营养品公司 (Glanbia Nutritionals)、凯瑞集团 (Kerry Group plc)、帝斯曼-菲美意公司 (DSM-Firmenich)、菲仕兰坎皮纳配料公司 (FrieslandCampina Ingredients)、阿拉食品配料公司 (Arla Foods Ingredreds (FrieslandCampina Ingredients)、阿拉食品配料公司 (Arla Foods Ingredreds)、泰森海德罗集团 (Tectront Group)、23 Foods] Day)、Geltor、GEA、Carbery、NiHTEK、恆天然 (Fonterra) 和凯敏工业 (Kemin Industries)。这些企业正透过拓展研发管线、建立长期合作伙伴关係以及投资可扩展的生产系统来巩固其市场地位。许多公司正在推进精准发酵和增强型水解技术,以提供功能可预测、吸收率更高、纯度更稳定的胜肽。与营养品牌、医疗保健机构和配方专家进行策略合作,有助于加速产品测试和商业化部署。此外,製造商也正在努力实现原材料来源多元化,以稳定供应链并拓展其清洁标籤产品线。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 对个人化营养解决方案的需求日益增长

- 健康意识的增强和功能性食品趋势

- 精准发酵技术的进步

- 提升运动与表现营养

- 产业陷阱与挑战

- 高昂的生产成本和技术投资要求

- 复杂的监管审批流程

- 消费者对下一代产品优势的认知有限。

- 市场机会

- 可持续蛋白质来源开发

- 药物和治疗应用扩展

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 产品

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依技术类型划分,2021-2034年

- 主要趋势

- 精准发酵

- 酶固定化与高级酶水解

- 生物活性胜肽萃取

- 薄膜过滤与分级分离

- 超临界流体处理

第六章:市场估算与预测:依蛋白质来源划分,2021-2034年

- 主要趋势

- 植物水解物

- 大豆蛋白水解物

- 豌豆蛋白水解物

- 米蛋白水解物

- 小麦蛋白水解物

- 其他的

- 动物来源水解物

- 乳清蛋白水解物

- 蛋清蛋白水解物

- 胶原蛋白水解物

- 海洋水解物

- 鱼蛋白水解物

- 贝类和海藻蛋白

- 藻类和海藻衍生的水解物

- 微生物水解物

- 单细胞蛋白

- 酵母和细菌蛋白

- 昆虫水解物

- 蟋蟀和麵包虫蛋白

- 黑水虻

第七章:市场估计与预测:依应用领域划分,2021-2034年

- 主要趋势

- 临床营养

- 运动与表现营养

- 蛋白质粉及混合物

- 水合与电解质

- 基于胶原蛋白胜肽

- 能量胶和能量棒

- 婴幼儿营养

- 低致敏配方

- 幼儿及儿童配方

- 功能性食品和饮料

- 强化零食

- 植物性饮料

- 即饮饮料

- 功能性果汁

- 个人护理及化妆品

- 保养

- 护髮

- 口服和皮肤胜肽

- 其他的

第八章:市场估算与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- Kerry Group plc

- DSM-Firmenich

- Arla Foods Ingredients

- Glanbia Nutritionals

- FrieslandCampina Ingredients

- Tessenderlo Group

- Fonterra

- Perfect Day

- Geltor

- Kemin Industries

- Carbery

- NiHTEK

The Global Next-Generation Protein Hydrolysates Market was valued at USD 900 million in 2024 and is estimated to grow at a CAGR of 10% to reach USD 2.3 billion by 2034.

Demand for tailored nutrition is accelerating product adoption as consumers and healthcare practitioners increasingly seek ingredient profiles aligned with metabolic needs, dietary sensitivities, and specialized nutrition programs. Globally expanding preventive health initiatives and digitally guided diet systems are encouraging the inclusion of fast-absorbing peptide ingredients in personalized formulations. Rising health consciousness and the popularity of functional foods continue to reinforce market momentum. National reports across multiple regions highlight ongoing growth in protein-fortified foods and beverages, creating opportunities for hydrolysates due to their high digestibility and reduced allergenic potential. Brands are incorporating these peptides into ready-to-drink formulas, nutrition beverages, fortified snacks, and clinical dietary products to appeal to wellness-focused buyers and clean-label priorities. Higher investment in self-care and broader retail access to protein-rich foods are supporting this shift. Advances in precision fermentation also influence market development by enabling consistent peptide structures, higher purity levels, and stronger bioactivity while decreasing dependency on variable conventional raw material sources.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $900 Million |

| Forecast Value | $2.3 Billion |

| CAGR | 10% |

The precision fermentation segment accounted for USD 405 million in 2024. This approach holds a sizable share because producers rely on its ability to deliver uniform, functional peptides with enhanced absorption properties. The method's scalability, reduced batch variation, and compatibility with clean-label specifications have made it a favored route for applications in medical nutrition, performance formulas, and specialty protein categories.

The plant-based hydrolysates segment reached USD 360 million in 2024. This segment commands a large share as developers work to meet rising interest in allergen-friendly, sustainable, and clean-label proteins. A wide portfolio of soy, pea, wheat, and rice hydrolysates enables efficient production and supports tailored amino acid compositions for lifestyle beverages, sports products, and metabolic nutrition. Their rapidly commercialized neutral-flavor and highly soluble varieties are strengthening vegan and flexitarian product lines across established and emerging brands.

North America Next-Generation Protein Hydrolysates Market held 38% share in 2024, with the United States contributing most of this share. Growth is supported by a mature nutrition sector, strong demand for clinical nutritional solutions, and the presence of multiple sports and performance nutrition companies. Advancements in hydrolyzed proteins for medical diets, especially for older adults and individuals recovering from medical procedures, are driving additional uptake. Rising interest in clean-label proteins that are easy to digest and suitable for those with sensitivities further reinforces market expansion.

Leading names in the Next-Generation Protein Hydrolysates Market include Glanbia Nutritionals, Kerry Group plc, DSM-Firmenich, FrieslandCampina Ingredients, Arla Foods Ingredients, Tessenderlo Group, Perfect Day, Geltor, GEA, Carbery, NiHTEK, Fonterra, and Kemin Industries. Companies competing in the Next-Generation Protein Hydrolysates Market are strengthening their positions by expanding R&D pipelines, building long-term partnerships, and investing in scalable production systems. Many firms are advancing precision fermentation and enhanced hydrolysis techniques to deliver peptides with predictable functionality, improved absorption, and consistent purity. Strategic collaborations with nutrition brands, healthcare organizations, and formulation specialists help accelerate product testing and commercial deployment. Manufacturers are also diversifying raw material sources to stabilize supply chains and broaden their clean-label offerings.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology Type

- 2.2.3 Protein Source

- 2.2.4 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for personalized nutritional solutions

- 3.2.1.2 Growing health consciousness & functional food trends

- 3.2.1.3 Technological advancements in precision fermentation

- 3.2.1.4 Increasing sports & performance nutrition

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production costs & technology investment requirements

- 3.2.2.2 Complex regulatory approval processes

- 3.2.2.3 Limited consumer awareness of next-generation benefits

- 3.2.3 Market opportunities

- 3.2.3.1 Sustainable protein source development

- 3.2.3.2 Pharmaceutical & therapeutic applications expansion

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 Product

- 3.8 Future market trends

- 3.9 Technology and Innovation Landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Technology Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Precision fermentation

- 5.3 Enzyme immobilization & advanced enzymatic hydrolysis

- 5.4 Bioactive peptide extraction

- 5.5 Membrane filtration & fractionation

- 5.6 Supercritical fluid processing

Chapter 6 Market Estimates and Forecast, By Protein Source, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Plant-based hydrolysates

- 6.2.1 Soy protein hydrolysates

- 6.2.2 Pea protein hydrolysates

- 6.2.3 Rice protein hydrolysates

- 6.2.4 Wheat protein hydrolysates

- 6.2.5 Others

- 6.3 Animal-based hydrolysates

- 6.3.1 Whey protein hydrolysates

- 6.3.2 Egg protein hydrolysates

- 6.3.3 Collagen hydrolysates

- 6.4 Marine-based hydrolysates

- 6.4.1 Fish protein hydrolysates

- 6.4.2 Shellfish & seaweed protein

- 6.4.3 Algae & seaweed derived hydrolysates

- 6.5 Microbial hydrolysates

- 6.5.1 Single-cell protein

- 6.5.2 Yeast & bacterial protein

- 6.6 Insect-based hydrolysates

- 6.6.1 Cricket & Mealworm protein

- 6.6.2 Black soldier fly

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Clinical nutrition

- 7.3 Sports & performance nutrition

- 7.3.1 Protein powder & blends

- 7.3.2 Hydration & electrolyte

- 7.3.3 Collagen peptide based

- 7.3.4 Energy gels and bars

- 7.4 Infant & pediatric nutrition

- 7.4.1 Hypoallergenic formula

- 7.4.2 Toddler & pediatric formulation

- 7.5 Functional foods & beverages

- 7.5.1 Fortified snacks

- 7.5.2 Plant based drinks

- 7.5.3 Ready to drink beverages

- 7.5.4 Functional juice

- 7.6 Personal care & cosmetics

- 7.6.1 Skincare

- 7.6.2 Haircare

- 7.6.3 Oral & dermal peptide

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Kerry Group plc

- 9.2 DSM-Firmenich

- 9.3 Arla Foods Ingredients

- 9.4 Glanbia Nutritionals

- 9.5 FrieslandCampina Ingredients

- 9.6 Tessenderlo Group

- 9.7 Fonterra

- 9.8 Perfect Day

- 9.9 Geltor

- 9.10 Kemin Industries

- 9.11 Carbery

- 9.12 NiHTEK