|

市场调查报告书

商品编码

1885825

发酵蛋白水解物市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Fermented Protein Hydrolysates Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

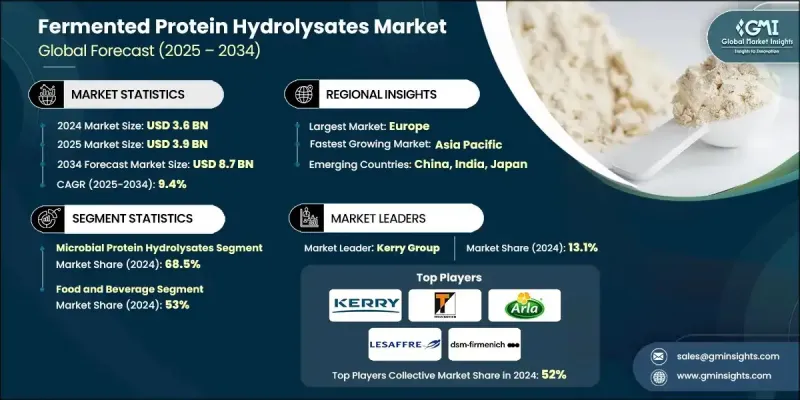

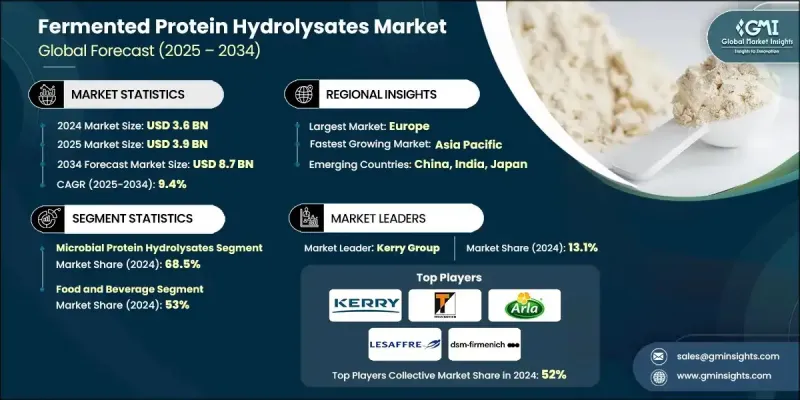

2024 年全球发酵蛋白水解物市场价值为 36 亿美元,预计到 2034 年将以 9.4% 的复合年增长率增长至 87 亿美元。

人们对健康和预防性营养的日益关注,催生了全球对功能性食品和膳食补充剂(主要成分为生物活性蛋白水解物)的约120亿至150亿美元需求。这些成分与多种生物活性有关,包括抗氧化、抗菌、降血压、抗发炎和免疫支持作用。临床证据和综合研究表明,每日摄取3-5克生物活性胜肽有助于血压管理。国际食品安全机构已将蛋白水解物纳入食品添加剂框架,全球委员会正在进行的评估有望制定可接受的摄取量限值,从而进一步促进其商业化。循环经济原则也正在重塑生产模式,将农业和海鲜加工残渣转化为高价值的营养物质。全球农业机构持续推广经济实惠的发酵和副产品加工方法,将废弃物转化为可用的蛋白质成分,有助于减少环境影响并提高经济效益。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 36亿美元 |

| 预测值 | 87亿美元 |

| 复合年增长率 | 9.4% |

2024年,微生物蛋白水解物市场占有率预计将达到68.5%,这主要得益于成熟的发酵基础设施、有利的监管环境以及成本效益高的规模化生产潜力。源自酵母、微藻、丝状真菌和细菌等微生物的蛋白质,其干重含量通常在30%至80%之间,具体含量取决于菌株和加工过程。

2024年,食品饮料产业占53%的市场。与完整蛋白质相比,这些成分可提高溶解性、乳化能力、起泡能力和凝胶化能力,使其可广泛应用于各种饮料、烘焙食品、乳製品替代配方和植物性产品。其生物活性胜肽还具有其他益处,例如透过酵素抑制活性来帮助控制血压,透过抗氧化作用降低氧化压力,以及透过抗菌特性延长产品保质期。

2024年,美国发酵蛋白水解物市场规模为7.134亿美元,预计到2034年将达到11亿美元,这主要得益于强大的生物技术实力、精准发酵领域不断增长的投资以及功能性营养品消费量的增长。美国监管架构透过「公认安全」(GRAS)途径评估发酵蛋白,并已发布多项涵盖多种精准发酵蛋白成分的认定,有效期至2025年。

全球发酵蛋白水解物市场的主要企业包括凯瑞集团(Kerry Group)、安琪酵母(Angel Yeast)、诺维信(Novozymes)、河北顺天生物技术有限公司、森馨科技(Sensient Technologies Corporation)、阿拉食品配料集团(Arla Foods Ingredients Group)、帝斯曼-菲利揓(DSM-Firmen)、Firmen(Saffre Group) Lyle)。这些企业采取的关键策略着重于提升竞争力并扩大全球影响力。许多企业正在投资先进的发酵技术,以提高产量、增强胜肽的功能并降低生产成本。此外,各公司还在生物技术、食品加工和配料开发领域建立合作关係,以加速创新并增强供应可靠性。一些公司优先考虑使用农业和海洋副产品,以支持循环经济模式并满足永续发展的要求。与监管机构的协调配合以及与安全机构的积极沟通有助于简化市场准入流程并建立客户信心。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场规模及预测:依来源划分,2021-2034年

- 主要趋势

- 动物性蛋白质水解物

- 鱼蛋白水解物

- 禽肉蛋白质水解物

- 畜牧蛋白水解物(非乳製品)

- 乳蛋白水解物

- 其他的

- 植物性蛋白质水解物

- 大豆蛋白水解物

- 豌豆蛋白水解物

- 小麦蛋白水解物

- 米蛋白水解物

- 其他的

- 微生物蛋白水解物

- 酵母萃取物和自溶物

- 细菌发酵产物

- 昆虫蛋白质水解物

- 其他的

第六章:市场规模及预测:依应用领域划分,2021-2034年

- 主要趋势

- 食品饮料应用

- 增味剂和调味料

- 蛋白质强化

- 婴儿配方奶粉与临床营养

- 功能性食品和饮料

- 动物饲料应用

- 水产饲料

- 牲畜饲料

- 家禽饲料

- 宠物食品

- 营养保健品和药品

- 生物活性胜肽

- 膳食补充剂

- 化妆品及个人护理

- 农业与园艺

- 其他的

第七章:市场规模及预测:依形式划分,2021-2034年

- 主要趋势

- 细粉

- 颗粒状/团聚状

- 浓缩液

- 糊状/半固体

- 其他的

第八章:市场规模及预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- Kerry Group

- Angel Yeast

- Arla Foods Ingredients Group

- Novozymes

- DSM-firmenich

- Fonterra

- Lesaffre Group

- Hebei Shuntian Biotechnology

- Sensient Technologies Corporation

- Tate & Lyle

- Ynsect

- Entomo Farms

- Gelita

- Rousselot

- Specialty Enzymes & Probiotics

- Azelis Group

The Global Fermented Protein Hydrolysates Market was valued at USD 3.6 billion in 2024 and is estimated to grow at a CAGR of 9.4% to reach USD 8.7 billion by 2034.

Growing attention to wellness and preventive nutrition has created an estimated USD 12-15 billion worldwide demand for functional foods and supplements that rely on bioactive protein hydrolysates. These ingredients are linked to various biological activities, including antioxidant, antimicrobial, antihypertensive, anti-inflammatory, and immune-supportive effects. Clinical evidence and aggregated research show that daily intake of 3-5 grams of bioactive peptides can contribute to blood pressure management. International food-safety bodies recognize protein hydrolysates within additive frameworks, and ongoing assessments by global committees are expected to establish acceptable intake limits, which may stimulate further commercialization. Circular-economy principles are also reshaping production by converting agricultural and seafood processing residues into high-value nutritional materials. Global agricultural agencies continue promoting affordable fermentation and by-product processing methods that convert waste into usable protein ingredients, helping both reduce environmental impact and improve economic returns.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.6 Billion |

| Forecast Value | $8.7 Billion |

| CAGR | 9.4% |

The microbial protein hydrolysates segment held 68.5% share in 2024, driven by established fermentation infrastructure, favorable regulations, and cost-efficient scale-up potential. Proteins derived from organisms such as yeasts, microalgae, filamentous fungi, and bacteria typically contain 30% to 80% protein on a dry-weight basis, depending on the strain and process used.

The food & beverage segment held 53% share in 2024. These ingredients improve solubility, emulsifying ability, foaming capacity, and gelation compared with intact proteins, enabling their use in a wide range of beverages, bakery items, dairy-alternative formulations, and plant-based products. Their bioactive peptides offer added benefits, supporting blood pressure control through enzyme-inhibitory activity, reducing oxidative stress via antioxidant action, and helping extend product shelf life through antimicrobial properties.

United States Fermented Protein Hydrolysates Market generated USD 713.4 million in 2024 and is estimated to reach USD 1.1 billion by 2034, supported by robust biotech expertise, increasing investment in precision fermentation, and rising consumption of functional nutrition. The US regulatory framework evaluates fermentation-based proteins through the Generally Recognized as Safe pathway, with multiple determinations covering a range of precision-fermented protein ingredients issued through 2025.

Major companies active in the Global Fermented Protein Hydrolysates Market include Kerry Group, Angel Yeast, Novozymes, Hebei Shuntian Biotechnology, Sensient Technologies Corporation, Arla Foods Ingredients Group, DSM-Firmenich, Fonterra, Lesaffre Group, and Tate & Lyle. Key strategies adopted by companies in the Fermented Protein Hydrolysates Market focus on boosting competitiveness and expanding global presence. Many players are investing in advanced fermentation technologies to improve yield, enhance peptide functionality, and lower production costs. Firms are also forming partnerships across biotechnology, food processing, and ingredient development to accelerate innovation and strengthen supply reliability. Several companies are prioritizing the use of agricultural and marine by-products to support circular-economy models and meet sustainability expectations. Regulatory alignment and proactive engagement with safety authorities help streamline market entry and build customer confidence.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Source

- 2.2.2 Application

- 2.2.3 Form

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Size and Forecast, By Source, 2021-2034 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Animal-based protein hydrolysates

- 5.2.1 Fish protein hydrolysates

- 5.2.2 Poultry protein hydrolysates

- 5.2.3 Livestock protein hydrolysates (non-dairy)

- 5.2.4 Dairy protein hydrolysates

- 5.2.5 Others

- 5.3 Plant-based protein hydrolysates

- 5.3.1 Soy protein hydrolysates

- 5.3.2 Pea protein hydrolysates

- 5.3.3 Wheat protein hydrolysates

- 5.3.4 Rice protein hydrolysates

- 5.3.5 Others

- 5.4 Microbial protein hydrolysates

- 5.4.1 Yeast extract & autolysates

- 5.4.2 Bacterial fermentation products

- 5.5 Insect protein hydrolysates

- 5.6 Others

Chapter 6 Market Size and Forecast, By Application, 2021-2034 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Food & beverage applications

- 6.2.1 Flavor enhancers & seasonings

- 6.2.2 Protein fortification

- 6.2.3 Infant formula & clinical nutrition

- 6.2.4 Functional foods & beverages

- 6.3 Animal feed applications

- 6.3.1 Aquaculture feed

- 6.3.2 Livestock feed

- 6.3.3 Poultry feed

- 6.3.4 Pet food

- 6.4 Nutraceuticals & pharmaceuticals

- 6.4.1 Bioactive peptides

- 6.4.2 Dietary supplements

- 6.5 Cosmetics & personal care

- 6.6 Agriculture & horticulture

- 6.7 Others

Chapter 7 Market Size and Forecast, By Form, 2021-2034 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Fine powder

- 7.3 Granular/agglomerated

- 7.4 Liquid concentrate

- 7.5 Paste/semi-solid

- 7.6 Others

Chapter 8 Market Size and Forecast, By Region, 2021-2034 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East & Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 Kerry Group

- 9.2 Angel Yeast

- 9.3 Arla Foods Ingredients Group

- 9.4 Novozymes

- 9.5 DSM-firmenich

- 9.6 Fonterra

- 9.7 Lesaffre Group

- 9.8 Hebei Shuntian Biotechnology

- 9.9 Sensient Technologies Corporation

- 9.10 Tate & Lyle

- 9.11 Ynsect

- 9.12 Entomo Farms

- 9.13 Gelita

- 9.14 Rousselot

- 9.15 Specialty Enzymes & Probiotics

- 9.16 Azelis Group