|

市场调查报告书

商品编码

1885896

人造肉配料市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Cultivated Meat Ingredients Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

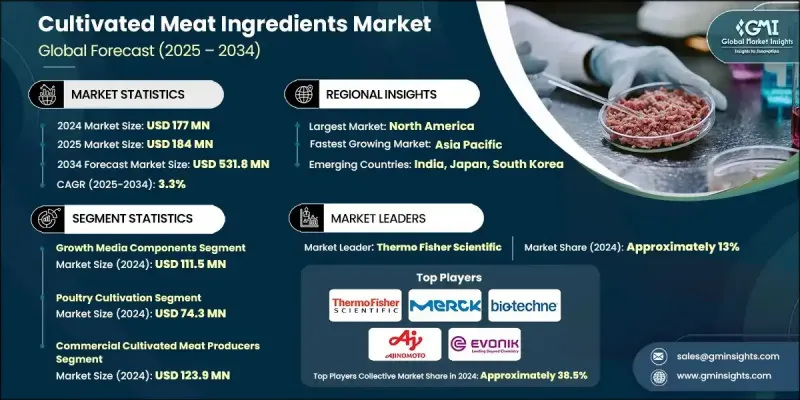

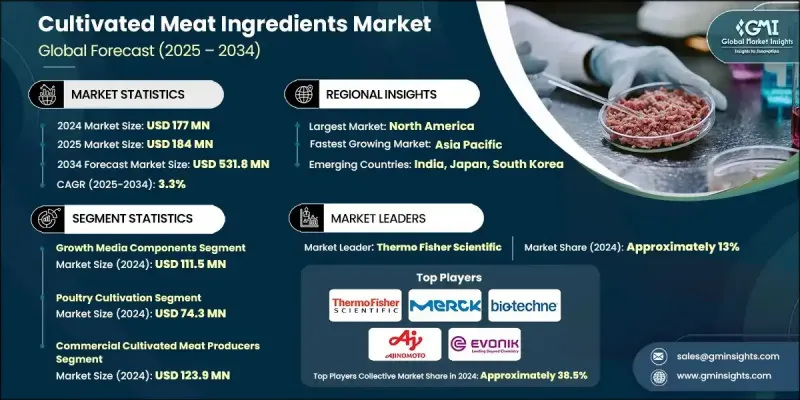

2024 年全球人造肉配料市场价值为 1.77 亿美元,预计到 2034 年将以 3.3% 的复合年增长率增长至 5.318 亿美元。

这些成分构成了细胞农业的基础,使人们能够透过可控的生物加工而非传统养殖方式,利用动物细胞生产真正的肉类。它们包括生长培养基成分、支架材料和加工添加剂等关键组分,这些成分支持细胞的扩增、成熟和结构化组织的形成。先进的生物製程工程和精准发酵技术被用于开发食品级原料,以帮助在大型生物反应器系统中形成肌肉、脂肪和结缔组织。随着法规的日益明确和永续发展优先事项的加强,製造商正着力开发不含动物成分、成本更低的配方,以推动该行业的价格与传统肉类持平。商业生产商是最大的需求群体,他们高度依赖高品质的培养基原料,包括基础营养素、重组生长因子(如FGF2和IGF-1)、无血清替代品以及专为高密度细胞性能设计的微量营养素混合物。这种循环的生物加工方法旨在减少对昂贵的药用级原料的依赖,并为能够支持工业级人造肉生产的可扩展生产系统铺平道路。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1.77亿美元 |

| 预测值 | 5.318亿美元 |

| 复合年增长率 | 3.3% |

2024年,培养基成分细分市场创造了1.115亿美元的收入,预计2025年至2034年将以3.2%的复合年增长率成长,2024年市占率将达到63%。这个类别占据主导地位,因为这些成分为细胞在整个培养过程中的稳健生长、存活和分化提供了必要的生化基础。基础营养素、特化蛋白、胺基酸混合物和无血清替代品协同作用,共同创造了组织形成的最佳环境。

2024年,家禽养殖业市场规模达7,430万美元,预计2025年至2034年间将以3.4%的复合年增长率成长,占2024年市场总额的42%。家禽细胞培养技术凭藉其良好的生长特性、更有效率的培养基需求以及消费者对各种家禽产品的广泛接受度,在该领域占据领先地位。更快的细胞倍增时间和更低的复杂性有助于降低营运成本和缩短商业化週期,这对于专注于快速扩大规模并同时控制资金需求的早期生产设施尤其重要。

预计2025年至2034年,北美人造肉配料市场将以3.3%的复合年增长率成长。企业对永续蛋白质生产日益增长的兴趣,以及人们对细胞农业在负责任的食品体系中作用的认识不断提高,正推动着人造肉配料在商业、试点和研究领域的应用。对环境影响和符合伦理的食品生产的关注,促使人们投资于先进的生物工艺技术,这些技术有望逐步补充传统的畜牧业体系。

全球人造肉配料市场的主要企业包括赛默飞世尔科技(Thermo Fisher Scientific)、默克集团(Merck KGaA)、百奥泰克(Bio-Techne)、味之素(Ajinomoto)、赢创工业集团(Evonik Industries)、CJ Bio、瓦克化学(Wacker Chemie瓦克)、赛多利斯本(Sartori) Bio)、鲁塞尔(Rousselot)、吉利达(GELITA)和帕尔斯加德(Palsgaard)。这些企业正透过大力投资研发来降低生产成本、提升功能性能,并开发适用于大规模生物加工的无动物性配料,从而增强自身的竞争优势。许多公司正在推动重组蛋白技术,优化营养成分配比,并与人造肉品生产商建立合作关係,共同开发专用培养基配方。企业正透过新建生产基地、进行策略合作以及整合供应链来扩大其全球业务版图,以确保配料的稳定供应。此外,包括转向使用食品级非药用成分在内的永续发展倡议,也为市场的长期扩张提供了支持。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 司机

- 陷阱与挑战

- 机会

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 按成分

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依成分划分,2021-2034年

- 主要趋势

- 生长培养基成分

- 基础培养基

- 血清及血清替代品

- 重组生长因子

- 重组结构蛋白和功能蛋白

- 胺基酸和氮源

- 维生素、矿物质和能量来源

- 生长培养基成分

- 奈米纤维支架

- 可食用微载体

- 可食用膜和中空纤维系统

- 细胞外基质(ECM)蛋白

- 植物来源的支架

- 真菌和微生物支架

- 合成聚合物支架

- 3D生物墨水

- 加工助剂和配方成分

- 交联酶

- 脂质和脂肪酸

- 乳化剂和稳定剂

- 脂肪替代品和油凝胶

- 风味系统和感官增强剂

第六章:市场估算与预测:依应用领域划分,2021-2034年

- 主要趋势

- 家禽养殖

- 海鲜及鱼类养殖

- 牛肉和红肉养殖

- 猪肉养殖

- 异国风味和新奇肉类

- 其他的

第七章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 商业养殖肉品生产商

- 试点和示范设施

- 研究机构与学术界

- 其他的

第八章:市场估算与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- Thermo Fisher Scientific

- Merck KGaA

- Bio-Techne

- Ajinomoto

- Evonik Industries

- CJ Bio

- Wacker Chemie

- Sartorius

- ADM

- Cargill

- GenScript

- Takara Bio

- Rousselot

- GELITA

- Palsgaard

The Global Cultivated Meat Ingredients Market was valued at USD 177 million in 2024 and is estimated to grow at a CAGR of 3.3% to reach USD 531.8 million by 2034.

These ingredients form the foundation of cellular agriculture, enabling the creation of real meat from animal cells through controlled bioprocessing rather than traditional farming. They include essential components such as growth media ingredients, scaffolding materials, and processing additives that support cell expansion, maturation, and structured tissue formation. Advanced bioprocess engineering and precision fermentation are used to develop food-grade inputs that help form muscle, fat, and connective tissue within large-scale bioreactor systems. As regulations become clearer and sustainability priorities strengthen, manufacturers are emphasizing animal-free, lower-cost formulations to push the industry toward price parity with conventional meat. Commercial producers represent the largest demand base, relying heavily on high-quality media inputs including basal nutrients, recombinant growth factors like FGF2 and IGF-1, serum-free replacements, and micronutrient blends designed for high-density cell performance. This circular approach to bioprocessing aims to reduce dependence on costly pharmaceutical-grade ingredients and builds the path toward scalable production systems capable of supporting industrial-level cultivated meat operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $177 million |

| Forecast Value | $531.8 million |

| CAGR | 3.3% |

The growth media components segment generated USD 111.5 million in 2024 and is expected to grow at a CAGR of 3.2% from 2025 to 2034, accounting for a 63% share in 2024. This category plays a dominant role because these components provide the biochemical foundation necessary for robust cell growth, survival, and differentiation throughout cultivation. Basal nutrients, specialized proteins, amino acid blends, and serum-free substitutes all work together to create the optimal environment for tissue formation.

The poultry cultivation segment generated USD 74.3 million in 2024 and is expected to grow at a CAGR of 3.4% between 2025 and 2034, representing 42% of the total market in 2024. Poultry cells hold a leading position in this sector due to their favorable growth behavior, more efficient media requirements, and broad consumer acceptance of various poultry-based products. Faster cell doubling times and reduced complexity contribute to lower operating costs and shorter commercialization timelines, which are especially important for early-stage production facilities focused on scaling rapidly while managing capital demands.

North America Cultivated Meat Ingredients Market is projected to grow at a CAGR of 3.3% from 2025 to 2034. Rising corporate interest in sustainable protein production and growing recognition of cellular agriculture's role in responsible food systems are contributing to increased adoption across commercial, pilot, and research environments. Concerns surrounding environmental impact and ethical food production are motivating investment into advanced bioprocess technologies that may gradually complement traditional livestock-based systems.

Leading companies in the Global Cultivated Meat Ingredients Market include Thermo Fisher Scientific, Merck KGaA, Bio-Techne, Ajinomoto, Evonik Industries, CJ Bio, Wacker Chemie, Sartorius, ADM, Cargill, GenScript, Takara Bio, Rousselot, GELITA, and Palsgaard. Companies in the Cultivated Meat Ingredients Market are strengthening their competitive positioning by investing heavily in R&D to lower production costs, improve functional performance, and develop animal-free ingredients tailored for large-scale bioprocessing. Many firms are advancing recombinant protein technologies, optimizing nutrient blends, and building partnerships with cultivated meat manufacturers to co-develop specialized media formulations. Businesses are expanding their global footprint through new production sites, strategic collaborations, and supply-chain integration to ensure reliable ingredient availability. Sustainability initiatives, including the shift toward food-grade, non-pharmaceutical components, also support long-term market expansion.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Ingredients trends

- 2.2.2 Application trends

- 2.2.3 End use trends

- 2.2.4 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Drivers

- 3.2.2 Pitfalls & Challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By ingredients

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Ingredients, 2021-2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 Growth media components

- 5.2.1 Basal media

- 5.2.2 Serum & serum alternatives

- 5.2.3 Recombinant growth factors

- 5.2.4 Recombinant structural & functional proteins

- 5.2.5 Amino acids & nitrogen sources

- 5.2.6 Vitamins, minerals & energy sources

- 5.3 Growth media components

- 5.3.1 Nanofibrous scaffolds

- 5.3.2 Edible microcarriers

- 5.3.3 Edible membranes & hollow fiber systems

- 5.3.4 Extracellular matrix (ECM) proteins

- 5.3.5 Plant-derived scaffolds

- 5.3.6 Fungal & microbial scaffolds

- 5.3.7 Synthetic polymer scaffolds

- 5.3.8 3D bioinks

- 5.4 Processing aids & formulation ingredients

- 5.4.1 Crosslinking enzymes

- 5.4.2 Lipids & fatty acids

- 5.4.3 Emulsifiers & stabilizers

- 5.4.4 Fat substitutes & oleogels

- 5.4.5 Flavor systems & sensory enhancers

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 Poultry cultivation

- 6.3 Seafood & fish cultivation

- 6.4 Beef & red meat cultivation

- 6.5 Pork cultivation

- 6.6 Exotic & novel meats

- 6.7 Others

Chapter 7 Market Estimates and Forecast, By End Use, 2021-2034 (USD Million & Kilo Tons)

- 7.1 Key trends

- 7.2 Commercial Cultivated Meat Producers

- 7.3 Pilot & Demonstration Facilities

- 7.4 Research Institutions & Academia

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Million & Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Thermo Fisher Scientific

- 9.2 Merck KGaA

- 9.3 Bio-Techne

- 9.4 Ajinomoto

- 9.5 Evonik Industries

- 9.6 CJ Bio

- 9.7 Wacker Chemie

- 9.8 Sartorius

- 9.9 ADM

- 9.10 Cargill

- 9.11 GenScript

- 9.12 Takara Bio

- 9.13 Rousselot

- 9.14 GELITA

- 9.15 Palsgaard