|

市场调查报告书

商品编码

1913389

培养肉市场:市场机会、成长驱动因素、产业趋势分析及预测(2026-2035)Cultured Meat Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

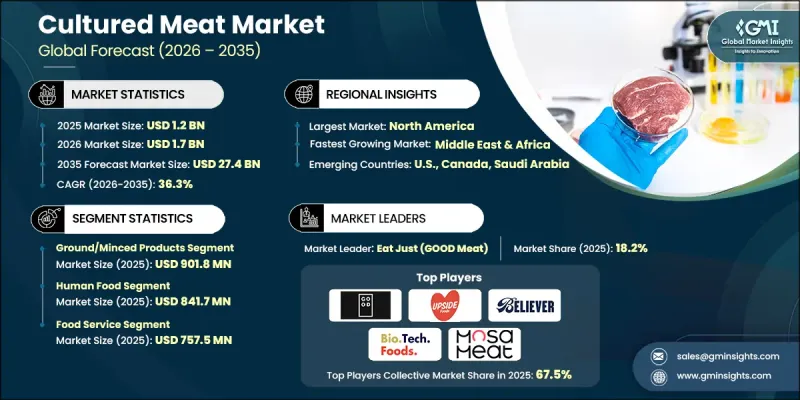

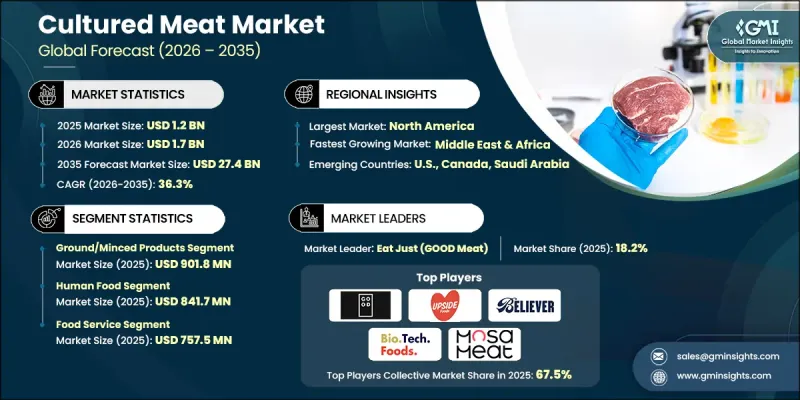

全球培养肉市场预计到 2025 年将达到 12 亿美元,到 2035 年将达到 274 亿美元,年复合成长率为 36.3%。

培养肉反应器是培养肉产业的核心,它提供了一种可扩展的解决方案,无需屠宰动物即可生产实验室培养肉。这些生物反应器为动物细胞培养创造了精确的环境,从而实现对细胞生长、营养输送和压力管理的精准控制。不同的系统,包括搅拌槽、灌注式、气升和中空纤维式生物反应器,在扩充性和细胞维护方面各具优势。生物反应器设计、培养基优化和放大技术的最新创新,使得经济高效的大规模生产成为可能。随着时间的推移,技术进步有望降低生产成本,提高培养肉的可负担性和普及性。人造肉质、风味和品质的提升也将推动消费者接受度,并促进市场扩张。日益增长的伦理、环境和永续性问题,以及对肉类替代品需求的不断增长,是推动该市场发展的关键因素。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测期 | 2026-2035 |

| 初始市场规模 | 12亿美元 |

| 市场规模预测 | 274亿美元 |

| 复合年增长率 | 36.3% |

永续性是培养肉生物反应器市场的关键驱动因素。实验室培育肉类为传统肉类生产提供了一种对环境友善且符合伦理的替代方案,并符合不断变化的消费者偏好。然而,高昂的初始资本和营运成本构成了挑战,尤其对于Start-Ups公司和新兴企业,儘管市场潜力巨大,但仍会阻碍其商业化进程。

预计到2025年,碎肉製品将占据最大市场份额,达到9.018亿美元。这些培养肉之所以能引领市场,是因为与挤压肉块相比,它们的生产流程更简单,规模化生产速度更快。由于其易于组织形成,製造商可以在较小的生物反应器中进行操作,而不会影响质地或感官品质。此外,它们用途广泛,可用于製作汉堡、肉丸、饺子和鸡块等各种流行食品,因此越来越受到消费者的青睐。这种相容性使生产商能够瞄准那些能够承受较高初始价格的大消费群体,同时保持可预测的需求模式。

预计到2025年,人类食品领域的市场规模将达到8.417亿美元。以人类消费为重点是培养肉产业发展的主要动力,各公司优先开发符合主流饮食习惯和商业食品服务需求的产品。试吃活动、早期监管核准和有限的零售推广主要面向人类消费,使公司能够更大规模地检验产品的口味、质地和安全性。这种策略符合永续性和伦理的蛋白质趋势,有助于将培养肉确立为传统动物性产品的可行替代品。

美国在北美培养肉市场占据主导地位,预计2025年将占38%的市场。这主要得益于强大的细胞农业Start-Ups生态系统、广泛的创业投资支持以及美国食品药物管理局(FDA)和农业部(USDA)的早期监管行动。该地区的成长也得益于对大型生产设施的大量投资、主要製造商持续开发商业工厂以及在餐饮服务管道开展的先导计画,这些项目有助于验证消费者对人造肉的接受度,并为人造肉的广泛应用做好准备。

目录

第一章:分析方法和范围

第二章执行摘要

第三章业界考察

- 产业生态系分析

- 供应商情况

- 利润率

- 每个阶段的附加价值

- 影响价值链的因素

- 中断

- 产业影响因素

- 司机

- 对动物性产品替代品的需求日益增长

- 线上食品配送通路的快速发展

- 技术成熟和成本降低

- 产业潜在风险与挑战

- 严格的法规环境和核准时间表

- 高资本投入与初始成本

- 市场机会

- 无动物源成分培养基的商业化

- 混合产品开发

- 司机

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特五力分析

- PESTEL 分析

- 价格趋势

- 按地区

- 产品

- 未来市场趋势

- 科技与创新趋势

- 当前技术趋势

- 新兴技术

- 专利状态

- 贸易统计(HS编码)(註:仅提供主要国家的贸易统计)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续努力

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章 竞争情势

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 企业矩阵分析

- 主要企业的竞争分析

- 竞争定位矩阵

- 主要趋势

- 企业合併(M&A)

- 商业伙伴关係与合作

- 新产品发布

- 扩张计划

第五章 依产品类型分類的市场估算与预测(2022-2035 年)

- 肉糜製品

- 汉堡

- 肉丸

- 香肠

- 碎肉

- 模製产品

- 金块

- 条状/嫩条

- 一块肉

- 其他的

第六章 按应用领域分類的市场估算与预测(2022-2035 年)

- 人类食物

- 宠物食品

- 狗粮

- 猫粮

- 异宠食品

- 研究与发展(R&D)

- 学术研究

- 产品开发

- 监管测试

- 其他的

第七章 按分销管道分類的市场估计和预测(2022-2035 年)

- DTC(直接面对消费者)

- 零售店

- 超级市场和大卖场

- 专卖店

- 便利商店

- 食品服务业

- 餐厅

- 餐饮服务

- 机构餐饮服务

- B2B

第八章 各地区市场估算与预测(2022-2035 年)

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 其他欧洲

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿拉伯聯合大公国

- 其他中东和非洲地区

第九章:公司简介

- Mosa Meat

- Upside Foods

- Aleph Farms

- Finless Foods

- Meatable

- Believer Meats(formerly Future Meat Technologies)

- HigherSteaks

- Avant Meats

- BlueNalu

- Eat Just(GOOD Meat)

- BioFood Systems

- Balletic Foods

- Biotech Foods

The Global Cultured Meat Market was valued at USD 1.2 billion in 2025 and is estimated to grow at a CAGR of 36.3% to reach USD 27.4 billion by 2035.

Cultured meat bioreactors are at the heart of the cultivated meat industry, providing scalable solutions for producing lab-grown meat without the need for animal slaughter. These bioreactors create precise environments for animal cell cultivation, enabling controlled growth, nutrient supply, and stress management. Different systems, including stirred-tank, perfusion, airlift, and hollow-fiber bioreactors, offer unique advantages for scalability and cell maintenance. Recent innovations in bioreactor design, culture media optimization, and scale-up techniques have improved cost efficiency, making mass production more feasible. Technological progress is expected to reduce production costs over time, increasing affordability and accessibility. Improved texture, flavor, and quality of cultivated meat will also drive consumer adoption, fueling market expansion. Growing ethical, environmental, and sustainability concerns, coupled with rising demand for meat alternatives, are key factors propelling this market.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.2 Billion |

| Forecast Value | $27.4 Billion |

| CAGR | 36.3% |

Sustainability is a central driver for the cultured meat bioreactors market. Lab-grown meat provides an environmentally friendly and ethical alternative to traditional meat production, aligning with changing consumer preferences. However, high initial capital and operational costs pose challenges, particularly for startups and emerging companies, slowing commercialization efforts despite strong market potential.

Ground and minced products accounted for a substantial share, valued at USD 901.8 million in 2025. These forms of cultured meat are leading the market due to their simpler production process and faster scalability compared with structured cuts. Their ease of tissue formation allows manufacturers to operate smaller bioreactors without compromising texture or sensory quality. Additionally, their versatility for popular applications such as burgers, meatballs, dumplings, and nuggets boosts consumer adoption. This compatibility enables producers to target high-volume segments that can absorb higher initial pricing while supporting predictable demand patterns.

The human food segment generated USD 841.7 million in 2025. The focus on human consumption drives much of the cultured-meat industry, as companies prioritize products aligned with mainstream diets and commercial foodservice demand. Pilot tastings, early regulatory approvals, and limited retail launches primarily target human consumption, allowing firms to validate taste, texture, and safety on a broader scale. This approach also aligns with sustainability and ethical protein trends, helping cultivated meat establish itself as a viable alternative to conventional animal products.

North America Cultured Meat Market captured 38% share in 2025, with the U.S. leading due to a strong ecosystem of cell-agriculture startups, extensive venture capital support, and initial regulatory engagement from the FDA and USDA. The region's growth is supported by substantial investments in large-scale production facilities, ongoing commercial plant developments by major manufacturers, and continued pilot projects in foodservice channels, which help confirm consumer acceptance and readiness for wider adoption.

Key players in the Global Cultured Meat Market include ABEC, Alfa Laval, Bioengineering AG, Eppendorf AG, Esco Lifesciences Group, GEA, Infors HT, INNOVA Bio-meditech, KBiotech GmbH, Merck KGaA, OLLITAL Technology, Pall Corporation, Sartorius AG, Solaris Biotech, and Vogtlin Instruments GmbH. Companies in the Global Cultured Meat Market are strengthening their foothold through strategic R&D investments to enhance bioreactor efficiency, scalability, and automation. Collaborations with research institutions and startups help accelerate technology development and optimize culture conditions. Expanding manufacturing capacities, developing cost-effective culture media, and offering turnkey solutions for pilot and commercial-scale production enhance market presence. Firms are also diversifying product portfolios to address specific applications in cellular agriculture and cultivated meat production. Regulatory engagement, participation in industry consortia, and sustainability initiatives further reinforce credibility and position companies as leaders in this emerging market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product Type

- 2.2.3 Application

- 2.2.4 Distribution Channel

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for animal-based product alternatives

- 3.2.1.2 Rapid evolution of online food delivery channels

- 3.2.1.3 Technology maturation & cost reduction

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory environment & approval timelines

- 3.2.2.2 High capital expenditure & setup costs

- 3.2.3 Market opportunities

- 3.2.3.1 Animal-free media commercialization

- 3.2.3.2 hybrid product development

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 Product

- 3.8 Future market trends

- 3.9 Technology and Innovation Landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2022 - 2035 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Ground/minced products

- 5.2.1 Burgers

- 5.2.2 Meatballs

- 5.2.3 Sausages

- 5.2.4 Ground meat

- 5.3 Structured products

- 5.3.1 Nuggets

- 5.3.2 Strips/tenders

- 5.3.3 Whole cuts

- 5.4 Others

Chapter 6 Market Estimates and Forecast, By Application, 2022 - 2035 (USD million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Human food

- 6.3 Pet food

- 6.3.1 Dog food

- 6.3.2 Cat food

- 6.3.3 Exotic pet food

- 6.4 Research & development

- 6.4.1 Academic research

- 6.4.2 Product development

- 6.4.3 Regulatory testing

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2022 - 2035 (USD million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Direct-to-Consumer (DTC)

- 7.3 Retail Stores

- 7.3.1 Supermarkets & hypermarkets

- 7.3.2 Specialty stores

- 7.3.3 Convenience stores

- 7.4 Food Service

- 7.4.1 Restaurants

- 7.4.2 Catering Services

- 7.4.3 Institutional Food Service

- 7.5 B2B

Chapter 8 Market Estimates and Forecast, By Region, 2022 - 2035 (USD million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Mosa Meat

- 9.2 Upside Foods

- 9.3 Aleph Farms

- 9.4 Finless Foods

- 9.5 Meatable

- 9.6 Believer Meats (formerly Future Meat Technologies)

- 9.7 HigherSteaks

- 9.8 Avant Meats

- 9.9 BlueNalu

- 9.10 Eat Just (GOOD Meat)

- 9.11 BioFood Systems

- 9.12 Balletic Foods

- 9.13 Biotech Foods