|

市场调查报告书

商品编码

1693822

日本工程塑胶:市场占有率分析、产业趋势与成长预测(2024-2029年)Japan Engineering Plastics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

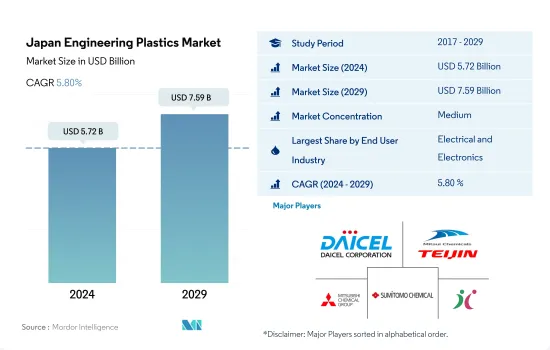

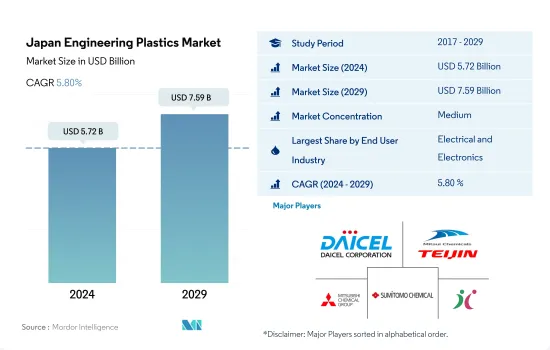

日本工程塑胶市场规模预计在 2024 年为 57.2 亿美元,预计到 2029 年将达到 75.9 亿美元,预测期内(2024-2029 年)的复合年增长率为 5.80%。

电气电子产业在价值和数量上保持主导地位

- 工程塑胶的应用范围包括航太领域的内墙板和门以及硬质和软质包装。日本的工程塑胶市场受到包装、电气/电子和汽车产业推动。 2022年工程塑胶市场容量占包装产业比重约26.89%,占电子电气产业比重约27.23%。

- 电气和电子产业是该国最大的产业。例如,日本电子产业预计2022年国内产值将年与前一年同期比较%,达到843.4亿美元。这一增长主要得益于电子元件设备出口条件有利、汽车中电子元件的使用增加以及5G技术的发展导致对电气测量仪器的需求增加。这些因素将推动国内工程塑胶消费量增加,2022与前一年同期比较量年增率将达1.12%。

- 2022年,汽车产业占据了25.65%的收益占有率,成为全国第二大最具前景的产业。 2022年日本汽车产业与前一年同期比较增15.15%。这主要由于国内汽车产量增加,2022年国内汽车产量与前一年同期比较增3.49%至941万辆。

- 航太业是该国收入成长最快的行业,预计复合年增长率为 7.69%,这归因于航太业支出的增加,预计这将在预测期内推动对工程塑胶的需求。预计到2029年,日本航太零件製造业收入将达到约170亿美元。

日本工程塑胶市场趋势

政府采取措施支持国内电气电子设备製造业

- 日本电子产业擅长零件和设备生产,生产固态固态电池和医疗相机等关键技术。预计政府在脱碳方面的努力以及以工厂自动化和远程办公为中心的工作方式改革功能的开发将带来进一步的创新,而汽车行业在这两方面表现优异。

- 2019年,受美国贸易战导致的晶片短缺以及远端办公带来的需求增加的影响,日本国内电子产品生产受到影响。 2020年,又受新冠疫情影响,日本电子元件设备和电子电路製造企业数量从上一年的约3,860家降至约3,790家,为10年来的最低水准。日本2020年家用电子电器产值为429.8亿日元,工业电子产值为2556.76亿日圆。

- 日本2020-2021年电气电子设备生产收入成长19.2%。日本电子产业总产值预计2021年将达到近11兆日圆,该产业包括消费性电子、工业电子、电子元件设备等。家用电子电器占日本经济产出的三分之一。

- 由于美国总统和日本首相承诺提高半导体製造能力,且日本也投资创新领域,日本电子产业在预测期内可能会被提振。

日本工程塑胶产业概况

日本工程塑胶市场适度整合,前五大公司占63.27%的市场。该市场的主要企业包括 Daicel Corporation、MCT PET Resin、三菱化学公司、住友化学、Techno-UMG 等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 最终用户趋势

- 航太

- 车

- 建筑与施工

- 电气和电子

- 包装

- 进出口趋势

- 价格趋势

- 回收概述

- 聚酰胺(PA)回收趋势

- 聚碳酸酯(PC)回收趋势

- 聚对苯二甲酸乙二醇酯(PET)的回收趋势

- 苯乙烯共聚物(ABS、SAN)的回收趋势

- 法律规范

- 日本

- 价值炼和通路分析

第五章市场区隔

- 最终用户产业

- 航太

- 车

- 建筑与施工

- 电气和电子

- 工业/机械

- 包装

- 其他的

- 树脂类型

- 氟树脂

- 依亚型

- 乙烯-四氟乙烯(ETFE)

- 氟化乙丙烯 (FEP)

- 聚四氟乙烯(PTFE)

- 聚氟乙烯(PVF)

- 聚二氟亚乙烯(PVDF)

- 其他子树脂类型

- 液晶聚合物(LCP)

- 聚酰胺(PA)

- 依树脂类型分

- 芳香聚酰胺

- 聚酰胺(PA)6

- 聚酰胺(PA)66

- 聚邻苯二甲酰胺

- 聚丁烯对苯二甲酸酯(PBT)

- 聚碳酸酯(PC)

- 聚醚醚酮(PEEK)

- 聚对苯二甲酸乙二醇酯(PET)

- 聚酰亚胺(PI)

- 聚甲基丙烯酸甲酯(PMMA)

- 聚甲醛(POM)

- 苯乙烯共聚物(ABS和SAN)

- 氟树脂

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- AGC Inc.

- Asahi Kasei Corporation

- Daicel Corporation

- Daikin Industries, Ltd.

- Kuraray Co., Ltd.

- Kureha Corporation

- MCT PET Resin Co Ltd

- Mitsubishi Chemical Corporation

- PBI Advanced Materials Co.,Ltd.

- Polyplastics-Evonik Corporation

- Sumitomo Chemical Co., Ltd.

- Techno-UMG Co., Ltd.

- Teijin Limited

- Toray Industries, Inc.

- UBE Corporation

第七章 CEO 的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架(产业吸引力分析)

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 数据包

- 词彙表

简介目录

Product Code: 5000160

The Japan Engineering Plastics Market size is estimated at 5.72 billion USD in 2024, and is expected to reach 7.59 billion USD by 2029, growing at a CAGR of 5.80% during the forecast period (2024-2029).

The electrical and electronics industry to maintain its dominance in terms of both value and volume

- Engineering plastics have applications ranging from interior wall panels and doors in aerospace to rigid and flexible packaging. In Japan, the engineering plastics market is led by the packaging, electrical and electronics, and automotive industries. Packaging and electrical and electronics industries accounted for around 26.89% and 27.23% of the engineering plastics market volume in 2022.

- The electrical and electronics sector is the largest in the country. For instance, the Japanese electronics industry experienced a 2% Y-o-Y increase in domestic production in 2022, reaching a total of USD 84.34 billion. This growth was mainly attributed to the strong performance of electronic components and devices in exports, the rising usage of electronic components in vehicles, and the increasing demand for electric measuring instruments due to the growth of 5G technology. These factors led to higher consumption of engineering plastics in the country, with volume growth of 1.12% in 2022 compared to the previous year.

- In 2022, the automotive industry accounted for 25.65% of the revenue share, which made it the second largest promising industry in the country. In 2022, the Japanese automotive industry grew at a Y-o-Y rate of 15.15% compared to the previous year. This was mainly due to an increase in vehicle production in the country, which was recorded at 9.41 million units in 2022, 3.49% higher than the previous year.

- Aerospace is the fastest-growing industry in the country in terms of revenue, with a projected CAGR of 7.69%, owing to increased spending in the aerospace industry, which is expected to drive the demand for engineering plastics during the forecast period. Japan's aerospace component production revenue is expected to reach around USD 17 billion by 2029.

Japan Engineering Plastics Market Trends

Government policies to support domestic electrical and electronics production

- The Japanese electronics industry excels in the production of components and devices, creating key technologies, such as all-solid batteries and medical cameras. The government's efforts toward decarbonization and the industry's proficiency in this field will enable further innovations by developing functions geared toward factory automation and telework-led workstyle reforms.

- The country faced chip shortages caused by the trade war between the United States and China, and the increased demand that followed the move to remote working that affected the production of electronics in the country in 2019. Consecutively, due to COVID-19 pandemic-related disruptions in 2020, the number of businesses in the Japanese electronic parts, devices, and electronic circuits manufacturing industry hit a decade low of approximately 3.79 thousand establishments, a decrease from around 3.86 thousand in the previous year. The country produced consumer electronic equipment of JPY 42,908 million, by value, and industrial electronic equipment of JPY 25,5676 million, by value, in 2020.

- Japan registered an increase of 19.2% in electrical and electronics production revenue from 2020 to 2021. The total production value of the electronics industry in Japan reached close to JPY 11 trillion in 2021. The industry encompasses consumer electronic equipment, industrial electronic equipment, and electronic components and devices. Consumer electronics account for a third of Japan's economic output.

- The US President and Japanese Prime Minister pledged to bolster semiconductor manufacturing capacity, and the country is also investing in the innovation sector, which may boost the electronic industry in the country during the forecast period.

Japan Engineering Plastics Industry Overview

The Japan Engineering Plastics Market is moderately consolidated, with the top five companies occupying 63.27%. The major players in this market are Daicel Corporation, MCT PET Resin Co Ltd, Mitsubishi Chemical Corporation, Sumitomo Chemical Co., Ltd. and Techno-UMG Co., Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Electrical and Electronics

- 4.1.5 Packaging

- 4.2 Import And Export Trends

- 4.3 Price Trends

- 4.4 Recycling Overview

- 4.4.1 Polyamide (PA) Recycling Trends

- 4.4.2 Polycarbonate (PC) Recycling Trends

- 4.4.3 Polyethylene Terephthalate (PET) Recycling Trends

- 4.4.4 Styrene Copolymers (ABS and SAN) Recycling Trends

- 4.5 Regulatory Framework

- 4.5.1 Japan

- 4.6 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Electrical and Electronics

- 5.1.5 Industrial and Machinery

- 5.1.6 Packaging

- 5.1.7 Other End-user Industries

- 5.2 Resin Type

- 5.2.1 Fluoropolymer

- 5.2.1.1 By Sub Resin Type

- 5.2.1.1.1 Ethylenetetrafluoroethylene (ETFE)

- 5.2.1.1.2 Fluorinated Ethylene-propylene (FEP)

- 5.2.1.1.3 Polytetrafluoroethylene (PTFE)

- 5.2.1.1.4 Polyvinylfluoride (PVF)

- 5.2.1.1.5 Polyvinylidene Fluoride (PVDF)

- 5.2.1.1.6 Other Sub Resin Types

- 5.2.2 Liquid Crystal Polymer (LCP)

- 5.2.3 Polyamide (PA)

- 5.2.3.1 By Sub Resin Type

- 5.2.3.1.1 Aramid

- 5.2.3.1.2 Polyamide (PA) 6

- 5.2.3.1.3 Polyamide (PA) 66

- 5.2.3.1.4 Polyphthalamide

- 5.2.4 Polybutylene Terephthalate (PBT)

- 5.2.5 Polycarbonate (PC)

- 5.2.6 Polyether Ether Ketone (PEEK)

- 5.2.7 Polyethylene Terephthalate (PET)

- 5.2.8 Polyimide (PI)

- 5.2.9 Polymethyl Methacrylate (PMMA)

- 5.2.10 Polyoxymethylene (POM)

- 5.2.11 Styrene Copolymers (ABS and SAN)

- 5.2.1 Fluoropolymer

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 AGC Inc.

- 6.4.2 Asahi Kasei Corporation

- 6.4.3 Daicel Corporation

- 6.4.4 Daikin Industries, Ltd.

- 6.4.5 Kuraray Co., Ltd.

- 6.4.6 Kureha Corporation

- 6.4.7 MCT PET Resin Co Ltd

- 6.4.8 Mitsubishi Chemical Corporation

- 6.4.9 PBI Advanced Materials Co.,Ltd.

- 6.4.10 Polyplastics-Evonik Corporation

- 6.4.11 Sumitomo Chemical Co., Ltd.

- 6.4.12 Techno-UMG Co., Ltd.

- 6.4.13 Teijin Limited

- 6.4.14 Toray Industries, Inc.

- 6.4.15 UBE Corporation

7 KEY STRATEGIC QUESTIONS FOR ENGINEERING PLASTICS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219