|

市场调查报告书

商品编码

1627098

北美数位电子看板:市场占有率分析、产业趋势与成长预测(2025-2030)North America Digital Signage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

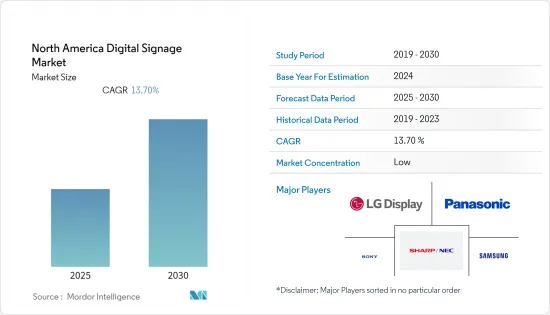

北美数位电子看板市场预计在预测期内复合年增长率为 13.7%

主要亮点

- 在美国,指示牌已成为影响购买决策的关键因素,政府、医疗保健、公共交通和零售商店等机构现在都在寻求更好的参与方式,以在很大程度上依赖数位电子看板向目标受众传达讯息。获得

- 由于显示、连接和监控方面的最新技术进步,数位电子看板越来越受欢迎,尤其是在美国。此外,由于采用率的提高,显示面板的价格也大幅下降。

- 在美国,零售商正在积极采用数位电子看板,主要和未来的企业选择由人工智慧和机器学习驱动的先进数位电子看板,以充分利用消费者分析。

- 此外,随着零售商越来越注重有针对性的行销策略,指示牌製造商正在与零售商店合作,创造有助于增加销售的品牌环境。例如,Mood Media 将北卡罗来纳州有机食品零售商 Earth Fare 的利润提高了 10%。

- 此外,该地区地方政府也正在推动智慧城市的实施。例如,拉斯维加斯正在测试三个先导计画,政府已拨款5亿美元寻找到2025年连接整个城市的方法。此外,智慧城市媒体技术公司 Intersection 最近与芝加哥交通管理局 (CTA) 签署了为期五年的协议,将部署 700 多个新显示器并为城市规划提供创新支援。

- 此外,随着匹兹堡伍德街车站管理局考虑扩大其自助服务终端覆盖范围,CHK America Inc. 的数位电子看板将支援路线摘要、即时到达资讯以及新票价和安全讯息等公共服务公告。

- 此外,该地区正在经历高技术渗透和采用,苹果和三星电子等科技巨头在数位电子看板方面进行了大量投资。例如,三星最近发布了“The Wall”,这是一种创新的显示解决方案,针对各种应用程式之间的有效通讯和协作进行了最佳化。同时,苹果正在考虑透过管理 API 和零售商的云端基础软体,让机上盒作为数位电子看板运作。这些技术创新很可能在未来的市场发展中发挥重要作用。

北美数位电子看板看板市场趋势

零售业预计将占据主要市场占有率

- 为了利用先进的指示牌技术,零售业正在透过在店内共用相关且资讯丰富的内容并将数位广告整合到商店中来改变店内用户体验,我们正在整合可用的数位工具来帮助我们。

- 他们透过融合数位和实体购物模式并重塑价格、内容、功能和广告方法等各种参数来创造一种有凝聚力的多通路体验。例如,NEC开发了一系列新的大尺寸超高清显示器,支援近距离和远距离观看,具有高清和大萤幕大小。

- 此外,零售商正在努力即时更新用户互动萤幕,以反映店内的年龄和性别趋势,促销特定商品,并从萤幕上删除已售罄的商品。

- 据 Scala Digital Signage 称,74% 的美国零售商认为开发更具吸引力的店内客户体验非常重要,其中 42% 的零售商认为在未来五年内开发更具吸引力的店内客户体验非常重要。来自商业网站。

- 此外,Tommy Hilfiger、IKEA、Argos 和 Last Call Studio 等零售商正在利用数位电子看板位看板以多种方式提供创新的购物体验,包括透过各种手持设备推出互动式显示器和更多创新的萤幕内容。

- 例如,数位电子看板正变得更具互动性和便利性,可以创造更强大、更有吸引力的橱窗展示平台,从而提高客户参与。智慧科技的整合有助于根据买家角色吸引更多受众。大多数零售商拥有超过 1,000 家商店,增加了对 POP 展示的需求。

美国占最大市场占有率

- 各级教育机构都在采用数位电子看板来改善访客、学生、教职员之间的沟通。数位电子看板用于紧急通知、寻路和其他应用,为教育部门提供了加强沟通的有效媒介。

- 数位电子看板解决方案取代了传统的讯息板和海报,可在整个教育机构中共用即时、时效性和高度吸引人的富媒体内容。例如,南加州大学使用 Enplug 的数位电子看板软体向教职员工和学生通报校园内发生的事情并让他们参与其中。

- 在美国,多个海军设施,例如海军水下作战中心(NUWC)、海军水面作战中心(NSWC)、海军造船厂(NSY)和其他维护设施,都使用基地范围内的网路进行员工通讯。 Aerva Inc. 签订了超过15 份合同,以启动其数位显示网。

- 此外,数位资讯亭已经在全国各地的电影院中使用。这些设备可以更轻鬆地查看座位安排,并有助于减少售票处的长队。随着电影院越来越多地采用这些设备,市场预计将会扩大。

- 电影院也受益于特许委员会。据 Broadsign 称,目前电影院大厅约 78% 的活动是特许购买。这意味着客户处于购买心态。数位菜单板可以使自助服务终端产品对消费者更加可见,并将销售额提高 10-50%。

- 此外,ScreenBeam Inc. 是美国领先的数位电子看板主要企业之一,其 1,100 名客户依靠会议室显示器向员工和客人传达讯息、企业品牌以及他们所需的更多内容。功能的更新,可协助您从应用程式中获得更多收益。

北美数位电子看板产业概况

北美数位电子看板市场相对分散,硬体领域由NEC Display Solutions、三星电子、Panasonic和SONY等全球主要公司所涵盖。同时,还有几家小型公司提供数位电子看板软体。此外,许多公司正在以独特的产品应用作为行业的利基参与者进入市场。

- 2021 年 5 月 - Broadsign 与 Pladway 签署协议,将 Broadsign Reach SSP 与 Pladway 的 DSP 整合。该交易预计将为品牌和媒体买家提供有影响力且可衡量的全球规划。同时,品牌和代理商将能够使用程式化的宣传活动规划解决方案,该解决方案可以覆盖该地区超过 80,000 个优质萤幕。

- 2020 年 1 月 - Hitachi, Ltd. 宣布有意将 Hitachi Vantara, Ltd. 和 Hitachi Consulting, Ltd. 合併,主导日立客户和合作伙伴在全球范围内推出基于 Lumada 的解决方案和数位功能。合併后的组织将以 Hitachi Vantara 品牌营运。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- 分销通路分析

- 产业价值链分析

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 承包解决方案的演变

- 与传统广告方法相比,推动情境广告成长的趋势

- 北美数位户外媒体支出的稳定成长持续补充市场成长

- 市场限制因素

- 对侵犯客户隐私的担忧

第 6 章 技术概览

- 美国数位电子看板解决方案的演变

- 电视墙、4K 和 8K 显示器、POS 系统和社交媒体的深度整合 - 预计将推动采用的关键技术趋势

第七章 市场区隔

- 按类型

- 硬体

- 液晶/LED显示

- 有机发光二极体显示器

- 媒体播放机

- 投影机/投影萤幕

- 其他硬体

- 软体

- 按服务

- 硬体

- 按最终用户产业

- 零售

- 运输

- 款待

- 公司

- 教育机构

- 政府机构

- 按行业分類的其他最终用户

- 按国家/地区

- 美国

- 加拿大

第八章 竞争格局

- 公司简介

- NEC Display Solutions Ltd

- Samsung Electronics Co. Ltd

- LG Display Co. Ltd

- Panasonic Corporation

- Sony Corporation

- Sharp Corporation

- Planar Systems Inc.

- Hitachi Ltd

- Barco NV

- Goodview

- Cisco Systems Inc.

第九章数位电子看板软体主要厂商分析

第10章供应商定位分析

第十一章 市场展望 市场展望

The North America Digital Signage Market is expected to register a CAGR of 13.7% during the forecast period.

Key Highlights

- The signages have played an important factor in influencing the purchase decision in the US, and institutions like the Government, Healthcare, Public transit, and retail stores are now heavily relying on digital signages to better engage their targeted audiences to communicate their message.

- Digital signages are gaining popularity in the region, especially in the United States, due to the recent technological advancement in the display, connectivity, and monitoring space. Furthermore, the increasing adoption has also resulted in prices of display panels coming down significantly.

- The retail sector has been significantly adopting digital signage in the US, with primary and upcoming businesses opting for advanced digital signages featuring AI and machine learning to gain the most out of consumer analytics.

- Also, With an increased focus among retailers on targeted marketing strategies, the signage manufacturers are collaborating with retail stores to leverage increased sales by creating a branded environment. For instance, Mood Media generated a 10% increased profits for a North Carolina-based organic food retailer named Earth Fare.

- Furthermore, local governments in the area are also promoting the adoption of smart cities. For instance, Las Vegas is testing three pilot projects, with the government allocating USD 500 million to find ways to connect the entire city by 2025. Also, Intersection, a smart cities media, and technology company, has recently signed a 5-year contract with Chicago Transit Authority (CTA) to deploy over 700 new displays at CTA's rail street-level bus-advertising assets aiding the innovative city initiatives.

- Additionally, Pittsburg's Wood Street Station authority is considering expanding the installation of kiosks, and digital signage from CHK America Inc., enabled with route overview, real-time arrival information, and public service announcements like new fares and safety messages.

- Moreover, due to the region's high penetration and adoption of technology, technology giants, like Apple Inc. and Samsung Electronics, have been investing significantly in digital signage. For instance, recently, Samsung launched The Wall, an innovative display solution optimized for effective communication and collaboration across various applications. Apple Inc., on the other hand, has been looking at converting its set-top box to operate as digital signage through its management APIs and cloud-based software for retail installations. These innovations are going to play a vital role in the development of the market in the future.

North America Digital Signage Market Trends

Retail Industry is Expected to Hold Significant Market Share

- In order to leverage advanced signage technologies, the retail players are integrating the digital tools at their disposal to share relevant and profitable content at their premises and integrate digital ads into their retail stores to create a different in-store user experience.

- They are fusing the digital and physical shopping mode to create a cohesive multichannel experience, thereby reshaping different parameters, such as prices, contents, features, method of advertisement, etc. For instance, NEC Corp. developed a new series of large-format UHD displays that support short and long-distance viewing through a high level of detail and huge screen sizes.

- Moreover, retailers are striving to update the user-interactive screens in real-time to reflect the current trends in in-store age or gender demographics to promote specific items or remove sold-out products from the screen.

- According to Scala Digital Signage, 74% of the US retailers consider that developing a more engaging in-store customer experience is critical, and out of that, 42% of the sales are expected to come from online, mobile, and social commerce sites, in the next five years.

- Further, retail players, such as Tommy Hilfiger, IKEA, Argos, Last Call Studio, and many more, are adopting innovative shopping experience using digital signage in multiple ways, such as interactive displays and more innovative screen content, through various handheld devices, which can draw the shopper experience, thereby, leaving a long-lasting impression.

- For instance, the digital signs are getting more interactive and convenient to create a more robust and engaging window displays platform in boosting customer engagement. The integration of intelligent technologies is helping them to attract a greater audience based on their buyer persona. The majority of the retailers maintain more than 1,000 stores, adding to the demand for POP displays.

United States Accounts for the Largest Market Share

- To improve visitor, student, and faculty communication, educational institutes of all levels adopt digital signage. Used for emergency notifications, way-finding, and other applications, digital signage offers the educational sector an effective medium to increase communication.

- By replacing traditional message boards and posters, digital signage solutions enable immediate, up-to-date, and highly engaging rich-media content shared throughout educational facilities. For instance, the University of Southern California has deployed digital signage software from Enplug to inform and engage faculty and students of the happenings across the campus.

- In the United States, the Navy has awarded over 15 contracts to Aerva Inc., to launch a base-wide network of digital displays for internal communications at several Naval facilities, including Naval Undersea Warfare Center (NUWC), Naval Surface Warfare Centers (NSWC), Naval Shipyards (NSY), as well as other maintenance facilities for employee communications.

- Furthermore, movie theaters are already using digital kiosks across various cinemas in the country. These devices help get a better view of the seating arrangement, and they assist in reducing the long queues at the ticket counters. Increasing adoption of these devices in theaters is expected to carry the market forward.

- Additionally, concession boards are where cinemas earn a profit. According to Broadsign, currently, around 78% of cinema lobby activities are concession purchases. This implies that customers are in a purchasing state of mind. Digital menu boards bring concession goods to consumers' attention and can produce a 10-50% increase in sales.

- Moreover, ScreenBeam Inc., one of the key players in the United States in wireless display and collaboration solutions, has released an update featuring a digital signage capability that will empower their 1,100 clients to better leverage their meeting room displays in communicating essential employees and guests messaging, company branding, and beyond.

North America Digital Signage Industry Overview

The North American digital signage market is relatively fragmented with major global players, like NEC Display Solutions Ltd, Samsung Electronics Co. Ltd, Panasonic Corporation, Sony Corporation, covering the hardware end of the spectrum. At the same time, there happen to be several medium and smaller players who provide software for digital signage. Moreover, many players are entering the market offering unique product applications as niche players in the industry.

- May 2021 - Broadsign entered an agreement with Pladway to integrate the Broadsign Reach SSP with Pladway's DSP. This agreement is expected to enable high-impact, measurable global planning for brands and media buyers. At the same time, provide brands and agencies access to a programmatic campaign planning solution that can reach more than 80,000 premium screens in the region.

- January 2020 - Hitachi, Ltd. announced its intent to integrate Hitachi Vantara Corporation and Hitachi Consulting Corporation to lead Hitachi's global expansion of Lumada-based solutions and digital capabilities for its customers and partners. The combined organization will operate under the Hitachi Vantara brand.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Distribution Channel Analysis

- 4.4 Industry Value Chain Analysis

- 4.5 Impact of COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Evolution of Turnkey Solutions

- 5.1.2 Trends Favoring the Growth of Context-aware Advertising as Opposed to Conventional Modes of Advertising

- 5.1.3 Steady Increase in DOOH Spending in the North America to Continue to Supplement Market Growth

- 5.2 Market Restraints

- 5.2.1 Concerns Over Invasion of Customer Privacy

6 TECHNOLOGY SNAPSHOT

- 6.1 Evolution of Digital Signage Solutions in the United Sates

- 6.2 Key Technological Trends Expected to Drive Adoption - Video Walls, 4K and 8K Displays, Deep Integration of POS Systems and Social Media

7 MARKET SEGMENTATION

- 7.1 By Type

- 7.1.1 Hardware

- 7.1.1.1 LCD/LED Display

- 7.1.1.2 OLED Display

- 7.1.1.3 Media Players

- 7.1.1.4 Projectors/Projection Screens

- 7.1.1.5 Other Hardware

- 7.1.2 Software

- 7.1.3 Services

- 7.1.1 Hardware

- 7.2 By End-user Vertical

- 7.2.1 Retail

- 7.2.2 Transportation

- 7.2.3 Hospitality

- 7.2.4 Corporate

- 7.2.5 Education

- 7.2.6 Government

- 7.2.7 Other End-user Verticals

- 7.3 By Country

- 7.3.1 United States

- 7.3.2 Canada

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 NEC Display Solutions Ltd

- 8.1.2 Samsung Electronics Co. Ltd

- 8.1.3 LG Display Co. Ltd

- 8.1.4 Panasonic Corporation

- 8.1.5 Sony Corporation

- 8.1.6 Sharp Corporation

- 8.1.7 Planar Systems Inc.

- 8.1.8 Hitachi Ltd

- 8.1.9 Barco NV

- 8.1.10 Goodview

- 8.1.11 Cisco Systems Inc.