|

市场调查报告书

商品编码

1636266

德国电动汽车电池製造设备:市场占有率分析、产业趋势、成长预测(2025-2030)Germany Electric Vehicle Battery Manufacturing Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

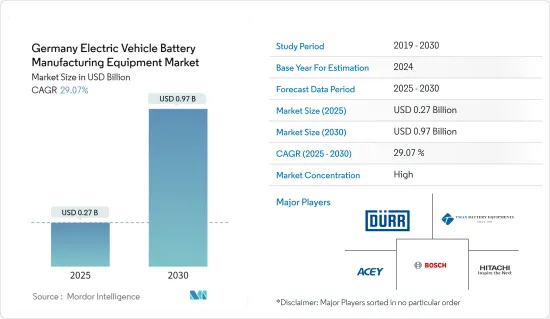

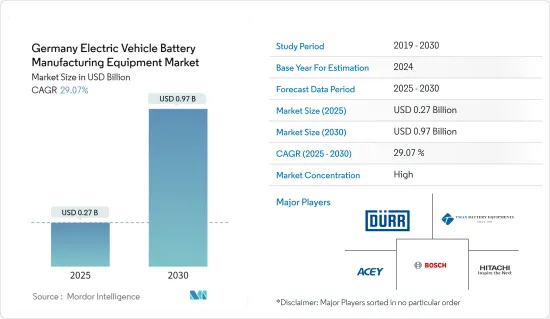

德国电动车电池製造设备市场规模预计2025年为2.7亿美元,预计2030年将达9.7亿美元,预测期间(2025-2030年)复合年增长率为29.07%。

主要亮点

- 从中期来看,电动车的普及以及政府法规和政策支持等因素预计将推动市场发展。

- 另一方面,来自现有市场的竞争预计将阻碍预测期内的市场成长。

- 供应链本地化预计将在未来几年为市场带来重大商机。

德国电动汽车电池製造设备市场趋势

电动车的扩张

- 德国是欧洲最大的汽车市场和汽车创新的领导者,处于电动车革命的前沿。根据国际能源总署(IEA)预测,德国电动车销量将从2019年的10.8万辆增加至2023年的70万辆,增幅超过540%。

- 随着越来越多的消费者转向电动车,电池(尤其是锂离子电池)的生产将需要扩大规模以满足不断增长的需求。例如,2024年3月,Northvolt宣布计画投资49亿美元在海德附近兴建新厂。计划于 2026 年开始生产,预计该计划将创造约 3,000 个就业机会。电池生产的扩张自然会导致对高效、大规模製造这些电池所需的专用设备的需求增加。

- 近年来,德国电动车市场经历了显着成长。在环保意识增强和拥有电动车带来的经济效益的推动下,电动车註册数量正在迅速增加。 Kraftfahrt-Bundesamt(KBA)预计,德国註册电动车数量将从2019年的63,281辆增加到2023年的524,219辆,四年内成长超过700%。此外,越来越多的德国人正在註册新的电动车,到 2024 年 5 月註册量将超过 140,700 辆。

- 德国政府的雄心勃勃的目标进一步凸显了电动车市场的成长潜力。例如,德国政府计划到 2030 年在德国道路上拥有至少 1500 万辆电动车,这进一步增加了对强大电池製造基础设施的需求。这将鼓励对满足预期需求所需的製造设备的投资。

- 随着製造商扩大生产以满足市场需求并利用不断扩大的电动车市场带来的机会,对先进高效製造设备的需求持续增长,这将为德国电动车行业的成长发挥重要作用。

锂离子电池领域占市场主导地位

- 锂离子电池是一种二次电池,以其能量密度高、寿命长、重量轻而闻名。透过在电极之间移动锂离子,可以有效地储存和释放能量。

- 2023年,该产业的市场规模(产量和进口减去出口)成长32%,达到232亿欧元(248.4亿美元)。这一增长是由主要用于电动车的锂离子电池推动的。

- 锂离子电池在电动车 (EV) 中至关重要,因为它们具有高能量密度,可实现更长的行驶里程和高效的性能。它们的长循环寿命和快速充电能力使其成为电动车的理想动力来源,支持其在汽车行业的广泛应用。随着德国不断扩大电动车生产规模,对与锂离子技术相容的先进电池製造设备的需求不断增加。

- 强化这项优势的关键因素之一是锂离子电池价格的下降。过去十年,技术的进步、规模经济和製造流程的改进显着降低了锂离子电池的成本。

- 在全球范围内,锂离子电池的价格在过去十年中大幅下降。 2023年,锂离子电池的平均价格约为每千瓦时139美元。与2013年相比,2023年价格将下降82%以上。

- 彭博新能源财经预测,随着采矿和精製能的增加以及锂价格开始回落,电池成本将在 2025 年再次开始下降。根据 BNEF 的 2023 年电池价格研究,预计到 2025 年,全球平均电池组价格将降至 113 美元/千瓦时以下,到 2030 年,全球整体电池组价格将降至 80 美元/千瓦时以下。

- 这些成本的降低使得电动车变得更加实惠和容易获得,从而加速了其在全国的普及。随着越来越多的消费者和企业转向电动车,锂离子电池的产量和需求激增,进一步巩固了电池製造设备市场。

- 因此,在国内需求以及该国成为欧洲电动车供应链关键参与企业的雄心壮志的推动下,德国的锂离子电池製造设备市场预计将扩大。

德国电动汽车电池製造设备产业概况

德国的电动车电池製造设备市场正在变得半固体。主要企业(排名不分先后)包括Duer AG、日立、ACEY新能源科技、Robert Bosch Manufacturing Solutions GmbH、厦门天迈电池设备有限公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 电动车的扩张

- 政府支持性法规和措施

- 抑制因素

- 与现有市场的竞争

- 促进因素

- 供应链分析

- PESTLE分析

- 投资分析

第五章市场区隔

- 按流程

- 混合

- 涂层

- 日历

- 狭缝/电极加工

- 其他的

- 透过电池

- 锂离子

- 铅酸电池

- 镍氢电池

- 其他电池

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Duerr AG

- Schuler AG

- Hitachi Ltd

- Xiamen Tmax Battery Equipments Limited

- ACEY New Energy Technology

- IPG Photonics Corporation

- Wuxi Lead Intelligent Equipment Co. Ltd

- Targray Technology International Inc.

- Xiamen Lith Machine Limited

- Robert Bosch Manufacturing Solutions GmbH

- 市场排名/份额(%)分析

- 其他知名公司名单

第七章 市场机会及未来趋势

- 供应链本地化

简介目录

Product Code: 50003548

The Germany Electric Vehicle Battery Manufacturing Equipment Market size is estimated at USD 0.27 billion in 2025, and is expected to reach USD 0.97 billion by 2030, at a CAGR of 29.07% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the increasing adoption of electric vehicles and supportive government regulations and policies are expected to drive the market.

- On the other hand, competition from established markets are likely to hinder market growth during the forecast period.

- Nevertheless, localization of supply chains are expected to provide significant opportunities for the market in the coming years.

Germany Electric Vehicle Battery Manufacturing Equipment Market Trends

Increasing Adoption of Electric Vehicles

- As Europe's largest automotive market and a leader in automotive innovation, Germany is at the forefront of the electric mobility revolution. According to the International Energy Agency, Germany's electric vehicle sales grew from 108,000 in 2019 to 700,000 in 2023, representing an increase of more than 540%.

- As more consumers shift toward EVs, the production of batteries, particularly lithium-ion batteries, will need to scale up to meet the increasing demand. For instance, in March 2024, Northvolt announced plans to invest USD 4.9 billion in a new plant near Heide. Production is scheduled to begin in 2026, and the project is anticipated to create approximately 3,000 jobs. This expansion in battery production will naturally lead to a higher demand for the specialized equipment required to manufacture these batteries efficiently and at scale.

- In recent years, the German EV market has seen impressive growth. The number of electric vehicle registrations has surged, supported by a growing awareness of environmental issues and the financial benefits of owning an EV. According to the Kraftfahrt-Bundesamt (KBA), electric car registrations in Germany grew from 63,281 in 2019 to 524,219 in 2023, representing an increase of more than 700% within four years. Further, more Germans are registering for new electric cars, with over 140,700 registrations till May 2024.

- The German government's ambitious targets further underscore the growth potential of the EV market. For instance, the German government planned to have at least 15 million electric cars on German roads by 2030, further intensifying the need for a robust battery manufacturing infrastructure. This, in turn, drives investment in the necessary manufacturing equipment to meet the anticipated demand.

- As manufacturers scale up production to meet market demands and capitalize on the opportunities presented by the expanding EV market, the demand for advanced and efficient manufacturing equipment will continue to rise, playing a critical role in the growth of the EV industry in Germany.

Lithium-Ion Batteries Segment to Dominate the Market

- Lithium-ion batteries are rechargeable batteries known for their high energy density, long lifespan, and lightweight. They work by moving lithium ions between electrodes to store and release energy efficiently.

- In 2023, the industry's market volumes, including production plus imports minus exports, rose by 32% to EUR 23.2 billion (USD 24.84 billion). This growth was primarily driven by the dominant segment of lithium-ion batteries used in electric mobility.

- Lithium-ion batteries are crucial in electric vehicles (EVs) because they provide high energy density, allowing for longer driving ranges and efficient performance. Their long cycle life and fast charging capabilities make them ideal for powering EVs, supporting their widespread use in the automotive industry. As Germany continues to scale up its EV production, the demand for advanced battery manufacturing equipment tailored to Li-Ion technology is rising.

- One of the key factors reinforcing this dominance is the declining price of lithium-ion batteries. Over the past decade, the cost of lithium-ion batteries has dropped significantly due to technological advancements, economies of scale, and improved manufacturing processes.

- Globally, the price of lithium-ion batteries declined steeply over the past ten years. In 2023, the price of an average lithium-ion battery was valued at around USD 139 per kWh. It witnessed a decrease in the price of more than 82% in 2023 compared to 2013.

- BloombergNEF anticipates that battery costs will begin to decline again in 2025 as more extraction and refinery capacity become operational and lithium prices begin to ease. By 2025, the average pack price is expected to drop below USD 113/kWh and USD 80/kWh by 2030 globally, according to BNEF's 2023 Battery Price Survey.

- This cost reduction has made electric vehicles more affordable and accessible, accelerating their adoption nationwide. As more consumers and companies transition to EVs, the production and demand for lithium-ion batteries have surged, further solidifying the market for battery manufacturing equipment.

- As a result, the market for lithium-ion battery manufacturing equipment in Germany is expected to expand, driven domestic demand and the country's ambition to become a key player in the European EV supply chain.

Germany Electric Vehicle Battery Manufacturing Equipment Industry Overview

The German electric vehicle battery manufacturing equipment market is semi-consolidated. Some of the major players (not in particular order) include Duerr AG, Hitachi Ltd, ACEY New Energy Technology, Robert Bosch Manufacturing Solutions GmbH, and Xiamen Tmax Battery Equipments Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumption

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Adoption of Electric Vehicles

- 4.5.1.2 Supportive Government Regulations and Policies

- 4.5.2 Restraints

- 4.5.2.1 Competition From Established Markets

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Process

- 5.1.1 Mixing

- 5.1.2 Coating

- 5.1.3 Calendaring

- 5.1.4 Slitting and Electrode Making

- 5.1.5 Other Processes

- 5.2 By Battery

- 5.2.1 Lithium-ion

- 5.2.2 Lead-acid

- 5.2.3 Nickel Metal Hydride Battery

- 5.2.4 Other Batteries

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Duerr AG

- 6.3.2 Schuler AG

- 6.3.3 Hitachi Ltd

- 6.3.4 Xiamen Tmax Battery Equipments Limited

- 6.3.5 ACEY New Energy Technology

- 6.3.6 IPG Photonics Corporation

- 6.3.7 Wuxi Lead Intelligent Equipment Co. Ltd

- 6.3.8 Targray Technology International Inc.

- 6.3.9 Xiamen Lith Machine Limited

- 6.3.10 Robert Bosch Manufacturing Solutions GmbH

- 6.4 Market Ranking/Share (%) Analysis

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Localization of Supply Chains

02-2729-4219

+886-2-2729-4219