|

市场调查报告书

商品编码

1636450

美国电动汽车电池製造:市场占有率分析、行业趋势和成长预测(2025-2030)United States Electric Vehicle Battery Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

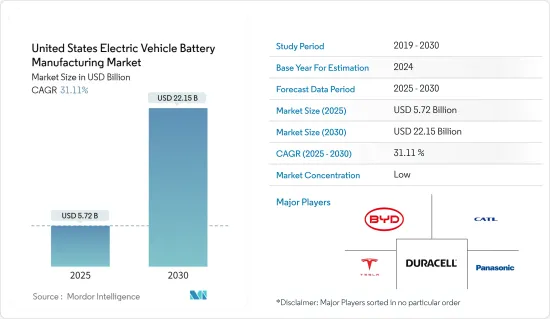

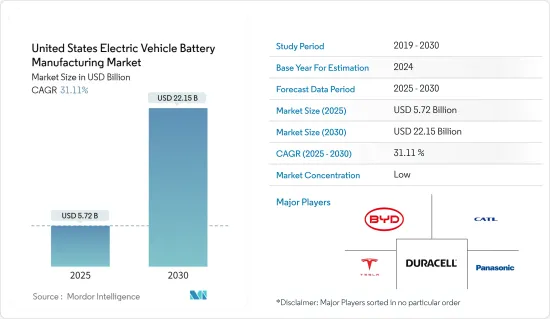

美国电动车电池製造市场规模预计到2025年为57.2亿美元,预计2030年将达到221.5亿美元,预测期内(2025-2030年)复合年增长率为31.11%。

主要亮点

- 从中期来看,增加电动车电池产能的投资以及电池原材料(尤其是锂离子)成本的下降预计将在预测期内推动市场发展。

- 另一方面,电池原料蕴藏量不足预计将拖累市场未来发展。

- 也就是说,美国电动车的长期雄心壮志预计将在预测期内创造重大机会。

美国电动车电池製造市场趋势

锂离子电池预计将占较大份额

- 近年来,美国对电动车的需求迅速成长。这些车辆主要依靠基于电池的能源储存系统,这对于全电动、插电式混合动力汽车和混合动力汽车至关重要。

- 大多数插电式混合动力汽车和全电动汽车都配备了锂离子电池。由于锂离子电池组价格的下降及其更高的能量密度、更长的循环寿命和效率等优点,插电式混合动力汽车对锂电池材料的需求正在增加。

- 2023年,锂离子电池组价格将比前一年下降14%,稳定在139美元/kWh。除了这些好处之外,正在进行的研究和开发旨在生产更有效的电动车锂电池材料。

- 此外,美国政府已优先从国内蕴藏量中提取锂矿石,以简化电动车电池的供应链。例如,正在计划从阿肯色州的地下盐水矿床中提取锂,并将其在当地转化为电池材料。

- 2024年6月,埃克森美孚与全球领先的电动车电池开发商SK On签署了一份不具约束力的谅解备忘录。这将使埃克森美孚能够从其位于阿肯色州的第一个计划中采购多达 10 万吨 Mobil TM 锂,并有可能签订多年承购协议。

- 此外,埃克森美孚计画在 2030 年利用这种锂每年生产约 100 万个电动车电池,从而加强美国电动车供应链。鑑于这些雄心勃勃的目标,电动车製造中的锂产业有望实现显着成长。

- 因此,由于锂离子电池价格下降以及美国新锂矿石的发现,该行业可能会占据重要的市场占有率。

政府扶持政策可望带动市场

- 近年来,由于政府提供税收优惠、补贴、津贴和贷款等支持性政策,美国电动车 (EV) 电池製造业蓬勃发展。先进技术汽车製造 (ATVM) 融资计划等联邦倡议正在资助尖端电池技术和製造设施的开发。

- 此外,政府不仅投资研发以提高电池技术,还透过优惠的贸易政策支持国内生产。这些努力有望扩大对电动车电池製造的需求。

- 例如,2024年1月,美国能源局累计1.31亿美元用于推进电动车电池和充电系统研发的计划。这笔资金将强化电动车生态系统,有助于降低技术成本,扩大电池车的续航里程,并创造安全、永续的国内电池供应链。

- 随着电动车销量的上升,政府可能会推出进一步政策以进一步加强电池製造。国际能源总署的报告显示,2023年美国电动车销量将达139万辆,较2022年的99万辆大幅成长。

- 为此,政府正在製定新的立法,扩大国内电池製造和加工,旨在加强电动车电池的关键供应链,促进向清洁能源的过渡。

- 例如,2023年11月,《两党基础设施法案》签署成为法律后,美国能源局宣布计划从该法案中向全国拨款高达35亿美元,以促进先进电池和材料的国内生产。

- 有了这些奖励和政府支持政策,市场可望强劲成长。

美国电动车电池製造业概况

美国电动车电池製造市场已减少一半。市场主要企业(排名不分先后)包括比亚迪有限公司、特斯拉公司、当代新能源科技有限公司、金霸王公司和松下控股公司。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- 投资增加电池产能

- 电池原物料成本下降

- 抑制因素

- 原料蕴藏量不足

- 促进因素

- 供应链分析

- PESTLE分析

- 投资分析

第五章市场区隔

- 透过电池

- 锂离子

- 铅酸电池

- 镍氢电池

- 其他的

- 依电池形状分类

- 方形

- 袋型

- 圆柱形

- 搭车

- 客车

- 商用车

- 其他的

- 透过促销

- 电池电动车

- 油电混合车

- 插电式混合动力电动车

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- BYD Co. Ltd

- Contemporary Amperex Technology Co. Limited

- Duracell Inc

- EnerSys

- GS Yuasa Corporation

- SK On Co, Ltd

- Hyundai Motor Group

- LG Chem Ltd

- Tesla, Inc

- Panasonic Corporation

- List of Other Prominent Companies

- 市场排名分析

第七章 市场机会及未来趋势

- 电动车的长期目标

简介目录

Product Code: 50003717

The United States Electric Vehicle Battery Manufacturing Market size is estimated at USD 5.72 billion in 2025, and is expected to reach USD 22.15 billion by 2030, at a CAGR of 31.11% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, investments to enhance electric vehicle battery production capacity, and a decline in the cost of battery raw material, especially lithium-ion, are expected to drive the market in the forecast period.

- On the other hand, the lack of battery raw materials reserves is expected to hamper the market in the future.

- Nevertheless, long-term ambitious targets for electric vehicles in the United States are expected to create a significant opportunity in the forecast period.

United States Electric Vehicle Battery Manufacturing Market Trends

Lithium-ion Battery is Expected to Have a Major Share

- In recent years, the demand for electric vehicles has surged in the United States. These vehicles rely on energy storage systems, primarily batteries, which are crucial for all-electric, plug-in hybrid, and hybrid vehicles.

- Most plug-in hybrids and all-electric vehicles are powered by lithium-ion batteries. The demand for lithium battery materials in plug-in hybrids is rising, driven by the declining prices of lithium-ion battery packs and their advantages, including high energy density, extended cycle life, and efficiency.

- In 2023, lithium-ion battery pack prices dropped by 14% from the previous year, settling at USD139/kWh. Beyond these benefits, ongoing research and development aim to produce even more effective lithium battery materials for electric vehicles.

- Moreover, the United States government is prioritizing the extraction of lithium ores from domestic reserves to streamline the EV battery supply chain. For instance, plans are underway to extract lithium from underground saltwater deposits in Arkansas and convert it into battery-grade material on-site.

- In June 2024, ExxonMobil and SK On, a leading global electric vehicle battery developer, signed a non-binding memorandum of understanding. This sets the stage for a potential multiyear offtake agreement, enabling ExxonMobil to acquire up to 100,000 metric tons of MobilTM Lithium from its first project in Arkansas.

- Additionally, ExxonMobil aims to utilize this lithium to produce approximately 1 million EV batteries each year by 2030, bolstering the U.S. EV supply chain. Given these ambitious targets, the lithium segment in electric vehicle manufacturing is poised for substantial growth.

- Consequently, with declining lithium-ion battery prices and fresh lithium ore discoveries in the United States, the segment is set to command a significant market share.

Supportive Government Policy and Schemes is Expected to Drive the Market

- In recent years, United States electric vehicle (EV) battery manufacturing has surged, due to supportive government policies offering tax incentives, subsidies, grants, and loans. Federal initiatives, such as the Advanced Technology Vehicles Manufacturing (ATVM) loan program, are channeling funds into the development of cutting-edge battery technologies and manufacturing facilities.

- Moreover, the government is not only investing in research and development to enhance battery technology but is also championing domestic production through favorable trade policies. These initiatives are poised to amplify the demand for electric vehicle battery manufacturing.

- For example, in January 2024, the U.S. Department of Energy earmarked USD 131 million for projects aimed at advancing research and development in EV batteries and charging systems. This funding is set to empower the EV ecosystem, helping to reduce technology costs, extend the driving range of battery vehicles, and forge a secure and sustainable domestic battery supply chain.

- With electric vehicle sales on the rise, the government is likely to introduce more policies to further bolster battery manufacturing. The International Energy Agency reported that United States EV car sales reached 1.39 million units in 2023, a notable increase from 0.99 million units in 2022.

- In line with this, the government is pushing for new laws to expand domestic battery manufacturing and processing, aiming to strengthen America's critical supply chains for electric vehicle batteries and facilitate the clean energy transition.

- As a case in point, in November 2023, the U.S. Department of Energy, after the signing of the Bipartisan Infrastructure Law, announced plans to allocate up to USD 3.5 billion from the law to bolster the domestic production of advanced batteries and their materials nationwide.

- Given these incentives and supportive government policies, the market is poised for significant growth.

United States Electric Vehicle Battery Manufacturing Industry Overview

The United States Electric vehicle battery manufacturing market is semi-fragmented. Some of the major players in the market (in no particular order) include BYD Company Ltd, Tesla, Inc., Contemporary Amperex Technology Co. Limited, Duracell Inc., and Panasonic Holdings Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Investments to Enhance the battery production capacity

- 4.5.1.2 Decline in cost of battery raw materials

- 4.5.2 Restraints

- 4.5.2.1 Lack of Raw Material Reserves

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE ANALYSIS

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery

- 5.1.1 Lithium-ion

- 5.1.2 Lead-Acid

- 5.1.3 Nickel Metal Hydride Battery

- 5.1.4 Others

- 5.2 Battery Form

- 5.2.1 Prismatic

- 5.2.2 Pouch

- 5.2.3 Cylindrical

- 5.3 Vehicle

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

- 5.3.3 Others

- 5.4 Propulsion

- 5.4.1 Battery Electric Vehicle

- 5.4.2 Hybrid Electric Vehicle

- 5.4.3 Plug-in Hybrid Electric Vehicle

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Co. Ltd

- 6.3.2 Contemporary Amperex Technology Co. Limited

- 6.3.3 Duracell Inc

- 6.3.4 EnerSys

- 6.3.5 GS Yuasa Corporation

- 6.3.6 SK On Co, Ltd

- 6.3.7 Hyundai Motor Group

- 6.3.8 LG Chem Ltd

- 6.3.9 Tesla, Inc

- 6.3.10 Panasonic Corporation

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Long-term ambitious targets for electric vehicles

02-2729-4219

+886-2-2729-4219