|

市场调查报告书

商品编码

1636472

北美电动车电池製造:市场占有率分析、产业趋势与成长预测(2025-2030)North America Electric Vehicle Battery Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

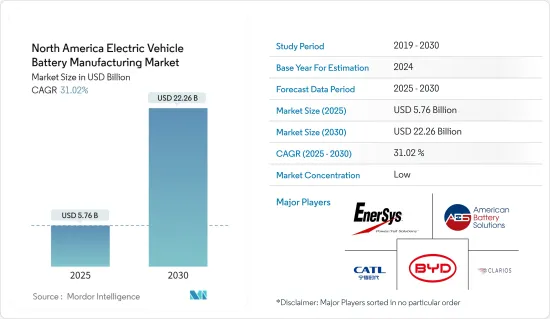

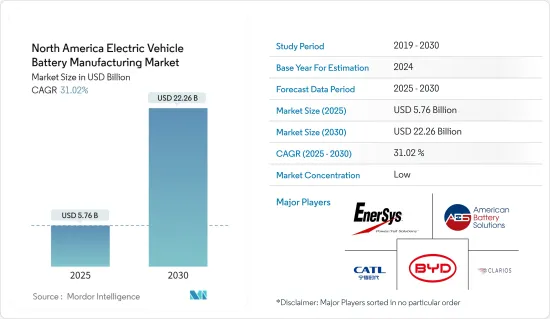

北美电动车电池製造市场规模预计到2025年为57.6亿美元,预计到2030年将达到222.6亿美元,预测期内(2025-2030年)复合年增长率为31.02%。

主要亮点

- 未来几年,在政府支持和政策的推动下,北美电动车电池製造市场预计将主要受到电动车日益普及的推动。

- 然而,来自亚太地区成熟电池市场的竞争对北美电动车电池製造市场构成了挑战。

- 然而,随着北美国家推动电池製造供应链的在地化,大量的市场成长机会正在出现。

- 随着美国政府加大力度提高电池製造水平以及电动车普及率的飙升,预计美国将引领市场并实现最显着的成长。

北美电动车电池製造市场趋势

电动汽车电池显着成长

- 在技术进步、监管加强和消费者偏好不断变化的推动下,北美电动车电池市场正在经历强劲而快速的成长,尤其是在纯电动车 (BEV) 领域。仅依靠电池供电的电动动力传动系统运行的纯电动车在世界向永续交通的转变中发挥着至关重要的作用。

- 在北美,随着汽车製造商和政策制定者承诺雄心勃勃地减少温室气体排放,纯电动车产业将会成长。遏制碳排放和遵守严格排放标准的努力正在推动纯电动车的生产和扩散。与混合动力汽车不同,纯电动车的特点是没有废气排放。

- 根据国际能源总署(IEA)的报告,自 2021 年以来,电动车销量激增,成长了一倍多,达到 727,730 辆。这一势头仍在持续,2022 年售出 1,117,719 套,2023 年跃升至 1,584,113 套。这种销售热潮与这些车辆的主要动力来源锂离子电池的需求激增密切相关。

- 北美不断增长的电池製造能力对于纯电动车领域的成功至关重要。鑑于依赖进口电池零件和原材料的地缘政治和物流障碍,建立强大的国内供应链变得越来越重要。为此,北美市场的投资不断增加,多家公司在全部区域建立了「超级工厂」。

- 例如,本田汽车工业计划投资110亿美元加强在加拿大安大略省的电动车和电池产能,并计划于2028年开始营运。这项雄心勃勃的计划是本田迄今为止在加拿大最大的投资,目标是每年生产 24 万辆电动车和 36 吉瓦时电池。

- 这些战略定位的设施通常位于汽车製造地附近,对于实现规模经济、控制生产成本以及让纯电动车更广泛地为消费者所用至关重要。由于靠近汽车生产基地,供应链流畅,可以实现准时生产。

- 考虑到这些动态,电池电动车领域预计在未来几年将显着成长。

美国主导市场

- 美国是北美电动车电池製造市场的关键参与者,其特点是创新活跃、政策支援和策略投资。由于国家迫切需要向更永续的交通生态系统过渡,电动车电池市场正在迅速扩大。政府对消费者和製造商的重大奖励正在支持这项转变。

- 电动车购买税额扣抵和大量研发资金等联邦政策旨在鼓励创新并增加电动车的采用。此外,《降低通货膨胀法》等最近的立法包括鼓励国内生产电动车电池的重要条款,为公司在该国建立製造设施提供财政奖励。

- 例如,根据美国环保基金会的数据,2023年即将建成的电池生产设施的总产能总合131GWh。据预测,到2025年,这一数字可能迅速上升至738GWh,年增率超过154%。此次扩张将显着影响电动车电池製造市场,使其能够满足电动车日益增长的需求。

- 创新是美国电动车电池製造市场的核心。美国公司和研究机构处于开发下一代电池技术的最前沿,其中包括固态电池,这些技术有望在能量密度、安全性和生命週期方面取得显着改善。

- 例如,2023年3月,美国能源局阿贡国家实验室成为锂空气电池先驱。这项技术创新预计将显着延长电动车的续航里程。该电池的潜在用途包括为汽车和家用飞机动力来源,以及为远距卡车运营提供动力。值得注意的是,这种设计解决了传统电池中普遍存在的重大安全问题,因为它消除了与液体电解相关的过热和火灾风险。

- 支持美国电动车电池製造市场扩张的是充电基础设施网路的扩张。美国正在大力投资开发全面的充电站网络,包括主要交通走廊沿线和都市区的快速充电选项。此外,无线充电和超快速充电等充电技术的创新也在考虑之中,以进一步改善用户体验并支援道路上不断增加的电动车数量。

- 因此,如上所述,美国预计将在预测期内成为市场的主导地区。

北美电动车电池製造业概况

北美电动车电池製造市场已减少一半。市场的主要企业(排名不分先后)是比亚迪、宁德时代新能源科技有限公司、American Battery Solutions, Inc.、EnerSys 和 Clarios。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- 电动车的扩张

- 政府支持性法规政策

- 抑制因素

- 与现有市场的竞争

- 促进因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品/服务的威胁

- 竞争公司之间的敌对关係

- 投资分析

第五章市场区隔

- 透过电池

- 锂离子

- 铅酸电池

- 镍氢电池

- 其他的

- 依电池形状分类

- 方形

- 袋型

- 圆柱形

- 搭车

- 客车

- 商用车

- 其他的

- 透过促销

- 电池电动车

- 油电混合车

- 插电式混合动力电动车

- 按地区

- 美国

- 加拿大

- 其他北美地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- BYD Co. Ltd

- Contemporary Amperex Technology Co. Limited

- American Battery Solutions, Inc.

- EnerSys

- GS Yuasa Corporation

- LG Chem Ltd

- Exide Industries

- Panasonic Corporation

- Sionic Energy

- Clarios LLC

- 其他主要企业名单

- 市场排名/份额(%)分析

第七章 市场机会及未来趋势

- 供应链本地化

简介目录

Product Code: 50003739

The North America Electric Vehicle Battery Manufacturing Market size is estimated at USD 5.76 billion in 2025, and is expected to reach USD 22.26 billion by 2030, at a CAGR of 31.02% during the forecast period (2025-2030).

Key Highlights

- In the coming years, the North American electric vehicle battery manufacturing market is poised to be significantly driven by the region's increasing adoption of electric vehicles, bolstered by supportive government policies and regulations.

- However, competition looms from established battery markets in the Asia Pacific, presenting a challenge to North America's electric vehicle battery manufacturing landscape.

- Yet, as North American countries push for localized battery manufacturing supply chains, they unveil a plethora of opportunities for the market's growth.

- With the United States government's intensified efforts to bolster battery manufacturing and the surging adoption of electric vehicles, the United States is set to lead the market and is projected to witness the most substantial growth.

North America Electric Vehicle Battery Manufacturing Market Trends

Battery Electric Vehicle to Witness Significant Growth

- Driven by technological advancements, regulatory backing, and evolving consumer preferences, the North American market for electric vehicle batteries is witnessing a robust surge, particularly in the battery electric vehicles (BEV) segment. BEVs, which operate exclusively on battery-powered electric powertrains, play a pivotal role in the global shift towards sustainable transportation.

- In North America, as automakers and policymakers commit to ambitious greenhouse gas emission reductions, the BEV segment is set for growth. The push to curb carbon footprints and adhere to strict emission standards is propelling the production and uptake of BEVs, which stand out by having no tailpipe emissions, unlike their hybrid counterparts.

- Electric vehicle sales, as reported by the International Energy Agency, have seen a meteoric rise since 2021, more than doubling to 727,730 units. The momentum continued with 1,117,719 units sold in 2022, and a leap to 1,584,113 units in 2023. This sales boom is closely linked to the surging demand for lithium-ion batteries, the mainstay power source for these vehicles.

- North America's burgeoning battery manufacturing capacity is crucial for the BEV segment's success. Given the geopolitical and logistical hurdles of depending on imported battery components and raw materials, the establishment of strong domestic supply chains takes on heightened significance. In response, the North American market is witnessing a flurry of investments, with several companies setting up 'gigafactories' across the region.

- As a case in point, Honda Motor is channeling a hefty USD 11 billion into bolstering its electric vehicle and battery production footprint in Ontario, Canada, with plans to commence operations by 2028. This ambitious endeavor, Honda's largest Canadian investment to date, aims for an annual output of 240,000 electric vehicles and 36 gigawatt-hours of batteries.

- These strategically located facilities, often near automotive manufacturing centers, are pivotal for achieving economies of scale, curbing production costs, and broadening the accessibility of BEVs to consumers. Their proximity to automotive hubs ensures a fluid supply chain and supports just-in-time production.

- Given these dynamics, the battery-electric vehicle segment is on track for substantial growth in the coming years.

United States to Dominate the Market

- The United States is a pivotal player in the North American electric vehicle battery manufacturing market, characterized by dynamic technological innovation, policy support, and strategic investments. The market for electric vehicle batteries is rapidly expanding, driven by a national imperative to transition to a more sustainable transportation ecosystem. Substantial government incentives aimed at both consumers and manufacturers support this shift.

- Federal policies, such as tax credits for electric vehicle purchases and substantial funding for research and development, are designed to spur innovation and increase the adoption of electric vehicles. Furthermore, recent legislation, such as the Inflation Reduction Act, includes significant provisions to promote the domestic production of electric vehicle batteries, providing financial incentives for companies to establish manufacturing facilities within the country.

- For instance, according to the United States Environmental Defense Fund, in 2023, the combined announced capacity of upcoming battery production facilities totaled about 131 GWh. Projections indicate this figure will surge, potentially hitting 738 GWh by 2025, translating to an annual growth rate exceeding 154%. This expansion significantly impacts the Electric Vehicle Battery Manufacturing Market, enabling it to meet the increasing demand for electric vehicles.

- Technological innovation is at the core of the United States electric vehicle battery manufacturing market. American companies and research institutions are at the forefront of developing next-generation battery technologies, including solid-state batteries, which promise significant improvements in energy density, safety, and lifecycle.

- For instance, in March 2023, the Argonne National Laboratory, under the United States Department of Energy, pioneered a lithium-air battery. This innovation holds the promise of substantially extending the range of electric vehicles. The battery's potential applications are vast, from powering cars and domestic airplanes to facilitating long-haul truck operations. Notably, this design addresses a critical safety concern prevalent in traditional batteries, as it eliminates the risk of overheating and fire associated with liquid electrolytes.

- A growing network of charging infrastructure supports the expansion of the electric vehicle battery manufacturing market in the United States. Significant investments are being made to develop a comprehensive network of charging stations across the country, including fast-charging options along major transportation corridors and in urban areas. Additionally, innovations in charging technology, such as wireless and ultra-fast charging, are being explored to improve the user experience further and support the growing number of electric vehicles on the road.

- Therefore, as mentioned above, the United States is expected to be the dominant region in the market during the forecast period.

North America Electric Vehicle Battery Manufacturing Industry Overview

The North America Electric Vehicle Battery Manufacturing Market is semi-fragmented. Some of the key players in this market (in no particular order) are BYD Co. Ltd, Contemporary Amperex Technology Co. Limited, American Battery Solutions, Inc., EnerSys, and Clarios.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Adoption of Electric Vehicles

- 4.5.1.2 Supportive Government Regulations and Policies

- 4.5.2 Restraints

- 4.5.2.1 Competition From Established Markets

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery

- 5.1.1 Lithium-ion

- 5.1.2 Lead-Acid

- 5.1.3 Nickel Metal Hydride Battery

- 5.1.4 Others

- 5.2 Battery Form

- 5.2.1 Prismatic

- 5.2.2 Pouch

- 5.2.3 Cylindrical

- 5.3 Vehicle

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

- 5.3.3 Others

- 5.4 Propulsion

- 5.4.1 Battery Electric Vehicle

- 5.4.2 Hybrid Electric Vehicle

- 5.4.3 Plug-in Hybrid Electric Vehicle

- 5.5 Geography

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Co. Ltd

- 6.3.2 Contemporary Amperex Technology Co. Limited

- 6.3.3 American Battery Solutions, Inc.

- 6.3.4 EnerSys

- 6.3.5 GS Yuasa Corporation

- 6.3.6 LG Chem Ltd

- 6.3.7 Exide Industries

- 6.3.8 Panasonic Corporation

- 6.3.9 Sionic Energy

- 6.3.10 Clarios LLC

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Localization of Supply Chains

02-2729-4219

+886-2-2729-4219