|

市场调查报告书

商品编码

1637848

託管基础设施服务:市场占有率分析、行业趋势和成长预测(2025-2030 年)Managed Infrastructure Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

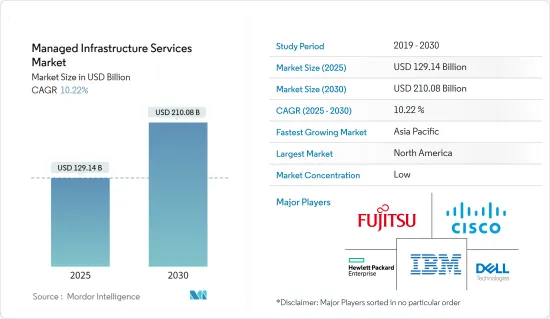

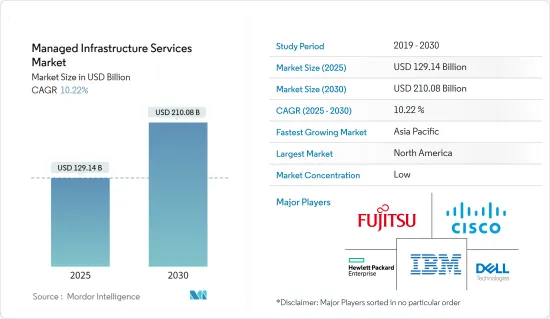

託管基础设施服务市场规模预计到 2025 年为 1,291.4 亿美元,预计到 2030 年将达到 2,100.8 亿美元,预测期内(2025-2030 年)复合年增长率为 10.22%。

分析、云端、物联网和认知运算等技术趋势正在创造新的业务需求。公司正在采用这些数位技术来创建创新的经营模式、优化业务流程、赋予员工权力并提供个人化的客户体验。

主要亮点

- 透过提供专业附加价值服务(例如应用程式测试、服务目录建立和专业咨询)的託管服务减少冗余停机时间。市场开发得到各种监控工具和由个人团队管理的多层基础设施的支援。例如,BMC 的「BMC Helix ITSM」系统是集中式的、云端原生的、可观察连接的、AIOps 优化的。此解决方案充分暴露来自IT基础设施、应用程式效能、网路效能和云端服务监控工具的资料。此外,团队和个人仪表板是根据每个使用者的需求量身定制的。

- 云端基础的技术的扩散和进步正在推动需求并推动市场。在过去几年中,伺服器故障修復和故障排除等日常业务已被外包,以减少对 IT 的关注,从而充分利用 IT 服务供应商的专业知识。透过行动和云端进行数位转型的采用正在增加,基础设施现代化正在取得进展。跟上最新技术改进的需求导致组织选择基础设施管理服务。

- 提高成本和营运效率以及更换过时的硬体正在推动市场发展。託管服务具有多项优势,其中最重要的是持续专注于营运和业务流程的持续改进。据思科系统公司称,託管服务可将内部经常性成本降低 30-40%,并将效率提高 50-60%。此外,随着新的和扩展的设备被引入基础设施,旧的硬体并不总是相容。随着资料中心营运的增加,硬体可能成为减慢营运速度的负债,而不是增强营运的资产。

- 利润率下降、诚信和可靠性问题正在限制市场成长。行动性和云端运算等新兴技术正在迅速改变商业格局。企业需要与这些技术同步,才能提供客户所需的好处。依赖合作伙伴託管关键业务基础设施时的可靠性挑战也阻碍了市场成长。

- 由于COVID-19的爆发,企业非常关注远距工作。在世界各国政府为阻止冠状病毒传播而实施的关闭措施期间,由于企业希望维持业务,云端服务的使用量大幅增加。由于预计云端迁移将变得更加广泛,甚至受到企业的关注,大多数企业已经与託管云端服务供应商续约了合约。此外,企业和组织优先考虑将扩增实境和机器学习等最尖端科技整合到当前的IT基础设施中,以推动数位转型。

託管基础设施服务市场趋势

云端细分市场预计将呈现最高成长

- 云端采用的出现改变了託管基础设施服务供应商(MISP) 的领域,导致采用在公共云端云或私有云端上提供技术服务的交付模式。鑑于云端提供的优势,MISP 与云端供应商(Google、AWS、Microsoft 等)合作,协助企业选择合适的云端供应商、迁移到云端并在迁移后管理云端服务。

- 随着企业需求的增加,公司正在发展其现有的託管云端基础设施服务。例如,2022 年 12 月,瑞士金融公司 Klarpay AG 决定使用 Amazon Web Services 建置其云端基础的基础架构。该公司没有将资源投入资料中心运营,而是专注于高价值业务,例如透过开发可扩展、支援 API 的交易功能等新功能来增强其银行产品。

- 越来越多的消费者正在使用数位平台,这增加了对数位化不断进步的需求,即高速资料传输和广泛的网路覆盖范围以储存大量资料。加速 IT 产业消费群成长的技术范例包括远距学习、多参与企业游戏、视讯会议和直播。 IT组织需要庞大的伺服器和资料储存单元来储存大量资料并提供更好的服务。

- 最近的技术趋势,例如增强的云端基础设施、支援物联网的生态系统,为整个美国IT 产业创造新的业务需求提供了机会,而且在疫情期间,美国的公共云端渗透率预计将大幅上升。此外,富士通也被亚马逊网路服务(AWS)认可为AWS官方託管基础设施供应商合作伙伴,透过加速云端转型帮助企业和政府加速创新,帮助企业和政府加速数位转型的能力得到认可。预计此类案例将在预测期内推动美国各地的市场需求。

亚太地区市场成长显着

- 亚太地区是中国和印度等国家 IT 和 IT 支援服务的主要来源,因此该地区的市场成长显着。例如,IT和BPM产业已成为印度最重要的经济引擎之一,对GDP和福利产生重大影响。 2022 财年,IT 产业贡献了印度 GDP 的 7.4%,预计到 2025 年将占印度 GDP 的 10%。根据印度国家软体与服务公司协会(Nasscom)统计,22财年印度IT产业收益达2,270亿美元,与前一年同期比较去年同期成长15.5%。印度IT投资预计将从2021年的818.9亿美元增加至2023年的1,103亿美元。

- 推动亚太地区託管基础设施服务成长的关键因素之一是各领域的快速数位化和技术进步。企业越来越依赖先进的IT基础设施来提高业务效率、敏捷性和竞争力。因此,对能够确保这些复杂 IT 环境的最佳效能和安全性的专业託管服务的需求变得至关重要。

- 亚太地区云端技术的采用也正在影响亚太地区託管基础设施服务市场。随着企业迁移到云端以获得更大的灵活性和可扩展性,託管基础设施服务已扩展到包括云端基础的基础设施管理,提供本地和云端环境之间的无缝整合。这种混合多重云端方法使企业能够优化 IT 资源,同时适应不断变化的工作负载和需求。

- 此外,根据麻省理工学院发布的2022年云端生态系指数,新加坡得分8.48分,在全球云端运算基础设施中排名最高。韩国、日本、澳洲和纽西兰是 2022 年云端服务生态系统得分最高的亚太国家。这项认可凸显了亚太地区对推动数位基础设施的承诺,使其成为云端服务乃至託管基础设施服务的有吸引力的地区。

託管基础设施服务产业概述

託管基础设施服务市场高度分散,预计竞争将加剧,许多技术成熟的大型公司将进入该市场。此外,为了维持市场、留住客户,企业正在采取强而有力的竞争策略,竞争企业之间的竞争正在加剧。主要参与企业包括富士通、思科系统公司和戴尔科技公司。

2023年9月,全球知名IT基础设施服务供应商Kyndryl与全端云端服务供应商Expedient宣布建立合作伙伴关係。透过此次合作,Kindril 利用 Expedient 可靠的云端基础架构和资料中心託管,为客户提供增强的业界领先的网路弹性能力。 Expedient 高度互连的资料中心全国网路专门提供屡获殊荣的基础设施,该基础设施是 Cloud Difference多重云端服务的关键组成部分。基础设施由基于 VMware 的 Expedient Enterprise Cloud、私有云端以及根据不同地区和细分市场的客户和潜在客户的需求量身定制的定製配置提供。

2023年8月,全球B2B订阅商务平台AppDirect宣布收购ADCom Solutions的网路营运中心(NOC)及VEEUE平台。 ADCom Solutions 是一家全球託管服务供应商,专门从事复杂IT基础设施的设计、实施和全面管理。透过此次收购,AppDirect 将能够为 VEEUE 提供广泛的技术顾问网路的存取权限,从而使 AppDirect 能够透过其 10,000 名顾问管道部署全套託管网路和基础设施服务。

2022 年 11 月 数位转型、高效能运算与资讯科技基础设施领域的全球领导者 Atos 与 Amazon.com, Inc. 旗下子公司 Amazon Web Services (AWS) 今天宣布签署全球策略转型计画。该协议将使拥有大规模基础设施外包协议的Atos客户能够加速将工作负载迁移到云端并完成其数位转型。这项业界首创的多年期协议使 Atos 和 AWS 能够进一步加强他们的策略伙伴关係。 Atos 选择 AWS 作为其首选企业云端供应商,AWS 也将 Atos 视为 IT 外包和资料中心转型的策略合作伙伴。此次合作将使 Atos 客户能够透过获得 Atos 的业务和技术咨询、数位工程和託管服务来加速他们的云端之旅。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 市场定义和范围

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业相关人员分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场动态

- 市场驱动因素

- 云端管理基础设施服务的使用增加

- 云端基础的技术的扩散和进步将推动需求

- 提高成本和营运效率,并更换老化硬件

- 市场限制因素

- 利润率下降、整合和可靠性问题

- COVID-19 对託管基础设施服务市场的影响

第六章 市场细分

- 依部署类型

- 本地

- 云

- 按服务类型

- 桌面列印服务

- 伺服器

- 存货

- 其他的

- 按最终用户

- BFSI

- 资讯科技和电信

- 医疗保健

- 製造业

- 零售

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 其他亚太地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 北美洲

第七章 竞争格局

- 公司简介

- Fujitsu Ltd

- Cisco Systems Inc.

- Dell Technologies Inc.

- IBM Corporation

- Hewlett Packard Enterprise

- Microsoft Corporation

- TCS Limited

- Canon Inc.

- Alcatel-Lucent SA(Nokia Corporation)

- Toshiba Corporation

- Verizon Communications Inc.

- Citrix Systems Inc.

- Deutsche Telekom AG

- Xerox Corporation

- Ricoh Company Ltd

- Lexmark International Inc.

- Konica Minolta Inc.

第八章投资分析

第九章 市场机会及未来趋势

The Managed Infrastructure Services Market size is estimated at USD 129.14 billion in 2025, and is expected to reach USD 210.08 billion by 2030, at a CAGR of 10.22% during the forecast period (2025-2030).

Technology trends such as analytics, Cloud, IoT, and Cognitive Computing are creating new business imperatives. Companies are adopting these digital technologies to build innovative business models, optimize business processes, empower their workforce, and personalize the customer experience.

Key Highlights

- Redundant downtime is reduced through managed services, which offer specialized value-added services like application testing, service catalog creation, and professional consulting. The market's development is aided by various monitoring tools and numerous layers of infrastructure controlled by separate teams. For instance, in BMC's "BMC Helix ITSM" the system is centralized, cloud-native, connected with observability, and optimized for AIOps. This solution fully exposes data from monitoring tools for IT infrastructure, application performance, network performance, and cloud services. Additionally, team and individual dashboards are customized to each user's needs.

- Technological proliferation and advancement of cloud-based technology boosting the demand is driving the market. Over the past few years, daily operations of break-fix and troubleshooting of servers have been outsourced to reduce their attention over IT, thereby allowing the expertise of IT service vendors. An increase in the adoption of digital transformation with mobility and cloud has led to infrastructure modernization. The need to keep up with the latest technological enhancements has led organizations to opt for infrastructure-managed services.

- Improved cost and operational efficiency and updates of outdated hardware are driving the market. Managed services offer several benefits, relentless focus on continuous improvement of operational and business processes being the most significant one. According to Cisco Systems, managed services reduce recurring in-house costs by 30-40% and increase efficiency by 50-60%. Moreover, as new and enhanced equipment is introduced to the infrastructure, the old hardware might not always be compatible. As data center operations increase, the hardware could become more of a liability which slows down operations, than an asset that enhances them.

- Declining profit margins and integration and reliability concerns are restraining the market to grow. Emerging technologies, such as mobility and cloud computing, are rapidly changing the business landscape. Companies have to be in sync with these technologies to deliver desired benefits to the customers. Reliability concerns are also challenging the market to grow when hiring another partner to host critical business infrastructure.

- Businesses are putting a lot of attention on remote working due to the COVID-19 pandemic. The use of cloud services grew significantly as companies became more concerned with maintaining operations during lockdowns imposed by various governments to stop the spread of the coronavirus. In anticipation of cloud migration becoming more widespread among corporations and, in some cases, even gaining traction, most businesses have already renewed their contracts with managed cloud service providers. Additionally, businesses and organizations prioritized integrating cutting-edge technologies like augmented reality and machine learning into their current IT infrastructure to promote digital transformation.

Managed Infrastructure Services Market Trends

The Cloud Segment is Expected to Exhibit the Highest Growth

- The advent of cloud deployment has brought changes in the managed infrastructure services providers (MISP) space and made them embrace a delivery model for delivering technology services over a public or private cloud. Considering the advantages the cloud offers, businesses are seeking MISPs that have partnerships with cloud providers (such as Google, AWS, Microsoft, etc.) to choose the right cloud providers, migrate to the cloud, and manage cloud services after the transition.

- With the increasing demand from enterprises, various companies have made advancements in their existing managed cloud infrastructure service. For instance, in December 2022, the Swiss finance company Klarpay AG decided to use Amazon Web Services to create its cloud-based infrastructure. Instead of spending its resources to operate a data center, the company concentrated on high-value tasks, such as enhancing its banking product by creating new features like scalable and API-enabled transactional capabilities.

- Increasingly more consumers are using digital platforms, which has increased the demand for ongoing digitalization advancements for high-speed data transport with wide network coverage for large amounts of data storage. Examples of technologies that have accelerated the growth of the consumer base in the IT business include distance learning, multiplayer gaming, videoconferencing, and live streaming. Enormous servers and data storage units are necessary for IT organizations to store large amounts of data and offer improved services.

- Recent technology trends, such as enhanced cloud infrastructure, IoT enabled ecosystems, have provided opportunities in creating new business imperatives across the US IT sector, and the penetration of public cloud in the United States is predicted to be higher during a pandemic. Additionally, Fujitsu has been recognized by Amazon Web Services (AWS) as an official AWS-managed infrastructure provider partner, thereby validating the company's capabilities in accelerating cloud transformation and helping fast-track digital transformation, and accelerating innovation for enterprises and government. Such instances are expected to fuel the demand of the market across the United States during the forecast period.

Asia-Pacific Account for a Significant Market Growth

- Asia-Pacific region accounts for the significant market growth due to dominating sources of IT and IT-enabled services in various countries such as China and India. For instance, the IT & BPM sector has become one of India's most significant economic generators, substantially impacting its GDP and welfare. The IT sector generated 7.4% of India's GDP in FY22; by 2025, it is expected to account for 10% of its GDP. The Indian IT industry's revenue reached USD 227 billion in FY22, a 15.5% YoY growth, according to the National Association of Software and Service Companies (Nasscom). India was predicted to spend USD 110.3 billion on IT in 2023, up from an estimated USD 81.89 billion in 2021.

- One of the key factors contributing to the growth of managed infrastructure services in the Asia-Pacific region is the rapid digitization and technological advancements across various sectors. Enterprises are increasingly relying on advanced IT infrastructure to enhance operational efficiency, agility, and competitiveness. As a result, the need for specialized managed services that can ensure the optimal performance and security of these complex IT environments has become crucial.

- The region's adoption of cloud technologies also influences the Asia-Pacific managed infrastructure services market. As organizations migrate to the cloud for enhanced flexibility and scalability, managed infrastructure services extend to cloud-based infrastructure management, ensuring seamless integration between on-premises and cloud environments. This hybrid and multi-cloud approach allows businesses to optimize their IT resources while adapting to changing workloads and demands.

- Further, according to an MIT Technology publication, Singapore ranked highest on the Cloud Ecosystem Index 2022, with a score of 8.48, for cloud computing infrastructure worldwide. South Korea, Japan, Australia, and New Zealand were top-scoring Asia-Pacific nations with favorable ecosystems for cloud services in 2022. This recognition emphasizes the region's commitment to advancing its digital infrastructure, making it an attractive hub for cloud services and, by extension, managed infrastructure services.

Managed Infrastructure Services Industry Overview

The managed infrastructure services market is highly fragmented as many large, technologically established players are present in the industry, and the rivalry is expected to be on the higher side. Additionally, in order to sustain in the market and retain their clients, companies are employing powerful competitive strategies, thereby intensifying competitive rivalry in the market. Key players are Fujitsu Ltd, Cisco Systems Inc., Dell Technologies Inc., etc.

In September 2023, Kyndryl, a prominent provider of IT infrastructure services globally, and Expedient, a Full-Stack Cloud service provider, announced a partnership. This partnership will improve Kyndryl's industry-leading cyber resilience capabilities to customers by utilizing Expedient's reliable cloud infrastructure and data center colocation. Expedient's highly interconnected nationwide network of data centers is dedicated to its award-winning infrastructure, a key component of its Cloud Different multi-cloud services. Infrastructure is offered in VMware-based Expedient Enterprise Cloud, private cloud, and customized configurations to suit the demands of clients and prospects in various geographies and sectors.

In August 2023, AppDirect, a global B2B subscription commerce platform, announced that it had acquired the Network Operations Center (NOC) and VEEUE platform of ADCom Solutions. ADCom Solutions has been a global provider of managed services, specializing in designing, implementing, and comprehensively administrating complex IT infrastructures. AppDirect will be able to offer VEEUE access to the extensive network of technology advisers through this acquisition, allowing AppDirect to introduce a suite of managed network and infrastructure services through its channel of 10,000 advisors.

In November 2022, Atos, a global leader in digital transformation, high-performance computing, and information technology infrastructure, and Amazon Web Services, Inc. (AWS), a subsidiary of Amazon.com, Inc., today announced a global Strategic Transformation Agreement. This agreement enables Atos customers with large-scale infrastructure outsourcing contracts to accelerate workload migrations to the cloud and complete digital transformation. With the multiyear, first-in-the-industry deal, Atos and AWS can further their strategic partnership. Atos has chosen AWS as its preferred enterprise cloud provider, and AWS has identified Atos as a strategic partner for IT outsourcing and data center transformation. With the help of this arrangement, Atos' clients may hasten their transitions to the cloud by receiving business and technology advisory, digital engineering, and managed services from Atos.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Market Definition and Scope

- 1.2 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing use of Cloud Managed Infrastructure Services

- 5.1.2 Technological Proliferation and Advancement of Cloud Based Technology Boosting the Demand

- 5.1.3 Improved cost and Operational Efficiency and Update of Outdated Hardware

- 5.2 Market Restraints

- 5.2.1 Declining Profit Margins and Integration and Reliability Concerns

- 5.3 Impact of COVID-19 on Managed Infrastructure Services Market

6 MARKET SEGMENTATION

- 6.1 By Deployment Type

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.2 By Services Type

- 6.2.1 Desktop and Print Services

- 6.2.2 Servers

- 6.2.3 Inventory

- 6.2.4 Other Types

- 6.3 By End User

- 6.3.1 BFSI

- 6.3.2 IT and Telecom

- 6.3.3 Healthcare

- 6.3.4 Manufacturing

- 6.3.5 Retail

- 6.3.6 Other End Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 UK

- 6.4.2.3 France

- 6.4.2.4 Spain

- 6.4.2.5 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Australia

- 6.4.3.5 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Mexico

- 6.4.4.3 Argentina

- 6.4.4.4 Rest of Latin America

- 6.4.5 Middle East and Africa

- 6.4.5.1 UAE

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 South Africa

- 6.4.5.4 Rest of Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Fujitsu Ltd

- 7.1.2 Cisco Systems Inc.

- 7.1.3 Dell Technologies Inc.

- 7.1.4 IBM Corporation

- 7.1.5 Hewlett Packard Enterprise

- 7.1.6 Microsoft Corporation

- 7.1.7 TCS Limited

- 7.1.8 Canon Inc.

- 7.1.9 Alcatel-Lucent SA (Nokia Corporation)

- 7.1.10 Toshiba Corporation

- 7.1.11 Verizon Communications Inc.

- 7.1.12 Citrix Systems Inc.

- 7.1.13 Deutsche Telekom AG

- 7.1.14 Xerox Corporation

- 7.1.15 Ricoh Company Ltd

- 7.1.16 Lexmark International Inc.

- 7.1.17 Konica Minolta Inc.