|

市场调查报告书

商品编码

1637868

欧洲个人护理包装:市场占有率分析、产业趋势、成长预测(2025-2030)Europe Personal Care Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

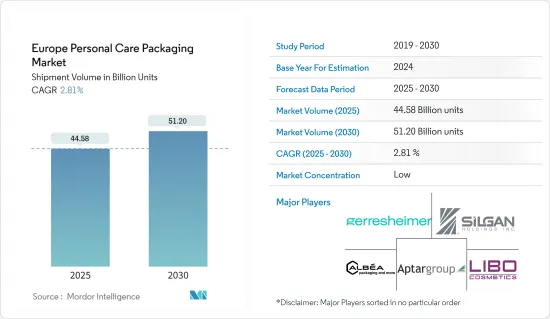

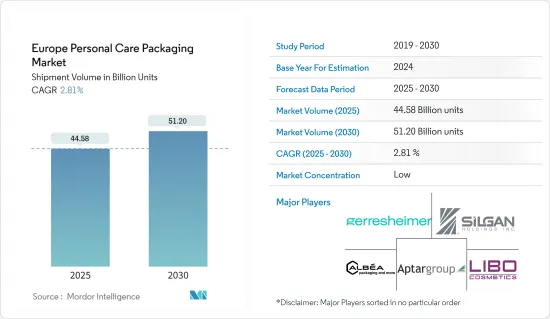

欧洲个人护理包装市场规模(以出货量为准)预计将从2025年的445.8亿件成长到2030年的512亿件,预测期间(2025-2030年)复合年增长率为2.81%。

主要亮点

- 欧洲对护肤品需求的增加是由于防晒油、保湿霜、美容霜等护肤品变得更容易获得且性价比更高,并且需求环境因市场扩张而发生变化。

- 由于生活方式的改变和工薪阶层女性压力的增加,越来越多的年轻人遇到皮肤问题,这可能会导致客製化产品的增加。专门配製和製造由有机成分组成、不含有害化学物质并采用环保材料包装的天然护肤的公司预计未来几年的需求将显着增长。

- 该地区的年轻消费者喜爱有机护肤品。因此,该地区的市场参与企业正在推出新的创新产品来满足消费者的需求。例如,2023 年 4 月,联合利华品牌 Dove 更新了沐浴乳,并添加了植物来源成分和低过敏性变种。预计这将推动对护肤包装解决方案的需求。

- 欧洲化妆品市场的发展反映了更广泛的欧洲市场的成长,其特点是注重品质、优质化和区域参与企业的增加。奢侈品与大众市场商品之间的差距持续扩大,该地区对奢侈品的兴趣持续增长,使市场受益。

- *优质化妆品品牌在市场上越来越受欢迎。随着时尚界的创新,眉笔、口红、粉底霜、乳液等化妆品销售量大幅成长。随着极简妆容的流行和高调产品的推出,我们看到消费者对有机脸部化妆品的兴趣不断增加。

- 2023 年 1 月,Unette Group 推出了 Tear n Tuck 可重复密封管,它补充了传统的螺帽管解决方案,并有助于减轻重量、成本和环境影响,同时减少 70% 的塑胶。这种可重新密封的解决方案被认为提供了一种多功能且方便的方式来包装防晒油、润滑剂、外用霜以及其他糊剂和液体。

- 由于消费者的偏好和需求不断变化,个人护理行业的产品种类显着增加。消费者正在寻找适合自己需求的创新和专业个人保健产品,包括天然和有机配方、抗衰老解决方案和永续选择。对如此多样化产品的需求不断增长,需要拥有专业知识、能力和资源来生产各种个人保健产品的契约製造製造商的参与。

- *欧洲护肤品需求的成长主要是由于防晒油、保湿霜和美容霜等护肤品的可用性和成本效益,以及线上分销的成长。

- *随着消费者越来越意识到自己对全球环境的影响,他们需要永续且无浪费的产品。因此,填充用玻璃瓶的需求不断增加。

- 填充用香水瓶可透过消除一次性包装的需要并减少塑胶废弃物来体现这些价值。玻璃不会劣化品质,并且可以无限期回收,使其成为填充用香水瓶的标语选择。

- *玻璃瓶具有无与伦比的美学吸引力,因此企业正在利用玻璃包装的精緻和精緻来增强其产品的视觉吸引力。玻璃的透明度使消费者能够欣赏颜色和纯度,从而增强了产品的整体吸引力。除了美观之外,玻璃包装还具有出色的耐用性和保质期。

欧洲个人护理包装市场趋势

护肤占很大市场占有率

- 多种因素,包括减缓衰老征兆的愿望、护肤习惯意识的增强以及社交媒体的影响,正在推动对护肤产品的需求,尤其是千禧世代。这种不断增长的需求直接影响了市场对此类产品的需求,并有助于护肤包装的製造。

- 千禧世代对护肤的日益关注,强调开发满足其特定需求和偏好的专门配方。这包括采用有机和天然成分的产品,因为千禧世代优先考虑永续性和清洁美容。因此,护肤行业的包装製造商正在增加研发投资,以满足这些需求。

- 随着个人保健产品消费率的提高,德国护肤和脸部保养产品的销售稳步增长,带动了对玻璃、纸张和金属製成的各种形式的包装的需求。收益从 2019 年的 35.714 亿美元增至 2023 年的 37.023 亿美元。

- 包装製造商需要掌握护肤行业的最新趋势、消费者偏好和监管要求。这样做可以有效满足客户不断变化的需求,为护肤包装市场的成长做出贡献。总体而言,护肤品在男性和女性中越来越受欢迎,製造商面临着生产针对特定性别的产品的压力,因此他们正在从内部包装转向合约包装和製造,以扩大规模,降低产品成本。

- 抗衰老护肤品含有有益成分,可改善肤质并减少细纹。此类产品需要适当的包装以保护配方的功效。采用创新的包装设计对于抗衰老产品的持久功效至关重要。

- 真空帮浦和滴管瓶等创新包装解决方案有助于维持产品效力和保质期,同时改善卫生状况。与二维码一样,互动式包装可以实现虚拟产品测试和个人化推荐。人们也越来越关注永续性,包装选择由可回收塑胶和永续材料(如竹子和生物分解性材料)製成。

- 2023 年 6 月,领先的玻璃包装製造商 Croxsons 为伦敦填充用护肤品牌 Necessary Good 开发了初级包装。 Croxsons 生活方式、美容、健康和保健部门设计了玻璃容器。 Necessary Good推出了脸部喷雾、洗面乳、保湿霜和胶束水等必需品。

英国预计将占较大市场份额

- 在英国,由于多种因素,市场正在成长,其中包括管包装比玻璃瓶和宝特瓶传统包装选项具有许多优势。除了方便和多功能之外,它们还价格实惠、环保并保护活性成分。管材的大规模生产可以快速且有效率地完成,因此与其他包装材料和製程相比,生产成本相对较低。

- 在化妆品行业,管材的使用正在扩大,用于凝胶、乳霜、软膏和精华液的包装,这些是管材包装的理想选择。市场上有这么多的产品,消费者比以往任何时候都变得更加挑剔。在不牺牲产品完整性的情况下拥有美观的包装变得越来越重要。

- 线上管道支持了我们在停工期间的业绩,并透过增加支出实现了显着增长。英国化妆品市场的发展反映了整个欧洲市场的扩张,其特点是注重品质、优质化和区域参与企业的不断增加。奢侈品与大众市场商品之间的差距持续拉大,国家对奢侈品的兴趣增加,令市场受益。

- 优质化妆品品牌在市场上越来越受欢迎。随着时尚产业的创新,彩妆品(包括眉笔、口红、粉底霜)等美容产品销售量大幅成长。随着更简约妆容的流行和高调产品的推出,我们看到消费者对有机脸部化妆品的兴趣增加。

- 英国国家统计局的数据显示,2023 年第一季个人照护支出增至约 97.522 亿美元,而 2021 年第一季约为 65.978 亿美元。个人护理品牌可能会投资于创新且有吸引力的包装设计,以吸引消费者并使其产品脱颖而出。这包括环保的包装材料、方便的包装形式或美观的设计等。随着品牌寻求在不断扩大的个人护理市场中保持竞争力,此类包装创新可能会刺激市场成长。

- 为了遵循永续性趋势并响应消费者偏好,英国製造商越来越多地将可再填充产品引入化妆品包装市场。例如,2023年7月,英国玻璃瓶製造商Croxsons为其填充用必需品护肤品牌Necessary Good推出了新的初级包装。玻璃瓶有100毫升和200毫升两种尺寸,形状像圆柱体。该公司的生活方式、美容、健康与保健部门开发了这种玻璃器皿包装。

欧洲个人护理包装产业概况

欧洲个人护理包装市场按 AptarGroup Inc.、Gerresheimer AG、Albea Group 和 Silgan Holdings Inc. 等参与企业的存在进行细分。这些参与企业正在推动欧洲包装产业走向永续性数位化,并透过大量研发投资扩大市场。

2023年9月,法国化妆品公司欧舒丹与Albea合作更新产品阵容。这种新管适用于法国和欧洲其他地区现有的 PE 回收系统。此包装解决方案包括经过塑胶回收再利用协会认证的全塑胶层压板和 Greenleaf 管材。该管具有多层 HDPE 套管。

2023年6月,瑞士欧瑞莲与法国Alvea合作推出新系列护髮素Duologi。 Duologi 的开发考虑了永续发展目标。本产品外壳不含铝,采用低 PP 型材的金属塑胶阻隔层压板 (PBL) 管包装。 Alvea采用的技术与欧洲MRP(高密度聚苯乙烯)回收流程完全相容。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场动态

- 市场驱动因素

- 化妆品需求稳定成长

- 越来越注重创新和有吸引力的包装

- 市场限制因素

- 欧洲国家化妆品塑胶包装重复利用率低

第六章 市场细分

- 依材料类型

- 塑胶

- 玻璃

- 金属

- 纸

- 按包装类型

- 塑胶瓶/容器

- 玻璃瓶/容器

- 金属容器

- 折迭式纸盒

- 瓦楞纸箱

- 管和棒

- 盖子与封口装置

- 泵浦和分配器

- 软质塑胶包装

- 按用途

- 口腔护理

- 头髮护理

- 彩妆品

- 护肤

- 男士美容

- 除臭剂

- 按国家/地区

- 英国

- 德国

- 法国

- 义大利

- 西班牙

第七章 竞争格局

- 公司简介

- Albea Group

- HCP Packaging Co. Ltd

- Berry Global Inc.

- Silgan Holdings Inc.

- Libo Cosmetics Company Ltd

- AptarGroup Inc.

- Amcor Group GmBH

- VERESCENCE FRANCE

- Alpla Group

- Rieke Packaging Systems Ltd

- Quadpack Industries SA

- Gerresheimer AG

- Raepak Ltd

第八章投资分析

第九章 市场未来展望

The Europe Personal Care Packaging Market size in terms of shipment volume is expected to grow from 44.58 billion units in 2025 to 51.20 billion units by 2030, at a CAGR of 2.81% during the forecast period (2025-2030).

Key Highlights

- The increased demand for skin care products in Europe is primarily attributed to the availability and cost-effectiveness of skin care products, such as sunscreen, moisturizer, and beauty cream, as well as the growth of online distribution through Europe, which has reshaped the demand landscape.

- A rising number of young adults have been experiencing skin problems due to changing lifestyle patterns and increased stress among the working-class female population, which is likely to lead to a rise in custom-made products. Companies specializing in formulating and producing natural skin care composed of organic ingredients, free from hazardous chemicals, and packaged in environmentally friendly materials are expected to experience considerable growth in demand over the coming years.

- Young consumers in the region have been using organic skincare products. Thus, market players in the region are launching new and innovative products to cater to consumer demand. For instance, in April 2023, Unilever brand Dove reformulated a body wash with plant-based ingredients and a hypoallergic variant. This is expected to drive the demand for skincare packaging solutions.

- The development of the European cosmetics market reflects the augmentation of the widespread European market, characterized by a growing focus on quality, premiumization, and the increased presence of regional players. The gap between premium and mass products continued to widen, with a more significant interest in premium products in the region, benefiting the market.

- * The market has been witnessing a growing popularity of premium cosmetic brands. With the innovations in the fashion industry, cosmetic products such as eyebrow liners, lipsticks, foundation creams, and lotions have seen strong growth in sales. The trend towards a minimalist makeup look and high-profile product launches witnessed consumers' increasing focus on organic face cosmetics.

- In January 2023, Unette Group launched its Tear n Tuck re-closable tubes in response to traditional screw cap tube solutions to help reduce weight, cost, and environmental impact with a 70% decrease in plastic. This resealable solution is thought to provide a versatile and convenient means of packaging suncream, lubricants, topical creams, and other pastes or liquids.

- The personal care industry has been witnessing a significant expansion in product offerings due to evolving consumer preferences and demands. Consumers seek innovative and specialized personal care products tailored to their needs, such as natural and organic formulations, anti-aging solutions, and sustainable options. This growing demand for diverse product ranges necessitates the involvement of contract manufacturers with the expertise, capabilities, and resources to produce a wide variety of personal care products.

- * The increased demand for skin care products in Europe is primarily attributed to the availability and cost-effectiveness of skin care products, such as sunscreen, moisturizer, and beauty cream, as well as the growth of online distribution.

- * With higher awareness about the impact on the global environment, consumers are looking for products that are sustainable and reduce waste. Consequently, there is a growing demand for refillable glass bottles.

- Refillable perfume bottles reflect these values by eliminating the need for disposable packaging and reducing plastic waste. Since glass is entirely recyclable indefinitely without degrading in quality, it is an uncontested choice for refillable perfume bottles.

- * Glass bottles provide an unparalleled aesthetic appeal; therefore, companies utilize the refinement and sophistication of glass packaging to elevate the visual appeal of their products. The clarity of the glass enables consumers to admire the hue and purity, contributing to the overall charm of the product. In addition to their aesthetic appeal, glass packaging offers excellent durability and preservation qualities.

Europe Personal Care Packaging Market Trends

Skincare will Hold a Significant Market Share

- The demand for skincare products, especially from millennials, is on the rise, driven by various factors such as the desire to delay the signs of aging, increasing awareness of skincare routines, and the influence of social media. This growing demand directly impacts the demand for such products in the market, aiding skincare packaging manufacturing.

- Millennials' focus on skincare has led to an increased emphasis on developing specialized formulations that cater to their specific needs and preferences. These include products that incorporate organic and natural ingredients, as millennials prioritize sustainability and clean beauty. Thus, packaging manufacturers in the skincare industry are investing more in research and development to meet these demands.

- The revenue from skin care and facial care products in Germany grows steadily with the growing consumption rate of personal care products, increasing the demand for different formats of packaging made with glass, paper, and metal. The revenue increased from USD 3571.4 million in 2019 to USD 3702.3 million in 2023.

- Packaging manufacturers must stay updated with the latest trends, consumer preferences, and regulatory requirements in the skincare industry. By doing so, they can effectively meet their clients' evolving demands and contribute to the growth of the skincare packaging market. Overall, skin care products are gaining traction in both males and females, and manufacturers have been pressured to create gender-specific products, causing them to shift from in-house packaging to contract packaging and manufacturing to scale up and reduce product costs.

- Anti-aging skincare products contain beneficial ingredients that enhance skin texture and minimize fine lines and wrinkles. These products require appropriate packaging materials to safeguard the efficacy of their formula. Employing innovative packaging designs is crucial to ensure the continued effectiveness of anti-aging products.

- Innovative packaging solutions, such as airless pumps and dropper bottles, help preserve products' potency and shelf life while enhancing hygiene. Like QR codes, interactive packaging allows virtual product testing and personalized recommendations. There is also a growing focus on sustainability, with options for recyclable plastic or packaging made from sustainable materials like bamboo or biodegradable substances.

- In June 2023, Croxsons, a leading glass packaging manufacturer, developed primary packaging for Necessary Good, a refillable skincare brand in London. Croxsons' lifestyle, beauty, health, and wellness division designed the glass containers. Necessary Good introduced essential products, including face mist, face wash, moisturizer, and micellar water.

The United Kingdom Expected to Hold Significant Share in the Market

- In the United Kingdom, the market is growing due to several factors, such as tube packaging offering many benefits over traditional packaging options like glass jars and plastic bottles. In addition to being convenient and versatile, they are affordable, eco-friendly, and provide active ingredient protection. As the production of tubes on a large scale can be done quickly and efficiently, the production cost is relatively low compared to other packaging materials and processes.

- The use of tubes in the cosmetic industry is growing to pack Gels, creams, ointments, and serums, as they are ideal for tube packaging. With so many products on the market, consumers are becoming choosier than ever before. Having aesthetically appealing packaging without sacrificing product integrity is becoming increasingly important.

- The online channel propped up performance throughout lockdown periods and experienced significant growth with spending rising. The development of the United Kingdom cosmetics market reflects the augmentation of the overall European market, characterized by a growing focus on quality, premiumization, and the increased presence of regional players. The gap between premium and mass products continued to widen, with a greater interest in premium products in the country, benefiting the market.

- The market witnessed the growing popularity of premium cosmetic brands. With the innovations in the fashion industry, beauty products such as color cosmetics (including eyebrow liners, lipsticks, and foundation creams) have seen strong growth in sales. The trend towards a more minimalist makeup look and high-profile product launches witnessed consumers' increasing focus on organic face cosmetics.

- According to the Office for National Statistics (UK), in the first quarter of 2023, personal care spending increased to around USD 9,752.2 million compared to the first quarter of 2021, which was around USD 6597.8 million. Personal care brands may invest in innovative and attractive packaging designs to attract consumers and differentiate their products. This could include environmentally friendly packaging materials, convenient packaging formats, or aesthetically pleasing designs. This innovation in packaging can stimulate market growth as brands seek to stay competitive in the expanding personal care market.

- In order to follow the sustainability trends and cater to consumer preferences, manufacturers in the United Kingdom are increasingly introducing refillable products in the cosmetic packaging market. For instance, in July 2023, Croxsons, a United Kingdom glass bottle manufacturer, launched the new primary packaging for the refillable essential skincare brand Necessary Good. Two 100 ml and 200 ml glass bottle sizes are shaped like cylinders. The company's lifestyle, beauty, and health and wellness division has developed this glassware packaging.

Europe Personal Care Packaging Industry Overview

The European personal care packaging market is fragmented due to the presence of players like AptarGroup Inc., Gerresheimer AG, Albea Group, and Silgan Holdings Inc., which are up-scaling the market with substantial R&D investments, driving toward the sustainability and digitization of the packaging industry in Europe.

September 2023: A France-based cosmetics company, L'Occitane, collaborated with Albea to redesign their product range. The new tube is suitable for use in existing PE recycling systems in France and the rest of Europe. The packaging solution includes an all-plastic laminate and a Greenleaf tube certified by the Association of Plastic Recyclers. The tube has a multi-layer sleeve in HDPE.

June 2023: Switzerland-based Oriflame company collaborated with Albea, a France-based company, to launch Duologi, a new range of conditioners. Duologi was developed in line with sustainability objectives. It is presented in a metallic plastic barrier laminate (PBL) tube with no aluminum in the shell and a low PP profile. The technology used by Albea is fully compliant with the European MRP (high-density polyethylene) recycling stream.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyer

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Steady Rise in Demand for Cosmetic Products

- 5.1.2 Increasing Focus on Innovation and Attractive Packaging

- 5.2 Market Restraints

- 5.2.1 Low Rates of Re-usability of Plastic Packaging of Cosmetic Products in European Countries

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Plastic

- 6.1.2 Glass

- 6.1.3 Metal

- 6.1.4 Paper

- 6.2 By Packaging Type

- 6.2.1 Plastic Bottles and Container

- 6.2.2 Glass Bottles and Containers

- 6.2.3 Metal Containers

- 6.2.4 Folding Cartons

- 6.2.5 Corrugated Boxes

- 6.2.6 Tube and Stick

- 6.2.7 Caps and Closures

- 6.2.8 Pump and Dispenser

- 6.2.9 Flexible Plastic Packaging

- 6.3 By Application Type

- 6.3.1 Oral Care

- 6.3.2 Hair Care

- 6.3.3 Color Cosmetics

- 6.3.4 Skin Care

- 6.3.5 Men's Grooming

- 6.3.6 Deodorants

- 6.4 By Country

- 6.4.1 United Kingdom

- 6.4.2 Germany

- 6.4.3 France

- 6.4.4 Italy

- 6.4.5 Spain

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Albea Group

- 7.1.2 HCP Packaging Co. Ltd

- 7.1.3 Berry Global Inc.

- 7.1.4 Silgan Holdings Inc.

- 7.1.5 Libo Cosmetics Company Ltd

- 7.1.6 AptarGroup Inc.

- 7.1.7 Amcor Group GmBH

- 7.1.8 VERESCENCE FRANCE

- 7.1.9 Alpla Group

- 7.1.10 Rieke Packaging Systems Ltd

- 7.1.11 Quadpack Industries SA

- 7.1.12 Gerresheimer AG

- 7.1.13 Raepak Ltd