|

市场调查报告书

商品编码

1640496

美国个人保健产品包装:市场占有率分析、行业趋势和成长预测(2025-2030 年)US Personal Care Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

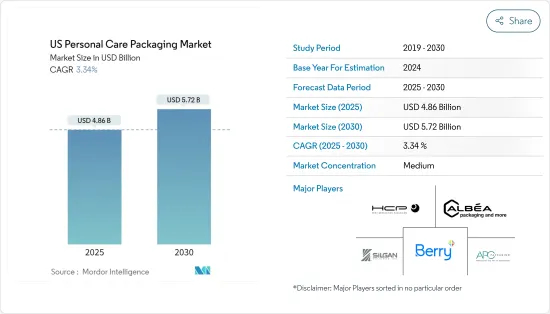

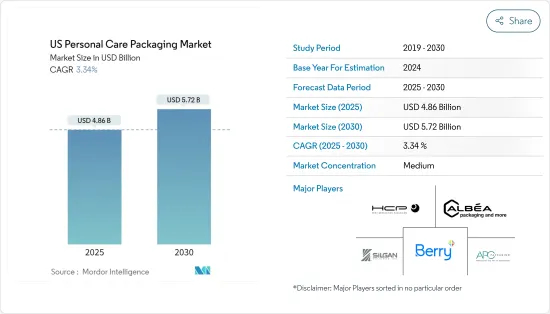

美国个人保健产品包装市场规模预计在2025年为48.6亿美元,预计到2030年将达到57.2亿美元,预测期内(2025-2030年)的复合年增长率为3.34%。

主要亮点

- 近年来,美国个人护理和化妆品行业的包装经历了强劲增长。化妆品行业对包装的要求是所有行业中最多样化的,目前该行业正努力通过新的周到的包装策略和精良的配方来减少对环境的影响。

- 美容市场包括各种各样的产品,包括化妆品、护肤和护髮产品。大多数美容产品销售都是透过电子商务进行的,线上和社交平台上的数位原生业务均出现了显着成长。

- 美国科技平台 Power Review 的资料显示,31% 的美国消费者在网路上购买美容产品上花费 1 至 50 美元。此外,近 33% 的消费者每月在化妆品和美容产品上的花费超过 100 美元。疫情爆发后,美国消费者在网路上购买化妆品的趋势明显,预计这一趋势将持续到预测期内。

- 此外,随着人们越来越意识到护肤品中防腐剂和化学物质的有害影响,消费者越来越多地转向有机产品和天然疗法。随着各种美容和护肤产品都宣称不含化学物质,具有天然功效,纸质包装也随之增加。

- 此外,美容化妆品的智慧包装正在改变产业,推动生产力和生产模式的升级。物联网和智慧包装正在世界各地兴起,化妆品和彩妆也不例外。化妆品瓶和护肤品的智慧包装仍然是一个利基市场,因为它允许公司提供最具创造性和乐趣的包装。

美国个人保健产品包装市场趋势

塑胶材料可望大幅成长

- 塑胶以其成本低、重量轻、灵活和耐用而闻名,是个人保健产品包装的主要材料。在个人护理行业,它是製造「防溢出」和「防碎」的瓶子、罐子、管子、盖子和封盖的首选材料。根据经济合作暨发展组织(OECD)的数据,预计2024年塑胶使用量将达到8,880万吨。

- 高密度聚乙烯瓶因其价格低廉、抗衝击性和优异的防潮性能而在个人护理市场上占据主导地位。乳液通常装在管子里,瓶盖形状、大小和样式各异,但许多人选择使用带有方便泵式分配器的塑胶乳液瓶,以满足那些不想费心使用瓶盖的人的需求。做。

- PP塑胶是个人护理容器的另一个受欢迎选择。除了PP之外,还有由更昂贵的丙烯酸和更便宜的PET製成的容器。压克力具有与玻璃相同的透明度,但比玻璃更耐破损。 PP 价格实惠且具有常见的圆柱形和管状包装形状,使其成为受欢迎的选择。

- PP塑胶容器可以创造性塑造成心形、字符形、方形等,以配合您的产品设计和行销。罐子和壶的尺寸从 20 毫米到 60 毫米不等,容量从 25 毫升到 250 毫升不等,常用于盛放乳霜、乳液、粉底、润唇膏、粉饼等。

- 随着生产商努力减少材料的使用,塑胶彻底改变了轻量化包装解决方案。由于塑胶对环境的影响,该行业正面临成长放缓。然而,再生塑胶的兴起和材料技术的突破正在为美国的环保包装解决方案铺平道路。

护髮品类占较大市场占有率

- 作为解决消费者面临的各种头髮问题的解决方案,护髮产品正在不断发展和壮大。头髮稀疏、头髮脱落和头髮干燥等问题推动了对提供有效且经济实惠的解决方案的护髮产品的需求,预计这些产品将在预测期内提振需求。

- 护髮业对各种产品的需求显着增加,包括洗髮精、护髮素、髮膜、造型产品和护理产品。这种需求是由人们对健康有光泽的头髮的渴望、解决各种头髮问题的专用产品和不断发展的美容趋势所驱动的。

- 根据全球个人护理杂誌《Happi Magazine》报道,抗衰老护髮产品在女性消费者中越来越受欢迎。在 2023 年的一项调查中,约有 24% 的美国女性购买美容产品时将针对头髮生长和丰盈的护髮精华素列为抗衰老护髮产品的首选。紧随其后的是针对白髮的产品。消费者正在寻找能够满足他们需求和喜好的创新、客製化的护髮解决方案。

- 根据2023年6月发布的联合国贸易报告,美国已开始在全球护髮市场占据主导地位。美国是各种护髮产品的主要出口国,包括洗髮精、护髮素、造型产品和护理产品。这种出口主导的发展模式使美国走在了行业前沿,美国品牌在国际市场上享有广泛的认可和需求。

- 美国作为个人护理产品出口国的突出地位也促使包装产业越来越关注永续性和环境问题。美国品牌越来越多地采用环保包装材料,包括生质塑胶、再生塑胶和可堆肥包装,以满足消费者对永续产品的偏好并减少对环境的影响。

美国个人保健产品包装产业概况

由于 Albea Services SA、Silgan Holdings Inc.、Berry Global Inc.、HCP Packaging 和 APC Packaging 等公司的存在,美国个人保健产品包装市场相当分散。各公司都在大力投资研发并拓展目标市场,以推动国内包装业务的永续性数位化。推出以永续性为重点的新产品和新项目受到多种问题的推动,包括人口老化、污染和新产品创新。这将对该国的个人保健产品包装市场产生积极影响。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 买家的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场动态

- 市场驱动因素

- 可支配所得增加导致个人保健产品消费增加

- 更重视创新和有吸引力的包装

- 市场限制

- 新包装解决方案的研究、开发和製造成本高昂

第六章 市场细分

- 依材料类型

- 塑胶

- 玻璃

- 金属

- 纸和纸板

- 依产品类型

- 瓶子

- 管棒

- 泵浦和分配器

- 小袋

- 其他产品类型(折迭式纸盒、瓶盖、封口)

- 按应用

- 护肤

- 头髮护理

- 口腔护理

- 彩妆产品

- 除臭剂和香水

- 其他用途(除毛、婴儿及儿童照护、防晒)

第七章 竞争格局

- 公司简介

- Albea Services SA

- HCP Packaging Co. Ltd

- Berry Global Group Inc.

- Silgan Holdings Inc.

- DS Smith PLC

- Graham Packaging Company

- Kaufman Container

- AptarGroup Inc.

- Amcor PLC

- Cosmopak USA LLC

- APC Packaging

- Rieke Corp(Trimas Corporation)

- Berlin Packaging LLC

- Glenroy Inc.

第八章投资分析

第九章:未来市场展望

The US Personal Care Packaging Market size is estimated at USD 4.86 billion in 2025, and is expected to reach USD 5.72 billion by 2030, at a CAGR of 3.34% during the forecast period (2025-2030).

Key Highlights

- The United States personal care and cosmetic industry packaging has witnessed robust growth in recent years. The cosmetic industry has the most varied packaging requirements of all the other sectors, and the industry now seems united in its efforts to reduce the impact on the environment with new thoughtful packaging strategies and refined formulations.

- The beauty market encompasses a range of products, including makeup, cosmetics, skincare, and hair care. A significant portion of beauty sales occurs through eCommerce, with a notable surge in digitally native businesses on both online and social platforms.

- Data from Power Review, a technology platform based in the United States, revealed that 31% of United States customers spent between USD 1 and USD 50 on online beauty purchases. Furthermore, nearly 33% of these consumers allocated over USD 100 monthly to cosmetics and beauty products. Post-pandemic, there was a marked increase in American consumers purchasing cosmetic products online, a trend anticipated to continue during the forecast period.

- Furthermore, as awareness grows about the detrimental effects of preservatives and chemicals in skincare products, consumers are increasingly gravitating toward organic products and natural remedies. A diverse array of beauty and skincare products tout their chemical-free and natural remedy credentials, leading to a surge in the use of folding cartons for packaging.

- In addition, smart packaging in beauty and cosmetics is transforming industries and driving upgrades in productivity and production models. IoT and smart packaging are rising worldwide, and cosmetics and makeup are no exception. Smart packaging in makeup bottles and skincare products continues to be a niche market because companies can provide the most creative and entertaining packaging.

US Personal Care Packaging Market Trends

Plastic Material is Expected to Witness Significant Growth

- Plastic, known for its low cost, lightweight nature, flexibility, and durability, is a staple in packaging personal care products. It's the go-to material for crafting "no-spill" and shatterproof bottles, jars, tubes, lids, and closures in the personal care industry. According to the Organization for Economic Cooperation and Development (OECD), the use of plastics in 2024 is expected to reach 88.80 million metric tons

- HDPE bottles dominate the personal care market due to their affordability, impact resistance, and superior moisture barrier. While lotions often find their home in variously shaped, sized, and styled capped tubes, many opt for plastic lotion bottles with convenient pump dispensers, catering to those who prefer not to fuss with caps.

- PP plastics are another favored choice for personal care containers. Beyond PP, containers might also be crafted from pricier acrylic or budget-friendly PET. With its glass-like transparency, acrylic boasts a breakage resistance that gives it an edge over glass. PP's affordability and common cylindrical or tube-like container shapes make it a popular choice.

- PP plastic containers can be creatively molded into heart, character, or square shapes, aligning with the product's design or marketing. Jars and pots, ranging from 20 mm to 60 mm in size and holding capacities from 25 ml to 250 ml, are the preferred choice for face creams, lotions, foundations, lip balms, powders, and more.

- As producers strive to minimize material use, plastics have revolutionized lightweight packaging solutions. The segment has faced a slowdown due to plastics' environmental repercussions. On a brighter note, the rise of recycled plastics and breakthroughs in material technology have paved the way for eco-friendly packaging solutions in the United States.

Hair Care Segment Holds Significant Market Share

- The development and growth of haircare products as a solution addresses various hair-related issues among consumers. Hair thinning, loss of volume, dryness, and other concerns have increased demand for haircare products that provide effective and affordable solutions, which are expected to propel their demand during the forecast period.

- The hair care industry is experiencing a significant increase in demand for a wide range of products, including shampoos, conditioners, hair masks, styling products, and treatments. This demand is driven by the desire for healthy, lustrous hair, specialized products for various hair concerns, and evolving beauty trends.

- According to Happi Magazine, a global personal care magazine, anti-aging hair care products among female consumers are rising; in a 2023 survey, roughly 24% of female beauty shoppers in the United States named hair serums targeting growth and fullness as their top choice for anti-aging hair care products. Following closely were products aimed at combating gray hair. Consumers seek innovative and customized hair care solutions that cater to their needs and preferences.

- According to a UN Comtrade report published in June 2023, the United States began dominating the global haircare market. It is a major exporter of various haircare products, including shampoos, conditioners, styling products, and treatments. This export-driven approach has propelled the country to the forefront of the industry, with American brands enjoying widespread recognition and demand in international markets.

- The United States' prominence as a personal care exporter has also contributed to a growing focus on sustainability and environmental concerns within the packaging industry. American brands are increasingly adopting eco-friendly packaging materials, such as bioplastics, recycled plastics, and compostable packaging, to address consumer preferences for sustainable products and reduce their environmental footprint.

US Personal Care Packaging Industry Overview

The US personal care packaging market is moderately fragmented due to the presence of players, including Albea Services SA, Silgan Holdings Inc., Berry Global Inc., HCP Packaging Co. Ltd, and APC Packaging. With significant R&D expenditures, the firms are advancing the sustainability and digitization of the nation's packaging business by expanding into the market under study. Introducing new products and programs focused on sustainability is being pushed by several issues, including an aging population, pollution, and new product innovations. This has a favorable effect on the country's market for personal care packaging.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Consumption of Personal Care Products with Growing Disposable Income

- 5.1.2 Growing Focus on Innovative and Attractive Packaging

- 5.2 Market Restraints

- 5.2.1 High Costs of R&D and Manufacturing of New Packaging Solution

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Plastic

- 6.1.2 Glass

- 6.1.3 Metal

- 6.1.4 Paper and Paperboard

- 6.2 By Product Type

- 6.2.1 Bottles

- 6.2.2 Tubes and Sticks

- 6.2.3 Pumps and Dispensers

- 6.2.4 Pouches

- 6.2.5 Other Product Types (Folding Cartons, Caps, and Closures)

- 6.3 By Application

- 6.3.1 Skin Care

- 6.3.2 Hair Care

- 6.3.3 Oral Care

- 6.3.4 Makeup Products

- 6.3.5 Deodorants and Fragrances

- 6.3.6 Other Applications (Depilatories, Baby and Child Care, and Sun Care)

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Albea Services SA

- 7.1.2 HCP Packaging Co. Ltd

- 7.1.3 Berry Global Group Inc.

- 7.1.4 Silgan Holdings Inc.

- 7.1.5 DS Smith PLC

- 7.1.6 Graham Packaging Company

- 7.1.7 Kaufman Container

- 7.1.8 AptarGroup Inc.

- 7.1.9 Amcor PLC

- 7.1.10 Cosmopak USA LLC

- 7.1.11 APC Packaging

- 7.1.12 Rieke Corp (Trimas Corporation)

- 7.1.13 Berlin Packaging LLC

- 7.1.14 Glenroy Inc.