|

市场调查报告书

商品编码

1639530

中国个人护理包装:市场占有率分析、产业趋势、成长预测(2025-2030)China Personal Care Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

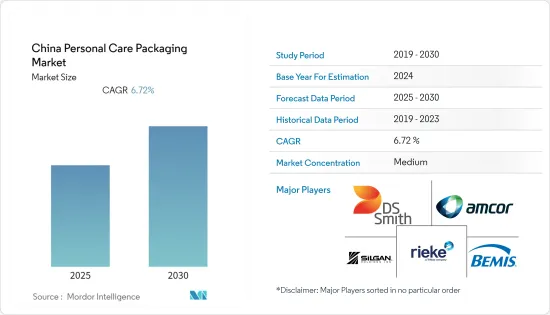

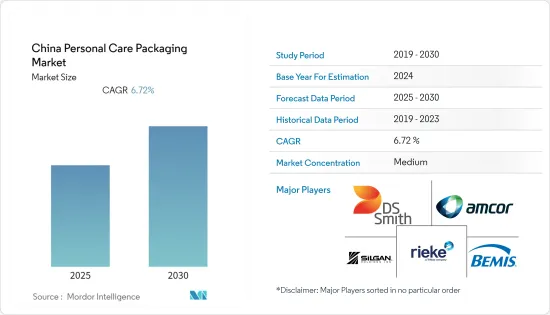

预计预测期内中国个人护理包装市场复合年增长率为6.72%

主要亮点

- 根据同一项研究,由于 COVID-19 大流行,化妆品行业的收入在 2020 年前几个月大幅下降,普遍影响了消费品的销售。不过,由于中国有效的疫情管理,零售交易金额迅速恢復。此外,男性对护肤态度的改变正在推动中国男性化妆品市场的繁荣。

- 该国在美容产品销售方面正在迅速赶上美国,即使成长放缓,预计仍将在 2023 年超过美国。消费者在化妆品和个人保健产品上的支出持续成长,推动了更多加工、包装和更昂贵产品的趋势。护肤和装饰化妆品健康成长,脸部保养和医学护肤需求强劲。此外,抗衰老产品和旨在防止环境污染的产品也有成长潜力。

- 根据天猫创新中心统计,1990年代以来的年轻女性已成为推动中国化妆品市场成长的最重要的消费群组。 90后拥有独立消费能力,该族群对美容护肤的兴趣日益浓厚,同步大幅增长。这正在推动该国化妆品包装市场的成长。

- 为了满足不断增长的需求,工业企业正在提高国内製造能力并抓住新机会。例如,2020 年,化妆品包装公司 Albea 开始在中国营运新的製造工厂,以利用不断成长的电子商务机会。同样在 2021 年 7 月,AptarGroup Inc. 与线上护肤解决方案公司 YAT 合作,为护肤市场开发创新产品和服务。

- 然而,由于为响应当前市场趋势和消费者需求而改变产品设计的成本增加,开发新包装设计所需的投资显着增加。因此,产品供应商可能会坚持现有的包装设计,因为他们担心与设计变更相关的更高的成本和生产成本,从而影响市场成长。

中国个人护理品包装市场趋势

塑胶瓶和容器领域预计将占据主要市场占有率

- 塑胶因其成本低、柔韧、重量轻和耐用而成为化妆品包装的主导元素。许多化妆品采用塑胶瓶和容器包装,因为它们易于成型、结构、设计和保护。在化妆品行业,塑胶瓶和容器是初级包装的首选形式,并主导市场半个世纪。

- 该地区的公司正在策略性地计划透过使用各种元素成分来减少宝特瓶对环境的影响。例如,2020年11月,欧莱雅利用回收的碳排放开发了一种聚乙烯碳中性塑胶瓶,目标是在四年内将其商业化。此外,2021 年 6 月,欧莱雅利用 Carbios 的酵素技术开发了世界上第一个完全由回收塑胶製成的化妆品瓶。 Calbios 技术是开发用于 PET 塑胶回收的生物技术解决方案的先驱,并描述了完全由透过酵素法生产的回收材料製成的新产品的创造之路。该技术适用于所有形式的 PET(透明、彩色、不透明和多层),并具有永久可回收的优点。

- 与其他塑胶包装产品相比,製造商更喜欢 PET,因为与其他塑胶产品相比,製造过程中原材料损失较少。它是优选的,因为它是可回收的,并且可以添加多种颜色和设计。随着消费者环保意识的增强,可再填充产品应运而生,从而创造了对该产品的需求。

- 此外,总部位于纽约的着名消费品公司高露洁棕榄 (Colgate-Palmolive) 的目标是到 2025 年实现所有产品类型的包装 100% 回收,目前塑胶包装的回收率达到 25%。化妆品品牌欧莱雅的目标是到 2025 年使所有塑胶包装可充电、可再填充、可回收或可堆肥。

- 此外,欧莱雅、宝洁和联合利华等知名品牌所有者希望在 2020 年大幅增加(在某些情况下加倍)他们在包装中使用的消费后回收 (PCR) 树脂的吨位。这种类型的树脂。

预计口腔护理领域市场将高速成长

- 消费者日益渴望过着更健康的生活方式,口腔卫生已成为不可或缺的一部分,从而推动了产业的发展。人们对口腔健康的认识不断提高以及对口腔问题根源的更好理解也促进了这一快速增长。口腔护理领域由少数公司主导,导致包装创新方面竞争激烈。因此,公司正在寻找使自己脱颖而出的方法。

- 口腔护理产品包括牙膏、漱口水/漱口水、牙刷和牙线。牙膏是口腔护理领域中消费最多的产品。一般来说,大多数牙膏管都是由塑胶层压板製成的。

- 牙膏管每天被数以百万计的消费者使用,但传统牙膏管的多层结构对回收设施提出了挑战,并且传统上不会被回收。随着市场上的几家公司转向可回收解决方案,这种趋势即将改变。例如,2021 年 5 月,联合利华旗下口腔护理品牌 Signal、Pepsodent 和 Closeup 宣布计划在 2025 年将其整个牙膏产品组合转换为可回收管。

- 同样在 2020 年 12 月,宝洁口腔护理为其牙膏品牌 Oral-B、Crest 和 Blend-a-med 推出了最新的包装创新。为了实施正确的解决方案并使牙膏管更具永续性,宝洁公司一直在与多家 HDPE 管供应商进行讨论,并已与 Albea 达成协议,开始使用其专有的 Greenleaf Generation 2 管技术。

中国个人护理包装产业概况

中国的个人护理包装市场与 Amcor PLC、Silgan Holdings Inc. 和 Albea 等主要参与者竞争适度。该行业的参与企业正在利用製造能力的研发生态系统来推动创新并保持市场竞争力。

- 2021 年 8 月 - 负责任包装开发和生产领域的全球领导者 Amcor PLC 宣布计划开设两个新的先进研发中心。位于比利时根特和中国江阴的新工厂将于 2022 年中期迎接客户,并将在未来两年内全面建成。预计总投资约3500万美元。更广泛的网路将使公司世界各地的客户能够利用该公司深厚的材料科学专业知识和包装开发能力。

- 2020 年 6 月 - 消费品硬包装解决方案供应商 Silgan Holdings Inc. 宣布收购 Albea Group 的分配器业务。该公司是一家全球领先的公司,为主要在美容和个人护理市场的知名品牌消费品公司提供精心设计的泵、喷雾器和泡沫分配器解决方案。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 技术简介

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 扩大化妆品消费

- 越来越注重创新和有吸引力的包装

- 市场限制因素

- 对永续性的兴趣日益浓厚

第六章 市场细分

- 依材料类型

- 塑胶

- 玻璃

- 金属

- 纸

- 按包装类型

- 塑胶瓶/容器

- 玻璃瓶/容器

- 金属容器

- 折迭式纸盒

- 瓦楞纸箱

- 管棒

- 盖子与封口装置

- 泵浦分配器

- 软质塑胶包装

- 依产品类型

- 口腔护理

- 头髮护理

- 彩妆品

- 护肤

- 男士美容

- 除臭剂

第七章 竞争格局

- 公司简介

- Albea SA

- HCP Packaging Co. Ltd

- RPC Group Plc

- Silgan Holdings Inc.

- DS Smith PLC

- Amcor PLC

- Bemis Company Inc.

- Quadpack Industries SA

- Rieke Packaging Systems Ltd

第八章投资分析

第9章 未来展望

简介目录

Product Code: 51031

The China Personal Care Packaging Market is expected to register a CAGR of 6.72% during the forecast period.

Key Highlights

- According to the same study, the cosmetics industry witnessed a significant decrease in revenue during the first months of 2020 due to the COVID-19 pandemic, which generally affected consumer goods sales. However, due to China's effective pandemic management, the retail trade value quickly recovered. In addition, the changing attitude among men toward skincare fosters the booming of the men's cosmetics market in China.

- The country has quickly gained on the United States in beauty sales and is set to overtake it by 2023, even if growth slows. Consumer spending on cosmetics and personal care products continues to grow, which is facilitating the trend toward adopting processed, packaged, and expensive products. Skincare and decorative cosmetics are growing soundly, with facial care and medical skincare witnessing a robust demand. Moreover, growth potential is also provided by anti-aging products and those intended to protect against environmental pollution.

- According to Tmall Innovation Center, the young women of the post-90s generation have become the most crucial consumer group driving growth in China's cosmetic sector. The post-90s generation has independent consuming power and a simultaneous surge of interest in beauty and skincare amongst this demographic has translated into significant growth. This is aiding the growth of the cosmetic packaging market in the country.

- To cater to the increasing demand, the players in the industry are strengthening their manufacturing capabilities in the country to tackle new opportunities. For instance, in 2020, Albea, a cosmetic packaging company, began the operations of its new manufacturing facility in China on the lookout to capitalize on the growing e-commerce opportunities. Also, in July 2021, AptarGroup Inc. and YAT, an online skincare solutions company, collaborated to develop an innovative range of products and services for the skincare market.

- However, the investments involved in developing the design for new packaging are significantly higher as the costs go up in changing the product design according to the current market trends and consumer requirements. This is challenging the growth in the market as product vendors may stick to their existing packaging designs in the wake of incurring higher costs associated with the change of design and production costs.

China Personal Care Packaging Market Trends

The Plastic Bottles and Containers Segment is Expected to Hold the Major Market Share

- Plastic is a prominent element in cosmetic packaging due to its low cost, flexibility, lightweight, durability, and other factors. Numerous cosmetic products come in plastic bottles and containers, owing to the material's easy molding, structuring, design capability, and protection. In the cosmetics industry, plastic bottles and containers are preferred forms of primary packaging and have held a major prominent share in the market for half a decade.

- The companies in the region are strategically planning to reduce the impact of plastic bottles on the environment by using different element compositions. For instance, in November 2020, Loreal developed a carbon-neutral plastic bottle of polyethylene from recycled and captured carbon emissions, which the company hopes to commercialize in four years. Also, in June 2021, L'Oreal developed the world's first cosmetic bottle made entirely of recycled plastic with Carbios' enzymatic technology. Carbios' technology, which was a pioneer in developing biotech solutions for the recycling of PET plastics, provides the path for creating new goods composed entirely of recycled materials produced through its enzymatic process. It has the advantage of being compatible with all forms of PET, including transparent, colored, opaque, multilayer, and eternally recyclable.

- Manufacturers prefer PET over other plastic packaging products, as it has a minimum loss of raw material during the manufacturing process when compared to other plastic products. Its recyclability and the feature to add multiple colors and designs augment it to become a preferred choice. Refillable products have emerged with the rising consumer awareness for the environment and have acted in creating demand for the product.

- Moreover, Colgate-Palmolive, a prominent consumer products company based in New York, committed to 100% recyclability of packaging across all its product categories by 2025 and achieving a 25% recycled content currently from plastic packaging. L'Oreal, a cosmetics brand, is working toward ensuring that all its plastic packaging will be rechargeable, refillable, recyclable, or compostable by 2025.

- Moreover, major brand owners, such as L'Oreal, P&G, and Unilever, have already announced their interests toward significantly increasing and, in some cases, doubling the current tonnage of post-consumer recycled (PCR) resin in their packaging by 2020, for which PET would be an apt resin type.

The Oral Care Segment is Expected to Witness a High Market Growth

- Oral health acts as an integral part of consumers' increasing desire to lead healthier lifestyles, resulting in industry growth. Rising awareness of oral health and an improved understanding of the underlying causes of oral issues also contribute to the surge. The oral care segment is dominated by a handful of players, resulting in aggressive competition in terms of packaging innovation. As a result, companies are progressively looking for ways to differentiate themselves.

- Several oral care products include toothpaste, mouthwashes and rinses, toothbrushes, and dental floss. Toothpaste is the most consumed product in the oral care segment. Generally, most toothpaste tubes are made from plastic laminate sheets.

- While toothpaste tubes are being utilized by millions of consumers every day, the conventional tubes could not be recycled so far as their multilayer construction poses a challenge for recycling facilities. This trend is about to change as several companies in the market are switching to recyclable solutions. For instance, in May 2021, Unilever's oral care brands, including Signal, Pepsodent, and Closeup, announced plans to convert their entire toothpaste portfolio to recyclable tubes by 2025.

- Also, in December 2020, Procter & Gamble Oral Care launched its latest packaging innovation across its toothpaste brands, Oral-B, Crest, and Blend-a-med. To introduce the correct solution and make its toothpaste tubes more sustainable, Procter & Gamble held discussions with different HDPE tube suppliers and has already formed an agreement with Albea to start utilizing its proprietary Greenleaf Generation 2 tube technology, which enables the tubes to be recyclable wherever collection schemes are present.

China Personal Care Packaging Industry Overview

The Chinese personal care packaging market is moderately competitive with the presence of major players like Amcor PLC, Silgan Holdings Inc., and Albea. The established players in the industry are leveraging their manufacturing capabilities research and development ecosystem to drive innovation and sustain their competitive position in the market.

- August 2021 - Amcor PLC, a global player in developing and producing responsible packaging, announced its plans to build two new advanced innovation centers. The new facilities in Ghent, Belgium, and Jiangyin, China, will welcome customers in mid-2022, with full build-out over the next two years. The total investment is expected to be approximately USD 35 million. The broader network will allow the company's customers globally to tap into its deep material science expertise and packaging development capabilities.

- June 2020 - Silgan Holdings Inc., a supplier of rigid packaging solutions for consumer goods products, announced its acquisition of the dispensing business of the Albea Group. This business is a leading global supplier of highly engineered pumps, sprayers, and foam dispensing solutions to major branded consumer goods product companies, primarily in the beauty and personal care markets.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Consumption of Cosmetic Products

- 5.1.2 Increasing Focus on Innovation and Attractive Packaging

- 5.2 Market Restraints

- 5.2.1 Growing Sustainability Concerns

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Plastic

- 6.1.2 Glass

- 6.1.3 Metal

- 6.1.4 Paper

- 6.2 By Packaging Type

- 6.2.1 Plastic Bottles and Containers

- 6.2.2 Glass Bottles and Containers

- 6.2.3 Metal Containers

- 6.2.4 Folding Cartons

- 6.2.5 Corrugated Boxes

- 6.2.6 Tube and Stick

- 6.2.7 Caps and Closures

- 6.2.8 Pump and Dispenser

- 6.2.9 Flexible Plastic Packaging

- 6.3 By Product Type

- 6.3.1 Oral Care

- 6.3.2 Haircare

- 6.3.3 Color Cosmetics

- 6.3.4 Skincare

- 6.3.5 Men's Grooming

- 6.3.6 Deodorants

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Albea SA

- 7.1.2 HCP Packaging Co. Ltd

- 7.1.3 RPC Group Plc

- 7.1.4 Silgan Holdings Inc.

- 7.1.5 DS Smith PLC

- 7.1.6 Amcor PLC

- 7.1.7 Bemis Company Inc.

- 7.1.8 Quadpack Industries SA

- 7.1.9 Rieke Packaging Systems Ltd

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK

02-2729-4219

+886-2-2729-4219