|

市场调查报告书

商品编码

1639466

数位电子看板看板:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Digital Signage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

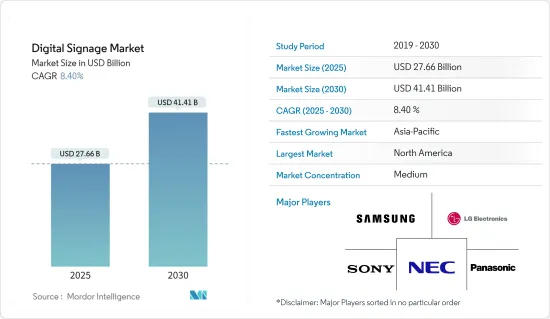

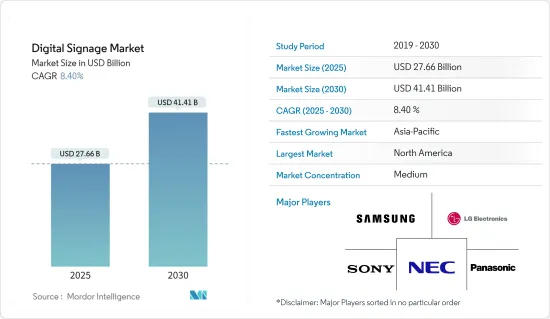

预计2025年数位电子看板市场规模为276.6亿美元,预计2030年将达到414.1亿美元,预测期内(2025-2030年)的复合年增长率为8.4%。

交通网络、公共基础设施和新商业建筑的成长,尤其是在新兴经济体中,为该市场创造了更多的机会。数位电子看板应用于所有公共交通系统,以吸引旅途中观众的注意力,并为相关旅行者资讯和广告提供即时位置和情境察觉。此外,数位电子看板系统正迅速成为许多教育机构的标准,学校和企业园区都在使用它们。

主要亮点

- 例如,Visix Inc. 于 2022 年 4 月宣布威奇托州立大学为 Metroplex 会议中心选择了 AxisTV Signage Suite数位电子看板系统,从而扩大了其高等教育计划组合。完整的解决方案包括一个云端託管的 CMS、3 个 Nano数位电子看板播放器和 10 个电子纸标牌,可动态显示发生的事件和会议。

- 数位电子看板系统消除了媒体播放器和显示器之间经常出现的兼容性和互通性问题。此外,数位电子看板广泛用作机场到达和离开公告板,称为航班资讯显示系统 (FIDS)。

- 例如,2022年10月,领先的企业数位电子看板解决方案供应商Mvix在其航班资讯显示(FIDS)模组中增加了用于机场显示器的全新乘客资讯指示牌解决方案。新套件提供即时航班资讯服务,可在机场和当地饭店的航空公司柜檯、登机口显示器、航站楼萤幕、行李领取处和行李传送带显示器上显示航班资料。

- 此外,客户对清晰、全面的产品资讯的需求不断增长,推动了数位化标牌的采用。教育领域对数位化科技的需求也日益增长。 2022年3月,全球视觉解决方案提供商ViewSonic Corp.在BETT展会上展示了其教育技术myViewBoard Sens。该技术采用人工智慧技术来提高学生的参与度并促进课堂健康。

- 所有这些因素以及全球领导者品牌知名度和认可度的提高预计将推动市场成长。然而,数位电子看板需要较高的功率,这间接影响了维护成本。这可能会阻碍市场的发展。

数位电子看板看板市场趋势

OLED 显示器预计将稳定成长

- OLED是唯一能够克服传统显示器限制的技术,并且与动态形式相结合,增强了真实感。 OLED 利用自发光光源,提供卓越的光线和色彩还原。它的灵活性和透明度是创新 OLED 材料开发的结果。

- 例如,2022 年 4 月,LG 商业解决方案在达拉斯的 AVI-SPL 办公室推出并安装了一块视频“波浪墙”,它由多个曲面 OLED 显示器组成,形成一个高清表面。电视墙安装有 65 吋 LG 互动式数位电子看板,提供方向资讯。

- OLED 显示器没有背光,这意味着它们具有极好的对比度(提供几乎「无限」的对比度)。 OLED 显示器具有真正的黑色背景,而 LCD 显示器则没有。由于 OLED 节能、轻巧和媒体呈现效果出色,其在室内品牌和体验媒体数位电子看板中的应用正在迅速增加。此外,LG 商业解决方案最近推出了 55EW5TF,这是一款拥有尖端触控萤幕技术的色彩鲜明、晶莹剔透的 OLED 显示器。

- 显示器采用投射电容式(P-Cap) 薄膜技术,提供灵敏且准确的触控体验,支援最多 10 个同时触控点。此外,OLED 技术即使在 P-Cap 触控膜上也能达到 33% 的透明度。它还具有纤薄的结构,不需要背光模组或液晶层。

- 例如,2022 年 4 月,摩托罗拉 Moto G52 作为该公司的最新智慧型手机在印度推出。摩托罗拉 Moto G52 配备支援 90Hz 更新率的 OLED 显示器。此外,LG 打算在年终( 2022 年 8 月)推出一款 20 吋 OLED 面板,这将是其迄今为止最短的 OLED 萤幕。这些发展可能会推动市场的进一步发展。

- 此外,透明 OLED(T-OLED)是一种自发光 OLED 技术,可实现四倍更高的透明度萤幕。它保留了 OLED 技术的无限对比度和完美色彩,从而产生令人惊嘆的影像迭加。 T-OLED的透明度为38%,而LCD的最佳透明度为10%。从正面观看时,萤幕后面的物体与内容融为一体,而正面的紫外线防护使其成为商店橱窗吸引路人眼球的理想展示。

预计亚太地区将占据最大市场占有率

- 由于美国地区主要供应商的存在以及技术的早期采用和进步,北美在预测期内将主导全球指示牌市场。显示技术的进步也推动了市场的发展。

- 此外,由于安全和成本原因,数位电子看板正日益取代印刷指示牌。数位电子看板使安全程序可见,这是智慧酒店和相关行业发展的重要元素,预计将在预测期内增加市场需求。例如,2022 年 3 月,为饭店和活动专业人士提供全方位服务的会议互联网和显示技术合作伙伴 Xpodigital(美国奥兰多)宣布将与 Xpodigital 合作,提供全面管理的会议互联网和数数位电子看板解决方案。个为了朝着成为该城市的首选迈出一步,它将关键的管理职位迁至拉斯维加斯。

- 此外,饭店数位电子看板使饭店大厅、餐厅和走廊现代化,借助视觉上吸引人的广告讯息传输更具互动性,营造出高檔的氛围。此外,数位电子看板看板的互动式寻路功能可透过提供自助服务资讯来源帮助提升住宿体验。 2022 年 3 月,飞利浦电视数位电子看板产品供应商 PPDS 宣布将把 Apple TV 应用程式引入饭店的飞利浦 Media Suite Hospitality 电视。

- 大型体育场通常在淡季被出租,用于举办大型公司赞助的音乐会和其他活动,例如会议或促销活动。配备引人注目的数位视讯显示器的体育场馆支援这些功能,并使场馆对赞助商更有价值。

- 此外,2022年3月,Quantela Inc.与领先的精品户外广告公司Liquid Outdoor宣布建立新的伙伴关係,共同建立完整的数位电子看板解决方案,以扩展Liquid的生活方式网络。 Quantela 提供全面的专案管理和技术平台来监控和管理美国生活方式组合中捕获的资料。 Quantera 也将为该计划提供 1500 万美元的种子资金,并透过主要投资者 Digital Alpha 的支持和捐助提供进一步的扩展机会。

- 此外,软体供应商正在致力于为行业新进入者提供与多种作业系统相容的客製化解决方案标准。对客製化解决方案的需求不断增长,导致人们对云端基础的设计解决方案的兴趣激增。 2022 年 2 月,三星在加州洛杉矶的 SoFi 体育场推出了一款名为 Infinity Screen 的全新中央吊挂视讯板。这是迄今为止为这项运动建造的最大的视频板。这款无限板采用独一无二的设计,两侧内建显示器。每个 LED 面板都可以进行独特的编程,或匹配统计数据、即时内容、动画内容等。

数位电子看板行业概况

数位电子看板市场相对分散,NEC显示解决方案有限公司、三星电子有限公司、Panasonic Corporation和Sony Corporation等全球主要公司覆盖硬体端。同时,也有少数中小型企业提供数位电子看板软体。此外,许多参与者已进入市场,作为行业中的利基参与者提供独特的产品应用。

2022 年 3 月,Planar 宣布推出两个新的 LED电视墙显示器系列,旨在满足快节奏活动和高环境光环境的需求:Planar Luminate Pro 系列和 Planar Venue Pro 系列。新系列产品采用机械元件,可加快临时或移动活动的安装和拆卸速度,同时还提供完整的前部安装和可维护性,使其成为更永久的壁挂式应用的理想选择。

2022年2月,设计製造LED显示器的美国私人公司NanoLumens推出了其透明LED网格产品系列「CLRVU」。该显示器安装在TK Elevator 的总部和位于亚特兰大 Battery 的测试设施。此显示器可在室内或室外使用,与建筑物无缝融合,并允许使用者自订显示解析度、功耗和透明度。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- COVID-19 产业影响评估

- 市场驱动因素

- 数位电子看板与跨平台媒体工具的融合

- 承包解决方案的演变

- 降低基础建设成本,提高采用率

- 市场限制

- 与复杂业务需求整合性差

第五章 市场区隔

- 按类型

- 电视墙

- 视讯萤幕

- 亭

- 透明液晶萤幕

- 数位海报

- 其他类型

- 按组件

- 硬体

- LCD/LED 显示器

- OLED 显示器

- 媒体播放机

- 投影机/投影萤幕

- 其他硬体

- 软体

- 服务

- 硬体

- 尺寸

- 少于 32 英尺

- 32 英尺至 52 英尺

- 超过 52 英尺

- 地点

- 商店内部

- 户外的

- 按应用

- 零售商

- 运输

- 饭店业

- 企业

- 教育机构

- 政府

- 其他用途

- 地区

- 北美洲

- 亚洲

- 澳洲和纽西兰

- 欧洲

- 拉丁美洲

- 中东和非洲

第六章 竞争格局

- 公司简介

- NEC Display Solutions Ltd.

- LG Display Co. Ltd.

- Samsung Electronics Co. Ltd.

- Panasonic Corporation

- Sony Corporation

- Stratacache

- Planar Systems Inc.

- Hitachi Ltd.

- Barco NV

- Goodview

- Cisco Systems Inc.

第七章投资分析

第 8 章:市场的未来

The Digital Signage Market size is estimated at USD 27.66 billion in 2025, and is expected to reach USD 41.41 billion by 2030, at a CAGR of 8.4% during the forecast period (2025-2030).

The growth in transport networks, public infrastructure, and new commercial buildings, particularly in developing economies, creates more opportunities in this market. Digital signage is being used in and on all modes of public transportation to attract the attention of on-the-go viewers, providing real-time location and context awareness related to traveler information and advertising. Moreover, it is fast becoming a standard in many educational facilities, with schools and corporate campuses facilitating digital signage systems.

Key Highlights

- For instance, in April 2022, Visix Inc. expanded its portfolio of higher education projects by announcing that Wichita State University had chosen an AxisTV Signage Suite digital signage system for its Metroplex convention center. The entire solution included a cloud-hosted CMS, three nano digital signage players, and ten Electronic Paper Room (E-Paper) Signs, which dynamically display events and meetings as they happen.

- Digital signage systems eliminate frequent compatibility and interoperability issues between media players and displays. Furthermore, digital signage boards are being extensively used as arrival and departure boards in airports, known as Flight Information Display Systems (FIDS).

- For instance, in October 2022, Mvix, a significant enterprise digital signage solutions provider, added a new passenger information signage solution for airport displays to its Flight Information Displays (FIDS) Module. The new suite displays flight data for airline counters, gate displays, terminal screens, baggage claim directories, and carousel displays for airports and local hotel properties, powered by real-time flight data services.

- Furthermore, rising customer demand for clear and comprehensive product information drives the adoption of digitized signs. There is also a rise in demand for digitized technology in education. In March 2022, ViewSonic Corp., a global visual solutions provider, showcased its myViewBoard Sens, an educational technology, at the BETT show. This technology is embedded with AI technology that increases student engagement and facilitates wellness in the classroom.

- Along with all these factors, enhancing brand awareness and perception among global leaders is expected to drive the market's growth. However, digital signage boards require high electricity, indirectly affecting maintenance costs. This could hinder the development of the market.

Digital Signage Market Trends

OLED Display is Expected to Experience Healthy Growth

- OLED is the only technology that overcomes the limitations of conventional displays, as it offers enhanced reality combined with a dynamic form. OLED provides superior light and color expression based on self-emitting light sources. Its flexibility and transparency are the results of developing innovative OLED materials.

- For instance, in April 2022, LG Business Solutions launched and installed a video "Wave Wall" with multiple curved OLED displays to form a high-definition surface at the AVI-SPL office in Dallas. The video wall features a 65-inch LG interactive digital signage board that provides wayfinding information.

- As OLED displays lack the backlight, they function exceptionally well in contrast (essentially offering an 'infinite' contrast ratio). OLED displays feature an accurate black background, something LCDs can not match. The application of OLED in digital signage for indoor branding and experiential media is increasing rapidly, driven by energy-efficient, lightweight, and superior media presentation. Furthermore, LG Business Solutions recently launched 55EW5TF, a vivid, transparent OLED display with cutting-edge touchscreen technology.

- This display uses projected capacitive (P-Cap) film technology for a highly responsive, accurate touch experience that simultaneously supports up to 10 touch points. Further, the OLED technology enables the display to achieve transparency of 33% even with the P-Cap touch film. It has a slimmer structure without needing a backlight unit or liquid crystal layer.

- For instance, in April 2022, Motorola Moto G52 was launched in India as the company's latest smartphone. The Motorola Moto G52 has an OLED display that supports a 90Hz refresh rate. Furthermore, in August 2022, LG intends to launch a 20-inch OLED panel at the end of this year, which would be its shortest OLED screen yet. Such developments may further drive market growth.

- Furthermore, transparent OLED (T-OLED) is a self-lighting OLED technology that creates four times more transparent screens. It maintains the infinite contrast and perfect colors of OLED technology for a stunning image overlay. T-OLED offers 38% transparency, whereas the highest clarity that has been achieved with LCD is 10%. When viewed head-on, objects behind the screen integrate with the content, and the front-facing UV protection makes the display ideal for store windows that catch the attention of passers-by.

Asia Pacific is Expected to Hold the Largest Market Share

- North America dominates the global signage market over the forecasted duration, owing to the existence of significant vendors in the US region and also due to early adoption and advancement in technology. Furthermore, the advances in display technology are also likely to drive the market.

- Further, digital signage is taking over printed signage owing to security and cost profits. It allows visualization of safety procedures, a vital component in developing smart hotels and related industries, and it is anticipated to augment market demand during the forecast period. For instance, in Mar 2022, Xpodigital, Orlando, United States, the full-service convention internet and display technology partner for hospitality and events professionals, moved vital management positions to Las Vegas as the first step in becoming the city's first choice for fully-managed conference internet and digital signage solutions.

- Further, digital signage in hotels makes the delivery of the messaging much more interactive with the help of visually appealing ads that modernizes hotel lobbies, restaurants, and hallways and contributes to an upscale ambiance. Furthermore, the interactive wayfinding maps feature of digital signage help to enhance the guest experience by providing a self-service source of information. In March 2022, PPDS, a supplier of Philips TVs and digital signage products, announced that it is bringing the Apple TV app to its Philips MediaSuiteHospitality TVs in hotels.

- Large stadiums are often rented out for other events during the off-season, such as concerts, conferences, or promotional events, sponsored by big businesses. A stadium with engaging digital video displays supports these functions and makes the venue more valuable to sponsors, which may further drive market growth.

- Moreover, in March 2022. Quantela Inc. and leading boutique outdoor advertising company Liquid Outdoor jointly announced a new partnership to create a complete digital signage solution to expand Liquid's lifestyle network. Quantela will supply total program management and the technology platform to monitor and manage data captured across the US lifestyle portfolio. Through outcomes and with support from crucial investor Digital Alpha, Quantela will additionally provide the initial USD 15 million capital required for the project and further expansion opportunities.

- Furthermore, the software providers are also engaged in providing a standard for customized solutions compatible with multiple operating systems to new entrants in the industry. There is an increased focus on cloud-based design solutions owing to the increasing demand for customized solutions. In February 2022, Samsung unveiled the Infinity Screen, a brand new, center-hung video board at Sofi Stadium in Los Angeles, California. This is the giant video board ever created for sports. The infinity board incorporates a display on dual sides with a one-of-a-kind design. Each LED panel can be uniquely or congruently programmed with statistics and live and animated content.

Digital Signage Industry Overview

The Digital Signage Market is relatively fragmented, with major global players, like NEC Display Solutions Ltd, Samsung Electronics Co. Ltd, Panasonic Corporation, and Sony Corporation, covering the hardware end of the spectrum. At the same time, there happen to be several medium and smaller players who provide software for digital signage. Moreover, many players are entering the market, offering unique product applications as niche players in the industry.

In March 2022, Planar launched two new LED video wall display families designed to serve the needs of fast-paced events and high-ambient light environments; the Planar Luminate Pro Series and Planar Venue Pro Series. The new families feature mechanical elements that accelerate set-up and takedown for temporary and mobile events but also feature complete front installation and serviceability, opening the door to more permanent wall-mounted applications.

In February 2022, NanoLumens, an American private corporation that designs and manufactures LED displays, released a transparent LED mesh product series called CLRVU. This display was installed for TK Elevators' headquarters and test facility at The Battery Atlanta. This display can be used indoors or outdoors to blend into the architecture of the building seamlessly, and it enables the user to customize the display's resolution, power consumption, and transparency.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Industry

- 4.5 Market Drivers

- 4.5.1 Convergence of Digital Signage with Cross-platform Media Tool

- 4.5.2 Evolution of Turnkey Solutions

- 4.5.3 Diminishing Cost of Infrastructure Leading to Higher Penetration

- 4.6 Market Restraints

- 4.6.1 Poor Integration with Complex Business Requirements

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Video Wall

- 5.1.2 Video Screen

- 5.1.3 Kiosk

- 5.1.4 Transparent LCD Screen

- 5.1.5 Digital Poster

- 5.1.6 Other Types

- 5.2 Component

- 5.2.1 Hardware

- 5.2.1.1 LCD/LED Display

- 5.2.1.2 OLED Display

- 5.2.1.3 Media Players

- 5.2.1.4 Projector/Projection Screens

- 5.2.1.5 Other Hardware

- 5.2.2 Software

- 5.2.3 Services

- 5.2.1 Hardware

- 5.3 Size

- 5.3.1 Below 32'

- 5.3.2 32' - 52'

- 5.3.3 Above 52'

- 5.4 Location

- 5.4.1 In-store

- 5.4.2 Outdoor

- 5.5 Application

- 5.5.1 Retail

- 5.5.2 Transportation

- 5.5.3 Hospitality

- 5.5.4 Corporate

- 5.5.5 Education

- 5.5.6 Government

- 5.5.7 Other Applications

- 5.6 Geography

- 5.6.1 North America

- 5.6.2 Asia

- 5.6.3 Australia and New Zealand

- 5.6.4 Europe

- 5.6.5 Latin America

- 5.6.6 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 NEC Display Solutions Ltd.

- 6.1.2 LG Display Co. Ltd.

- 6.1.3 Samsung Electronics Co. Ltd.

- 6.1.4 Panasonic Corporation

- 6.1.5 Sony Corporation

- 6.1.6 Stratacache

- 6.1.7 Planar Systems Inc.

- 6.1.8 Hitachi Ltd.

- 6.1.9 Barco NV

- 6.1.10 Goodview

- 6.1.11 Cisco Systems Inc.