|

市场调查报告书

商品编码

1641842

电子商务包装:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)E-Commerce Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

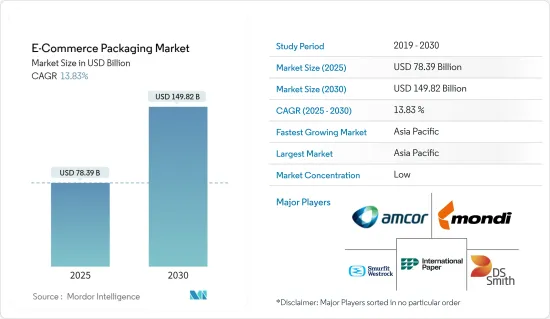

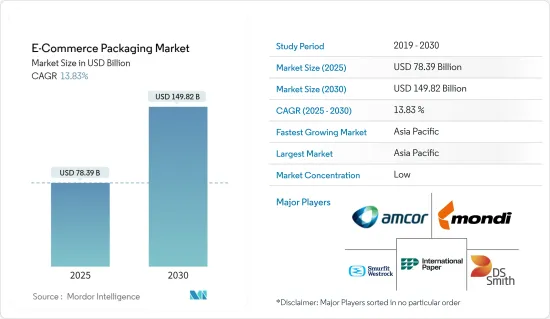

2025 年电子商务包装市场规模预估为 783.9 亿美元,预计到 2030 年将达到 1,498.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 13.83%。

主要亮点

- 网路和智慧型手机的使用范围不断扩大,以及经济的快速成长,推动了网路支出的成长。然而,预计该行业成长阻碍因素是无法在购买前亲身体验产品,以及线上业务在世界偏远地区的渗透率有限。此外,俄罗斯和乌克兰之间的战争对整个包装生态系统产生了负面影响。

- 由于宅配、购物方便、商品搜寻容易等各种原因,网路购物网站已被广泛采用,成为消费者购买商品的首选。全球范围内线上业务的快速扩张极大地推动了对坚固包装解决方案的需求。

- 随着互联网普及率在全球范围内不断增长,以及全球新兴经济体中大量人口能够更多地使用互联网,网路购物和包装提供商正在进入尚未开发的市场占有率。

- 认识到塑胶垃圾日益增多,企业正努力减少垃圾,并提供一系列 100% 可回收和生物分解性的产品。

- 一些原生塑胶生产中使用的添加剂使回收变得复杂或对人类和环境健康构成风险,因此受到越来越多的审查。对塑胶废弃物中此类添加剂的不确定性最终可能会阻碍再生塑胶生产商的回收。

电子商务包装市场的趋势

消费性电子产业正在经历显着的成长。

消费性电子产品包装产品製造商和出口商越来越多地转向使用保护性包装,例如气泡膜、空气枕和其他充气包装产品来保护消费性电子产品。例如,根据印度商务部统计,印度消费性电子产品出口额为110.12亿美元。

电子商务赢得了消费者对优质交货和售后服务支援的信任,鼓励他们在网路上多次下单。对于处理和物流,包装解决方案提供了强大的遏制解决方案来防止损坏。

行动市场是消费性电子产品中最热门的更新类别,随着科技的发展,行动市场的成长也呈现倍数成长。由于这种成长,电子商务公司正在合作推出和分销产品,从而增加了线上零售市场对此类包装材料的需求。

此外,预计产品开发的活性化将开启新的市场机会,进一步提高产业成长率。该市场的成长也受到多项专注于设计和製造流程的创新产品创新的刺激。预计电子商务包装市场製造商的商机将来自于开发有效且生态高效的电子商务包装的技术进步。

亚太地区占很大市场份额

亚太地区是全球成长最快的新兴市场之一。印度和中国等主要国家的基本客群不断成长,推动了电子商务出货量的成长。这可能会推动该地区对包装解决方案的需求。

中国是电子商务快速发展的新兴国家之一,这得益于消费者对网路购物的偏好、付款方式的增加以及产品每日促销等活动。

在印度,由于人口成长、收入水准提高、生活方式改变和经济活动活性化,对电子商务包装的需求正在增长。根据品牌资产基金会的资料,到 2026 年,印度电子商务产业规模预计将成长到 2,000 亿美元。该领域的成长很大程度上归因于网路和行动电话使用量的增加。

时尚服饰、家用电器和个人护理正在推动市场的快速扩张。对消费性电子产品、个人护理、时尚和纺织业的大量投资使得包装选择变得更加容易。

电子商务包装产业概况

有多家公司提供电子商务包装解决方案,导致市场分散。在市场上营运的主要企业包括 Amcor PLC、Mondi PLC、International Paper Company 和 Smurfit Kappa Group PLC。

2024 年 2 月,安姆科宣布将与该国两家领先的有机优格製造商 Stonyfield Organic 和 Cheer Pack 合作推出首款全聚乙烯 (PE) 喷口袋。包装省去了标准袋结构中常见的沉淀或箔基薄膜层,同时为喷口插入提供了出色的耐热性。

2023 年 10 月,Mondi PLC 与小木屋合作,以纸质解决方案取代传统的塑胶地膜。牛皮纸覆盖物是纸张的替代品,常用于保护植物免受鸟类和自然因素的侵害。这种工业可堆肥的纸质解决方案采用负责任采购的木材製成,不含任何塑胶或涂层,并通过了 DIN EN 13432 认证,可提供与塑胶地膜相同的保护。

2023 年 9 月,Sonoco Products Company 将从合资伙伴 WestRock 手中收购 RTS Packaging LLC (RTS) 的剩余股权,以及 WestRock 位于田纳西州查塔努加的造纸厂。这项交易使 Sonoco 在美国、墨西哥和南美洲拥有了 15 个营运网路。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场动态

- 市场驱动因素

- 网路零售的兴起与全通路的出现

- 增加轻质软包装的使用

- 生物分解性塑胶包装在网路零售的兴起

- 市场挑战

- 缺乏良好的生产规范

- 限制使用塑料

第六章 市场细分

- 依材料类型

- 塑胶

- 纸板

- 纸

- 其他材料

- 按最终用户

- 服装与时尚

- 家电

- 饮食

- 个人保健产品

- 其他最终用户

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 亚洲

- 印度

- 中国

- 日本

- 澳洲和纽西兰

- 拉丁美洲

- 巴西

- 阿根廷

- 中东和非洲

- 阿拉伯聯合大公国

- 南非

- 北美洲

第七章 竞争格局

- 公司简介

- Amcor PLC

- Mondi PLC

- International Paper Company

- Smurfit Kappa Group PLC

- DS Smith PLC

- Klabin SA

- Georgia-Pacific LLC

- Nippon Paper Industries Co. Ltd

- Pacman LLC

- Sealed Air Corporation

- Rengo Co. Ltd

- Shorr Packaging Corporation

第八章投资分析

第九章 市场机会与未来趋势

The E-Commerce Packaging Market size is estimated at USD 78.39 billion in 2025, and is expected to reach USD 149.82 billion by 2030, at a CAGR of 13.83% during the forecast period (2025-2030).

Key Highlights

- The growth in the use of the Internet and smartphones, as well as an economy that is growing very quickly, are all pointing to increased spending on the Internet. However, a major growth inhibiting factor for this sector is expected to be the lack of firsthand product experience before purchase and the limited penetration of online businesses in remote parts of the world. In addition, the Russian-Ukraine war has had a negative impact on the overall packaging ecosystem.

- For various reasons, e.g., home delivery, the convenience of shopping, and easy product search, online shopping sites have become widely adopted by consumers as their preferred option for buying goods. The rapid expansion of online businesses around the world has significantly boosted the demand for solid packaging solutions.

- An enormous opportunity for online shopping and packaging providers to penetrate untapped markets and gain market share in this process has emerged because of increasing internet penetration worldwide and increased Internet access by the majority of people in emerging economies around the world.

- Recognizing the growing waste of plastics, companies seek to minimize it and offer a complete range of 100% recycled or biodegradable products.

- Additives used in producing some virgin plastics that complicate recycling or pose risks to human and environmental health are increasingly under scrutiny. Uncertainty regarding such additives in plastic waste may ultimately prevent recycling for producers of recycled plastics.

Ecommerce Packaging Market Trends

Consumer Electronics Segment to Witness Significant Growth

Manufacturers and exporters of consumer electronics packaging products are increasingly adopting protective packaging such as air bubble wraps, air pillows, and other inflatable packaging products that protect consumer electronics. In the future, these packaging options will be suited to all electronic segments' needs; for instance, according to the Department of Commerce (India), consumer electronics worth USD 11.012 billion were exported by the country.

E-commerce has gained consumers' trust in quality deliverables and aftersales support, encouraging them to place multiple orders online. In the case of handling and logistics, packaging solutions provide a strong containment solution to cope with damage.

The mobile market is a refreshed category of consumer electronics with the highest penetration, and the growth of the mobile market is multiplying as technology develops. In response to this growth, e-commerce companies are collaborating with each other on the launch and distribution of their products, which is why there is increasing demand for these packaging materials in the online retail market.

Moreover, the industry's growth rate is set to be increased by opening up new market opportunities as a result of increasing product development. The growth of this market is also stimulated by several innovative product innovations that focus on designing and manufacturing processes. It is expected that profitable opportunities for manufacturers in the e-commerce packaging market will be generated by technological advances to develop effective and environmentally efficient electronic commerce packaging.

Asia-Pacific Holds a Major Share in the Market

Asia-Pacific is one of the world's fastest-developing e-commerce markets. Increased shipments of eCommerce are being driven by increasing client bases in major countries, such as India and China. Therefore, there will be a growing demand for packaging solutions in this area.

One of the emerging countries where e-commerce is rapidly growing is China, owing to consumer preference for internet shopping and increasing payment options and events such as day deals on merchandise, which are accompanied by a strong logistics infrastructure.

In India, there is a growth in the demand for e-commerce packaging because of population increases, income levels, lifestyle changes, and increased economic activity. Based on data from the Brand Equity Foundation, India's e-commerce industry is estimated to grow to USD 200 billion by 2026. Most of the growth in this sector is thanks to an increase in Internet and mobile phone use.

Fashion & apparel, consumer electronics, and personal care drive the rapid expansion of the market. Packaging options are becoming more accessible thanks to substantial investments in the consumer electronics, personal care, fashion, and textile sectors.

E-Commerce Packaging Industry Overview

The availability of several players providing e-commerce packaging solutions has rendered the market fragmented. Key players operating in the market include Amcor PLC, Mondi PLC, International Paper Company, and Smurfit Kappa Group PLC, among others.

In February 2024, Amcor announced the collaboration with Stonyfield Organic, the country's leading organic yogurt maker, and Cheer Pack to launch the first all-polyethylene (PE) spouted pouch; where the new pouch uses Amcor's AmPrima Plus, an all-PE film that is designed to meet the APR Design Guide for recyclability, and Cheer Pack North America's Vizi cap. The package removes the metalized or foil-based film layers commonly found in standard pouch structures while providing superior heat resistance for spout insertion.

In October 2023, Mondi PLC partnered with Cotesi to replace conventional plastic mulch film with a paper solution. Kraft Mulch is a paper alternative commonly used to protect plants from birds and weather impacts. It is created from responsibly sourced wood with no plastic or coating, is an industrially compostable paper solution certified according to DIN EN 13432, and provides comparable protection as plastic mulch film.

In September 2023, Sonoco Products Company completed the acquisition of the remaining portion of its equity stake in the company RTS Packaging LLC (RTS) from WestRock, a joint venture partner, and a single WestRock paper mill located in Chattanooga, Tennessee, for a total consideration of USD 330 million. This transaction brought Sonoco's network of 15 operations to the United States, Mexico, and South America.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Proliferation of Online Retailing and Emergence of Omni-channel Presence

- 5.1.2 Rising Usage of Lightweight Flexible Packaging

- 5.1.3 Increasing Biodegradable Plastic Packaging for Online Retail

- 5.2 Market Challenges

- 5.2.1 Lack of Exposure to Good Manufacturing Practices

- 5.2.2 Regulation Pertaining to the Use of Plastic

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Plastic

- 6.1.2 Corrugated

- 6.1.3 Paper

- 6.1.4 Other Materials

- 6.2 By End User

- 6.2.1 Fashion and Apparel

- 6.2.2 Consumer Electronics

- 6.2.3 Food and Beverages

- 6.2.4 Personal Care Products

- 6.2.5 Other End Users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.3 Asia

- 6.3.3.1 India

- 6.3.3.2 China

- 6.3.3.3 Japan

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.5.1 Brazil

- 6.3.5.2 Argentina

- 6.3.6 Middle East and Africa

- 6.3.6.1 United Arab Emirates

- 6.3.6.2 South Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor PLC

- 7.1.2 Mondi PLC

- 7.1.3 International Paper Company

- 7.1.4 Smurfit Kappa Group PLC

- 7.1.5 DS Smith PLC

- 7.1.6 Klabin SA

- 7.1.7 Georgia-Pacific LLC

- 7.1.8 Nippon Paper Industries Co. Ltd

- 7.1.9 Pacman LLC

- 7.1.10 Sealed Air Corporation

- 7.1.11 Rengo Co. Ltd

- 7.1.12 Shorr Packaging Corporation