|

市场调查报告书

商品编码

1683934

中国室内 LED 照明:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)China Indoor LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

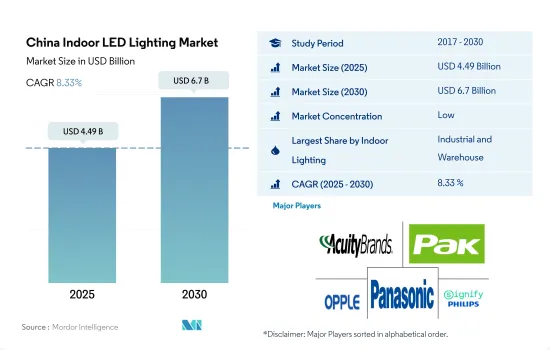

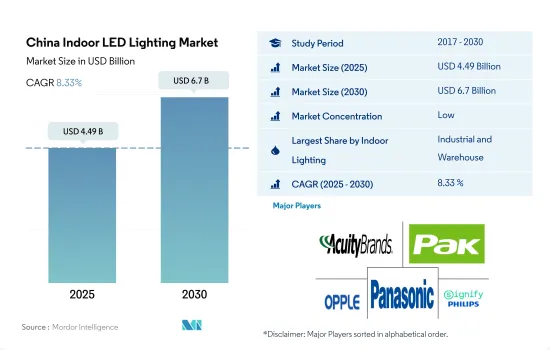

预计2025年中国室内LED照明市场规模为44.9亿美元,2030年将达67亿美元,预测期间(2025-2030年)的复合年增长率为8.33%。

Start-Ups数量增加、製造设施数量增加以及零售上升预计将推动室内照明的需求

- 到 2023 年,工业和仓储(I&W)将占据大部分份额(79.6%),其次是商业、农业和住宅。预计未来几年内所有应用领域的市场占有率将增加。中国工业面临国内外多重阻力,包括国内消费疲软、景气下降、以及因新冠肺炎病例激增导致的供应链中断。此外,中国在 2021 年维持了工业生产。 2021 年,中国总产出为 4,8,658 亿美元,比 2020 年成长 26.04%。因此,工业产量的增加将在未来几年创造对室内照明的需求。

- 由于全球汽车市场依赖中国提供廉价的零件和整车供应商,中国各地对汽车製造厂和仓库的需求正在成长。由于这些案例,预计在研究期间对室内 LED 的需求将会增加。 BMW在渖阳开设了新工厂,奥迪位于长春的新电动车工厂也开始生产。

- 中国零售业持续呈现强劲成长迹象,2023年5月零售业与前一年同期比较增12.7%。预计网路购物激增将推动该地区对新仓库的进一步需求,进而推动对室内照明的需求。

- 中国是全球最大的十亿美元新兴企业产生国之一。 2022年,中国产生了74家新的独角兽企业,落后美国。约70%的新独角兽来自医疗保健和智慧物流领域,带动商业空间需求激增。预计这些案例将推动明年室内 LED 的需求。

中国室内LED照明市场趋势

人均收入成长与家庭收入成长相辅相成

- 2017年,中国平均家庭规模为3.03人。到2021年,这一数字将下降到2.7人,这意味着单户住宅/住宅将会增加。 1998年后,现有公共住宅被私有化,大量供给以自有住宅为主的私人住房,使中国从一个公共租赁住宅占多数的国家转变为住房自有率最高的国家。到2020年,中国90%以上的家庭将拥有住宅(都市区为87%,农村为96%)。与许多富裕国家相比,超过20%的中国家庭拥有一处以上的房产。因此,预计房地产数量的增加将推动该国采用LED满足照明需求。

- 中国的可支配所得不断增加,使得个人消费能力增强,有能力在新的居住空间上花费更多。 2022年12月,中国的人均收入达到12,732.5美元,而2021年12月为12,615.7美元。截至2022年3月,印度的人均所得为2,301.4美元,低于中国。

- 据报道,2019年中国农村人均住宅占地面积为48,900平方米,高于上年的47,300平方米。在都市区,由于对小型公寓/单间公寓的投资增加,公寓的平均面积从 2019 年的 39,800 平方米减少到 2020 年的 38,600 平方米。这推动了该国LED照明的发展。例如,中国人正在中国较小的城市投资廉价公寓。 2012年,中国家庭获得价值22亿元人民币(3,100万美元)的补贴计划,用于使用节能灯泡和LED灯。预计此类案例将增加该国对 LED 照明的需求。

中国的节能倡议或将推动该国 LED 照明市场

- 2021年,华人家庭用电量约1170兆瓦时。包括製造业在内的第二产业部门消耗的能源最多,约5,610兆瓦时。住宅和商业部门分别位居第二和第三。由于房地产市场低迷,市场成长为负。虽然新建设在下降,但既有建筑维修、绿建筑建设等成长潜力大,将带动中国LED市场规模扩大。

- 在正常营业时间内,商业机构会遭遇用电高峰。通常每天持续10至12小时。工业部门的电力消耗在一天内和全年内都不会改变。例如,製造工厂全年 365 天、每天 24 小时运作。住宅部门通常在晚上遇到电力需求高峰,持续时间为 5.5 至 7 小时。

- 2021年4月《文化旅游发展「十四五」规划》透过设立200座智慧灯塔计划,鼓励发展夜间经济,建立国家夜间文化旅游丛集,进而刺激LED照明市场的成长。

- 到2022年,都市区70%的新建建筑必须依照新标准获得绿建筑认证。根据方案,所有公共设施、2万平方公尺以上建筑以及其他大型公共建筑均须符合中国绿色建筑评估标示三星级绿建筑标准。随着国家对节能减排的重视,LED照明的发展正在加速。

中国室内LED照明产业概况

中国室内LED照明市场较为分散,前五大企业占比为28.16%。市场的主要企业有:ACUITY BRANDS, INC.、广东百亮光电股份有限公司、欧普照明、松下控股株式会社和 Signify(飞利浦)(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 人口

- 人均收入

- LED进口总量

- 照明电力消耗量

- 家庭数量

- LED渗透率

- 园艺区

- 法律规范

- 中国

- 价值链与通路分析

第五章 市场区隔

- 室内照明

- 农业照明

- 商业照明

- 办公室

- 零售

- 其他的

- 工业/仓库

- 住宅

第六章 竞争格局

- 主要策略趋势

- 市场占有率分析

- 业务状况

- 公司简介(包括全球概况、市场层级概况、主要业务部门、财务状况、员工人数、关键资讯、市场排名、市场占有率、产品和服务、最新发展分析)

- ACUITY BRANDS, INC.

- Anhui Shilin Lighting Co., Ltd.

- Guangdong PAK Corporation Co.,Ltd.

- Hengdian group tospo lighting co. ltd.

- NVC INTERNATIONAL HOLDINGS LIMITED

- OPPLE Lighting Co., Ltd

- Panasonic Holdings Corporation

- Signify(Philips)

- TCL Lighting(TCL Group)

- Zhejiang Yankon Group Co.,Ltd

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源和进一步阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 50001632

The China Indoor LED Lighting Market size is estimated at 4.49 billion USD in 2025, and is expected to reach 6.7 billion USD by 2030, growing at a CAGR of 8.33% during the forecast period (2025-2030).

Growing star-ups, rising manufacturing facilities, and increasing retail sales are expected to raise the demand for indoor lighting

- In 2023, industrial and warehouse (I&W) accounted for the majority of the share (79.6%), followed by commercial, agricultural, and residential. The market share is expected to have a minimal reduction in all applications and a gain in (I&W) in the coming years. Chinese industries faced several internal and external headwinds, such as weak domestic consumption, declining business confidence, and supply chain disruptions caused by the surge of COVID-19. Further, China sustained its industrial production in 2021. In 2021, China produced a total of USD 4865.8 billion, an increase of 26.04% compared to 2020. Thus, the growing industrial production will create demand for Indoor lighting in the coming years.

- The demand for automotive manufacturing plants and warehouses across China is rising, and this is due to the global auto market relying on China because of its cheap components, source of finished cars, and others. Such instances necessitate more requirements for Indoor LEDs during the study period. BMW opened a new factory in the city of Shenyang, and Audi started production at a new EV factory in the city of Changchun.

- China's retail sector continues to show signs of robust growth, with retail sales surging by 12.7% in May 2023 from a year earlier. The rapid increase in online shoppers is further expected to boost the need for new warehouses in the region, resulting in more demand for indoor lighting.

- China is one of the top players in creating billion-dollar start-ups. In 2022, China added 74 new unicorns, falling behind the United States. Around 70% of its new unicorns come from the healthcare and smart logistics sectors, which surges the demand for commercial spaces. The above instances are expected to drive the demand for Indoor LEDs in the coming year.

China Indoor LED Lighting Market Trends

The rising per capita income complements the growth of households

- The average household size in China registered 3.03 persons in 2017. By 2021, it reduced to 2.7, indicating an increase in private households/housing ownerships. After 1998, China went from being a nation dominated by public renters to one with the highest homeownership rates, owing to the privatization of existing public housing and the vast provision of private housing, primarily in the ownership sector. By 2020, more than 90% of households in China owned their homes (87% in urban areas and 96% in rural areas). In contrast to many affluent countries, more than 20% of Chinese households own several properties. Thus, the increase in the number of properties is expected to create more LED penetration for the need for illumination in the country.

- In China, disposable income is growing, resulting in the rising spending power of individuals who spend more money on new residential spaces. China's per capita income reached USD 12,732.5 in December 2022 compared to USD 12,615.7 in December 2021. India's per capita income was USD 2,301.4 as of Mar 2022, which is lower than China's.

- In China, the floor area of residential buildings per capita for rural areas was reported at 48.900 sq. m in 2019, an increase from the previous year of 47.300 sq. m. In urban areas, it was 38.600 sq. m in 2020, a decrease from 39.800 sq. m in 2019 due to an increase in the investment in small-size apartments/studio apartments. This is propelling the growth of LED lighting in the country. For instance, people in China invested in low-cost apartments in small Chinese cities. In 2012, households in China were offered a subsidy program of CNY 2.2 (USD 0.31) billion for the use of energy-conserving light bulbs and LEDs. Such instances are expected to increase the demand for LED lighting in the country.

China's energy conservation initiatives could propel the LED lighting market in the country

- In 2021, Chinese households used approximately 1,170 terawatt hours of electricity. At around 5,610 terawatt hours, the secondary sector, which includes the manufacturing industries, consumed the most energy. The residential and commercial sectors came in second and third. Market growth is negative as a result of the real estate market slump. Despite the decline in new construction, chances for significant growth exist in the renovation of the existing structures and the creation of green buildings, leading to the expansion of the LED market in China.

- During normal business hours, commercial electricity use is at its peak. It usually lasts between 10 and 12 hours every day. Electricity consumption in the industrial sector does not vary during the day or year; for example, manufacturing facilities operate 24 hours a day, 365 days a year. The residential sector often has peak electricity demand in the evenings, ranging from 5.5 to 7 hours.

- The 14th Five-Year Plan for the Development of Culture and Tourism in April 2021 encouraged the development of the night-time economy and the construction of national clusters for culture and tourism at night by installing 200 intelligent lamp post projects, driving the growth of the LED lighting market.

- By 2022, 70% of new urban buildings must be recognized as green buildings, according to the new standards. According to the Plan, all public facilities, structures larger than 20,000 sq. m, and other sizable public structures must adhere to China's Green Building Evaluation Label's 3-Star Green Building Standards. The development of LED lighting is being accelerated by China's emphasis on energy conservation.

China Indoor LED Lighting Industry Overview

The China Indoor LED Lighting Market is fragmented, with the top five companies occupying 28.16%. The major players in this market are ACUITY BRANDS, INC., Guangdong PAK Corporation Co.,Ltd., OPPLE Lighting Co., Ltd, Panasonic Holdings Corporation and Signify (Philips) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 Per Capita Income

- 4.3 Total Import Of Leds

- 4.4 Lighting Electricity Consumption

- 4.5 # Of Households

- 4.6 Led Penetration

- 4.7 Horticulture Area

- 4.8 Regulatory Framework

- 4.8.1 China

- 4.9 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Indoor Lighting

- 5.1.1 Agricultural Lighting

- 5.1.2 Commercial

- 5.1.2.1 Office

- 5.1.2.2 Retail

- 5.1.2.3 Others

- 5.1.3 Industrial and Warehouse

- 5.1.4 Residential

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ACUITY BRANDS, INC.

- 6.4.2 Anhui Shilin Lighting Co., Ltd.

- 6.4.3 Guangdong PAK Corporation Co.,Ltd.

- 6.4.4 Hengdian group tospo lighting co. ltd.

- 6.4.5 NVC INTERNATIONAL HOLDINGS LIMITED

- 6.4.6 OPPLE Lighting Co., Ltd

- 6.4.7 Panasonic Holdings Corporation

- 6.4.8 Signify (Philips)

- 6.4.9 TCL Lighting (TCL Group)

- 6.4.10 Zhejiang Yankon Group Co.,Ltd

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219