|

市场调查报告书

商品编码

1683951

印度室内 LED 照明:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)India Indoor LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

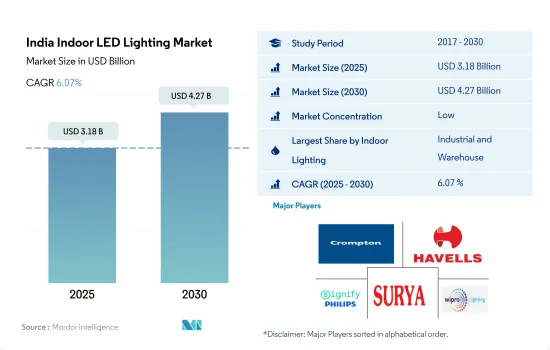

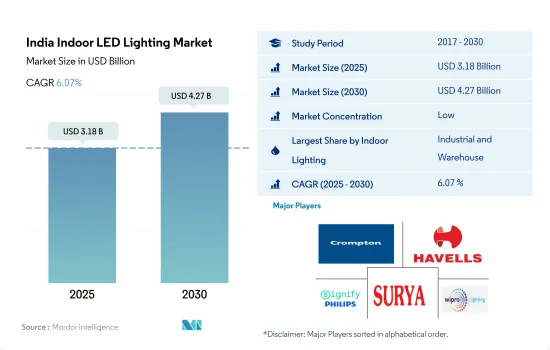

印度室内 LED 照明市场规模预计在 2025 年为 31.8 亿美元,预计到 2030 年将达到 42.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.07%。

工业领域的发展和住宅数量的增加将推动LED照明市场的成长

- 就金额份额而言,工业和仓储将在 2023 年占据最大份额 (58%),其次是住宅(24.4%)、商业 (15.2%) 和农业照明 (2%)。到 2030 年,印度预计将成为全球主要製造地,出口额将达到 1 兆美元。此外,印度也正在实施各种计画和政策,例如《国家製造业政策》,旨在到 2025 年将製造业在 GDP 中的比例提高到 25%。该倡议旨在进一步加速核心製造业的发展。仓储业、物流和工业营运对工业照明的需求正在稳步增长。例如,仓储、工业和物流 (WIL) 产业预计将对印度实现到 2025 财年成为 5 兆美元经济体的愿景发挥关键作用。这些因素正在推动全国仓库和工业领域 LED 照明销售的成长。

- 从数量份额来看,2023年住宅照明将占最大份额(68%),其次是商业照明(28.4%)、工业/仓库照明(2%)和农业照明(2%)。 2022年,包括全国所有登记居民在内的平均家庭规模将达到4.4人,单人家庭和房主数量将增加。在印度,超过50%的人住在自己的家里,近30%的人住在租来的房子里,13%的人住在父母家。此外,由于对办公和住宅空间的需求不断增加,印度的房地产行业近年来也经历了显着增长。 21 财年第四季度,印度七个城市的住宅销售额成长了 29%,新房源数量与 20 财年第四季相比成长了 51%。这些发展推动了住宅对 LED 照明的需求。

印度室内 LED 照明市场趋势

核心家庭、都市化和人均收入的提高正在推动住宅产业的成长

- 2014年,印度的平均家庭规模为4.8人。在许多州和联邦属地,农村家庭的人口多于都市区家庭的人口。到 2022 年,包括所有登记家庭在内的平均家庭规模将达到 4.4 人,导致单人家庭/房屋所有权增加。虽然超过 50% 的印度人住在自己的家里,但近 30% 的人租房子住,13% 的人住在父母家。移民占都市区总人口的很大一部分。随着移民的增加,预计LED将变得更加普及,以满足照明需求。

- 印度的可支配收入不断增加,这反过来又提高了个人消费能力,从而增加了对新生活空间的支出。 2022 年 3 月,印度的人均收入为 2,301.4 美元,而 2021 年 3 月为 1,971.6 美元。与一些开发中国家相比,印度的人均收入较低。例如,2022年日本的人均所得为3,3,911.2美元,越南为3,716.8美元,中国为1,2732.5美元。这显示印度个人的购买力可能低于其他国家。

- 由于对办公室和住宅的需求不断增加,印度房地产行业近年来一直经历着高速成长。 21 财年第四季度,印度七个城市的住宅销售额与 20 财年第四季相比成长了 29%,新房开建率成长了 51%。政府已推出多项节能计划。电力部在 UJALA(全民可负担 LED 灯带来的 Unnat Jyoti)计划下,七年内已分发了 3.678 亿个 LED 灯,每年可节省 4.778 亿个电力单位。该计划于2015年1月5日开始实施。预计此类案例将进一步增加日本对LED照明的需求。

增加外国直接投资和关注高效照明将推动 LED 的采用

- 2021年,工业部门将消耗总能源的41%,其次是住宅部门(26%)和商业部门(8%)。此外,建筑业正在迅速扩张。 2021 年 3 月,议会核准透过自动途径允许 100% 的外国直接投资进入印度建筑业,用于乡镇、商场/购物中心和商业建筑的营运和管理。这意味着将会建造更多的建筑物,对 LED 的需求也将增加。

- 商业部门的电力需求往往在11至13小时左右。工业部门的用电量在一天和一年中往往更加稳定。住宅领域的电力需求通常在晚上亮灯时最高,平均照明时间约为六至八小时。此外,透过提高亮度和减少暗区,国家街道照明计画提高了公民的夜间工作效率,并为驾驶员和行人提供了更安全的道路。已安装1.3兆个智慧LED的州的电费已减少高达50%。这些自动灯在日出和日落时打开和关闭,最大限度地减少浪费。

- 到2021年,可再生能源发电将占总发电量的20%左右。该国计划在 2030 年实现可再生能源容量达到 500 吉瓦。此外,作为 UJALA倡议的一部分,印度各地已分发了超过 3.613 亿盏 LED 灯。预计每年可节省能源469.2亿千瓦时,减少温室气体排放3,800万二氧化碳。此举减少了印度的电力使用并促进了LED的使用。

印度室内LED照明产业概况

印度室内LED照明市场较为分散,前五大厂商的市占率为11.62%。市场的主要企业是:Crompton Greaves Consumer Electricals Limited、Havells India Ltd.、Signify (Philips)、Surya Roshni Limited 和 Wipro Lighting Limited (Wipro Enterprises Ltd.)(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 人口

- 人均收入

- LED进口总量

- 照明电力消耗量

- 家庭数量

- LED渗透率

- 园艺区

- 法律规范

- 印度

- 价值链与通路分析

第五章 市场区隔

- 室内照明

- 农业照明

- 商业照明

- 办公室

- 零售

- 其他的

- 工业/仓库

- 住宅

第六章 竞争格局

- 主要策略趋势

- 市场占有率分析

- 业务状况

- 公司简介(包括全球概况、市场层级概况、主要业务部门、财务状况、员工人数、关键资讯、市场排名、市场占有率、产品和服务、最新发展分析)

- Bajaj Electrical Ltd

- Crompton Greaves Consumer Electricals Limited

- Eveready Industries India Limited

- Havells India Ltd.

- OPPLE Lighting Co., Ltd

- Orient Electric Limited

- Signify(Philips)

- Surya Roshni Limited

- Syska Led Lights Private Limited

- Wipro Lighting Limited(Wipro Enterprises Ltd.)

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源和进一步阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

The India Indoor LED Lighting Market size is estimated at 3.18 billion USD in 2025, and is expected to reach 4.27 billion USD by 2030, growing at a CAGR of 6.07% during the forecast period (2025-2030).

Increasing development in the industrial sector and increase in the number of residential houses to drive the growth of the LED lighting market

- In terms of value share, industrial and warehouse will have the largest share (58%) in 2023, followed by residential (24.4%), commercial (15.2%) and agricultural lighting (2%). India is on track to become a major manufacturing hub in the world, with the ability to export USD 1 trillion worth of goods by 2030. Further, the implementation of various programs and policies, such as the National Manufacturing Policy, which aims to increase the manufacturing share of GDP to 25% by 2025. The effort is aimed at further accelerating the development of the core manufacturing industry. Demand for industrial lighting has grown steadily in warehousing, logistics, and industrial operations. For example, the Warehousing, Industry, and Logistics (WIL) sector is expected to be crucial to realizing India's vision of becoming a USD 5 trillion economy by FY2025. These factors are increasing sales of LED lighting in domestic warehouses and industries.

- In terms of volume share, residential lighting will have the largest share (68%) in 2023, followed by commercial (28.4%), industrial and warehouse lighting (2%), and agricultural lighting (2%). The average household size, including all registrants nationwide, in 2022 was 4.4, leading to an increase in private households and homeowners. Over 50% of people in India live in their own homes, nearly 30% live in rented houses, and 13% live in their parents' homes. In addition, the Indian real estate sector has recently experienced significant growth due to increased demand for office and residential space. Home sales in seven Indian cities increased by 29% in Q4 FY2021, with new listings up 51% compared to Q4 FY2020. These developments cater to the need for LED lights in houses.

India Indoor LED Lighting Market Trends

Increasing nuclear families, urbanization, and increasing per capita income are driving the growth of the housing sector

- The average household size in India in 2014 was 4.8 people per household. In many states and union territories, more people live in rural households than in urban households. The average household size, including all registered households, was 4.4 by 2022, which resulted in increased private household/own housing ownership. More than 50% of people in India live in their own houses, while almost 30% live on a rental basis and 13% in their parents' houses. A large share of the total urban population are migrants. The increase in the number of migrants is expected to create LED penetration in the country to meet the need for illumination.

- In India, disposable income is growing, resulting in the rising spending power of individuals and spending on new residential spaces. India's per capita income reached USD 2,301.4 in March 2022, compared to 1,971.6 USD in March 2021. Compared to some developing nations, India's per capita income is less. For instance, in 2022, Japan's per capita income was USD 33,911.2, Vietnam's was USD 3,716.8, and China's was USD 12,732.5. This suggests that the purchasing power of individuals in India may be lower than those of other nations.

- The Indian real estate sector has witnessed high growth in recent times with a rise in demand for office as well as residential spaces. Housing sales in seven Indian cities increased by 29% and new launches by 51% in Q4 FY21 over Q4 FY20. The government introduced a few energy-saving schemes. The Power Ministry distributed 36.78 crore LED lights under the Unnat Jyoti by Affordable LEDs for All (UJALA) program in seven years, which saved 47,778 million units of electricity per annum. The program was launched on January 05, 2015. Such instances are further expected to raise the demand for LED lighting in the country.

Increasing FDI and emphasis on efficient lighting is pushing the implementation of LEDs

- In 2021, the industrial sector consumed 41% of all energy, followed by the household sector (26%) and the commercial sector (8%). Additionally, the construction sector is expanding quickly. In March 2021, the Parliament approved allowing 100% FDI in India's construction sector through the automatic route for the operation and management of townships, malls/shopping centers, and commercial buildings. This suggests that more buildings will be built, raising the need for LEDs.

- Electricity demand in the commercial sector tends to be around 11-13 hours. Electricity use in the industrial sector tends not to fluctuate through the day or year. Electricity demand in the residential sector tends to be highest in the evenings, when lights are turned on, and the average lighting time varies for about 6 to 8 hours. Further, due to improved brightness and fewer dark areas, the Street Lighting National Program has allowed citizens to increase their productivity at night and made roadways safer for drivers and pedestrians. The electricity costs in the states where 1.03 crore smart LEDs have been installed are reduced by up to 50%. These automatic lights minimize waste by turning on and off at sunrise and sunset.

- In 2021, renewable energy accounted for around 20% of total electricity generation. The nation is slated to reach a renewable energy capacity of 500 gigawatts by 2030. Additionally, more than 36.13 billion LED lights have been distributed throughout India as part of the UJALA initiative. As a result, there have been estimated annual energy savings of 46.92 billion kWh and reductions in greenhouse gas emissions of 38 million CO2 annually. This initiative has reduced electricity use and promoted LED use in the country.

India Indoor LED Lighting Industry Overview

The India Indoor LED Lighting Market is fragmented, with the top five companies occupying 11.62%. The major players in this market are Crompton Greaves Consumer Electricals Limited, Havells India Ltd., Signify (Philips), Surya Roshni Limited and Wipro Lighting Limited (Wipro Enterprises Ltd.) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 Per Capita Income

- 4.3 Total Import Of Leds

- 4.4 Lighting Electricity Consumption

- 4.5 # Of Households

- 4.6 Led Penetration

- 4.7 Horticulture Area

- 4.8 Regulatory Framework

- 4.8.1 India

- 4.9 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Indoor Lighting

- 5.1.1 Agricultural Lighting

- 5.1.2 Commercial

- 5.1.2.1 Office

- 5.1.2.2 Retail

- 5.1.2.3 Others

- 5.1.3 Industrial and Warehouse

- 5.1.4 Residential

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 Bajaj Electrical Ltd

- 6.4.2 Crompton Greaves Consumer Electricals Limited

- 6.4.3 Eveready Industries India Limited

- 6.4.4 Havells India Ltd.

- 6.4.5 OPPLE Lighting Co., Ltd

- 6.4.6 Orient Electric Limited

- 6.4.7 Signify (Philips)

- 6.4.8 Surya Roshni Limited

- 6.4.9 Syska Led Lights Private Limited

- 6.4.10 Wipro Lighting Limited (Wipro Enterprises Ltd.)

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms