|

市场调查报告书

商品编码

1683940

法国汽车 LED 照明:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)France Automotive LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

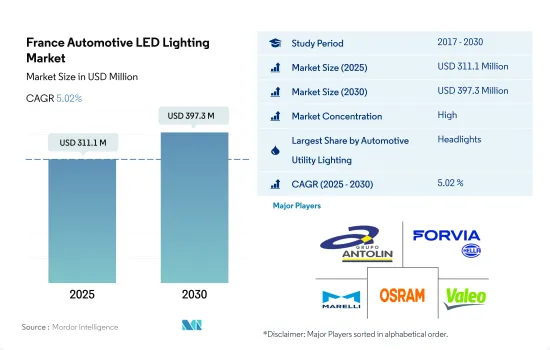

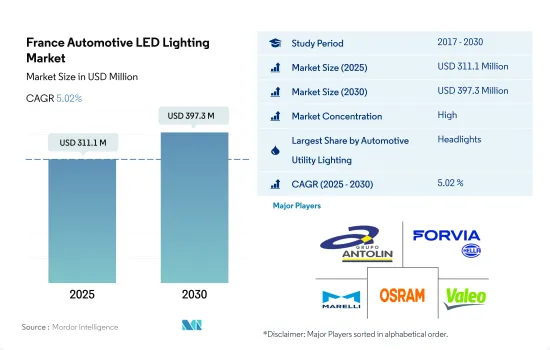

预计 2025 年法国汽车 LED 照明市场规模为 3.111 亿美元,到 2030 年将达到 3.973 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.02%。

交通事故增加以及乘用车和轻型商用车需求成长将推动 LED 灯需求

- 就以金额为准,2023 年前照灯将占据大部分份额,其次是其他灯和日间行车灯。预计预测期内该市场占有率将维持不变。由于法国道路交通事故的增加,对安全元件的需求日益增加。具有有效照明的车辆可以让驾驶员做出必要且适当的决定。人们对道路交通事故的担忧日益增加,将导致对汽车增强安全功能的需求增加,最终导致增加头灯,进一步推动该国 LED 的成长。

- 2022年1月,警方接获的交通事故数为3,728起。这一数字高于去年的 3,508 起,比 2021 年 1 月增加了 220 起。这些事故中很大一部分是由于车辆照明不当造成的。这些因素增加了对汽车头灯的需求。这导致人们对道路安全的担忧日益增加,从而促进了车头灯的普及,并进而推动了该国 LED 灯的使用增加。

- 从销售来看,2023年转向信号灯将占据最大份额,其次是头灯和其他灯光。由于乘用车和商用车数量的增加,市场正在扩大。近年来,全球对商用车的需求大幅增加。 2020年,法国汽车製造商向法国境外运送了约350万辆乘用车。 2020年,法国汽车製造商向法国境外运送了约350万辆乘用车。标緻雪铁龙集团和雷诺等法国汽车製造商在全球汽车市场上竞争激烈。因此,随着汽车领域对LED的需求增加,预计该国转向信号灯的使用量将会增加。

法国汽车 LED 照明市场趋势

电动车销售奖励措施增加推动 LED 市场成长

- 预计2022年法国汽车总产量将达171万辆,2023年将达182万辆。在法国,新冠疫情已经影响到汽车价值链的每个阶段。与2019年4月相比,法国新车销量下降了89%。在第二波疫情期间,法国的限制措施比其他欧洲国家更为严格。法国的经销商被要求关闭展示室,但被允许进行「点击提货」销售。法国更严格的监管扰乱了汽车零件的供应链,减少了对 LED 灯的需求。

- 该地区的汽车製造商包括雷诺集团、大众集团、Stellantis、标緻和Ligier。法国汽车工业的三大发展是电气化、自动化和连结性。这三者相互关联,对于汽车零件製造商的成功至关重要。继德国和英国之后,法国占欧盟 ECV 市场的约 14%,并且在 2019 年前三个季度的 ECV 註册数量位居第三。

- 自新冠疫情爆发以来,法国汽车产业发展相当顺利。越来越多的人开始使用公共交通,製造商也开始专注于商务传输的电动车。例如,12月份法国新乘用车註册量强劲,达到158,006辆。自 2023 年 1 月 1 日起,法国将把新电动车的补贴从 6,000 欧元减少到 5,000 欧元(6,479.04 美元至 5,399.20 美元)。因此,LED照明的兴起完全依赖汽车产业的扩张,而汽车产业在预测期内仍处于起步阶段。

政府为促销而提供的补贴和奖励正在推动 LED 市场的发展

- 2022年,法国乘用车註册量下降7.2%,销量较上年下降约12万辆。但电动车在危机中呈现上涨,飙升了131.5%。此外,2022年法国将註册超过34.6万辆新的插电式电动车,高于2021年的31.5万辆,这一与前一年同期比较增长率为10%,远低于往常。截至2022年12月,法国共有82,107个公共充电站。这意味着一年内成长了53%,两年内成长了2.6倍。

- 作为重组汽车产业战略的一部分,法国计划在2020年5月提高补贴率,主要原因是新冠疫情导致销量下降。当时,最高补贴额从6,479.04美元提高至7,558.88美元。 2021年年中,最高税率从7,558.88美元降至6,479.04美元。此外,2023 年,电动车补助将从 2023 年 1 月起从 6,479 美元降至 5,399.2 美元。在法国,二手电动车将继续获得 1,079.8 美元的补贴,对于家庭收入较低的人则为 3,239.5 美元。

- 2023年5月,法国政府宣布,计划启动该国首家电动车电池工厂,作为其「再工业化」计画的一部分。政府也设定了到 2030 年每年生产 200 万辆电动车的目标。

- 此外,由于电动车的需求不断增长,国内主要製造商正专注于汽车 LED 的开发和生产。 LED汽车照明比卤素灯泡消耗更少的电量,有助于电动车节省能源并延长行驶里程;这些方面预计将进一步推动汽车LED的需求。

法国汽车LED照明产业概况

法国汽车LED照明市场比较集中,前五大厂商的市占率合计为70.51%。该市场的主要企业有:GRUPO ANTOLIN IRAUSA, SA、HELLA GmbH & Co. KGaA、Marelli Holdings、OSRAM GmbH。以及 Valeo(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 汽车产量

- 人口

- 人均收入

- 汽车贷款利率

- 充电站数量

- 汽车持有量

- LED进口总量

- 家庭数量

- 道路网络

- 渗透率

- 法律规范

- 法国

- 价值链与通路分析

第五章 市场区隔

- 汽车实用照明

- 日间行车灯 (DRL)

- 转向指示灯

- 头灯

- 倒车灯

- 红绿灯

- 尾灯

- 其他的

- 汽车照明

- 二轮车

- 商用车

- 搭乘用车

第六章 竞争格局

- 主要策略趋势

- 市场占有率分析

- 业务状况

- 公司简介(包括全球概况、市场层级概况、主要业务部门、财务状况、员工人数、关键资讯、市场排名、市场占有率、产品和服务、最新发展分析)

- GRUPO ANTOLIN IRAUSA, SA

- HELLA GmbH & Co. KGaA

- Horpol JIAT Horeczy Sp. k.

- Luxor Lighting

- Marelli Holdings Co., Ltd.

- OSRAM GmbH.

- Stanley Electric Co., Ltd.

- Valeo

- VIGNAL GROUP

- ZKW Group

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源和进一步阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 50001638

The France Automotive LED Lighting Market size is estimated at 311.1 million USD in 2025, and is expected to reach 397.3 million USD by 2030, growing at a CAGR of 5.02% during the forecast period (2025-2030).

Increased traffic accidents and rising demand for passenger and commercial vehicles accelerate the demand for LED lights

- In terms of value, in 2023, headlights accounted for the majority share, followed by other lights and DRL. The market share is expected to remain the same during the forecast period. Due to an increase in traffic accidents in France, there is a greater demand for safety elements. Vehicles with effective lighting allow the driver to make the necessary, suitable decisions. Increased worry about traffic accidents drives demand for enhanced safety measures in cars, which finally results in the addition of headlights and encourages further growth of LED in the nation.

- The number of road injury accidents reported by police forces in January 2022 was 3,728. This increased over the previous year's result, 3,508 accidents, or 220 more injury accidents than in January 2021. A significant portion of these accidents were caused by improper vehicle lighting. These elements increase the need for headlights in automobiles. As a result, rising concern for road safety fuels the expansion of headlights and, consequently, the country's growing use of LED.

- In terms of volume, in 2023, directional signal lights accounted for the majority share, followed by headlights and other lights. Due to an increase in passenger and commercial vehicles, the market is expanding. Demand for commercial vehicles has increased significantly globally in recent years. Around 3.5 million passenger automobiles were shipped by French automakers outside of France in 2020. Around 3.5 million passenger automobiles were shipped by French automakers outside of France in 2020. French automakers like PSA and Renault actively compete in the world automotive market. Thus, the country's use of directional signal lights is anticipated to increase as the demand for LEDs increases in the automobile sector.

France Automotive LED Lighting Market Trends

Increasing EV incentives to increase the sales of electric vehicles to drive the growth of the LED market

- The total automobile vehicle production in France was 1.71 million units in 2022, and it was expected to reach 1.82 million units in 2023. In France, the COVID-19 pandemic impacted every step of the automotive value chain. Compared to April 2019, sales of new cars fell by 89% in France. France had stricter regulations than other European nations during the second wave of the pandemic. Dealerships in France were requested to shut down their showrooms but were still permitted to do "click-and-collect" sales. Due to the high regulatory measures in the country, the supply chain of automotive components was hampered, resulting in lower demand for LED lights.

- The region's automakers include Groupe Renault, Volkswagen Group, Stellantis, Peugeot, and Ligier. The three main developments in the French automotive industry are electrification, automation, and connection. All three were interrelated and essential to the success of auto part manufacturers. After Germany and the United Kingdom, France accounted for roughly 14% of the EU's ECV market and registered the third-highest number of ECVs during the first three quarters of 2019.

- After the COVID-19 pandemic, the automotive industry in France has been expanding quite steadily. More people are using public transportation, and manufacturers are concentrating on electric vehicles for commercial transportation. For instance, the number of new passenger car registrations in France in December was steady at 158,006. As of January 1, 2023, France will reduce its incentives for new all-electric vehicles from EUR 6,000 to EUR 5,000 (USD 6479.04 to 5399.20). Thus, this demonstrates that the rise of LED lighting is entirely dependent upon the expansion of the automotive industry, which is still in its infancy during the forecast period.

The LED market is driven by government subsidies and incentives to promote the sales of EV

- In 2022, passenger automobile registrations in France declined by 7.2%, with about 120,000 fewer units sold than the previous year. However, electric automobiles emerged during the crisis, surging by 131.5%. Further, more than 346,000 new plug-in electric automobiles were registered in France in 2022, up from over 315,000 in 2021. This Y-o-Y growth of 10% is much lower than in previous years. By December 2022, France had 82,107 public charging stations. That is a 53% growth in one year and a 2.6 multiplication in two years.

- As part of a restructuring strategy for the automotive industry, France planned to raise subsidy rates in May 2020. The main reason was a drop in sales caused by the Corona crisis. The maximum subsidy rate was increased from USD 6479.04 to USD 7558.88 at the time. In mid-2021, the maximum rate was reduced from USD 7558.88 to USD 6479.04. Further, in 2023, the government reduced subsidies for electric cars to USD 5399.2 from 6479.0, effective from January 2023. In France, used electric vehicles will continue to be supported with USD 1079.8 or USD 3239.5 if the household income is low.

- In May 2023, the French government announced the plan to launch its first battery factory for electric cars, a "reindustrialization" plan for France, with a clutch of factories set to emerge in the north of the country over the next three years. The government also has set a target of producing 2 million electric vehicles per year by 2030.

- Moreover, key manufacturers in this country are focusing on developing and producing automotive LEDs because the demand for EVs is growing, and LED car lights can help EVs save energy and extend their driving range, as they consume less power than halogen bulbs, such aspect is further expected to boost the demand for automotive LEDs.

France Automotive LED Lighting Industry Overview

The France Automotive LED Lighting Market is fairly consolidated, with the top five companies occupying 70.51%. The major players in this market are GRUPO ANTOLIN IRAUSA, S.A., HELLA GmbH & Co. KGaA, Marelli Holdings Co., Ltd., OSRAM GmbH. and Valeo (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Automotive Production

- 4.2 Population

- 4.3 Per Capita Income

- 4.4 Interest Rate For Auto Loans

- 4.5 Number Of Charging Stations

- 4.6 Number Of Automobile On-road

- 4.7 Total Import Of Leds

- 4.8 # Of Households

- 4.9 Road Networks

- 4.10 Led Penetration

- 4.11 Regulatory Framework

- 4.11.1 France

- 4.12 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Automotive Utility Lighting

- 5.1.1 Daytime Running Lights (DRL)

- 5.1.2 Directional Signal Lights

- 5.1.3 Headlights

- 5.1.4 Reverse Light

- 5.1.5 Stop Light

- 5.1.6 Tail Light

- 5.1.7 Others

- 5.2 Automotive Vehicle Lighting

- 5.2.1 2 Wheelers

- 5.2.2 Commercial Vehicles

- 5.2.3 Passenger Cars

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 GRUPO ANTOLIN IRAUSA, S.A.

- 6.4.2 HELLA GmbH & Co. KGaA

- 6.4.3 Horpol JIAT Horeczy Sp. k.

- 6.4.4 Luxor Lighting

- 6.4.5 Marelli Holdings Co., Ltd.

- 6.4.6 OSRAM GmbH.

- 6.4.7 Stanley Electric Co., Ltd.

- 6.4.8 Valeo

- 6.4.9 VIGNAL GROUP

- 6.4.10 ZKW Group

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219