|

市场调查报告书

商品编码

1683972

美国汽车 LED 照明:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)US Automotive LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

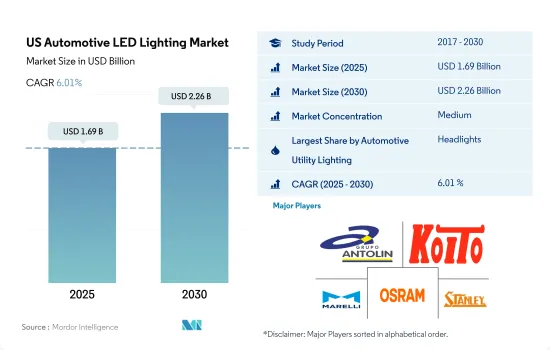

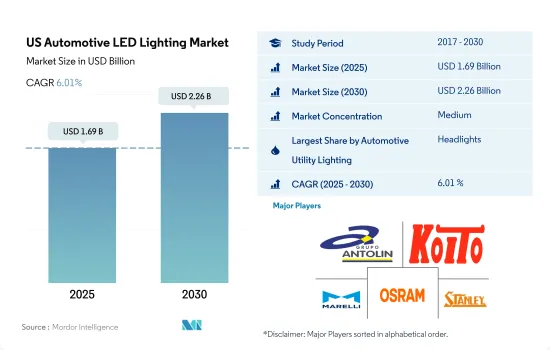

预计 2025 年美国汽车 LED 照明市场规模为 16.9 亿美元,到 2030 年将达到 22.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.01%。

电动车需求的增加和事故数量的增加正在推动市场成长

- 2020年,新冠疫情导致汽车LED产量下降,汽车半导体短缺。此外,中美贸易战导致关键原料取得困难,影响了供应链。

- 从金额份额来看,「其他」将在 2023 年占多数,其次是头灯 (35.1%)、方向灯 (DSL) (12.7%)、煞车灯、日间行车灯 (DRL)。在研究期间,预计所有照明领域的市场占有率将保持稳定,而其余领域的市场份额预计将略有下降。随着事故趋势上升, LED灯的普及率预计会增加。在美国,2022 年预计将有 46,000 人死于车祸。与大流行前的死亡率相比,这一数字增加了近 22%。

- 从销售份额来看,DSL 将在 2023 年占据最大份额 (26.2%),其次是头灯 (17.4%)、其他灯和煞车灯。预计预测期内所有精简版市场占有率将保持稳定,而 DSL 将略有下降。

- 在扩张和创新方面,美国是世界领先的汽车生产国。 2022年,美国汽车产业产量约1,006万辆。其中包括乘用车、轻型商用车、卡车、巴士和长途客车。市场上的主要汽车製造商都致力于扩大电动车的规模。充电和加油基础设施津贴计画将在五年内津贴25 亿美元。因此,NEV(近场电动车)的成长预计将增加汽车 LED 在市场的渗透率。

美国汽车 LED 照明市场趋势

汽车升级和电动车的兴起将推动 LED 照明的使用增加

- 预计2023年南美汽车产量将达到983万辆 新冠疫情对全球经济几乎所有国家和产业都产生了重大影响。汽车业受到的打击尤其严重,美国汽车销量从2019年到2020年下降了15%。根据汽车创新联盟的数据,2020年4月份总产量创下月度新低,该联盟计算出,截至3月底,美国93%的汽车生产已暂时停止。因此,产量低对 LED 晶片的需求产生了负面影响,而汽车产业需要 LED 晶片来生产 LED 灯。

- 一些顶级美国汽车製造商包括宝马、福特、通用汽车、本田、现代、起亚、特斯拉、日产、梅赛德斯-奔驰、丰田、大众和沃尔沃。这些製造商正在不断升级他们的汽车。近日,2023年4月,沃尔沃为沃尔沃EX90的内装整修了LED照明。整个系统由 72 个 SunLike LED 组成,安装在汽车内部,提供接近阳光的感觉。这些技术进步正在推动汽车领域对 LED 扩展的需求。

- 电动车(EV)市场正在迅速扩张,预计未来十年仍将继续成长。美国电动车销量从 2011 年占汽车总销量的 0.2% 成长到 2021 年的 4.6%。从 2011 年到 2021 年的 10 年间,道路上的电动车数量大幅增加,从约 2.2 万辆增加到 200 多万辆。因此,随着电动车的兴起,用于各种电动车应用的半导体晶片的需求也日益增长,这反过来又推动了对 LED 照明的需求。

政府透过税收优惠和资助电动车充电站对电动车製造业的投资将推动 LED 市场的发展

- 美国正在向电动车迈进。电动车正从汽车产业的异类变成未来的潮流,预计2022年其销量将成长65%。为进一步扩大规模,政府公布了2021年1兆美元的基础设施法案,其中拨款75亿美元用于在2030年前额外建设50万个公共电动汽车充电器,同时也透过为购买在美国组装的电动车提供7,500美元的税收优惠来投资电动车製造业。此外,电动车主要参与者之一特斯拉承诺到年终年底将在美国为其所有品牌的电动车提供约 3,500 个超级充电站和 4,000 个二级充电座。

- 2023 年 3 月,拜登-哈里斯政府宣布将开放一项新的数十亿美元计画的申请,用于资助全国城镇、指定道路、州际公路和主要路线沿线的电动车 (EV) 充电和替代燃料基础设施。 《两党基础设施法案》建立了新的美国运输部充电和加油基础设施(CFI)自由裁量补助计划,该计划将在五年内向广泛的申请者(包括城市、县、地方政府和部落)提供 25 亿美元补助。

- 到2030年,预计乔治亚、肯塔基州和密西根州将占据美国电动车电池製造的大部分份额。这种电动车电池生产能力将促进每年生产 1,000 万至 1,300 万辆全电动汽车,使美国成为全球电动车竞争对手。因此,上述案例将因电动车需求的增加而引发新发电厂的开发和生产,从而推动该国对汽车 LED 的需求。

美国汽车LED照明产业概况

美国汽车LED照明市场格局适度整合,前五大厂商合计占51.04%。该市场的主要企业有:GRUPO ANTOLIN IRAUSA,SA、KOITO MANUFACTURING、Marelli Holdings、OSRAM GmbH。以及史丹利电气(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 汽车产量

- 人口

- 人均收入

- 汽车贷款利率

- 充电站数量

- 汽车持有量

- LED进口总量

- 家庭数量

- 道路网络

- 渗透率

- 法律规范

- 美国

- 价值链与通路分析

第五章 市场区隔

- 汽车实用照明

- 日间行车灯 (DRL)

- 方向指示器

- 头灯

- 倒车灯

- 红绿灯

- 尾灯

- 其他的

- 汽车照明

- 二轮车

- 商用车

- 搭乘用车

第六章 竞争格局

- 主要策略趋势

- 市场占有率分析

- 业务状况

- 公司简介(包括全球概况、市场层级概况、主要业务部门、财务状况、员工人数、关键资讯、市场排名、市场占有率、产品和服务、最新发展分析)

- GRUPO ANTOLIN IRAUSA, SA

- HELLA GmbH & Co. KGaA(FORVIA)

- Hyundai Mobis

- KOITO MANUFACTURING CO., LTD.

- Marelli Holdings Co., Ltd.

- Nichia Corporation

- OSRAM GmbH.

- Signify(Philips)

- Stanley Electric Co., Ltd.

- Valeo

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源和进一步阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

The US Automotive LED Lighting Market size is estimated at 1.69 billion USD in 2025, and is expected to reach 2.26 billion USD by 2030, growing at a CAGR of 6.01% during the forecast period (2025-2030).

Growing demand for EVs and increasing number of accidents drive the market's growth

- In 2020, automotive LED production decreased because of the COVID-19 pandemic, leading to an automotive semiconductor shortage. The supply chain was also being impacted by difficulties in gaining access to key materials because of the China-US trade war.

- In terms of value share, in 2023, others accounted for the majority of the share, followed by headlights (35.1%), directional signal lights (DSL) (12.7%), stoplights, and daytime running lights (DRL). The market share is expected to remain the same for all lighting during the study period, with a small reduction in others. With the rising accident trend, the penetration rate of fog LED lamps is anticipated to rise. In the United States, the number of motor vehicle deaths reached an estimated 46,000 in 2022. Compared to the pre-pandemic death rate, it increased by nearly 22%.

- In terms of volume share, in 2023, DSL accounted for the majority of the share (26.2%), followed by headlights (17.4%), others, and stoplights. The market share is expected to remain the same for all the lights during the forecast period, with a small reduction in DSLs.

- In terms of expansion and innovations, the United States is one of the significant auto-producing nations in the world. In 2022, the auto industry in the United States produced approximately 10.06 million motor vehicles. It includes passenger cars, light commercial vehicles, heavy trucks, buses and coaches. The key automotive manufacturers in the market are focusing on expanding electric vehicles. The Charging and Fueling Infrastructure Grant Program would grant USD 2.5 billion over five years. Thus, the growth in NEVs (neighborhood electric vehicles) would increase the penetration of automotive LEDs in the market.

US Automotive LED Lighting Market Trends

Upgradation of automobiles and more EV are seen on road, indicating more use of LED lights

- The total automobile vehicle production in South America was expected to reach 9.83 million units in 2023. The COVID-19 pandemic significantly impacted almost every nation and sector of the global economy. The automotive industry was particularly exposed and badly affected, with a 15% decline in US vehicle sales from 2019 to 2020. In 2020, the total production in April was the lowest monthly production level, according to the Alliance for Automobile Innovation, which calculated that 93 percent of all automobile production in the United States was temporarily halted by late March. Thus, the low production negatively affected the demand for LED chips required to produce LED lights in the automotive industry.

- The top American automakers include BMW, Ford, General Motors, Honda, Hyundai, KIA, Tesla, Nissan, Mercedes-Benz, Toyota, Volkswagen, Volvo, and many more. These producers upgrade their automobiles constantly. Recently, in April 2023, Volvo renovated the inside of the Volvo EX90 using LED lighting. An entire system of 72 SunLike LEDs was installed inside the car to provide a near-sunlight sensation. Such technical advancement fuels the need to expand LED in the automobile sector.

- The market for electric cars (EVs) has expanded quickly and is anticipated to do so throughout the next ten years. From just 0.2 percent of all car sales in 2011 to 4.6 percent in 2021, electric car sales in the US grew. Over the decade of 2011-21, the number of EVs on the road increased significantly, from around 22,000 to over 2 million. As a result, the need for semiconductor chips used in various EV applications rises along with the popularity of EVs, raising the need for LED illumination.

Government investments in EV manufacturing by providing tax benefits and funding of EV charging stations to drive the LED market

- The United States is turning electric. Electric vehicles are transitioning from an outliner in the automotive industry to the wave of the future, with sales increasing by 65% in 2022. To expand further, the government issued a trillion-dollar infrastructure bill in 2021 that allocates USD 7.5 billion toward building 500,000 more public EV chargers by 2030 and also made investments in EV manufacturing by providing tax benefits of USD 7,500 for purchasing an EV assembled in the US. Also, Tesla, one of the significant players in EVs, committed to delivering around 3,500 of its US Supercharger stations and 4,000 Level 2 charging docks available to all brands of electric vehicles by the end of 2024.

- In March 2023, the Biden-Harris Administration announced the availability of applications for a new multibillion-dollar program to fund electric vehicle (EV) charging and alternative-fuel infrastructure in towns around the country and along designated roads, interstates, and major routes. The Bipartisan Infrastructure Act established the US Department of Transportation's new Charging and Fueling Infrastructure (CFI) Discretionary Grant Programme, which would grant USD 2.5 billion over five years to a wide range of applicants, including cities, counties, local governments, and Tribes.

- By 2030, Georgia, Kentucky, and Michigan are expected to dominate electric vehicle battery manufacturing in the United States. This EV battery manufacturing capacity will facilitate the production of 10 to 13 million all-electric vehicles per year, positioning the United States as a global EV competitor. Thus, the above instances lead to the development and production of new power stations because of the growing demand for EVs, which boosts the demand for automotive LEDs in the country.

US Automotive LED Lighting Industry Overview

The US Automotive LED Lighting Market is moderately consolidated, with the top five companies occupying 51.04%. The major players in this market are GRUPO ANTOLIN IRAUSA, S.A., KOITO MANUFACTURING CO., LTD., Marelli Holdings Co., Ltd., OSRAM GmbH. and Stanley Electric Co., Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Automotive Production

- 4.2 Population

- 4.3 Per Capita Income

- 4.4 Interest Rate For Auto Loans

- 4.5 Number Of Charging Stations

- 4.6 Number Of Automobile On-road

- 4.7 Total Import Of Leds

- 4.8 # Of Households

- 4.9 Road Networks

- 4.10 Led Penetration

- 4.11 Regulatory Framework

- 4.11.1 United States

- 4.12 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Automotive Utility Lighting

- 5.1.1 Daytime Running Lights (DRL)

- 5.1.2 Directional Signal Lights

- 5.1.3 Headlights

- 5.1.4 Reverse Light

- 5.1.5 Stop Light

- 5.1.6 Tail Light

- 5.1.7 Others

- 5.2 Automotive Vehicle Lighting

- 5.2.1 2 Wheelers

- 5.2.2 Commercial Vehicles

- 5.2.3 Passenger Cars

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 GRUPO ANTOLIN IRAUSA, S.A.

- 6.4.2 HELLA GmbH & Co. KGaA (FORVIA)

- 6.4.3 Hyundai Mobis

- 6.4.4 KOITO MANUFACTURING CO., LTD.

- 6.4.5 Marelli Holdings Co., Ltd.

- 6.4.6 Nichia Corporation

- 6.4.7 OSRAM GmbH.

- 6.4.8 Signify (Philips)

- 6.4.9 Stanley Electric Co., Ltd.

- 6.4.10 Valeo

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms