|

市场调查报告书

商品编码

1844621

银行业的 UCaaS:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)UCaaS In Banking - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

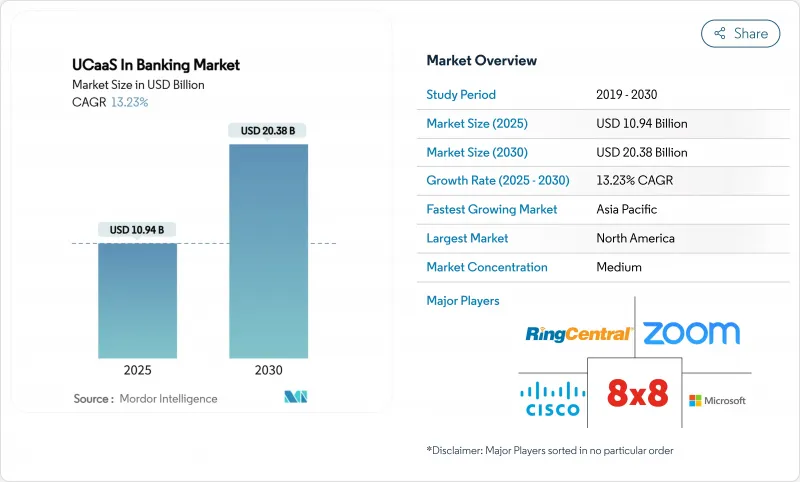

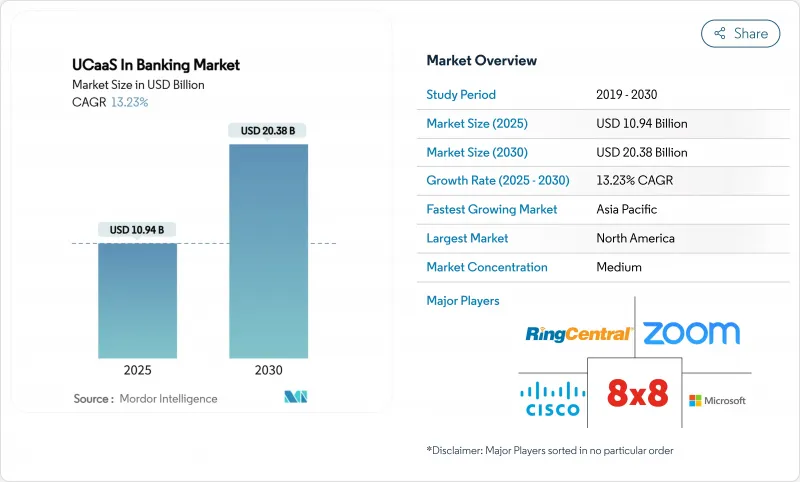

预计到 2025 年银行市场 UCaaS 将达到 109.4 亿美元,到 2030 年将达到 203.8 亿美元,复合年增长率为 13.23%。

这项市场扩张反映了产业向云端原生通讯的决定性转变,以维持混合劳动力并满足严格的监管审核追踪。对无缝客户参与、加速的金融科技伙伴关係以及更快的新数位产品上市时间日益增长的需求进一步推动了采用。虽然公共云端UCaaS 仍然很受欢迎,但随着银行寻求在不牺牲灵活容量的情况下获得细粒度的资料主权,混合架构正在兴起。巴克莱银行在全球推出 Microsoft Teams 等策略性采用正在推动整合平台的兴起,这些平台可简化传统语音安装、整合协作工具并降低整体拥有成本。随着通讯业者与结合人工智慧 (AI) 功能(例如即时语言翻译、情绪评分和合规性监控)的云端原生专家竞争,竞争正在加剧。

全球银行 UCaaS 市场趋势与洞察

BYOD 和行动办公

随着混合型员工逐渐将个人设备使用标准化,银行机构正逐渐摆脱对桌上型电话的依赖。 UCaaS 工具能够端对端加密流量、强制执行基于角色的策略并联合身份,使员工能够从任何地方进行连接,且不影响合规性。瑞穗证券决定将外部通讯迁移至 Zoom,并采用其主动主机收费模式,这清楚地表明了灵活的许可机制如何在保持审核的同时降低暂停状态席位成本。 BYOD 策略可以降低硬体支出并提高员工满意度,但需要先进的行动装置管理和地理围篱功能才能满足预防资料外泄法规的要求。行动性支援与 UCaaS 安全性之间的相互作用,巩固了能够兼顾灵活性和严格监管的银行的竞争优势。

企业范围 UC 整合的需求

过去,语音、聊天和交易大厅管道彼此孤立,阻碍了流畅的协作。现代 UCaaS 平台统一了这些接触点,并整合了工作流程触发器,以确保警报和文件在分店、客服中心和合规部门之间流畅地流动。 NTT Communications 透过单一租户全球 UC 架构支援 190 多个国家/地区,使跨国银行能够标准化拨号计画、报告和策略执行,同时降低维护开销。在合併期间,新收购的分店必须快速过渡,因此对整合的需求更加迫切。领先的解决方案现在应用人工智慧将问询路由到最合适的专家,从而提高首次呼叫解决率指标并优化人员配置。统一跨管道的血缘关係也简化了电子取证请求,监管机构预计该请求将在数小时内完成。

二、三线银行对云端统一通讯的认知度较低

区域性金融机构通常缺乏专业人员来评估统一通讯即服务 (UCaaS)提案,并预设透过现有业者进行传统电话通讯。美国评估警告称,有限的云端知识会使中小型银行面临潜在的弹性和网路风险,延长传统系统的使用时间,并限制其现代化进程。因此,教育加速器、蓝图模板和託管服务包在降低准入门槛方面发挥着至关重要的作用。提供迁移奖励、承包安全管理和监管文件的提供者可以解锁这一服务不足的群体。

細項分析

到2024年,语音通信将占银行统一通讯即服务(UCaaS)市场规模的42.5%,因为语音对于诈欺侦测、交易执行和客户身份验证至关重要。然而,随着视讯、持续聊天和共用文件工作区整合到单一管理平台,预计到2030年,协作套件的复合年增长率将达到18.50%。这种融合减少了客户关係经理的「椅子旋转」时间,加快了入职和问题解决速度。 Five9报告称,自然语言处理路由器现在可将80%的入境转接给合适的技能组,无需人工分类,从而降低了放弃率。统一通讯将电子邮件、简讯和安全聊天讯息压缩成一个执行绪历史记录,提高了合规性的审核。视讯银行自助服务终端将咨询服务扩展到农村地区,通讯平台API将双重认证语音通话直接嵌入到行动应用程式中。这种模组化设计使银行无需重新设计后端核心即可添加管道,从而增强了平台黏性并增加了转换成本。

随着银行透过应用程式内横幅广告、RCS 和 OTT 即时通讯应用程式等方式推出贷款核准通知、外汇提醒和卡片使用异常等情境通知,对嵌入式通讯的需求日益增长。 Webex CPaaS 银行模组透过 WhatsApp 和 Apple Messages 的开箱即用范本加速部署,同时保留加密和审核日誌记录功能。这种 API 优先的模型使开发人员能够编配各种流程,例如当高价值交易超过预设阈值时,聊天机器人会升级到安全视讯。 Gartner 预测,到 2030 年,API主导的管道将占金融服务出站流量的一半,这凸显了语音通信正逐渐从独立产品转变为整合套件中的基础服务。

在承包可扩展性和消费定价的推动下,公共云端将在2024年占据银行UCaaS市场份额的61.4%。然而,预计到2030年,混合云的复合年增长率将达到19.20%,反映出董事会对司法合规性和延迟敏感型工作负载的关注度日益提高。 First Horizon Bank迁移到Webex Contact Center采用了分层架构,将受监管的员工记录保存在本地,同时AI分析在思科的多租户云端中处理匿名资料。这一蓝图使该银行能够在单一主机上维护2万个终端和750名座席,而不会违反受託资料处理义务。

虽然私有云端仍然是拥有客製化加密和主权授权的全球性、系统重要性银行的一种选择,但资本和人员配置要求限制了其吸引力。混合策略支援分阶段迁移,允许逐步淘汰每个站点老化的PBX,并将流量透过会话边界控制器传输到云端核心。持续整合管道支援降级功能,例如噪音抑制和自动重新编辑,而无需停机。随着环境、社会和管治承诺的不断增加,工作负载弹性还可以减少閒置能源消耗,帮助银行实现碳减排目标。

全球银行整合通讯即服务 (UCaaS) 市场根据组件(语音通信、统一通讯、客服中心、协作平台等)、部署模型(公共云端、混合云端、私有云端)、组织规模(中小企业、大型企业)、银行应用(零售银行、企业和批发银行等)和地区进行细分。

区域分析

至2024年,北美银行业UCaaS市占率将维持36.7%,并利用成熟的云端法规和雄厚的预算进行企业现代化。巴克莱银行、瑞银集团和花旗集团是大规模部署的典范,它们将AI Copilot与协作套件结合,以简化顾问工作流程。虽然正在取得进展,但只有不到40%的公司完成了迁移,许多地区性银行仍然依赖老旧的PBX。因此,混合部署正成为主流,在转型动能与审慎的风险管理之间取得平衡。

到2030年,亚太地区将以14.80%的复合年增长率引领成长,因为行动优先的人口结构促使数位银行将语音和讯息直接嵌入其应用程式中。 NTT和Softbank Corporation等日本通讯业者将其UCaaS业务拓展至全球,而Vonage与当地整合商的伙伴关係则将东南亚各地的客服中心设施数位化。对话式人工智慧的采用正在加速,提高了首次解决率,并实现了全天候多语言支援。

在欧洲,对资料主权的日益重视促使银行青睐区域锁定的云端服务和主权伙伴关係关係。义大利裕信银行 (UniCredit) 斥资 4 亿美元收购 Vodeno,提供了一个包含智慧合约引擎的云端原生平台,满足 PSD2 开放银行要求并扩展了白牌功能。在中东和非洲,云端技术的采用正在超越传统的 PBX。例如,Ecobank 与Google云端合作,正在 35 个国家/地区推进一项由分析主导的包容性计划。这些市场凸显了统一通讯即服务 (UCaaS) 在实体店稀少地区弥合服务缺口方面的作用。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- BYOD 和行动办公

- 企业范围 UC 整合的需求

- 纯数位银行的兴起

- 支援 AI 的 UCaaS,用于合规性监控

- 5G专网

- 将 CPaaS 嵌入银行应用程式

- 市场限制

- 二、三线银行对云端统一通讯的认知度较低

- 严格的资料安全和居住要求

- 传统的本地 PBX 锁定

- 供应商 API 锁定风险

- 关键法规结构的评估

- 价值链分析

- 技术展望

- 五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 关键用例和案例研究

- 宏观经济因素对市场的影响

- 投资分析

第五章市场区隔

- 按组件

- 语音通信

- 统一通讯

- 客服中心

- 协作平台

- 视讯会议

- 通讯平台API

- 按部署模型

- 公共云端

- 私有云端

- 混合云端

- 按组织规模

- 大公司

- 小型企业

- 透过银行申请

- 零售银行

- 企业及批发银行业务

- 投资银行

- 支付及金融科技子公司

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲和纽西兰

- 其他亚太地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲国家

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- Microsoft Corporation

- Cisco Systems, Inc.

- RingCentral, Inc.

- 8x8, Inc.

- Zoom Video Communications, Inc.

- Avaya LLC

- Fuze, Inc.

- West Technology Group, LLC(formerly West UC)

- VOSS Solutions

- NetFortris, Inc.

- TetraVX(Netrix, LLC)

- Kurmi Software SAS

- Vonage Holdings Corp.

- Dialpad, Inc.

- Mitel Networks Corporation

- Revation Systems, Inc.

- NICE Ltd.

- Genesys Telecommunications Labs, Inc.

- Google LLC

- Amazon Web Services, Inc.

第七章 市场机会与未来展望

The UCaaS in banking market size stood at USD 10.94 billion in 2025 and is forecast to reach USD 20.38 billion by 2030, advancing at a 13.23% CAGR.

The expansion reflects a decisive industry shift toward cloud-native communications that sustain hybrid workforces and satisfy strict regulatory audit trails. Heightened demand for seamless customer engagement, accelerated fintech partnerships, and accelerated time-to-market for new digital products further uplift adoption. Public-cloud UCaaS remains pervasive, yet hybrid architectures are gaining ground as banks seek fine-grained data-sovereignty control without forfeiting the flexibility of elastic capacity. Strategic deployments-such as Barclays' global roll-out of Microsoft Teams-spotlight how integrated platforms rationalize legacy voice estates, consolidate collaboration tools and contain total cost of ownership. Competitive intensity is shaped by telecom incumbents battling cloud-native specialists that embed artificial-intelligence (AI) functions such as real-time language translation, sentiment scoring and compliance surveillance.

Global UCaaS In Banking Market Trends and Insights

BYOD and Workforce Mobility

Banking institutions are dismantling desk-phone dependencies as hybrid workforces normalize personal device use. UCaaS tools that encrypt traffic end-to-end, enforce role-based policies and federate identity allow staff to connect from any location without jeopardizing compliance. Mizuho Securities' decision to migrate external communications to Zoom under an active-host billing model underscores how flexible licensing reduces dormant seat costs while sustaining auditability. BYOD strategies cut hardware outlays and elevate employee satisfaction, yet they demand advanced mobile-device-management and geo-fencing to meet sectoral data-loss-prevention rules. The interplay between mobility enablement and UCaaS security solidifies competitive advantage for banks able to blend flexibility with rigorous supervision.

Need for Enterprise-wide UC Integration

Historically, siloed voice, chat and trading-floor channels obstructed fluid collaboration. Contemporary UCaaS platforms unify these touchpoints and embed workflow triggers so alerts and documents flow between branches, contact centers and compliance desks. NTT Communications underpins more than 190 countries with a single-tenant global UC fabric, allowing multinational banks to standardize dial plans, reporting and policy enforcement while trimming maintenance overhead. Integration imperatives intensify during mergers, when newly acquired branches must migrate rapidly. Leading solutions now apply AI to route queries to the best-suited specialist, elevating first-call-resolution metrics and optimizing workforce allocation. Unified lineage across channels also simplifies e-discovery requests, which regulators expect within hours.

Low Cloud-UC Awareness in Tier-2/3 Banks

Community institutions often lack specialist staff to evaluate UCaaS proposals, defaulting to incumbent telcos for plain-old telephony. A U.S. Treasury-commissioned assessment warns that limited cloud acumen exposes smaller banks to hidden resiliency and cyber risks, prolonging legacy usage and constraining modernization. Educational accelerators, blueprint templates and managed-service bundles therefore play a pivotal role in lowering entry barriers. Providers that extend migration incentives, turnkey security controls and regulatory documentation can unlock this underserved cohort.

Other drivers and restraints analyzed in the detailed report include:

- Digital-only Banking Expansion

- AI-Enabled UCaaS for Compliance Monitoring

- Stringent Data-Security and Residency Mandates

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Telephony accounted for 42.5% of the UCaaS in banking market size in 2024 as voice remains indispensable for fraud verification, trade execution and customer identity confirmation. Collaboration suites, however, are projected to drive an 18.50% CAGR through 2030 as video, persistent chat and shared-document workspaces coalesce into a single pane. The convergence reduces swivel-chair actions for relationship managers, speeding onboarding and issue resolution. Five9 reports that natural-language-processing routers now direct 80% of inbound calls to the correct skill group without human triage, trimming abandonment rates. Unified messaging compresses email, SMS and secure chat feeds into threaded histories, boosting compliance auditability. Video-banking kiosks extend advisory services to rural zones, while communication-platform APIs embed two-factor-authentication voice calls directly into mobile apps. This modularity ensures banks add channels without re-architecting back-end cores, reinforcing platform stickiness and raising switching costs.

Demand for embedded communications intensifies as banks deploy contextual notifications-loan-approval pings, FX-rate alerts and card-usage anomalies-through in-app banners, RCS and OTT messengers. Webex CPaaS banking modules deliver out-of-the-box templates for WhatsApp and Apple Messages, accelerating deployment while retaining encryption and audit logging. Such API-first models empower developers to orchestrate journeys where a chatbot escalates to secure video when high-value transactions exceed preset thresholds. Gartner predicts that by 2030, API-driven channels will account for half of financial-services outbound traffic, underscoring telephony's gradual transition from standalone product to foundational service within integrated suites.

Public-cloud captured 61.4% of UCaaS in banking market share in 2024 on the back of turnkey scalability and consumption pricing. Yet hybrid approaches, forecasting a 19.20% CAGR to 2030, reflect heightened boardroom focus on jurisdictional compliance and latency-sensitive workloads. First Horizon Bank's Webex Contact Center migration showcased a layered architecture where recordings of regulated staff remained on-prem while AI analytics processed anonymized data in Cisco's multitenant cloud. This blueprint allowed the bank to maintain 20,000 endpoints and 750 agents under one console without breaching fiduciary data-handling obligations.

Private-cloud remains an option for global systemically important banks with bespoke encryption and sovereignty mandates, although capital and staffing requirements curb its wider appeal. Hybrid strategies support phased migration: institutions can retire aging PBXs site by site, funneling traffic via session-border controllers to a cloud core. Continuous-integration pipelines then deliver feature drops such as noise suppression or auto-redaction without downtime. Given rising environmental, social and governance commitments, workload elasticity also lowers idle energy use, helping banks hit carbon-cut targets.

Global Unified Communication-As-A-Service (UCaaS) in Banking Market is Segmented by Component (Telephony, Unified Messaging, Contact Center, Collaboration Platform, and More), Deployment Model (Public Cloud, Hybrid Cloud, and Private Cloud), Organization Size (Small and Medium-Sized Enterprises, Large Enterprises), Banking Application (Retail Banking, Corporate and Wholesale Banking, and More), and Geography.

Geography Analysis

North America retained 36.7% UCaaS in banking market share in 2024, capitalizing on mature cloud regulations and sizeable budgets for enterprise modernization. Barclays, UBS and Citigroup exemplify large-scale deployments that marry collaboration suites with AI copilots to streamline advisor workflows . Despite headway, many regional banks remain tethered to depreciating PBXs, as less than 40% of businesses have completed migration. Hybrid rollouts therefore dominate, balancing transformation momentum with risk-management caution.

Asia-Pacific leads growth at 14.80% CAGR through 2030 as mobile-first demographics spur digital banks to embed voice and messaging directly in apps. Japanese carriers such as NTT and SoftBank export UCaaS footprints globally, while partnerships between Vonage and local integrators digitize contact-center estates throughout Southeast Asia. Conversational-AI adoption rises in concert, lifting first-contact resolution and enabling 24/7 multilingual servicing.

Europe emphasizes data-sovereignty, prompting banks to prefer region-locked clouds or sovereign partnerships. UniCredit's USD 400 million acquisition of Vodeno delivers a cloud-native platform with built-in smart-contract engines, aligning with PSD2 open-banking requisites while expanding white-label capabilities. In the Middle East and Africa, cloud adoption leapfrogs legacy PBX phases; for instance, Ecobank's alliance with Google Cloud powers analytics-driven inclusion programs across 35 nations. These markets underline UCaaS' role in bridging service gaps where physical branches remain sparse.

- Microsoft Corporation

- Cisco Systems, Inc.

- RingCentral, Inc.

- 8x8, Inc.

- Zoom Video Communications, Inc.

- Avaya LLC

- Fuze, Inc.

- West Technology Group, LLC (formerly West UC)

- VOSS Solutions

- NetFortris, Inc.

- TetraVX (Netrix, LLC)

- Kurmi Software SAS

- Vonage Holdings Corp.

- Dialpad, Inc.

- Mitel Networks Corporation

- Revation Systems, Inc.

- NICE Ltd.

- Genesys Telecommunications Labs, Inc.

- Google LLC

- Amazon Web Services, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 BYOD and workforce mobility

- 4.2.2 Need for enterprise-wide UC integration

- 4.2.3 Digital-only banking expansion

- 4.2.4 AI-enabled UCaaS for compliance monitoring

- 4.2.5 5G private branch networks

- 4.2.6 Embedded CPaaS in banking apps

- 4.3 Market Restraints

- 4.3.1 Low cloud-UC awareness in tier-2/3 banks

- 4.3.2 Stringent data-security and residency mandates

- 4.3.3 Legacy on-prem PBX lock-ins

- 4.3.4 Vendor API lock-in risk

- 4.4 Evaluation of Critical Regulatory Framework

- 4.5 Value Chain Analysis

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Key Use Cases and Case Studies

- 4.9 Impact on Macroeconomic Factors of the Market

- 4.10 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Telephony

- 5.1.2 Unified Messaging

- 5.1.3 Contact Center

- 5.1.4 Collaboration Platform

- 5.1.5 Video Conferencing

- 5.1.6 Communication-Platform APIs

- 5.2 By Deployment Model

- 5.2.1 Public Cloud

- 5.2.2 Private Cloud

- 5.2.3 Hybrid Cloud

- 5.3 By Organization Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium-Sized Enterprises

- 5.4 By Banking Application

- 5.4.1 Retail Banking

- 5.4.2 Corporate and Wholesale Banking

- 5.4.3 Investment Banking

- 5.4.4 Payment and FinTech Subsidiaries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Microsoft Corporation

- 6.4.2 Cisco Systems, Inc.

- 6.4.3 RingCentral, Inc.

- 6.4.4 8x8, Inc.

- 6.4.5 Zoom Video Communications, Inc.

- 6.4.6 Avaya LLC

- 6.4.7 Fuze, Inc.

- 6.4.8 West Technology Group, LLC (formerly West UC)

- 6.4.9 VOSS Solutions

- 6.4.10 NetFortris, Inc.

- 6.4.11 TetraVX (Netrix, LLC)

- 6.4.12 Kurmi Software SAS

- 6.4.13 Vonage Holdings Corp.

- 6.4.14 Dialpad, Inc.

- 6.4.15 Mitel Networks Corporation

- 6.4.16 Revation Systems, Inc.

- 6.4.17 NICE Ltd.

- 6.4.18 Genesys Telecommunications Labs, Inc.

- 6.4.19 Google LLC

- 6.4.20 Amazon Web Services, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment