|

市场调查报告书

商品编码

1849852

统一通讯即服务 (UCaaS):市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Unified Communication-as-a-Service (UCaaS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

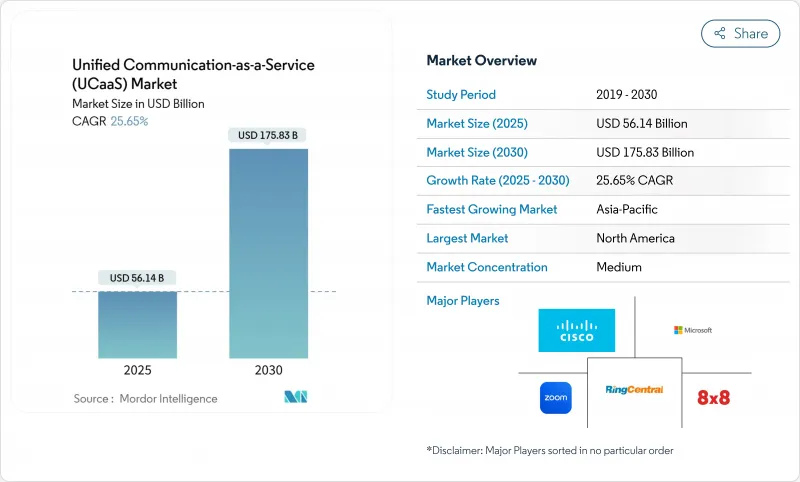

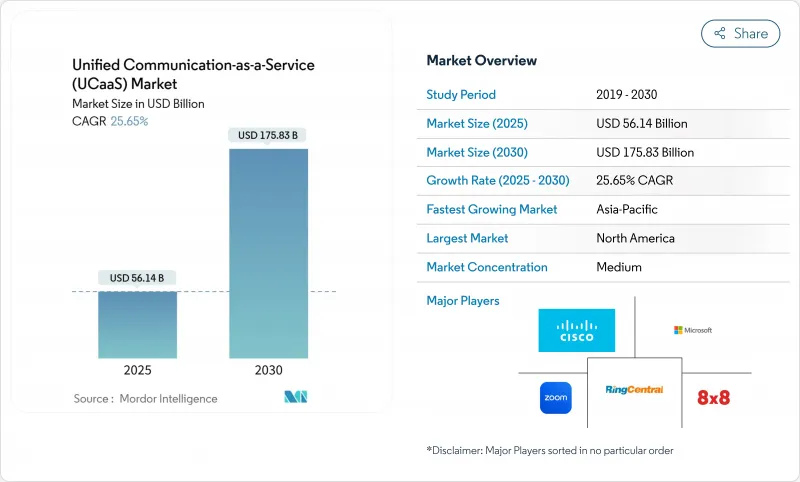

UCaaS 市场预计在 2025 年达到 561.4 亿美元,到 2030 年将达到 1,758.3 亿美元,复合年增长率为 25.65%。

这种快速扩张的驱动力源于企业范围内碎片化通讯工具的整合、人工智慧驱动的生产力功能带来的可衡量的投资回报率,以及云端语音通信应用的曲折点,而云端电话的应用范围远超基本的语音替代。虽然北美公司仍然占据最大的区域份额,但随着5G网路和行动优先策略解锁前沿用例,亚太地区正以两位数的速度成长。大型企业仍然是主要的收益来源,但注重成本的中小企业正在采用计量收费模式,这种模式既能减轻资本支出,又能增强弹性。将统一通讯即服务 (UCaaS) 与通讯即服务 (CCaaS) 和通讯即服务 (CPaaS) 整合的供应商正在扩大其市场份额,而以安全主导的区域资料驻留框架正成为塑造全球扩张的基本要求。

全球统一通讯即服务 (UCaaS) 市场趋势与洞察

计量收费的OPEX 模式吸引了注重成本的中小企业

託管式 UCaaS 解决方案使中小企业能够以可预测的月费取代资本密集的 PBX 系统,与本地电话相比,可节省高达 55% 的成本。因此,中小企业将成为成长最快的使用者群体,2024 年至 2030 年的复合年增长率将达到 27.8%。 51.3% 的中小企业将网路防御视为其首要技术重点,认为企业级云端防御优于本地防御。在亚太和拉丁美洲的新兴市场,网路防御的采用尤为强劲,这些地区的本地连接合作伙伴正在提供将语音、视讯和通讯与 5G 行动存取相结合的全託管服务。

远距和混合式工作政策强化了对随时随地工作的需求

91% 的雇主已实施弹性工作时间,98% 的会议至少有一名远距参与者。整合语音、视讯、聊天和文件共用的平台已成为关键任务基础设施,而非可有可无的工具。员工每天在多个应用程式之间切换浪费 36 分钟,这迫使资讯长整合重迭的服务。北美公司正在使用人工智慧辅助设备对过时的会议室进行现代化改造,这些设备可以自动框选发言者并产生即时字幕;而欧洲公司则优先考虑符合《通用资料保护规范》(GDPR)的隐私主导资料处理。

多供应商 UC 堆迭中的技能差距延长了迁移週期

企业认为,云端原生语音工程师和 API 整合专家的短缺是迁移的主要障碍,62% 的 IT 领导者表示迁移有延迟。大型企业难以在不停机的情况下整合传统的 PBX、SIP 中继和新的 AI 服务,这迫使他们转向成本高昂的系统整合商。这种瓶颈在银行业和医疗保健行业尤其明显,因为这些行业的安全监管正在延长计划进度。

細項分析

到2024年,语音通信将占据UCaaS市场份额的38.3%,而协作平台的复合年增长率将达到28.3%,这反映出其从纯语音转向整合视讯、聊天和内容共用的转变。随着资讯长追求生产力的提升,统一通讯和多方会议工具将继续成为预算优先事项。人工智慧增强功能(例如即时翻译、即时白板和自动行动追踪)的投资正在进行中,这些功能可将会议转化为企业知识。

预计到 2030 年,协作平台的 UCaaS 市场规模将达到 820 亿美元,这反映了所有垂直产业的应用。语音通信对于受监管的通话记录和紧急服务仍然至关重要,但商品化压力仍然强劲。供应商正在透过内建分析、服务水准保证和区域资料驻留来打造差异化,以满足公共部门的需求。

统一通讯即服务 (UCaaS) 市场按组件(语音通信、统一通讯等)、最终用户公司规模(大型企业、中小型企业)、垂直行业(BFSI、零售/电子商务、教育等)和地区细分。市场预测以美元计算。

区域分析

到2024年,北美将以43.4%的收入份额引领UCaaS市场,这得益于云端运算的广泛成熟、强大的宽频基础设施以及Microsoft Teams的普及。美国将进一步受益于FedRAMP授权产品带来的公共部门合约解锁。随着采用率接近饱和,成长已放缓至两位数的低位,但人工智慧整合、客服中心整合和第一线员工解决方案将继续推动支出成长动能。

在欧洲,英国、德国和法国的采用率正在稳定上升。 《一般资料保护规范》(GDPR)、《数位市场法案》以及即将推出的国家云端运算法规,促使企业更倾向于选择拥有本地资料中心和跨平台互通性的供应商。独立服务提供者透过提供符合语言要求和垂直合规法规的解决方案,正在赢得市场份额,尤其是在医疗保健和政府领域。

到2030年,亚太地区的复合年增长率将达到30.4%,位居榜首。 5G的全国普及、纯行动办公的劳动力以及政府主导的数位化议程,正在推动日本、韩国、新加坡和澳洲等国的5G应用。东南亚国家正在突破固网的限制,而云端原生UCaaS则能够满足中小企业的多语言需求和价格分布。如果目前的动能持续下去,预计到2030年,亚太地区的UCaaS市场规模将与北美匹敌。拉丁美洲、中东和非洲地区目前落后,但随着光纤和4G/5G的普及降低云端通讯的存取成本,预计未来机会将会增加。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 计量型的OPEX 模式吸引了注重成本的中小企业

- 远距和混合工作政策正在推动对随时随地工作的需求

- UCaaS、CCaaS 和 CPaaS 整合将增加钱包份额

- 人工智慧生产力(会议摘要、语音机器人)提高投资报酬率

- 适用于前线/现场作业的 5G 移动优先 UCaaS

- FedRAMP 级安全 UCaaS 推动受监管产业的采用

- 市场限制

- 多供应商 UC 堆迭中的技能差距延长了迁移週期

- 话费诈骗和 SIP 中继安全漏洞增加导致 TCO 上升

- 公共互联网Over-the-Top中的语音品质变化

- 国家资料主权法限制全球席次部署

- 供应链分析

- 监管格局

- 技术展望

- 波特五力模型

- 买方的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场规模及成长预测

- 按组件

- 电话

- 统一通讯

- 音讯/视讯会议

- 协作平台

- 按最终用户公司规模

- 小型企业

- 大公司

- 按最终用户

- BFSI

- 零售与电子商务

- 医疗保健和生命科学

- 政府和公共部门

- 资讯科技和通讯

- 教育

- 其他(製造业、旅馆业等)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 俄罗斯

- 西班牙

- 瑞士

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 新加坡

- 越南

- 印尼

- 其他亚太地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 奈及利亚

- 南非

- 其他非洲国家

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Microsoft Corp.

- Cisco Systems Inc.

- Zoom Video Communications Inc.

- RingCentral Inc.

- 8x8 Inc.

- Mitel Networks Corp.

- Verizon Communications Inc.

- BT Group plc

- Vodafone Group plc

- NTT Communications Corp.

- Telstra Corp. Ltd.

- Deutsche Telekom AG(T-Systems)

- Orange Business Services

- ATandT Inc.

- Nextiva Inc.

- Gamma Communications plc

- KPN NV

- Telia Co. AB

- PCCW Global

- Maxis Bhd.

- PLDT Enterprise

- Wildix

- Avaya LLC

第七章 市场机会与未来展望

The UCaaS market is valued at USD 56.14 billion in 2025 and is projected to reach USD 175.83 billion in 2030, advancing at a 25.65% CAGR.

The rapid expansion is fueled by enterprise-wide consolidation of fragmented communication tools, measurable ROI from AI-powered productivity functions, and an inflection point in cloud telephony adoption that now extends well beyond basic voice replacement. North American enterprises still account for the largest regional share, yet Asia-Pacific is growing at double-digit rates as 5G networks and mobile-first strategies unlock frontline use cases. Large organizations remain the primary revenue contributors, but cost-sensitive SMEs are embracing pay-as-you-go models that free them from capital outlays while enhancing resilience. Providers that integrate UCaaS with CCaaS and CPaaS are expanding wallet share, and security-driven regional data residency frameworks are becoming a baseline requirement that shapes global roll-outs.

Global Unified Communication-as-a-Service (UCaaS) Market Trends and Insights

Pay-as-you-go OPEX Model Attracts Cost-Sensitive SMEs

Hosted UCaaS solutions let smaller businesses replace capital-heavy PBX systems with predictable monthly fees, yielding up to 55% cost savings over premises-based telephony. SMEs consequently represent the fastest-growing user cohort, posting a 27.8% CAGR from 2024 to 2030. Security matters just as much as cost: 51.3% of SMEs cite cyber protection as their top technology priority, viewing enterprise-grade cloud defenses as superior to in-house safeguards. Uptake is particularly strong in emerging Asia-Pacific and Latin America, where local connectivity partners bundle voice, video, and messaging with 5G mobile access to deliver a fully managed service.

Remote and Hybrid Work Policies Cement Work-from-Anywhere Demand

Hybrid schedules are now permanent, with 91% of employers offering flexible work and 98% of meetings featuring at least one remote participant. A unified platform that combines voice, video, chat, and file sharing has become mission-critical infrastructure, not a discretionary tool. Employees lose 36 minutes daily when forced to juggle multiple apps, prompting CIOs to consolidate overlapping services. North American enterprises are modernizing outdated meeting rooms with AI-assisted devices that auto-frame speakers and generate live captions, while European firms emphasize privacy-led data handling in compliance with GDPR.

Skills Gap in Multi-Vendor UC Stacks Prolongs Migration Cycles

Enterprises cite a lack of cloud-native voice engineers and API integration specialists as the main impediment to migration, with 62% of IT leaders reporting delays. Larger organizations struggle to mesh legacy PBX, SIP trunking, and new AI services without downtime, forcing reliance on costly systems integrators. This bottleneck is particularly visible in banking and healthcare, where security scrutiny extends project timelines.

Other drivers and restraints analyzed in the detailed report include:

- Integration of UCaaS with CCaaS and CPaaS Broadens Wallet Share

- AI-Powered Productivity Features Lift ROI

- Rising Toll-Fraud and SIP-Trunk Security Breaches Inflate TCO

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Telephony accounted for 38.3% of UCaaS market share in 2024, yet collaboration platforms are growing at a 28.3% CAGR, echoing the pivot from stand-alone voice to integrated video, chat, and content sharing. Unified messaging and multi-party conferencing tools secure ongoing budget priority as CIOs seek productivity gains. Investments flow toward AI-enhanced features such as live translation, real-time whiteboarding, and automated action tracking that convert meetings into corporate knowledge.

The UCaaS market size for collaboration platforms is forecast to reach USD 82 billion by 2030, reflecting adoption across all verticals. Telephony remains essential for regulated call recording and emergency services, but commoditization pressures persist. Vendors differentiate via embedded analytics, guaranteed quality-of-service, and regional data residency that satisfy public-sector requirements.

Unified Communication-As-A-Service (UCaaS) Market is Segmented by by Component (Telephony, Unified Messaging and More), End-User Enterprise Size (Large Enterprises and Small and Medium Enterprises (SMEs)), End-User Vertical (BFSI, Retail and E-Commerce, Education and More) and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the UCaaS market with 43.4% revenue share in 2024 thanks to widespread cloud maturity, robust broadband infrastructure, and entrenched Microsoft Teams deployments. The United States further benefits from FedRAMP-certified offerings that unlock public-sector contracts. Growth is slowing to low-double digits as penetration nears saturation, yet AI integration, contact-center convergence, and frontline worker solutions keep spending momentum intact.

Europe follows with steady uptake in the United Kingdom, Germany, and France. GDPR, the Digital Markets Act, and impending national cloud regulations prompt enterprises to favor providers with local data centers and cross-platform interoperability. Independent service providers gain share by tailoring solutions to linguistic requirements and vertical compliance rules, especially in health and public administration.

Asia-Pacific delivers the strongest trajectory at a 30.4% CAGR through 2030. National 5G coverage, mobile-only workforces, and government-sponsored digital agendas propel adoption in Japan, South Korea, Singapore, and Australia. Southeast Asian nations are leapfrogging fixed-line limitations, with cloud-native UCaaS meeting multilingual needs and price points for SMEs. The UCaaS market size in Asia-Pacific is forecast to match North America by 2030 if current momentum continues. Latin America and the Middle East and Africa trail but show rising opportunity through fiber and 4G/5G roll-outs that lower access costs for cloud communications.

- Microsoft Corp.

- Cisco Systems Inc.

- Zoom Video Communications Inc.

- RingCentral Inc.

- 8x8 Inc.

- Mitel Networks Corp.

- Verizon Communications Inc.

- BT Group plc

- Vodafone Group plc

- NTT Communications Corp.

- Telstra Corp. Ltd.

- Deutsche Telekom AG (T-Systems)

- Orange Business Services

- ATandT Inc.

- Nextiva Inc.

- Gamma Communications plc

- KPN N.V.

- Telia Co. AB

- PCCW Global

- Maxis Bhd.

- PLDT Enterprise

- Wildix

- Avaya LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Pay-as-you-go OPEX model attracts cost-sensitive SMEs

- 4.2.2 Remote and hybrid work policies cement work-from-anywhere demand

- 4.2.3 Integration of UCaaS with CCaaS and CPaaS broadens wallet-share

- 4.2.4 AI-powered productivity (meeting summaries, voice bots) lifts ROI

- 4.2.5 5G-enabled mobile-first UCaaS in frontline/field operations

- 4.2.6 FedRAMP-grade secure-UCaaS unlocks regulated-industry adoption

- 4.3 Market Restraints

- 4.3.1 Skills gap in multi-vendor UC stacks prolongs migration cycles

- 4.3.2 Rising toll-fraud and SIP-trunk security breaches inflate TCO

- 4.3.3 Voice-quality variance on over-the-top public internet links

- 4.3.4 National data-sovereignty laws constrain global seat roll-outs

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Telephony

- 5.1.2 Unified Messaging

- 5.1.3 Audio / Video Conferencing

- 5.1.4 Collaboration Platforms

- 5.2 By End-user Enterprise Size

- 5.2.1 Small and medium enterprises

- 5.2.2 Large Enterprises

- 5.3 By End-user Vertical

- 5.3.1 BFSI

- 5.3.2 Retail and e-Commerce

- 5.3.3 Healthcare and Life Sciences

- 5.3.4 Government and Public Sector

- 5.3.5 IT and Telecom

- 5.3.6 Education

- 5.3.7 Others (Manufacturing, Hospitality, etc.)

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Russia

- 5.4.3.6 Spain

- 5.4.3.7 Switzerland

- 5.4.3.8 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 India

- 5.4.4.3 Japan

- 5.4.4.4 South Korea

- 5.4.4.5 Malaysia

- 5.4.4.6 Singapore

- 5.4.4.7 Vietnam

- 5.4.4.8 Indonesia

- 5.4.4.9 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Middle East

- 5.4.5.1.1 Saudi Arabia

- 5.4.5.1.2 United Arab Emirates

- 5.4.5.1.3 Turkey

- 5.4.5.1.4 Rest of Middle East

- 5.4.5.2 Africa

- 5.4.5.2.1 Nigeria

- 5.4.5.2.2 South Africa

- 5.4.5.2.3 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Microsoft Corp.

- 6.4.2 Cisco Systems Inc.

- 6.4.3 Zoom Video Communications Inc.

- 6.4.4 RingCentral Inc.

- 6.4.5 8x8 Inc.

- 6.4.6 Mitel Networks Corp.

- 6.4.7 Verizon Communications Inc.

- 6.4.8 BT Group plc

- 6.4.9 Vodafone Group plc

- 6.4.10 NTT Communications Corp.

- 6.4.11 Telstra Corp. Ltd.

- 6.4.12 Deutsche Telekom AG (T-Systems)

- 6.4.13 Orange Business Services

- 6.4.14 ATandT Inc.

- 6.4.15 Nextiva Inc.

- 6.4.16 Gamma Communications plc

- 6.4.17 KPN N.V.

- 6.4.18 Telia Co. AB

- 6.4.19 PCCW Global

- 6.4.20 Maxis Bhd.

- 6.4.21 PLDT Enterprise

- 6.4.22 Wildix

- 6.4.23 Avaya LLC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment