|

市场调查报告书

商品编码

1906228

义大利资讯通信技术市场:市场份额分析、行业趋势和统计数据、成长预测(2026-2031 年)Italy ICT - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

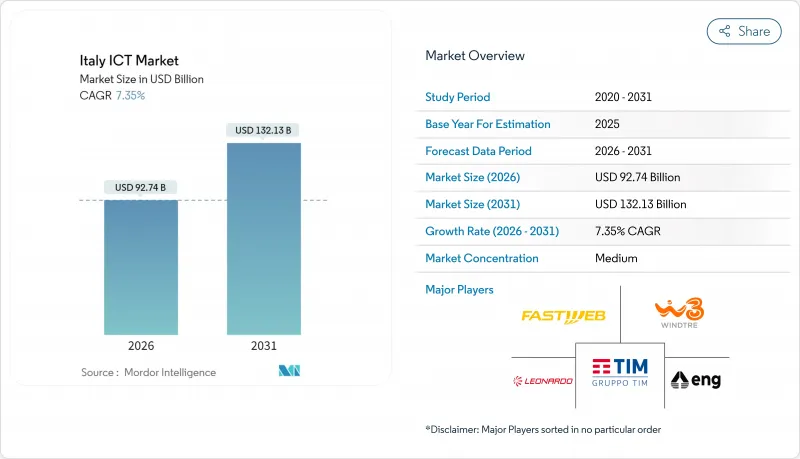

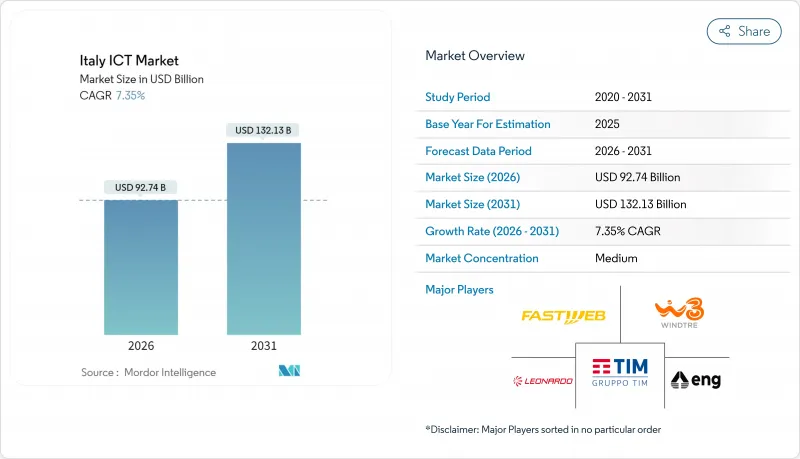

2025 年义大利 ICT 市场规模价值为 863.9 亿美元,预计将从 2026 年的 927.4 亿美元增长到 2031 年的 1321.3 亿美元,在预测期(2026-2031 年)内复合年增长率为 7.35%。

目前的成长势头得益于政府的《国家復苏与韧性计划》、私营部门的资本流入以及向自主云架构的快速转型,这些转型减少了对旧有系统的依赖。北部製造中心的边缘运算试点、全国范围内的5G网路密集化以及网路安全的快速投入,正在推动以数据为中心的服务转型。同时,来自超大规模资料中心业者和本土营运商的加大投资,正使义大利ICT市场成为欧洲数位价值链的核心参与者。 Fastweb和沃达丰的合併加剧了竞争,在现有营运商TIM的基础设施之外,又出现了一个完整的网络,从而扩大了连接选择范围并降低了价格。

义大利资讯通信技术市场趋势与洞察

NRRP资助的数位投资激增

「转型5.0计画」已向企业数位化和能源效率领域注入138亿美元,订单。欧盟復苏资金至少20%必须用于数位化目标的分配规则,进一步增强了支出的永续性。在义大利南部(梅佐焦尔诺)建立本地供应基地的供应商将受益于3.27亿美元的义大利南部预算拨款,该拨款旨在缩小区域差距,并满足传统服务不足地区不断增长的需求。这一轮资金支持将持续到2029年,为系统整合商和营运商创造可预测的业务管道。

企业云端迁移加速

义大利电信(TIM)2024年云端业务营收成长19%,其中网路安全部门销售额翻番,显示云端采用与安全需求成长之间存在关联。微软正在投资47亿美元在义大利新建资料中心区域和人工智慧研究实验室,而亚马逊云端服务(AWS)也在边缘区域投资13亿美元,预计五年内将为义大利GDP贡献9.58亿美元。这些倡议透过降低延迟、满足数据主权法规要求以及吸引应用开发加入本地生态系统,正在重振义大利的ICT市场。结合本地可用区和本地边缘伺服器的混合架构如今已成为主要製造商和银行的标配,并将加速到2027年的工作负载迁移。

数位技能短缺

只有45%的义大利人具备基本的数位技能,低于欧盟设定的2030年80%的目标。目前,义大利网路安全专业人员缺口已超过1万人,到2027年,资讯通讯技术(ICT)人才缺口可能高达17.5万人,这将导致薪资上涨和计划週期延长。义大利大学每年培养4.4万名ICT毕业生,而全国实际需要8.8万人。这迫使企业要么引进人才,要么将专业任务外包。儘管国家復苏与韧性计画(PNRR)以及私立院校的技能发展计画展现出一定的成效,但结构性改善预计要到2028年才能实现,义大利ICT市场的成长预计将会趋于平缓。

细分市场分析

截至2025年,电信服务将占义大利资讯通信技术(ICT)市场的34.12%,反映出义大利在5G和光纤回程传输的大规模投资。随着银行、公共产业和公共机构在国家网路安全策略的指导下加强关键业务,IT安全/网路安全产业正以12.4%的复合年增长率快速成长。预计到2025年,义大利与安全相关的ICT市场规模将达到24.7亿美元,其中24亿美元将用于威胁预防计划。

预计2025年至2026年间,义大利将投资109亿美元建置边缘资料中心,将推动硬体销售成长;同时,零售和物流行业的云端原生开发和低程式码应用也将带动软体需求。中小企业将外包转型工作,IT供应商将从中受益;随着超大规模云端服务商在地化,云端超大规模资料中心业者产业也将实现两位数成长。这些因素共同推动义大利ICT市场维持成长势头,摆脱对传统电信收入来源的依赖。

大型企业凭藉多年数位化策略和内部IT团队的支持,将在2025年占据义大利ICT市场59.15%的份额,它们目前优先考虑人工智慧增强型分析、自主资料架构和零信任架构。同时,中小企业的支出将以7.95%的复合年增长率成长,缩小数位落差,释放潜在需求。一项价值3.27亿美元的代金券计画以及义大利南部地区的宽频补贴政策降低了进入门槛。

然而,中小企业的采购仍然分散,营运商越来越多地将网路连接、云端服务和安全性整合到固定价格套餐中。由于这些整合服务,Fastweb 和沃达丰企业部门在 2025 年第一季实现了 2.7% 的营收成长。那些能够提供用户友好型入口网站、双语支援和按需付费模式的供应商,将有机会在义大利 ICT 市场抓住新的机会。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 市场定义与研究假设

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- NRRP资助的数位投资激增

- 企业正快速迁移到云端。

- 全国范围内的5G和FTTH部署

- 促进主权云和 GAIA-X 合规性

- 製造丛集中的边缘运算

- 公共部门混合云端(PSN) 迁移

- 市场限制

- 数位技能短缺

- 宏观经济和能源价格波动

- 中小企业资讯通信技术采购分散化问题

- 6G频段监理延迟

- 价值/供应链分析

- 重要法规结构评估

- 关键相关人员影响评估

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 宏观经济因素的影响

第五章 市场规模与成长预测

- 按类型

- IT硬体

- 电脑硬体

- 网路装置

- 周边设备

- IT软体

- IT服务

- 託管服务

- 业务流程服务

- 商业咨询服务

- 云端服务

- IT基础设施/资料中心

- IT安全/网路安全

- 解决方案

- 应用程式安全

- 云端安全

- 资料安全

- 身分和存取管理

- 基础设施保护

- 综合风险管理

- 网路安全设备

- 其他解决方案

- 服务

- 专业服务

- 託管服务

- 解决方案

- 通讯服务

- IT硬体

- 按最终用户公司规模划分

- 小型企业

- 大公司

- 按最终用户行业划分

- BFSI

- 资讯科技和电信

- 政府机构

- 零售与电子商务

- 製造业

- 卫生保健

- 能源与公共产业

- 其他的

- 透过部署模式

- 本地部署

- 云

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Telecom Italia SpA(TIM)

- Fastweb SpA

- Vodafone Italia SpA

- Wind Tre SpA

- Leonardo SpA

- IBM Italia SpA

- Accenture SpA

- Capgemini Italia SpA

- Oracle Italia Srl

- Microsoft Italia Srl

- Google Cloud Italy Srl

- Amazon Web Services Italy Srl

- Engineering Ingegneria Informatica SpA

- Reply SpA

- AlmavivA SpA

- SIA SpA(Nexi Group)

- Dedagroup SpA

- Aruba SpA

- Dell Technologies Italy Srl

- Hewlett Packard Enterprise Italia Srl

- SAP Italia SpA

- Cisco Systems Italy Srl

- Italtel SpA

- InfoCert SpA

第七章 市场机会与未来趋势

- 评估差距和未满足的需求

The Italy ICT market was valued at USD 86.39 billion in 2025 and estimated to grow from USD 92.74 billion in 2026 to reach USD 132.13 billion by 2031, at a CAGR of 7.35% during the forecast period (2026-2031).

Current momentum stems from the government's National Recovery and Resilience Plan, private-sector capital inflows, and rapid migration toward sovereign cloud architectures that reduce legacy system dependence. Edge computing pilots in Northern manufacturing hubs, nationwide 5G densification, and fast-growing cybersecurity spend reinforce the shift toward data-centric services. At the same time, heightened investment from hyperscalers and domestic operators positions the Italy ICT market as a core part of Europe's digital value chain. Competitive intensity has risen following the Fastweb + Vodafone integration, which introduced a second full-service network alongside incumbent TIM's infrastructure, enabling broader connectivity options and nudging prices lower.

Italy ICT Market Trends and Insights

NRRP-funded Digital Investment Surge

The Piano Transizione 5.0 channelled USD 13.8 billion into enterprise digitalisation and energy efficiency, triggering record purchase orders for cloud, cybersecurity, and data integration tools . Allocation rules that earmark at least 20% of EU Recovery funds for digital objectives further extend the spending runway. Vendors that establish local delivery facilities in Mezzogiorno benefit from a USD 327 million Southern Italy budget line, which addresses regional gaps while lifting demand in traditionally underserved provinces. The funding cycle supports the Italy ICT market through 2029, creating a predictable pipeline for system integrators and telecom carriers.

Rapid Enterprise Cloud Migration

TIM recorded 19% cloud revenue growth in 2024, while its cybersecurity unit doubled sales, proving the link between cloud adoption and stronger security demand . Microsoft pledged USD 4.7 billion for new Italian data-center regions and AI labs, and AWS added USD 1.3 billion for edge zones that will inject USD 958 million into GDP over five years. These moves lower latency, address data-sovereignty rules, and draw application developers into local ecosystems, fuelling the Italy ICT market. Hybrid architectures that combine local availability zones with on-premise edge servers are now standard for large manufacturers and banks, accelerating workload migration through 2027.

Digital-Skills Deficit

Only 45% of Italians hold basic digital capabilities, below the EU's 80% target for 2030. Unfilled cybersecurity roles already exceed 10,000, and a 175,000-person ICT shortage is possible by 2027, squeezing wages and elongating project cycles. Universities produce 44,000 ICT graduates per year against 88,000 needed, prompting firms to import talent or outsource specialised tasks. Upskilling programmes in the PNRR and private academies help, yet structural relief will not arrive before 2028, capping the growth pace of the Italy ICT market.

Other drivers and restraints analyzed in the detailed report include:

- Nationwide 5G and FTTH Roll-out

- Sovereign-Cloud and GAIA-X Compliance Push

- Macroeconomic and Energy-Price Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Communication Services contributed a 34.12% share to the Italy ICT market in 2025, reflecting sizeable 5G and fiber backhaul capex. IT Security/Cybersecurity is expanding at an 12.4% CAGR as banks, utilities, and public agencies harden critical workloads under the National Cybersecurity Strategy. The Italy ICT market size for security reached USD 2.47 billion in 2025 and is projected to grow alongside USD 2.4 billion earmarked for threat-defence projects.

Edge-enabled data-center builds worth USD 10.9 billion for 2025-2026 elevate hardware sales, while software demand is fuelled by cloud-native development and low-code adoption in retail and logistics. IT Services vendors benefit from SMEs that outsource transformation tasks, and cloud units record double-digit gains as hyperscalers localise capacity. Together these shifts indicate the Italy ICT market will carry momentum beyond traditional telecom revenue streams.

Large Enterprises captured 59.15% of the Italy ICT market in 2025 thanks to multi-year digital agendas and in-house IT teams. They now prioritise AI-enhanced analytics, sovereign data fabrics, and zero-trust architectures. Conversely, SMEs are expected to expand spending at 7.95% CAGR, narrowing the digital divide and broadening addressable demand. Voucher schemes worth USD 327 million in Southern Italy, plus subsidised broadband tariffs, lower entry barriers.

SME procurement, however, remains fragmented, prompting operators to bundle connectivity, cloud, and security into fixed-price packages. Fastweb + Vodafone's Enterprise Business Unit posted 2.7% revenue growth in Q1 2025 on these converged offers. Vendors that combine user-friendly portals, bilingual support, and pay-as-you-grow terms are positioned to capture incremental Italy ICT market opportunities.

Italy ICT Market Report is Segmented by Type (IT Hardware [Computer Hardware, and More], IT Software, IT Services [Managed Service, and More], IT Infrastructure, and More), End-User Enterprise Size (Small and Medium Enterprise, Large Enterprises), End-User Industry (BFSI, IT and Telecom, and More), and Deployment Mode (On-Premise, Cloud). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Telecom Italia S.p.A. (TIM)

- Fastweb S.p.A.

- Vodafone Italia S.p.A.

- Wind Tre S.p.A.

- Leonardo S.p.A.

- IBM Italia S.p.A.

- Accenture S.p.A.

- Capgemini Italia S.p.A.

- Oracle Italia S.r.l.

- Microsoft Italia S.r.l.

- Google Cloud Italy S.r.l.

- Amazon Web Services Italy S.r.l.

- Engineering Ingegneria Informatica S.p.A.

- Reply S.p.A.

- AlmavivA S.p.A.

- SIA S.p.A. (Nexi Group)

- Dedagroup S.p.A.

- Aruba S.p.A.

- Dell Technologies Italy S.r.l.

- Hewlett Packard Enterprise Italia S.r.l.

- SAP Italia S.p.A.

- Cisco Systems Italy S.r.l.

- Italtel S.p.A.

- InfoCert S.p.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Market Definition and Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 NRRP-funded digital investment surge

- 4.2.2 Rapid enterprise cloud migration

- 4.2.3 Nationwide 5G and FTTH roll-out

- 4.2.4 Sovereign-cloud and GAIA-X compliance push

- 4.2.5 Edge computing in manufacturing clusters

- 4.2.6 Public-sector hybrid cloud (PSN) transition

- 4.3 Market Restraints

- 4.3.1 Digital-skills deficit

- 4.3.2 Macroeconomic and energy-price volatility

- 4.3.3 Fragmented SME ICT procurement

- 4.3.4 Regulatory delay for 6G spectrum

- 4.4 Value / Supply-Chain Analysis

- 4.5 Evaluation of Critical Regulatory Framework

- 4.6 Impact Assessment of Key Stakeholders

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Impact of Macro-economic Factors

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 IT Hardware

- 5.1.1.1 Computer Hardware

- 5.1.1.2 Networking Equipment

- 5.1.1.3 Peripherals

- 5.1.2 IT Software

- 5.1.3 IT Services

- 5.1.3.1 Managed Services

- 5.1.3.2 Business Process Services

- 5.1.3.3 Business Consulting Services

- 5.1.3.4 Cloud Services

- 5.1.4 IT Infrastructure / Data Centers

- 5.1.5 IT Security / Cybersecurity

- 5.1.5.1 Solutions

- 5.1.5.1.1 Application Security

- 5.1.5.1.2 Cloud Security

- 5.1.5.1.3 Data Security

- 5.1.5.1.4 Identity and Access Management

- 5.1.5.1.5 Infrastructure Protection

- 5.1.5.1.6 Integrated Risk Management

- 5.1.5.1.7 Network Security Equipment

- 5.1.5.1.8 Other Solutions

- 5.1.5.2 Services

- 5.1.5.2.1 Professional Services

- 5.1.5.2.2 Managed Services

- 5.1.5.1 Solutions

- 5.1.6 Communication Services

- 5.1.1 IT Hardware

- 5.2 By End-user Enterprise Size

- 5.2.1 Small and Medium Enterprises

- 5.2.2 Large Enterprises

- 5.3 By End-user Industry

- 5.3.1 BFSI

- 5.3.2 IT and Telecom

- 5.3.3 Government

- 5.3.4 Retail and E-commerce

- 5.3.5 Manufacturing

- 5.3.6 Healthcare

- 5.3.7 Energy and Utilities

- 5.3.8 Others

- 5.4 By Deployment Mode

- 5.4.1 On-premise

- 5.4.2 Cloud

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Telecom Italia S.p.A. (TIM)

- 6.4.2 Fastweb S.p.A.

- 6.4.3 Vodafone Italia S.p.A.

- 6.4.4 Wind Tre S.p.A.

- 6.4.5 Leonardo S.p.A.

- 6.4.6 IBM Italia S.p.A.

- 6.4.7 Accenture S.p.A.

- 6.4.8 Capgemini Italia S.p.A.

- 6.4.9 Oracle Italia S.r.l.

- 6.4.10 Microsoft Italia S.r.l.

- 6.4.11 Google Cloud Italy S.r.l.

- 6.4.12 Amazon Web Services Italy S.r.l.

- 6.4.13 Engineering Ingegneria Informatica S.p.A.

- 6.4.14 Reply S.p.A.

- 6.4.15 AlmavivA S.p.A.

- 6.4.16 SIA S.p.A. (Nexi Group)

- 6.4.17 Dedagroup S.p.A.

- 6.4.18 Aruba S.p.A.

- 6.4.19 Dell Technologies Italy S.r.l.

- 6.4.20 Hewlett Packard Enterprise Italia S.r.l.

- 6.4.21 SAP Italia S.p.A.

- 6.4.22 Cisco Systems Italy S.r.l.

- 6.4.23 Italtel S.p.A.

- 6.4.24 InfoCert S.p.A.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-space and Unmet-need Assessment