|

市场调查报告书

商品编码

1911430

印度资讯通信技术:市场份额分析、产业趋势与统计、成长预测(2026-2031)India ICT - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

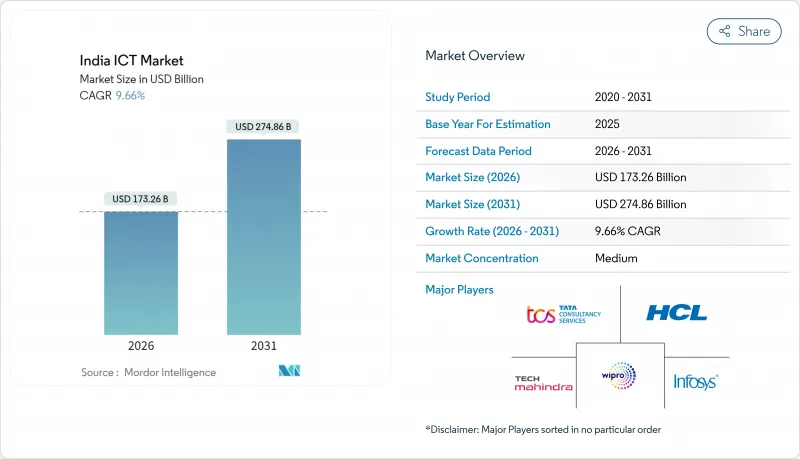

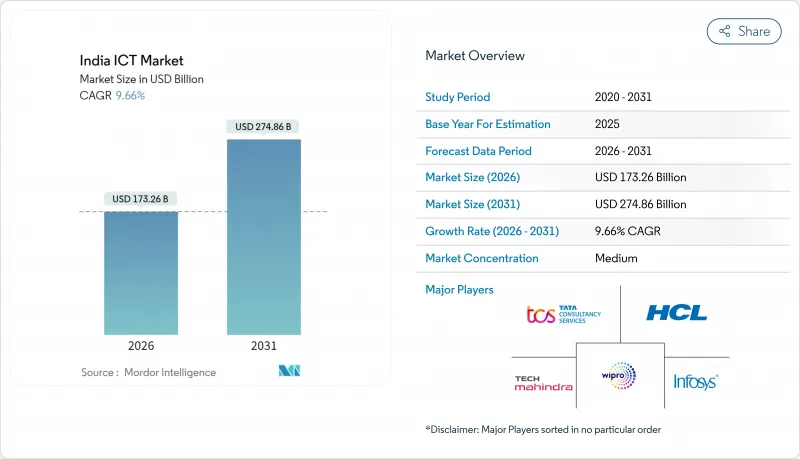

印度资讯通信技术市场规模预计到 2026 年将达到 1,732.6 亿美元,高于 2025 年的 1,580 亿美元。

预计到 2031 年,该市场规模将达到 2,748.6 亿美元,从 2026 年到 2031 年的复合年增长率为 9.66%。

这一成长轨迹反映了印度资讯通信技术市场受益于政府数位化项目、创纪录的企业云端迁移以及快速增长的消费者连接。大规模超大规模资料中心业者计划、蓬勃发展的Start-Ups生态系统以及与生产连结奖励计画,持续推动技术投资从成本优化转向策略差异化。通讯业者正在将5G网路扩展到二线城市,而企业则将预算重新分配到云端原生架构、人工智慧和网路安全领域。儘管人才短缺和农村地区最后一公里光纤覆盖不足限制了原本强劲的成长前景,但持续的技能培训倡议和BharatNet的推出有望在中期内推动市场改善。

印度资讯通信技术市场趋势与洞察

政府的「数位印度」计画和与生产连结奖励计画将促进企业科技支出。

生产连结奖励计画计画已吸引14.6兆卢比的投资,并创造了125兆卢比的生产价值,使印度电子製造业产能从2014年的24兆卢比成长到2024年的98兆卢比。印度人工智慧使命已拨款12.5亿美元用于运算、创新和Start-Ups融资,以建立国家人工智慧基础设施。 82%的执行长计划在2025年将其数位化预算增加5%以上,以应对合规义务和竞争需求。执行长(NIC)将IT容量扩展至1000兆瓦,储存容量扩展至100PB,这表明政府对公共基础设施的长期承诺,并将转化为对私人技术的需求。这些措施将透过确保强大的国内供应链、加速企业现代化以及推动超大规模资料中心业者资料中心计划,来增强印度的资讯通讯技术市场。

后疫情时代加速云采用

67%的印度企业已将工作负载迁移到云端平台,混合云环境已成为主流部署模式。预计2028年,公共云端收入将达242亿美元,复合年增长率达23.8%。微软、亚马逊和谷歌等超大规模资料中心业者云端服务商将投资2,17亿美元,用于建立符合资料主权规范和效能目标的在地化基础设施。企业人工智慧支出成长率是整体数位支出的2.2倍,并依赖提供可扩展运算和现成机器学习服务的云端平台。云端原生架构能够加速产品週期,并大幅减少营运瓶颈,进而增强印度资讯通讯技术市场早期采用者的竞争优势。

尖端领域存在技能缺口与高离职率

由于人工智慧、云端架构和网路安全领域的人才需求远超供给,目前约有30万个技术职缺。专业离职率率高于行业平均水平,他们纷纷转向全球发展机会和Start-Ups,导致企业内部知识流失。薪资上涨推高了计划成本,挤压了印度资讯通讯技术(ICT)市场服务供应商的利润空间。健康资讯学和工业IoT等领域的专业人才短缺加剧了这一困境,因为大学难以即时调整课程。除非技能再培训专案能够迅速扩大规模,否则交付速度和创新步伐都将面临放缓的风险。

细分市场分析

到2025年,电信服务将占印度资讯通信技术(ICT)市场的36.50%,这主要得益于4G和5G的广泛部署以及稳定的频谱政策。硬体需求正随着生产关联激励(PLI)计划的实施而同步增长,该计划鼓励设备和组件製造的本地化,从而降低进口依赖并加强供应链。随着企业将分析技术融入业务流程,软体(尤其是人工智慧平台)的采用率正经历两位数的成长。 IT服务正持续从人员增补模式转向咨询主导、以结果基本契约,从而确保利润率。云端服务虽然规模较小,但预计将以15.71%的复合年增长率(CAGR)实现最快成长,这反映了资料中心建设的推进以及企业向营运支出(OPEX)模式的转变。

云端服务的强劲发展势头正助力基础设施即服务 (IaaS)、平台即服务 (PaaS)和软体即服务(SaaS) 在印度资讯通讯技术 (ICT) 市场中占据越来越大的份额。电信公司正利用其基地台资源提供边缘云端服务,而硬体供应商则向国内原始设备製造商 (OEM) 提供人工智慧优化晶片。软体供应商正与超大规模资料中心业者中心营运商合作,提供包含生成式人工智慧的垂直整合解决方案,从而创造交叉销售协同效应。整体而言,随着新的云端原生企业逐步取代传统的託管服务合同,市场竞争日益激烈。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 行动数据消费量的爆炸性成长和价格实惠的 4G/5G费率方案

- 政府的「数位印度」计画和生产连结奖励计画(PLI)将促进企业在技术方面的支出。

- 后疫情时代加速云采用

- 微企业数位商务的快速成长

- 超大规模资料中心业者资料中心在区域城市的扩张(此趋势鲜为人知)

- 气候科技对绿色资料中心的需求

- 市场限制

- 尖端领域存在技能缺口与高离职率

- 农村地区最后一公里光纤网路的碎片化

- 供应链对进口半导体的依赖性

- 电力成本波动影响资料中心投资报酬率

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 投资分析

第五章 市场规模与成长预测

- 按类型

- 硬体

- 电脑硬体

- 网路装置

- 周边设备

- IT软体

- IT服务

- 託管服务

- 业务流程服务

- 商业咨询服务

- 云端服务

- IT基础设施

- IT安全

- 通讯服务

- 硬体

- 按最终用户公司规模划分

- 大公司

- 小型企业

- 按行业

- BFSI

- 政府和公共机构

- 零售、电子商务与物流

- 製造业和工业4.0

- 医疗保健和生命科学

- 游戏和电子竞技

- 石油和天然气(上游、中游、下游)

- 能源与公共产业

- 其他行业

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Tata Consultancy Services Ltd

- HCL Technologies Ltd

- Infosys Ltd

- Tech Mahindra Ltd

- Wipro Ltd

- Bharti Airtel Ltd

- Reliance Jio Infocomm Ltd

- Vodafone Idea Ltd

- IBM India Pvt Ltd

- Accenture Solutions Pvt Ltd

- Capgemini Technology Services India Ltd

- Mphasis Ltd

- Mindtree Ltd

- Larsen & Toubro Infotech Ltd

- Oracle India Pvt Ltd

- Cisco Systems India Pvt Ltd

- Amazon Internet Services Pvt Ltd(AWS India)

- Google Cloud India Pvt Ltd

- Microsoft Corporation India Pvt Ltd

- Dell Technologies India

- Hewlett Packard Enterprise India

- Atria Convergence Technologies Ltd

- Bharat Sanchar Nigam Ltd

- Sify Technologies Ltd

- Allied Digital Services Ltd

第七章 市场机会与未来趋势

- 閒置频段与未满足需求评估

The India ICT market size in 2026 is estimated at USD 173.26 billion, growing from 2025 value of USD 158 billion with 2031 projections showing USD 274.86 billion, growing at 9.66% CAGR over 2026-2031.

The growth trajectory reflects how the India ICT market benefits from government digitization programs, record enterprise cloud migrations, and fast-rising consumer connectivity. Large hyperscaler projects, a flourishing startup ecosystem, and production-linked incentives continue to shift technology investments from cost optimization to strategic differentiation. Telecom operators are expanding 5G networks into Tier-2 cities, while enterprises channel budgets toward cloud-native architectures, artificial intelligence, and cybersecurity. Talent shortages and rural last-mile fiber gaps temper the otherwise buoyant outlook, but ongoing skilling initiatives and BharatNet roll-outs offer medium-term relief

India ICT Market Trends and Insights

Government Digital India and PLI Incentives Boosting Enterprise Tech Spend

The Production Linked Incentive scheme has attracted INR 1.46 lakh crore investments and generated INR 12.50 lakh crore production value, transforming electronics manufacturing capacity from INR 2.4 lakh crore in 2014 to INR 9.8 lakh crore in 2024. The IndiaAI mission allocates USD 1.25 billion to compute, innovation, and startup funding, laying a sovereign AI foundation. Eighty-two percent of CXOs plan digital budgets to rise by more than 5% during 2025, responding to compliance obligations and competitive needs. National Informatics Centre expansion to 1,000 MW IT load and 100 PB storage signals a long-term public infrastructure commitment that cascades into private technology demand. These interventions reinforce the India ICT market by ensuring robust local supply chains, stimulating enterprise modernization, and anchoring hyperscaler data-center projects.

Accelerated Cloud Adoption After COVID-19

Sixty-seven percent of Indian organizations are migrating workloads to cloud platforms, making hybrid the dominant deployment choice. Public-cloud revenue is forecast to reach USD 24.2 billion by 2028, growing at a 23.8% CAGR. Hyperscaler commitments totaling USD 21.7 billion from Microsoft, Amazon, and Google secure localized infrastructure that answers data sovereignty norms and performance targets. Enterprise AI spending is expanding at 2.2X the pace of general digital outlays, tethered to cloud platforms that deliver scalable compute and ready-made ML services. Cloud-native architectures speed product cycles and slash operational bottlenecks, reinforcing the competitive edge of early movers within the India ICT market.

Skill-Gap and High Attrition in Cutting-Edge Domains

Roughly 300,000 technology vacancies remain open, as AI, cloud-architecture, and cybersecurity demands outrun talent supply. Attrition in niche skills exceeds sector norms as specialists pursue global opportunities or startups, diluting institutional knowledge. Rising wage offers inflate project costs and squeeze margins across service providers in the India ICT market. Domain expertise shortages, such as healthcare informatics and industrial IoT, magnify the constraint because universities struggle to adapt curricula in real-time. Unless reskilling programs scale rapidly, delivery timelines and innovation velocity risk deceleration.

Other drivers and restraints analyzed in the detailed report include:

- MSME Digital-Commerce Boom

- Exploding Mobile-Data Consumption and Affordable 4G/5G Tariffs

- Fragmented Last-Mile Fiber in Rural Belts

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Telecommunication Services captured 36.50% India ICT market share in 2025, underpinned by vast 4G and 5G roll-outs and a consistent spectrum policy. Hardware demand rises in sync with PLI incentives that localize device and component manufacturing, reducing reliance on imports and strengthening supply resilience. Software adoption, especially AI-enabled platforms, records double-digit growth as enterprises embed analytics in workflows. IT Services continues the pivot from staff-augmentation to consulting-led, outcome-based engagements, safeguarding margins. Cloud Services, while smaller, shows the steepest climb at a 15.71% CAGR, reflecting data-center buildouts and enterprise shift to OPEX models.

Momentum in Cloud Services translates into a growing slice of the India ICT market size for infrastructure-as-a-service, platform-as-a-service, and software-as-a-service lines. Telecom firms pursue edge-cloud offerings to leverage tower real estate, and hardware vendors push AI-optimized chips to domestic OEMs. Software suppliers align with hyperscalers to offer vertical solutions infused with generative AI, creating cross-selling synergies. Overall, competition intensifies as cloud-native entrants nibble at legacy managed-service accounts.

The India ICT Market Report is Segmented by Type (Hardware, Software, IT Services, Telecommunication Services), Enterprise Size (Large Enterprises, Smes), Industry Vertical (BFSI, Government and Public Administration, Retail, E-Commerce and Logistics, Manufacturing and Industry 4. 0, Healthcare and Life Sciences, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Tata Consultancy Services Ltd

- HCL Technologies Ltd

- Infosys Ltd

- Tech Mahindra Ltd

- Wipro Ltd

- Bharti Airtel Ltd

- Reliance Jio Infocomm Ltd

- Vodafone Idea Ltd

- IBM India Pvt Ltd

- Accenture Solutions Pvt Ltd

- Capgemini Technology Services India Ltd

- Mphasis Ltd

- Mindtree Ltd

- Larsen & Toubro Infotech Ltd

- Oracle India Pvt Ltd

- Cisco Systems India Pvt Ltd

- Amazon Internet Services Pvt Ltd (AWS India)

- Google Cloud India Pvt Ltd

- Microsoft Corporation India Pvt Ltd

- Dell Technologies India

- Hewlett Packard Enterprise India

- Atria Convergence Technologies Ltd

- Bharat Sanchar Nigam Ltd

- Sify Technologies Ltd

- Allied Digital Services Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Exploding mobile-data consumption and affordable 4G/5G tariffs

- 4.2.2 Government "Digital India" and PLI incentives boosting enterprise tech spend

- 4.2.3 Accelerated cloud adoption after COVID-19

- 4.2.4 MSME digital-commerce boom

- 4.2.5 Growing hyperscaler colocation in Tier-2 cities (under-the-radar)

- 4.2.6 Climate-tech demand for green data-centres (under-the-radar)

- 4.3 Market Restraints

- 4.3.1 Skill-gap and high attrition in cutting-edge domains

- 4.3.2 Fragmented last-mile fibre in rural belts

- 4.3.3 Supply-chain dependence on imported semiconductors

- 4.3.4 Power-cost volatility hitting data-centre ROI (under-the-radar)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Hardware

- 5.1.1.1 Computer Hardwar

- 5.1.1.2 Networking Equipment

- 5.1.1.3 Peripherals

- 5.1.2 IT Software

- 5.1.3 IT Services

- 5.1.3.1 Managed Services

- 5.1.3.2 Business Process Services

- 5.1.3.3 Business Consulting Services

- 5.1.3.4 Cloud Services

- 5.1.4 IT Infrastructure

- 5.1.5 IT Security

- 5.1.6 Communication Services

- 5.1.1 Hardware

- 5.2 By End-user Enterprise Size

- 5.2.1 Large Enterprises

- 5.2.2 SMEs

- 5.3 By Industry Vertical

- 5.3.1 BFSI

- 5.3.2 Government and Public Administration

- 5.3.3 Retail, E-commerce and Logisitcs

- 5.3.4 Manufacturing and Industry 4.0

- 5.3.5 Halthcare and Life Sciences

- 5.3.6 Gaming and Esports

- 5.3.7 Oil and Gas (Up-, Mid-, Down-stream)

- 5.3.8 Energy and Utilities

- 5.3.9 Other Verticals

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Tata Consultancy Services Ltd

- 6.4.2 HCL Technologies Ltd

- 6.4.3 Infosys Ltd

- 6.4.4 Tech Mahindra Ltd

- 6.4.5 Wipro Ltd

- 6.4.6 Bharti Airtel Ltd

- 6.4.7 Reliance Jio Infocomm Ltd

- 6.4.8 Vodafone Idea Ltd

- 6.4.9 IBM India Pvt Ltd

- 6.4.10 Accenture Solutions Pvt Ltd

- 6.4.11 Capgemini Technology Services India Ltd

- 6.4.12 Mphasis Ltd

- 6.4.13 Mindtree Ltd

- 6.4.14 Larsen & Toubro Infotech Ltd

- 6.4.15 Oracle India Pvt Ltd

- 6.4.16 Cisco Systems India Pvt Ltd

- 6.4.17 Amazon Internet Services Pvt Ltd (AWS India)

- 6.4.18 Google Cloud India Pvt Ltd

- 6.4.19 Microsoft Corporation India Pvt Ltd

- 6.4.20 Dell Technologies India

- 6.4.21 Hewlett Packard Enterprise India

- 6.4.22 Atria Convergence Technologies Ltd

- 6.4.23 Bharat Sanchar Nigam Ltd

- 6.4.24 Sify Technologies Ltd

- 6.4.25 Allied Digital Services Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-space and Unmet-Need Assessment