|

市场调查报告书

商品编码

1911723

菲律宾资讯通信技术市场:市场份额分析、行业趋势与统计、成长预测(2026-2031年)Philippines ICT - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

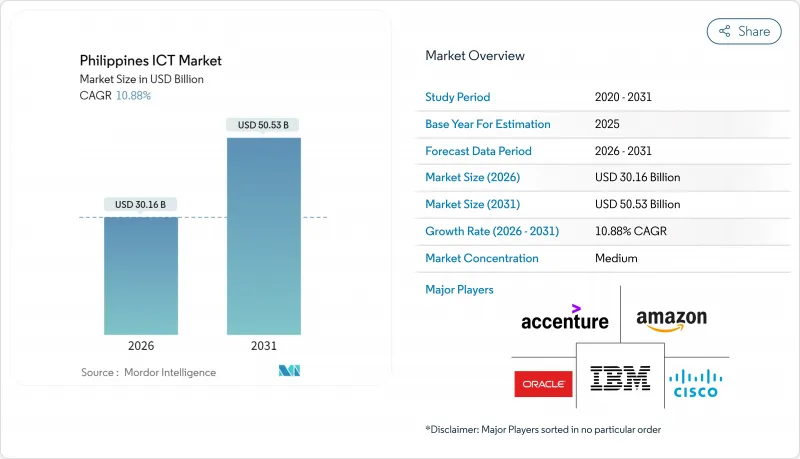

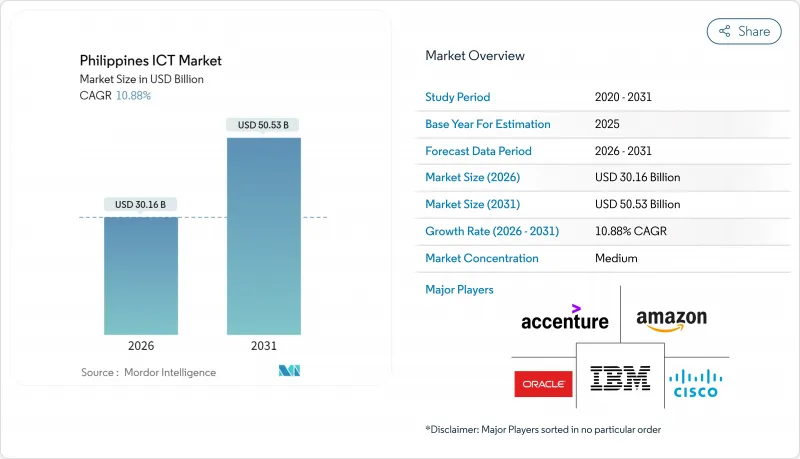

预计到 2025 年,菲律宾 ICT 市场价值将达到 272 亿美元,从 2026 年的 301.6 亿美元增长到 2031 年的 505.3 亿美元,在预测期(2026-2031 年)内复合年增长率为 10.88%。

这一强劲的成长轨迹反映了该国自由化的外商投资环境、大规模的5G部署、超过100亿美元的超大规模资料中心投资计划,以及政府旨在将70%以上的公共服务数位化的计划。对云端运算、边缘运算和网路安全解决方案日益增长的需求正在推动支出成长,而铁塔共用政策和新成立的通用铁塔公司正在扩大网路覆盖范围,惠及服务不足的农村地区。同时,菲律宾资讯通信技术市场正受益于东协供应链的多元化,吸引半导体组装、数据分析和人工智慧等工作负载进入该国不断增长的技能人才库。固网营运商和行动通讯业者之间日益激烈的竞争通讯业者了电信资费的下降趋势,同时也促进了对光纤回程传输、专用5G和卫星通讯链路的投资,从而有助于提高服务品质和地理覆盖范围。

菲律宾资讯通信技术市场趋势与洞察

快速部署 5G 推动基础架构现代化

在菲律宾商业资讯通信技术(ICT)市场,网路现代化正在加速推进。 Globe和PLDT计划到2025年在地理位置偏远且服务不足的地区(GIDA)联合增设100多个5G基地台。扩展的中波频谱和新建的Apricot海底光缆将使国际容量提升33%,使菲律宾成为超大规模流量的冗余枢纽。 5G专用网路正在扩展到物流、采矿和精密农业等光纤铺设难度较高的领域。同时,新资料中心边缘节点的延迟已低于10毫秒,这对于智慧工厂分析至关重要。通讯业者也尝试开放式无线接取网路(Open RAN),以降低无线成本并实现供应商多元化,从而提高长期资本效率。这些努力共同深化并增强了菲律宾的互联互通,支援低延迟应用,并提升了菲律宾ICT市场对全球云端服务供应商的吸引力。

政府电子政府总体规划加速公共部门数位化

资讯通讯技术部 (DICT) 已着手实现其电子化政府目标,目前已将 70% 的公共服务上线,发放了超过一百万份数位数位签章,并在偏远村镇(政府辖区)安装了 438 个 VSAT 终端。随着政府机构将其资料库迁移到主权云,对安全可靠的 IaaS、SaaS 和整合服务的需求也在稳步增长。基于区块链的土地所有权证书发放和补贴分配采购平台也已开始试点,这预示着专业系统整合商未来将迎来商机。同时,由法国、新加坡和多边合作伙伴支持的「数位互助」计画为地方政府官员提供技能培训,从而加强了技术的长期应用。这些倡议加深了菲律宾资讯通信技术市场在农村地区的渗透,并为供应商创造了可靠的公共部门收入来源。

IT人才持续短缺限制了市场成长。

在人工智慧、数据分析和网路安全领域,只有十分之一的科技求职者符合招募标准,导致约20万个职缺。儘管菲律宾技术教育与技能发展署(TESDA)的线上註册人数自2023年以来增长了两倍,但在主要大学之外,人们仍然缺乏工业4.0设备的实际操作经验。企业学徒制培训仅占所有培训的不到4%,这阻碍了菲律宾资讯通信技术(ICT)市场吸收高附加价值计划的能力。菲律宾半导体和电子工业基金会已提出奖励方案和一个5亿美元的技能基金,以遏制该地区的人才流失,但预计要到2027年才能看到成效。

细分市场分析

到2025年,IT服务将占菲律宾ICT市场份额的27.42%,这主要得益于企业将资本预算转向以结果为导向的管理解决方案,例如云端迁移、人工智慧试点和流程自动化。预计到2031年,随着国际超大规模资料中心业者与本地整合商深化合作,以及通讯业者将5G边缘解决方案打包销售,该领域的成长速度将超过硬体支出。同时, IT安全将成为营收成长最快的领域,年复合成长率将达到11.65%,这主要受勒索软体攻击事件增加和新的资料隐私法规的推动。

同时,硬体板块依然疲软,预计2023年至2024年半导体组装基地营收成长将较上季萎缩,2025年仅成长1-2%。然而,来自中国的近岸外包以及电动车零件的优惠待遇有望提振印刷电路基板和基板製造设施的投资,从2027年起改善硬体板块的贡献。由于各方竞相部署光纤和卫星通讯以满足频宽需求,通讯服务支出将保持强劲,这将巩固菲律宾ICT市场顶级软体和平台收入的基础。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 快速部署5G

- 加速中小企业采用云端运算

- 政府电子政府政府总体规划 2022-2028

- 超大规模资料中心投资激增

- 电子钱包等数位支付方式的快速成长

- 马尼拉大都会区以外正在蓬勃发展的科技Start-Ups生态系统

- 市场限制

- 农村地区最后一公里连接缺口

- 资讯科技人员持续短缺

- 电费上涨影响资料中心

- 网路威胁与勒索软体事件

- 价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 投资分析

- 宏观经济因素的影响

- 产业相关人员分析

第五章 市场规模与成长预测

- 依产品类型

- IT硬体

- 电脑硬体

- 网路装置

- 周边设备

- IT软体

- IT服务

- IT咨询与实施支持

- IT外包(ITO)

- 业务流程外包(BPO)

- 资安管理服务

- 云端和平台服务

- IT基础设施

- IT安全/网路安全

- 通讯服务

- IT硬体

- 按公司规模

- 小型企业

- 大公司

- 按最终用户行业划分

- 政府和公共机构

- BFSI

- 资讯科技和电信

- 能源与公共产业

- 零售、电子商务与物流

- 製造业和工业4.0

- 医疗保健和生命科学

- 石油和天然气

- 游戏和电子竞技

- 其他行业

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Accenture plc

- Amazon.com Inc.

- Alphabet Inc.(Google)

- Cisco Systems Inc.

- Huawei Technologies Co. Ltd.

- International Business Machines Corporation

- Microsoft Corporation

- Oracle Corporation

- Cognizant Technology Solutions Corporation

- PLDT Inc.

- Globe Telecom Inc.

- Total Information Management Corporation

- Doa Alejandra Inc.

- CTO Phils Inc.

- P-Tech People and Technology Inc.

- Trend Micro Inc.

- Hewlett Packard Enterprise Company

- Dell Technologies Inc.

- Lenovo Group Limited

- SAP SE

- Vendor Positioning Analysis

第七章 市场机会与未来展望

The Philippines ICT market was valued at USD 27.2 billion in 2025 and estimated to grow from USD 30.16 billion in 2026 to reach USD 50.53 billion by 2031, at a CAGR of 10.88% during the forecast period (2026-2031).

This strong trajectory reflects the archipelago's liberalized foreign-investment regime, large-scale 5G roll-outs, more than USD 10 billion in hyperscale data-center commitments, and a government digitalization plan that is migrating over 70% of public services online. Intensifying demand for cloud, edge, and cybersecurity solutions is reinforcing spending momentum, while tower-sharing policies and new common-tower companies are widening network reach to underserved provinces.Simultaneously, the Philippines ICT market is benefiting from ASEAN supply-chain diversification, which is drawing semiconductor assembly, data-analytics, and AI workloads toward the country's growing pool of skilled talent. Heightened competition among fixed and mobile operators is compressing tariffs but stimulating investment in fiber backhaul, private 5G, and satellite links that collectively lift service quality and geographic coverage.

Philippines ICT Market Trends and Insights

Rapid 5G Rollout Drives Infrastructure Modernization

The commercial Philippines ICT market is accelerating network modernization as Globe and PLDT jointly surpassed 100 additional Geo-Isolated and Disadvantaged Area (GIDA) 5G sites in 2025. Expanded mid-band spectrum and the new Apricot subsea cable now lift international capacity 33%, positioning the country as a redundancy hub for hyperscale traffic. 5G private networks are extending to logistics, mining, and precision agriculture where fiber remains impractical, while edge nodes colocated within new data centers deliver sub-10 ms latency critical for smart-factory analytics. Carriers are also experimenting with open-RAN to drive down radio costs and diversify vendors, reinforcing long-run capital efficiency. Collectively, these activities are adding depth and resilience to national connectivity, enabling low-latency applications and boosting the Philippines ICT market's attractiveness to global cloud providers.

Government e-Gov Masterplan Accelerates Public-Sector Digitalization

The Department of Information and Communications Technology has already taken 70% of public services online, issued more than 1 million digital signatures, and deployed 438 VSAT terminals in remote barangays to fulfill e-Gov targets. As ministries migrate databases into sovereign clouds, demand for secure IaaS, SaaS, and integration services grows steadily. Procurement platforms leveraging blockchain for land titling and grant disbursement are being piloted, signaling future opportunities for specialist system integrators. Meanwhile, the Digital Bayanihan program backed by France, Singapore, and multilateral partners supplies skills training for local officials, thus reinforcing long-term adoption. These initiatives deepen the Philippines ICT market penetration into rural regions and produce a reliable public-sector revenue stream for vendors.

Persistent IT-Talent Shortage Constrains Market Growth

Only 1 in 10 technical applicants meets AI, data-analytics, or cybersecurity hiring thresholds, leaving an estimated 200,000 vacancies unfille. Although TESDA has tripled online enrollments since 2023, hands-on exposure to Industry 4.0 equipment remains scarce outside flagship universities. Enterprise-based apprenticeships account for less than 4% of total training, dampening the Philippines ICT market's ability to absorb high-value projects. The Semiconductor and Electronics Industries in the Philippines Foundation is lobbying for incentive packages and a USD 500 million skills fund to stave off regional talent leakage, but any impact is unlikely before 2027.

Other drivers and restraints analyzed in the detailed report include:

- Hyperscale Data-Center Investment Transforms Digital Infrastructure

- Digital-Payments Boom Reshapes Financial-Services ICT

- Rising Electricity Costs Threaten Data-Center Economics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

IT services controlled 27.42% of Philippines ICT market share in 2025 as enterprises shifted capital budgets toward outcome-based managed solutions for cloud migration, AI pilots, and process automation. The segment is forecast to outpace hardware spending through 2031 as international hyperscalers deepen partnerships with local integrators and telcos bundle 5G-enabled edge solutions. At the same time, IT security contributes the fastest incremental revenue, rising at an 11.65% CAGR thanks to ransomware frequency and new data-privacy directives.

The hardware slice remains subdued because the semiconductor assembly base posted just 1-2% top-line growth in 2025 after back-to-back contractions in 2023-2024. Nonetheless, near-shoring from China and incentives for electric-vehicle components are renewing investment in printed-circuit and substrate facilities that could lift hardware contributions after 2027. Communication-services spend is resilient as fiber and satellite deployments race to meet bandwidth demand, strengthening the Philippines ICT market's foundation for higher-layer software and platform revenues.

The Philippines ICT Market Report is Segmented by Product Type (IT Hardware, IT Software, IT Services, IT Infrastructure, IT Security, Communication Services), Enterprise Size (Small and Medium Enterprises, Large Enterprises), and End-User Industry Vertical (Government and Public Administration, BFSI, Energy and Utilities, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Accenture plc

- Amazon.com Inc.

- Alphabet Inc. (Google)

- Cisco Systems Inc.

- Huawei Technologies Co. Ltd.

- International Business Machines Corporation

- Microsoft Corporation

- Oracle Corporation

- Cognizant Technology Solutions Corporation

- PLDT Inc.

- Globe Telecom Inc.

- Total Information Management Corporation

- Doa Alejandra Inc.

- CTO Phils Inc.

- P-Tech People and Technology Inc.

- Trend Micro Inc.

- Hewlett Packard Enterprise Company

- Dell Technologies Inc.

- Lenovo Group Limited

- SAP SE

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid 5G roll out

- 4.2.2 Accelerated cloud adoption by SMEs

- 4.2.3 Government's e-Gov Masterplan 2022-2028

- 4.2.4 Surge in hyperscale data center investments

- 4.2.5 Digital payments boom via e-wallets

- 4.2.6 Growing tech startup ecosystem outside Metro Manila

- 4.3 Market Restraints

- 4.3.1 Last-mile connectivity gaps in rural provinces

- 4.3.2 Persistent IT talent shortage

- 4.3.3 Rising electricity costs impacting data centers

- 4.3.4 Cyber-extortion and ransomware incidents

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

- 4.9 Impact of Macroeconomic Factors

- 4.10 Industry Stakeholder Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 IT Hardware

- 5.1.1.1 Computer Hardware

- 5.1.1.2 Networking Equipment

- 5.1.1.3 Peripherals

- 5.1.2 IT Software

- 5.1.3 IT Services

- 5.1.3.1 IT Consulting and Implementation

- 5.1.3.2 IT Outsourcing (ITO)

- 5.1.3.3 Business Process Outsourcing (BPO)

- 5.1.3.4 Managed Security Services

- 5.1.3.5 Cloud and Platform Services

- 5.1.4 IT Infrastructure

- 5.1.5 IT Security/Cybersecurity

- 5.1.6 Communication Services

- 5.1.1 IT Hardware

- 5.2 By Enterprise Size

- 5.2.1 Small and Medium-sized Enterprises

- 5.2.2 Large Enterprises

- 5.3 By End-user Industry Vertical

- 5.3.1 Government and Public Administration

- 5.3.2 BFSI

- 5.3.3 IT and Telecom

- 5.3.4 Energy and Utilities

- 5.3.5 Retail, E-commerce, and Logistics

- 5.3.6 Manufacturing and Industry 4.0

- 5.3.7 Healthcare and Life Sciences

- 5.3.8 Oil and Gas

- 5.3.9 Gaming and Esports

- 5.3.10 Other Verticals

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Accenture plc

- 6.4.2 Amazon.com Inc.

- 6.4.3 Alphabet Inc. (Google)

- 6.4.4 Cisco Systems Inc.

- 6.4.5 Huawei Technologies Co. Ltd.

- 6.4.6 International Business Machines Corporation

- 6.4.7 Microsoft Corporation

- 6.4.8 Oracle Corporation

- 6.4.9 Cognizant Technology Solutions Corporation

- 6.4.10 PLDT Inc.

- 6.4.11 Globe Telecom Inc.

- 6.4.12 Total Information Management Corporation

- 6.4.13 Doa Alejandra Inc.

- 6.4.14 CTO Phils Inc.

- 6.4.15 P-Tech People and Technology Inc.

- 6.4.16 Trend Micro Inc.

- 6.4.17 Hewlett Packard Enterprise Company

- 6.4.18 Dell Technologies Inc.

- 6.4.19 Lenovo Group Limited

- 6.4.20 SAP SE

- 6.5 Vendor Positioning Analysis

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment