|

市场调查报告书

商品编码

1906993

润滑油:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Lubricants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

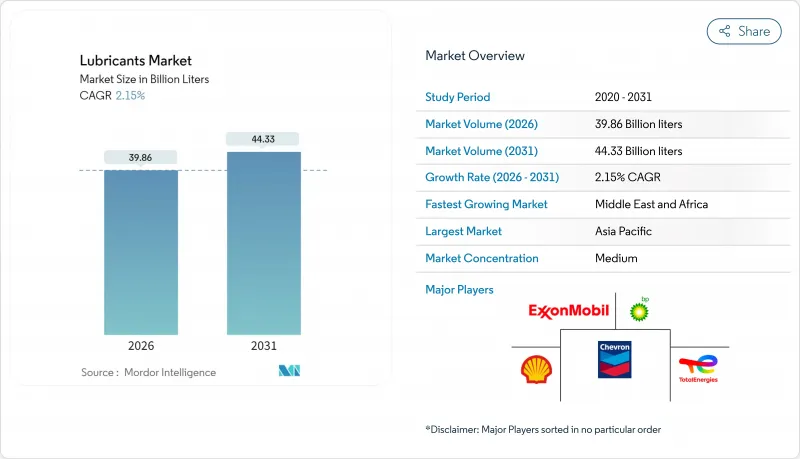

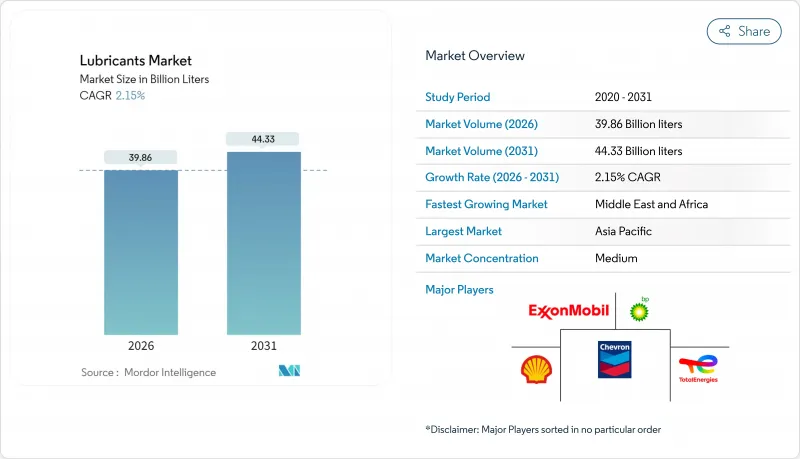

预计到 2026 年,润滑油市场规模将达到 398.6 亿公升,高于 2025 年的 390.2 亿公升。预计到 2031 年,润滑油市场规模将达到 443.3 亿公升,2026 年至 2031 年的复合年增长率为 2.15%。

日益严格的环保法规以及汽车製造商为提高燃油经济性而降低黏度的努力,正推动市场需求从传统矿物油转向高性能合成油。同时,风力发电机齿轮箱和电动车温度控管系统等新的应用场景不断涌现,创造了新的收入来源,弥补了传统内燃机应用领域成长放缓的局面。高黏度合成酯的供应链风险、欧洲可能对内燃机的禁令以及北美日益严格的挥发性有机化合物(VOC)法规,都凸显了复杂的风险回报格局,而拥有多元化产品系列的灵活配方商更受青睐。随着各国石油公司进行垂直整合,以及全球巨头扩大合成油产能以在高端细分市场获取更高利润,市场竞争持续加剧。

全球润滑油市场趋势与洞察

汽车保有量迅速成长,尤其是在新兴亚洲国家

中国和印度公路车辆的快速成长正在重塑润滑油市场格局,预计到2030年,两国售后市场需求将分别成长14.7%和12.2%。中等收入家庭私家车拥有量的成长正在加速向合成油的转变,合成油有望提高燃油经济性并延长车辆使用寿命。印度对TREM Stage IV-V排放标准的遵守进一步推动了商用车领域对低SAP(硫含量)优质混合油的需求。南亚地区农业机械销售的强劲成长也推动了对能够承受严苛使用週期的多级高扭力润滑油的需求。虽然从2029年起绝对销售成长将放缓,但优质化趋势预计将推动以美元计价的收入成长速度超过以升计价的销售成长速度。能够开发本地化配方并利用品牌价值的全球供应商将能够充分利用这些结构性利好因素。

扩大发电设施(燃气涡轮机、风力发电)的建设

全球可再生能源和燃气涡轮机计划的扩张,对能够承受极端温度和延长保养週期的特殊润滑油产生了持续的需求。现代风力发电机机齿轮箱必须长达10年无需换油,这需要运作全合成的PAO基润滑油,以防止白蚀裂缝和微点蚀。燃气涡轮机同样依赖高黏度指数润滑油,这种润滑油能够在200°C下保持黏度,从而推动了对III类和茂金属PAO基础油的需求。离岸风力发电电场面临盐雾和高湿度的挑战,通常会与能够保证运转率的润滑油供应商签订多年服务合约。能够满足严格的OEM核准标准的供应商相对较少,这使得符合认证标准的供应商拥有定价权。

严格的矿物油生态毒性和挥发性有机化合物(VOC)法规

欧洲的REACH法规和加州的VOC法规正迫使润滑油产业从传统的矿物油基润滑油转向合成和生物基替代品。加州最新的消费品法规旨在每天减少21吨VOC排放,这将直接影响煞车清洁剂等高润滑油用量的产品。在欧洲,氢氧化锂水合物被列为生殖毒性物质,刺激了对磺酸磺酸盐和铝复合润滑脂技术的研发投入。这些变化正推动润滑油产业开发环保润滑油。

细分市场分析

第一类基础油目前仍占据润滑油市场最大份额,占总市场份额的42.15%,但随着高硫低黏度指数产品因原始设备製造商(OEM)规格要求而逐渐被淘汰,其市场份额正在稳步下降。第三类基油的产量在亚太地区正快速成长,这主要得益于新加坡和中国新建的加氢裂解计划。预计到2026年,这两个项目将使高品质基油的日供应量增加4万桶以上。

这正推动润滑油市场向低挥发性、高纯度基料重新平衡,从而实现 0W-16 和 0W-8 配方,并将换油週期延长高达 30%。拥有整合炼油和添加剂技术的製造商能够确保成本协同效应,并拥有受监管影响较小的供应链。同时,IV 类聚对氧酸酯 (PAO) 在航空、航太和风力发电机等细分市场中保持着高利润率,这些市场对热稳定性和抗氧化性要求极高。虽然 V 类酯类的产量较低,但它们为下一代电动车润滑油奠定了基础,并提供了一层多元化保障,以缓解传统领域产量下降的影响。

儘管面临多方面的不利因素,矿物油在 2025 年仍将占据 65.85% 的市占率。由于其成本竞争力,矿物油将在价格敏感的市场(例如农业机械和摩托车维修)中保持强势地位,尤其是在东南亚和非洲。

然而,永续性要求、原始设备製造商 (OEM) 规范以及整体拥有成本计算工具日益重要,预计将推动合成和半合成润滑油市场份额的成长。生物基润滑油正以 3.21% 的复合年增长率成长,并越来越多地应用于对环境敏感的应用领域,例如林业、船舶甲板和食品加工机械,这些领域中意外洩漏会造成生态风险。挑战仍然存在:氧化稳定性和低温流动性的不足阻碍了其广泛应用,而来自食品应用领域的竞争也使植物油原料的供应稳定性变得复杂。不过,欧洲和北美部分地区的税收优惠和绿色采购法规正在缩小价格差距,并鼓励矿物油用户转向永续的替代方案。

润滑油报告依组别(I组、II组、III组、IV组、V组)、基础油(矿物油、合成油、半合成油、生物基油)、产品类型(引擎油、变速箱和齿轮油、液压油、金属加工液等)、最终用户业(汽车、发电、重型机械等)及地区(亚太地区(亚太地区、北美地区)进行细分。

区域分析

亚太地区润滑油市场占有率高达45.10%,这主要得益于中产阶级汽车保有量的成长以及日益严格的区域排放标准推动高规格产品成为主流。埃克森美孚的新加坡残渣油升级计划、雪佛龙奥伦耐特的宁波计划以及壳牌泰国润滑脂工厂产能翻倍等战略性产能扩张,正在增强该地区的供应韧性。

中东和非洲地区虽然绝对规模小规模,但到2031年将以3.19%的年增长率成为成长的主要驱动力。随着工业化进程的加速,阿联酋和沙乌地阿拉伯正将新建炼油厂与下游润滑油调配业务结合,以瞄准尼日利亚和肯亚等高成长市场。欧洲和北美市场已趋于成熟。排放控制政策正推动市场向合成和生物基产品转型,而美国页岩基油的供应也支撑了国内调配业务的经济效益。拉丁美洲正处于转型期,基础设施投资和汽车产业的復苏推动润滑油市场温和成长,但政策的不确定性限制着其长期前景。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 汽车保有量快速成长-尤其是在新兴亚洲地区

- 扩建发电设施(燃气涡轮机、风力发电)

- 为了延长换油週期,汽车製造商正在降低机油黏度等级(0W-XX)。

- 主流电气化仍然需要特殊的传热流体。

- 人工智慧驱动的预测性维护促进优质工业油的发展

- 市场限制

- 对矿物油製定严格的环境毒性和挥发性有机化合物(VOC)法规

- 欧洲加速禁止内燃机(ICE)将降低长期机油需求。

- 高黏度指数合成酯(航空、电动车)的供应风险

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模和成长预测(价值和数量)

- 按组

- 第一组

- 第二组

- 第三组

- 第四组

- 第五组

- 依基料

- 矿物油润滑油市场

- 合成润滑油市场

- 半合成润滑油市场

- 生物基润滑剂市场

- 依产品类型

- 机油

- 变速箱油和齿轮油

- 油压

- 金属加工液

- 润滑脂

- 其他产品类型

- 按最终用户行业划分

- 车

- 发电

- 重型机械

- 冶金与金属加工

- 其他终端用户产业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 印尼

- 泰国

- 马来西亚

- 越南

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 土耳其

- 俄罗斯

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 卡达

- 奈及利亚

- 南非

- 埃及

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- BP PLC

- Chevron Corporation

- China National Petroleum Corporation(CNPC)

- China Petroleum & Chemical Corporation(SINOPEC)

- ENEOS Corporation

- Exxon Mobil Corporation

- FUCHS

- Hindustan Petroleum Corporation Limited

- Idemitsu Kosan Co. Ltd

- Indian Oil Corporation Ltd

- LUKOIL

- MOTUL

- Petromin

- PETRONAS Lubricants International

- Phillips 66 Company

- PT Pertamina Lubricants

- Repsol

- Shell Plc

- TotalEnergies

- VALVOLINE INC.

第七章 市场机会与未来展望

Lubricants Market size in 2026 is estimated at 39.86 billion liters, growing from 2025 value of 39.02 billion liters with 2031 projections showing 44.33 billion liters, growing at 2.15% CAGR over 2026-2031.

Demand is shifting from traditional mineral-oil grades toward higher-performance synthetics as environmental regulations tighten and OEMs seek viscosity downgrades for fuel economy gains. Simultaneously, new use cases, including wind-turbine gearboxes and electric-vehicle thermal management systems, create fresh revenue pools that offset slower growth in legacy internal combustion applications. Supply-chain risk for high-viscosity synthetic esters, potential internal-combustion bans in Europe, and increasingly stringent VOC limits in North America underscore a complex risk-reward landscape that rewards agile formulators with diversified portfolios. Competitive intensity continues to rise as national oil companies vertically integrate and global majors expand synthetic capacity to secure higher margins in premium niches.

Global Lubricants Market Trends and Insights

Surging Vehicle Parc-Especially in Emerging Asia

The rapid expansion of the on-road vehicle population in China and India is reshaping the lubricants market, with aftermarket demand in those two nations rising at 14.7% and 12.2% respectively, through 2030. Rising middle-income ownership of personal vehicles is accelerating the shift from conventional mineral oils to synthetics, which promise fuel-economy gains and longer service intervals. Compliance with India's TREM Stage IV-V standards further lifts demand for low-SAPs, premium formulations in the commercial-vehicle segment. Strong growth in agricultural machinery sales across South Asia also spurs demand for multi-grade, high-torque lubricants that withstand harsher duty cycles. Although absolute volume expansion moderates after 2029, the premiumization trend is expected to lift dollar revenues faster than liter volumes. Global suppliers that localize blending and leverage brand equity are positioned to benefit from this structural tailwind.

Expanding Power-Generation Build-Out (Gas-Turbine, Wind)

Ambitious renewable and gas-turbine projects worldwide generate steady demand for specialty lubricants engineered for extreme temperatures and long service intervals. A modern wind-turbine gearbox must run as long as 10 years without an oil change, requiring fully synthetic PAO-based fluids tailored to prevent white-etching cracks and micro-pitting. Gas turbines likewise rely on high-VI lubricants that retain viscosity at 200 °C, fostering demand for Group III and metallocene PAO basestocks. Offshore wind farms present salinity and moisture challenges, prompting operators to forge multi-year service contracts with lubricant suppliers that can guarantee equipment uptime. With relatively few suppliers qualifying under stringent OEM approvals, pricing power favors those who clear the certification bar.

Stringent Eco-Toxicity and VOC Norms on Mineral Oils

European REACH requirements and California's VOC regulations are forcing a pivot away from conventional mineral-oil lubricants toward synthetics and bio-based alternatives. California's latest Consumer-Products rulemaking aims to eliminate 21 tons per day of VOC emissions, directly impacting common lubricant-rich products such as brake cleaners. In Europe, the classification of lithium hydroxide monohydrate as a reproductive toxicant has triggered research and development investments in calcium-sulfonate and aluminum-complex grease technologies. These shifts are propelling the lubricants industry towards development of environmentally acceptable lubricants.

Other drivers and restraints analyzed in the detailed report include:

- OEM Viscosity-Grade Downgrading (0W-XX) Extends Drain Intervals

- Mainstream Electrification Still Needs Specialty Thermal Fluids

- Accelerated ICE Bans in Europe Cut Long-Term Engine-Oil Demand

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Group I basestocks retain the largest 42.15% share of the lubricants market size, but their lead is steadily shrinking as OEM specifications render higher-sulfur, lower-VI products obsolete. Group III output is scaling rapidly in the Asia-Pacific region, buoyed by new hydrocracking projects in Singapore and China that, together, will add more than 40,000 barrels per day of premium basestock supply by 2026.

The lubricants market is therefore recalibrating toward low-volatility, high-purity basestocks that enable 0W-16 and 0W-8 formulations, extending oil-drain intervals by up to 30%. Producers with integrated refining and additive capabilities capture cost synergies and restriction-proof supply chains. Meanwhile, Group IV PAOs command high margins in the aviation, aerospace, and wind turbine niches, where thermal stability and oxidative resistance are non-negotiable. Group V esters, though small in volume, underpin next-generation EV fluids, adding a diversification layer that cushions volume erosion in traditional segments.

Mineral oils still command 65.85% of 2025 volume despite multi-faceted headwinds. Cost competitiveness keeps them entrenched in price-sensitive markets such as agricultural equipment and two-wheeler maintenance, especially across Southeast Asia and Africa.

Yet the lubricants market share of synthetic and semi-synthetic products is set to climb as sustainability mandates, OEM specs, and total-cost-of-ownership calculators gain prominence. Bio-based lubricants, expanding at 3.21% CAGR, are increasingly adopted in applications with environmental sensitivity, think forestry, marine decks, and food-processing machinery, where accidental leakage poses ecological risk. Obstacles remain: oxidative stability and cold-flow limits hinder broader adoption, and supply security for vegetable-oil feedstocks is complicated by competition with food uses. Nevertheless, tax incentives and green-procurement rules in Europe and parts of North America are closing the price gap, nudging mineral oil users toward sustainable substitutes.

The Lubricants Report is Segmented by Group (Group I, Group II, Group III, Group IV, and Group V), Base Stock (Mineral-Oil, Synthetic, Semi-Synthetic, and Bio-Based), Product Type (Engine Oils, Transmission and Gear Oils, Hydraulic Fluids, Metalworking Fluids, and More), End-User Industry (Automotive, Power Generation, Heavy Equipment, and More), and Geography (Asia-Pacific, North America, Europe, and More).

Geography Analysis

The Asia-Pacific's 45.10% lubricants market share is driven by trends amplified by the growth of middle-class vehicle ownership and stringent local emissions standards, which are pulling higher-spec products into the mainstream. Strategic capacity expansions, ExxonMobil's Singapore Resid Upgrade, Chevron Oronite's Ningbo project, and Shell's Thailand grease plant tripling output-fortify supply resilience in the region.

Middle East and Africa, though smaller in absolute terms, leads volumetric expansion at 3.19% through 2031. The UAE and Saudi Arabia are pairing new refining ventures with downstream lube blending, targeting high-growth markets such as Nigeria and Kenya, where industrialization is gathering pace in the lubricants industry. Europe and North America operate under mature market dynamics: restrictive emissions policies catalyze migration to synthetics and bio-based grades, while shale-advantaged basestock supply in the United States supports domestic blending economics. Latin America sits in transition; infrastructure spending and a rebounding automotive sector place the lubricants market on a moderate upward slope, though policy instability dampens long-term forecasts.

- BP PLC

- Chevron Corporation

- China National Petroleum Corporation (CNPC)

- China Petroleum & Chemical Corporation (SINOPEC)

- ENEOS Corporation

- Exxon Mobil Corporation

- FUCHS

- Hindustan Petroleum Corporation Limited

- Idemitsu Kosan Co. Ltd

- Indian Oil Corporation Ltd

- LUKOIL

- MOTUL

- Petromin

- PETRONAS Lubricants International

- Phillips 66 Company

- PT Pertamina Lubricants

- Repsol

- Shell Plc

- TotalEnergies

- VALVOLINE INC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging Vehicle Parc - Especially in Emerging Asia

- 4.2.2 Expanding Power-Generation Build-Out (Gas-Turbine, Wind)

- 4.2.3 OEM Viscosity-Grade Downgrading (0W-XX) Extends Drain Intervals

- 4.2.4 Mainstream Electrification Still Needs Specialty Thermal Fluids

- 4.2.5 AI-Enabled Predictive Maintenance Boosts Premium Industrial Oils

- 4.3 Market Restraints

- 4.3.1 Stringent Eco-Toxicity and VOC Norms on Mineral Oils

- 4.3.2 Accelerated ICE Bans in Europe Cut Long-Term Engine-Oil Demand

- 4.3.3 Supply-Risk of High-VI Synthetic Esters (Aviation, EV)

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Group

- 5.1.1 Group I

- 5.1.2 Group II

- 5.1.3 Group III

- 5.1.4 Group IV

- 5.1.5 Group V

- 5.2 By Base Stock

- 5.2.1 Mineral-oil Lubricants

- 5.2.2 Synthetic Lubricants

- 5.2.3 Semi-synthetic Lubricants

- 5.2.4 Bio-based Lubricants

- 5.3 By Product Type

- 5.3.1 Engine Oils

- 5.3.2 Transmission and Gear Oils

- 5.3.3 Hydraulic Fluids

- 5.3.4 Metalworking Fluids

- 5.3.5 Greases

- 5.3.6 Other Product Types

- 5.4 By End-user Industry

- 5.4.1 Automotive

- 5.4.2 Power Generation

- 5.4.3 Heavy Equipment

- 5.4.4 Metallurgy and Metalworking

- 5.4.5 Other End-user Industries

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Indonesia

- 5.5.1.6 Thailand

- 5.5.1.7 Malaysia

- 5.5.1.8 Vietnam

- 5.5.1.9 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Nordics

- 5.5.3.7 Turkey

- 5.5.3.8 Russia

- 5.5.3.9 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Qatar

- 5.5.5.4 Nigeria

- 5.5.5.5 South Africa

- 5.5.5.6 Egypt

- 5.5.5.7 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BP PLC

- 6.4.2 Chevron Corporation

- 6.4.3 China National Petroleum Corporation (CNPC)

- 6.4.4 China Petroleum & Chemical Corporation (SINOPEC)

- 6.4.5 ENEOS Corporation

- 6.4.6 Exxon Mobil Corporation

- 6.4.7 FUCHS

- 6.4.8 Hindustan Petroleum Corporation Limited

- 6.4.9 Idemitsu Kosan Co. Ltd

- 6.4.10 Indian Oil Corporation Ltd

- 6.4.11 LUKOIL

- 6.4.12 MOTUL

- 6.4.13 Petromin

- 6.4.14 PETRONAS Lubricants International

- 6.4.15 Phillips 66 Company

- 6.4.16 PT Pertamina Lubricants

- 6.4.17 Repsol

- 6.4.18 Shell Plc

- 6.4.19 TotalEnergies

- 6.4.20 VALVOLINE INC.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Growing Adoption of Bio-lubricants