|

市场调查报告书

商品编码

1907263

欧洲货运与物流:市场份额分析、行业趋势、统计数据和成长预测(2026-2031 年)Europe Freight And Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

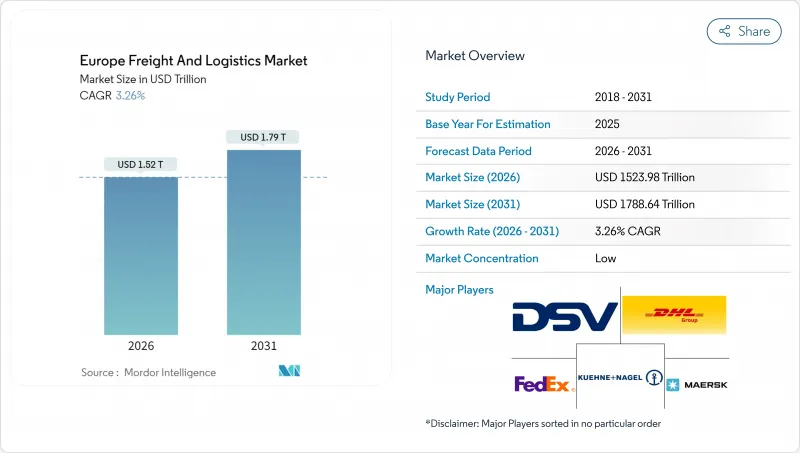

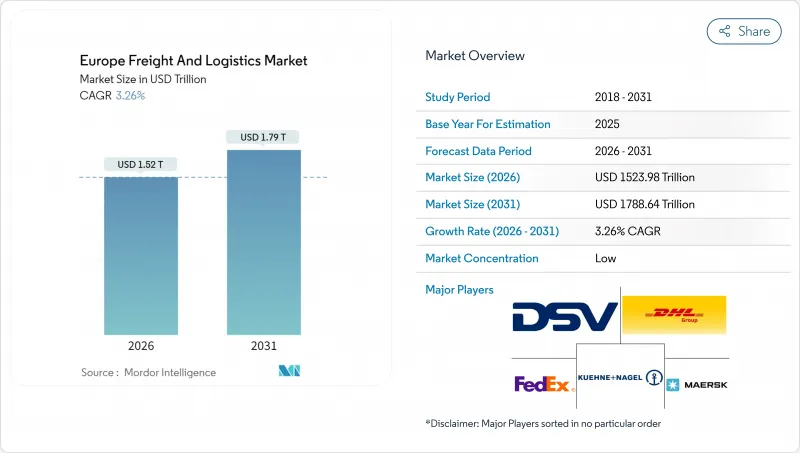

2025年欧洲货运和物流市场价值为14758.8亿美元,预计到2031年将达到17886.4亿美元,2026年为15239.8亿美元。

预计在预测期(2026-2031 年)内,复合年增长率将达到 3.26%。

这一强劲前景得益于欧洲大陆在全球贸易走廊中的核心地位、对智慧基础设施的持续投资以及旨在实现供应链脱碳的政策压力。儘管货运仍占据物流功能的最大份额,但随着跨境电子商务重塑分销模式,宅配、快捷邮件和小包裹(CEP) 服务正经历最快的成长。泛欧 5G 走廊提供的即时网路可视性,以及欧盟绿色交易中优先发展铁路而非道路运输的措施,正在重塑运输路线的经济格局。同时,高附加价值製造业的快速復苏、自动化宅配柜的日益普及以及国防相关物流涌入东欧,都推动了对「欧洲货运和物流市场」一体化解决方案的新需求。随着主要企业为寻求规模而活性化併购力度、投资低温运输资产以及竞相获得自动驾驶场内卡车试点认证(预计将降低成本并提高安全性),竞争格局日益严峻。

欧洲货运及物流市场趋势及洞察

泛欧5G走廊变革即时物流可视性

数位欧洲正在投资75亿欧元(约82.7亿美元)用于5G基础建设,并将物流走廊列为首要任务。该基础设施将使配备丰富感测器的卡车、火车和船舶能够每毫秒传输位置、状态和天气资料。 FERNRIDE于2024年获得TÜV SÜD认证,使自动驾驶卡车能够在运作场地运作。预测性维护分析已将停机时间减少高达20%,并降低了欧洲货运和物流市场低温运输中冷藏货物的损耗率。

欧盟绿色交易加速了从公路到铁路的模式转换

「Fit for 55」立法方案要求到2030年将碳排放量减少55%,并鼓励货运公司从长途公路运输转向铁路和水路运输。光是法国就已拨款11亿欧元(约12.1亿美元)用于2030年建造多式联运码头。然而,2024年上半年铁路货运量年减2.8%,显示运力不足阻碍了运输方式转型的计画。欧盟排放权交易体系(EU ETS)对海运和道路运输附加税不断上涨,使得铁路运输在欧洲货运和物流业的成本竞争力日益增强。

驾驶人危机引发薪资上涨螺旋

国际道路运输联盟(IRU)估计,目前全球道路运输驾驶人达50万,2028年可能增加至74.5万。运输公司正在实施每年15%至25%的薪资成长,主要运输路线的公路货运费率也在上涨18%至22%。温控货车运输受到的影响更为严重,在需求量大的枢纽站,合格的驾驶要求年薪达到6万欧元。

细分市场分析

到2025年,製造业将占欧洲货运和物流市场份额的32.01%,其中汽车、机械和化学工业是核心。 2兆美元的製造业回流投资将使货运重心转向洲际路线,进而维持稳健的合约物流系统。

2026年至2031年间,批发和零售贸易将以3.47%的复合年增长率成长,主要受73%的消费者电子商务渗透率的推动。全通路模式提倡超当地语系化配送,有利于微型仓配中心的发展。建筑物流将适度受益于欧盟下一代能源计画的支出,而可再生能源计划正在为涡轮叶片和电池化学品建立专门的货运路线。

货运代理是欧洲货运和物流市场规模的支柱,预计到2025年将占总收入的62.74%。跨国电商(CEP)业务虽然规模较小,但成长速度更快,2026年至2031年的复合年增长率(CAGR)将达到3.70%。跨境电商是推动成长的主要动力,其中国际小包裹的成长率为5.33%。数位化海关入口网站将清关週期缩短了最多两天,从而提高了B2C领域的重复业务量。

欧洲货运和物流市场正受到日益完善的CEP网路的影响,这些网路包括自动化分类系统、人工智慧路线规划和温控储物柜。同时,仓储服务也不断扩展,因为可扩展的城市履约中心对于实现隔日达至关重要。货运正朝向多模态模式转型,而逆向物流、贴标和套件组装等附加价值服务在欧盟循环经济规则下变得日益重要。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 人口统计数据

- 按经济活动分類的GDP分配

- 按经济活动分類的GDP成长

- 通货膨胀

- 经济表现及概况

- 电子商务产业的趋势

- 製造业趋势

- 运输和仓储业的GDP

- 出口趋势

- 进口趋势

- 燃油价格

- 卡车运输营运成本

- 卡车运输车队规模(按类型)

- 主要卡车供应商

- 物流绩效

- 按交通方式分享

- 海运船队运力

- 班轮运输连接

- 停靠港口和演出

- 货运费率趋势

- 货物吨位趋势

- 基础设施

- 法规结构(公路和铁路)

- 法国

- 德国

- 义大利

- 荷兰

- 北欧国家

- 俄罗斯

- 西班牙

- 英国

- 法规结构(海事和航空)

- 法国

- 德国

- 义大利

- 荷兰

- 北欧国家

- 俄罗斯

- 西班牙

- 英国

- 价值炼和通路分析

- 市场驱动因素

- 泛欧5G走廊部署

- 欧盟绿色交易下的模式转换促进措施

- 重要製造业的回流

- B2C小包裹递送密度迅速扩展到主要都会区以外地区

- 乌克兰危机后,国防后勤需求增加

- 自动驾驶场内卡车试点计画进入规模化阶段

- 市场限制

- 司机短缺导致通货膨胀螺旋上升

- 铁路网运力瓶颈

- 码头工人工会造成的混乱

- 碳边境调节成本

- 市场创新

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 终端用户产业

- 农业、渔业、林业

- 建造

- 製造业

- 石油天然气、采矿和采石

- 批发和零售

- 其他的

- 物流职能

- 宅配、速递和小包裹(CEP)

- 按目的地类型

- 国内的

- 国际的

- 按目的地类型

- 货运代理

- 透过交通工具

- 航空

- 海路和内河航道

- 其他的

- 透过交通工具

- 货物运输

- 透过交通工具

- 航空

- 管道

- 铁路

- 路

- 海路和内河航道

- 透过交通工具

- 仓储和存储

- 透过温度控制

- 非温控型

- 温度控制

- 透过温度控制

- 其他服务

- 宅配、速递和小包裹(CEP)

- 国家

- 丹麦

- 芬兰

- 法国

- 德国

- 冰岛

- 义大利

- 荷兰

- 挪威

- 俄罗斯

- 西班牙

- 瑞典

- 英国

- 其他欧洲地区

第六章 竞争情势

- 市场集中度

- 重大策略倡议

- 市占率分析

- 公司简介

- AP Moller-Maersk

- CH Robinson

- CMA CGM Group(Including CEVA Logistics)

- DACHSER

- DHL Group

- DSV A/S(Including DB Schenker)

- Expeditors International of Washington, Inc.

- FedEx

- GEFCO

- Hapag-Lloyd

- Hellmann Worldwide Logistics

- International Distributions Services(Including GLS)

- Kuehne+Nagel

- La Poste Group

- Mainfreight

- Panattoni Europe

- Rhenus Group

- SNCF Group

- United Parcel Service of America, Inc.(UPS)

- XPO, Inc.

第七章 市场机会与未来展望

The Europe freight and logistics market was valued at USD 1475.88 billion in 2025 and estimated to grow from USD 1523.98 billion in 2026 to reach USD 1788.64 billion by 2031, at a CAGR of 3.26% during the forecast period (2026-2031).

The solid outlook stems from the continent's central role in global trade corridors, continued investments in smart infrastructure, and policy pressure to decarbonize supply chains. Freight transport retains the largest logistics function share, while courier, express, and parcel (CEP) activities record the fastest growth as cross-border e-commerce reorders distribution models. Real-time network visibility enabled by the Pan-European 5G corridor, together with EU Green Deal incentives that favor rail over road, is reshaping route economics. Simultaneously, the rapid reshoring of high-value manufacturing, wider deployment of automated parcel machines, and defense-related flows into Eastern Europe spur fresh demand for integrated "Europe freight and logistics market" solutions. Competitive dynamics intensify as scale players pursue M&A, invest in cold-chain assets, and race to certify autonomous yard-truck pilots that promise cost and safety gains.

Europe Freight And Logistics Market Trends and Insights

Pan-European 5G Corridor Transforms Real-Time Logistics Visibility

Digital Europe dedicates EUR 7.5 billion (USD 8.27 billion) to 5G infrastructure, with logistics lanes topping the priority list. This backbone enables sensor-rich trucks, trains, and vessels to communicate location, condition, and weather data every millisecond. FERNRIDE secured TUV SUD certification in 2024, allowing autonomous trucks to operate in live yard environments. Predictive maintenance analytics already trim downtime by up to 20% and reduce chilled-cargo loss rates in the "Europe freight and logistics market" cold chain.

EU Green Deal Accelerates Modal Shift from Road to Rail

The Fit-for-55 legislative package compels a 55% carbon cut by 2030, encouraging shippers to swap long-haul trucks for rail or waterways. France alone earmarked EUR 1.1 billion (USD 1.21 billion) for intermodal terminals through 2030. Yet rail freight fell 2.8% year-on-year in H1 2024, exposing capacity shortfalls that hinder modal ambitions. Rising EU ETS surcharges on maritime and road make the rail alternative progressively cost-competitive in the Europe freight and logistics industry.

Driver Shortage Crisis Triggers Wage Inflation Spiral

The International Road Transport Union calculates a 500,000-driver shortfall that could swell to 745,000 by 2028. Operators have raised wages 15-25% annually, driving road freight rates up 18-22% in major corridors. Temperature-controlled units feel the pinch more acutely, as qualified drivers command EUR 60,000 packages in high-demand hubs.

Other drivers and restraints analyzed in the detailed report include:

- Critical Manufacturing Reshoring Drives Logistics Demand

- B2C Parcel Density Expands Beyond Tier-1 Cities

- Port Labour Disruptions Create Vessel Backlogs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Manufacturing supplied 32.01% of the Europe freight and logistics market share in 2025, anchored by automotive, machinery, and chemicals. Reshoring capital outlays of USD 2 trillion tilt volumes toward continental routes, sustaining robust contract-logistics pipelines.

Wholesale and retail trade, powered by 73% consumer e-commerce penetration, grows at 3.47% CAGR (2026-2031). Omnichannel models demand hyper-local distribution, favoring micro-fulfillment facilities. Construction logistics benefits moderately from Next Generation EU spending, while renewable-energy projects introduce special-cargo lanes for turbine blades and battery chemicals.

Freight transport remained the backbone of the Europe freight and logistics market size, accounting for 62.74% revenue in 2025. CEP operations, though smaller, are scaling faster at a 3.70% CAGR between 2026-2031. Growth is rooted in cross-border e-commerce, with international parcels advancing at a 5.33% pace. Digital customs gateways shorten clearance cycles by up to two days, translating into repeat B2C volumes.

The Europe freight and logistics market is increasingly shaped by CEP network upgrades such as automated sortation, AI-guided route planning, and temperature-controlled lockers. Warehousing services rise in tandem, as next-day delivery promises hinge on expandable urban fulfillment nodes. Freight forwarding adapts through multimodal bundles, while value-added services-reverse logistics, labeling, kitting-gain relevance under EU circular-economy rules.

The Europe Freight and Logistics Market Report Segments the Industry Into End User Industry (Agriculture, Fishing, and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale and Retail Trade, and More), by Logistics Function (Courier, Express, and Parcel, Freight Forwarding, Freight Transport, and More), and Country (Denmark, Finland, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- A.P. Moller - Maersk

- C.H. Robinson

- CMA CGM Group (Including CEVA Logistics)

- DACHSER

- DHL Group

- DSV A/S (Including DB Schenker)

- Expeditors International of Washington, Inc.

- FedEx

- GEFCO

- Hapag-Lloyd

- Hellmann Worldwide Logistics

- International Distributions Services (Including GLS)

- Kuehne+Nagel

- La Poste Group

- Mainfreight

- Panattoni Europe

- Rhenus Group

- SNCF Group

- United Parcel Service of America, Inc. (UPS)

- XPO, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Demographics

- 4.3 GDP Distribution by Economic Activity

- 4.4 GDP Growth by Economic Activity

- 4.5 Inflation

- 4.6 Economic Performance and Profile

- 4.6.1 Trends in E-Commerce Industry

- 4.6.2 Trends in Manufacturing Industry

- 4.7 Transport and Storage Sector GDP

- 4.8 Export Trends

- 4.9 Import Trends

- 4.10 Fuel Price

- 4.11 Trucking Operational Costs

- 4.12 Trucking Fleet Size by Type

- 4.13 Major Truck Suppliers

- 4.14 Logistics Performance

- 4.15 Modal Share

- 4.16 Maritime Fleet Load Carrying Capacity

- 4.17 Liner Shipping Connectivity

- 4.18 Port Calls and Performance

- 4.19 Freight Pricing Trends

- 4.20 Freight Tonnage Trends

- 4.21 Infrastructure

- 4.22 Regulatory Framework (Road and Rail)

- 4.22.1 France

- 4.22.2 Germany

- 4.22.3 Italy

- 4.22.4 Netherlands

- 4.22.5 Nordics

- 4.22.6 Russia

- 4.22.7 Spain

- 4.22.8 United Kingdom

- 4.23 Regulatory Framework (Sea and Air)

- 4.23.1 France

- 4.23.2 Germany

- 4.23.3 Italy

- 4.23.4 Netherlands

- 4.23.5 Nordics

- 4.23.6 Russia

- 4.23.7 Spain

- 4.23.8 United Kingdom

- 4.24 Value Chain and Distribution Channel Analysis

- 4.25 Market Drivers

- 4.25.1 Pan-European 5G Corridor Roll-Out

- 4.25.2 EU Green Deal Modal-Shift Incentives

- 4.25.3 Reshoring of Critical Manufacturing

- 4.25.4 Rapid B2C Parcel Density Beyond Tier-1 Cities

- 4.25.5 Defence-Logistics Uptick Post-Ukraine

- 4.25.6 Autonomous Yard-Truck Pilots Reaching Scale

- 4.26 Market Restraints

- 4.26.1 Driver-Shortage Inflation Spiral

- 4.26.2 Rail Network Capacity Bottlenecks

- 4.26.3 Port Labour-Union Disruptions

- 4.26.4 Carbon-Border Adjustment Compliance Costs

- 4.27 Technology Innovations in the Market

- 4.28 Porter's Five Forces Analysis

- 4.28.1 Threat of New Entrants

- 4.28.2 Bargaining Power of Buyers

- 4.28.3 Bargaining Power of Suppliers

- 4.28.4 Threat of Substitutes

- 4.28.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Logistics Function

- 5.2.1 Courier, Express, and Parcel (CEP)

- 5.2.1.1 By Destination Type

- 5.2.1.1.1 Domestic

- 5.2.1.1.2 International

- 5.2.1.1 By Destination Type

- 5.2.2 Freight Forwarding

- 5.2.2.1 By Mode of Transport

- 5.2.2.1.1 Air

- 5.2.2.1.2 Sea and Inland Waterways

- 5.2.2.1.3 Others

- 5.2.2.1 By Mode of Transport

- 5.2.3 Freight Transport

- 5.2.3.1 By Mode of Transport

- 5.2.3.1.1 Air

- 5.2.3.1.2 Pipelines

- 5.2.3.1.3 Rail

- 5.2.3.1.4 Road

- 5.2.3.1.5 Sea and Inland Waterways

- 5.2.3.1 By Mode of Transport

- 5.2.4 Warehousing and Storage

- 5.2.4.1 By Temperature Control

- 5.2.4.1.1 Non-Temperature Controlled

- 5.2.4.1.2 Temperature Controlled

- 5.2.4.1 By Temperature Control

- 5.2.5 Other Services

- 5.2.1 Courier, Express, and Parcel (CEP)

- 5.3 Country

- 5.3.1 Denmark

- 5.3.2 Finland

- 5.3.3 France

- 5.3.4 Germany

- 5.3.5 Iceland

- 5.3.6 Italy

- 5.3.7 Netherlands

- 5.3.8 Norway

- 5.3.9 Russia

- 5.3.10 Spain

- 5.3.11 Sweden

- 5.3.12 United Kingdom

- 5.3.13 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Key Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 A.P. Moller - Maersk

- 6.4.2 C.H. Robinson

- 6.4.3 CMA CGM Group (Including CEVA Logistics)

- 6.4.4 DACHSER

- 6.4.5 DHL Group

- 6.4.6 DSV A/S (Including DB Schenker)

- 6.4.7 Expeditors International of Washington, Inc.

- 6.4.8 FedEx

- 6.4.9 GEFCO

- 6.4.10 Hapag-Lloyd

- 6.4.11 Hellmann Worldwide Logistics

- 6.4.12 International Distributions Services (Including GLS)

- 6.4.13 Kuehne+Nagel

- 6.4.14 La Poste Group

- 6.4.15 Mainfreight

- 6.4.16 Panattoni Europe

- 6.4.17 Rhenus Group

- 6.4.18 SNCF Group

- 6.4.19 United Parcel Service of America, Inc. (UPS)

- 6.4.20 XPO, Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment