|

市场调查报告书

商品编码

1911483

德国网路安全市场:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Germany Cybersecurity - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

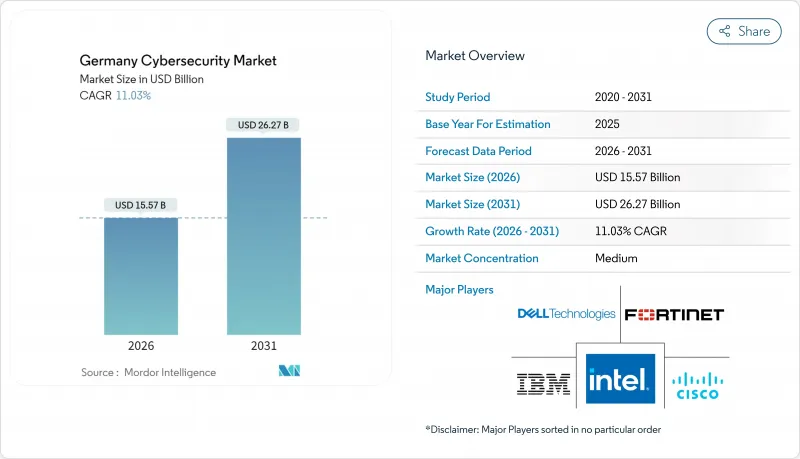

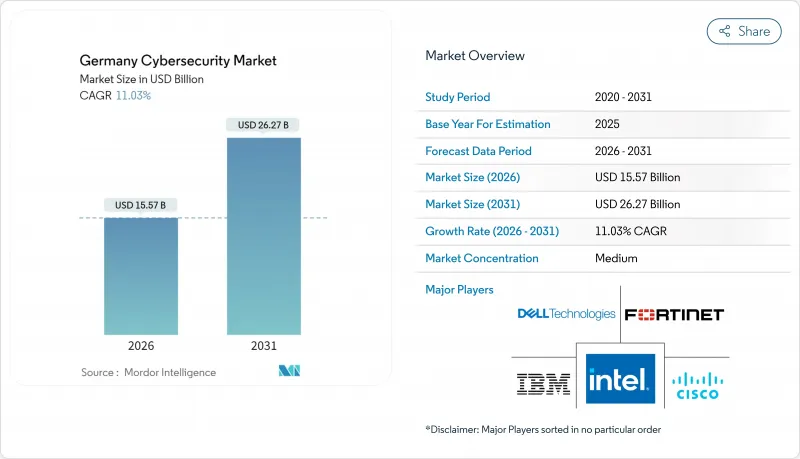

据估计,德国网路安全市场在 2026 年的价值为 155.7 亿美元,从 2025 年的 140.2 亿美元增长到 2031 年的 262.7 亿美元,2026 年至 2031 年的年复合成长率(CAGR)为 11.03%。

2024年全年,德国联邦资讯安全办公室(BSI)共记录了7.2万起安全事件报告,比上年增加21%。同时,该机构的产品指南(Produkt-Kompass)登记了24531个公开漏洞,其中15%被评为「严重」漏洞。新的法规,特别是《NIS2实施和加强网路安全法案》和《数位营运弹性法案》,以及德国联邦金融监理局(BaFin)更新的IT要求,将导致2025年至2027年间强制支出74亿欧元。同时,监管力道也正在加强,2024年,68%的DAX指数成分股公司设立了董事会级别的网路安全委员会(高于2022年的42%)。这些管治措施正在加速预算核准,并鼓励将安全防线纳入德国网路安全市场的核心IT资本投资。

德国联邦统计局报告称,云端使用率将从2021年的54%增加到2024年的69%。去年,随着各部会收紧国内资料储存规则,公共机构的自主云端合约成长了27%。此外,各组织越来越多地将人工智慧和网路安全预算合併到一个指导委员会下,预计这将推动德国网路安全市场支出成长。

德国网路安全市场趋势与洞察

云端原生应用程式在公共部门和医疗保健领域的兴起

德国《线上查询法》要求到2026年,575项联邦和市政服务必须数位化交付。截至2024年12月,其中41%的服务已在德国电信开放云端运作。一家大学医院将其混合云端储存容量扩展至每年Petabyte,用于归檔影像资料集。所有新增工作负载都必须符合BSI C5安全框架,2024年获得认证的供应商数量从23家增加到34家。更快捷的认证流程减少了采购摩擦,并鼓励了进一步的迁移。这直接转化为德国网路安全市场对许可证和咨询服务需求的成长。

工业4.0时代OT/ICS安全的迫切性

根据德国机械设备製造业联合会 (VDMA) 的报告,到 2024 年,智慧感测器在生产线上的应用率将达到 71%。科隆研究所 (IW Cologne Research Institute) 估计,汽车工厂的平均停机成本为每小时 29 万欧元。资产发现平台目前已在全国范围内绘製了 230 万台关键工业设备的地图,为被动监控奠定了基础。透过将网路安全防护措施整合到整体设备效率 (OEE) 运算中,製造商正在将资金从可自由支配的 IT 预算转移到必要的营运防护上,从而推动德国网路安全市场工业级解决方案的收入成长。

合格的网路安全专业人员短缺

德国预计到2025年将有96,300个IT安全职缺,比上一年成长25%。慕尼黑高级安全营运中心(SOC)分析师的平均年薪为96,000欧元,比2019年成长57%。虽然有28所大学提供相关专业学位,但每年只有3,400名毕业生进入劳动市场,仅能满足7%的需求。人才短缺导致企业预算中最低工资标准提高,支出转向自动化、SOC即服务(SOCaaS)和託管检测服务。这虽然会挤压利润空间,但却能为德国网路安全市场的服务供应商带来收入。

细分市场分析

到2025年,解决方案领域将占据德国网路安全市场份额的66.05%(92.6亿美元)。同时,资安管理服务创造了37.1亿美元的收入,实现了18.12%的成长。企业也采购了16.4万台经BSI认证的新一代防火墙,出货量成长了14%。业务收益正日益转向按使用量付费模式:据德国电信称,2024年42%的安全合约将采用计量型,而非固定费用模式。将服务供应商的奖励与实际威胁情势挂钩,可确保德国网路安全市场持续优化并实现长期客户留存。

中央政府斥资 6.8 亿欧元製定的 2024 年安全营运中心 (SOC) 框架协议进一步推动了对资安管理服务(MSS) 的需求,并促使供应商扩张。对软体定义边界 (SDP) 和零信任试点专案的日益依赖,需要全天候策略协调,这对大多数内部团队来说难以管理,也加速了对外包 SOC 能力的需求。

截至2025年,本地部署和私有云端环境将占德国网路安全市场52.85%(74.1亿美元)的份额,而公共云端安全市场将以16.52%的复合年增长率成长。根据欧盟统计局的一项调查,46%的德国公司在公共云端中储存部分数据,但只有11%的公司将核心财务记录储存在公有云中。Capgemini SA顾问公司的调查显示,本地託管服务的价格比公有云高出18%,但58%的用户愿意接受这笔价格上涨。

Eco eV 估计,在转型阶段,72% 的公司正在运行两个 SIEM 平台。整合本地和云端遥测功能的供应商预计,2024 年的年度经常性收入 (ARR) 将成长 41%。这种双栈模式加剧了复杂性,使扩充性平台比单一产品更具优势,并强化了指导德国网路安全市场的「主权优先」理念。

德国网路安全市场报告按公共产业类型(解决方案、服务)、部署模式(云端、本地部署)、最终用户垂直产业(银行、金融服务和保险、医疗保健、IT 和电信、工业和国防、製造业、零售和电子商务、能源和公用事业、其他)以及最终用户公司规模(中小企业、大型企业)对产业进行细分。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 德国公共部门和医疗保健领域云端原生应用的成长

- 工业4.0时代OT/ICS安全的迫切性

- 扩展5G和互联行动基础设施

- 网路保险需求增加推动安全支出

- 监理合规要求(NIS2、DORA、BaFin IT法规)

- 人工智慧驱动的威胁侦测和自动回应

- 市场限制

- 德语世界严重缺乏网路安全专家。

- 中型企业(Mittelstand)的预算限制,该地区以中小企业为主。

- 资料主权问题限制了全球SaaS安全工具的采用

- 联邦采购体系碎片化延缓了大规模推广应用

- 关键法规结构评估

- 价值链分析

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 主要用例和案例研究

- 宏观经济因素对市场的影响

- 投资分析

第五章 市场区隔

- 报价

- 解决方案

- 应用程式安全

- 云端安全

- 资料安全

- 身分和存取管理

- 基础设施保护

- 综合风险管理

- 网路安全设备

- 端点安全

- 其他服务

- 服务

- 专业服务

- 託管服务

- 解决方案

- 透过部署模式

- 本地部署

- 云

- 按最终用户行业划分

- BFSI

- 卫生保健

- 资讯科技和电信

- 工业与国防

- 製造业

- 零售与电子商务

- 能源与公共产业

- 其他的

- 按最终用户公司规模划分

- 中小企业

- 大公司

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Deutsche Telekom(T-Systems)

- SAP SE

- Siemens AG

- IBM Deutschland GmbH

- Cisco Systems Germany

- Fortinet Germany GmbH

- Palo Alto Networks

- Check Point Software Tech

- Trend Micro Deutschland

- Kaspersky Labs DE

- Arctic Wolf

- CrowdStrike Germany

- Sophos Ltd

- Thales DIS Germany

- Atos Eviden

- Rheinmetall Cyber Solutions

- Deutsche Bahn Cyberservice

- Signal Iduna Cyber Protect

- Airbus Defence & Space Cybersecurity

- Rohde & Schwarz Cybersecurity

- IONOS Cloud Security

- CGI Deutschland

第七章 市场机会与未来展望

The German Cybersecurity market size in 2026 is estimated at USD 15.57 billion, growing from 2025 value of USD 14.02 billion with 2031 projections showing USD 26.27 billion, growing at 11.03% CAGR over 2026-2031.

Across 2024, the Federal Office for Information Security (BSI) logged 72,000 incident reports, a 21% jump on the prior year, while its Produkt-KOMPASS registered 24,531 published vulnerabilities, 15% of which were labelled critical . Fresh statutes-most notably the NIS2 Implementation and Cyber Security Strengthening Act, the Digital Operational Resilience Act and BaFin's updated IT requirements-unlock EUR 7.4 billion of compulsory outlays between 2025 and 2027. Oversight is tightening in parallel; 68% of DAX constituents created a board-level cybersecurity committee in 2024, up from 42% in 2022. These governance moves encourage earlier budget sign-off and embed protection lines within core IT capex across the German Cybersecurity market.

The Federal Statistical Office reported cloud use by 69% of companies in 2024, compared with 54% in 2021. Sovereign-cloud contracts inside public agencies expanded 27% last year as ministries tightened domestic-data-residency rules. Organizations also fuse AI and protection budgets under single steering committees, and that integration is expected to reinforce spending momentum across the German Cybersecurity market.

Germany Cybersecurity Market Trends and Insights

Cloud-native application expansion in public sector and healthcare

Germany's Online Access Act mandates digital delivery of 575 federal and municipal services by 2026. By December 2024, 41% of those services already ran on Open Telekom Cloud. University hospitals raised hybrid-cloud storage to 94 petabytes over the year to archive imaging datasets. All new workloads must conform to the BSI C5 security framework, whose list of certified providers grew from 23 to 34 during 2024. Faster certification lowers procurement friction and fuels additional migrations, translating directly into higher license and consulting demand across the German Cybersecurity market.

OT/ICS security urgency amid Industrie 4.0 roll-outs

The VDMA reported that smart-sensor adoption reached 71% of production lines in 2024. IW Cologne pegged average downtime costs at EUR 290,000 per hour in automotive plants. Asset-discovery platforms now map 2.3 million critical industrial components nationwide, underpinning passive-monitoring adoption. By integrating cyber safeguards in overall-equipment-effectiveness calculations, manufacturers shift budgets from discretionary IT to mandatory operational protection, tilting revenue towards industrial-grade solutions inside the German Cybersecurity market.

Shortage of qualified cybersecurity professionals

Germany entered 2025 with 96,300 open IT-security positions, 25% higher than a year earlier. Senior SOC analysts in Munich command average pay of EUR 96,000, 57% above 2019 levels. Although 28 universities award specialist degrees, only 3,400 graduates enter the workforce annually, covering 7% of demand. Scarcity hardwires elevated wage floors into corporate budgets and directs spending towards automation, SOC-as-a-service and managed detection, which tempers margins yet supports service-provider revenues in the German Cybersecurity market.

Other drivers and restraints analyzed in the detailed report include:

- 5G and connected-mobility infrastructure growth

- Cyber-insurance requirements

- Budget limitations across the Mittelstand

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions accounted for 66.05% of 2025 German Cybersecurity market share, equal to USD 9.26 billion, while managed security services produced USD 3.71 billion and are pacing an 18.12% expansion curve. Companies also bought 164,000 BSI-certified next-generation firewalls, a 14% shipment gain. Service revenue is increasingly usage-based; Deutsche Telekom said that 42% of 2024 security bookings were metered rather than fixed-fee. Aligning provider incentives with live threat conditions ensures continuous optimisation and long-term stickiness across the German Cybersecurity market.

MSS engagement is further fuelled by central government placing EUR 680 million of SOC framework orders in 2024, which broadens vendor scale. The growing reliance on software-defined perimeters and zero-trust pilots requires 24/7 policy tuning unavailable in most internal teams, accelerating demand for outsourced SOC capacity.

On-premise and private-cloud instances retained 52.85% of the German Cybersecurity market size in 2025, or USD 7.41 billion, even as public-cloud security exhibits a 16.52% CAGR. Eurostat shows 46% of German firms storing some data in the public cloud, yet only 11% entrust core financial records. Capgemini measured an 18% premium for locally hosted services, but 58% of adopters accept the higher price.

Eco e.V. estimates that 72% of enterprises operate two SIEM platforms during transition phases. Vendors that unify on-premise and cloud telemetry registered 41% new ARR growth in 2024. This dual-stack reality entrenches complexity, favouring extensible platforms over point products and reinforcing the sovereign-first ethos guiding the German Cybersecurity market.

The Germany Cyber Security Market Report Segments the Industry Into by Offering (Solutions, and Services), Deployment Mode (Cloud, and On-Premise), End-User Vertical (BFSI, Healthcare, IT and Telecom, Industrial and Defense, Manufacturing, Retail and E-Commerce, Energy and Utilities, and Others), and End-User Enterprise Size (Small and Medium Enterprises (SMEs), and Large Enterprises).

List of Companies Covered in this Report:

- Deutsche Telekom (T-Systems)

- SAP SE

- Siemens AG

- IBM Deutschland GmbH

- Cisco Systems Germany

- Fortinet Germany GmbH

- Palo Alto Networks

- Check Point Software Tech

- Trend Micro Deutschland

- Kaspersky Labs DE

- Arctic Wolf

- CrowdStrike Germany

- Sophos Ltd

- Thales DIS Germany

- Atos Eviden

- Rheinmetall Cyber Solutions

- Deutsche Bahn Cyberservice

- Signal Iduna Cyber Protect

- Airbus Defence & Space Cybersecurity

- Rohde & Schwarz Cybersecurity

- IONOS Cloud Security

- CGI Deutschland

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cloud-native Application Growth in Germany's Public Sector & Healthcare

- 4.2.2 OT/ICS Security Urgency amid Industrie 4.0 Roll-outs

- 4.2.3 Expansion of 5G and Connected Mobility Infrastructure

- 4.2.4 Rise of Cyber-Insurance Requirements Driving Security Spending

- 4.2.5 Regulatory compliance mandates (NIS2, DORA, BaFin IT rules)

- 4.2.6 AI-driven threat detection and response automation

- 4.3 Market Restraints

- 4.3.1 Severe Shortage of German-speaking Cybersecurity Professionals

- 4.3.2 Budget Limitations across SME-dominated Mittelstand

- 4.3.3 Data-Sovereignty Concerns Limiting Adoption of Global SaaS Security Tools

- 4.3.4 Federal Procurement Fragmentation Slowing Large-scale Roll-outs

- 4.4 Evaluation of Critical Regulatory Framework

- 4.5 Value Chain Analysis

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Key Use Cases and Case Studies

- 4.9 Impact on Macroeconomic Factors of the Market

- 4.10 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Offering

- 5.1.1 Solutions

- 5.1.1.1 Application Security

- 5.1.1.2 Cloud Security

- 5.1.1.3 Data Security

- 5.1.1.4 Identity and Access Management

- 5.1.1.5 Infrastructure Protection

- 5.1.1.6 Integrated Risk Management

- 5.1.1.7 Network Security Equipment

- 5.1.1.8 Endpoint Security

- 5.1.1.9 Other Services

- 5.1.2 Services

- 5.1.2.1 Professional Services

- 5.1.2.2 Managed Services

- 5.1.1 Solutions

- 5.2 By Deployment Mode

- 5.2.1 On-Premise

- 5.2.2 Cloud

- 5.3 By End-User Vertical

- 5.3.1 BFSI

- 5.3.2 Healthcare

- 5.3.3 IT and Telecom

- 5.3.4 Industrial and Defense

- 5.3.5 Manufacturing

- 5.3.6 Retail and E-commerce

- 5.3.7 Energy and Utilities

- 5.3.8 Others

- 5.4 By End-User Enterprise Size

- 5.4.1 Small and Medium Enterprises (SMEs)

- 5.4.2 Large Enterprises

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Deutsche Telekom (T-Systems)

- 6.4.2 SAP SE

- 6.4.3 Siemens AG

- 6.4.4 IBM Deutschland GmbH

- 6.4.5 Cisco Systems Germany

- 6.4.6 Fortinet Germany GmbH

- 6.4.7 Palo Alto Networks

- 6.4.8 Check Point Software Tech

- 6.4.9 Trend Micro Deutschland

- 6.4.10 Kaspersky Labs DE

- 6.4.11 Arctic Wolf

- 6.4.12 CrowdStrike Germany

- 6.4.13 Sophos Ltd

- 6.4.14 Thales DIS Germany

- 6.4.15 Atos Eviden

- 6.4.16 Rheinmetall Cyber Solutions

- 6.4.17 Deutsche Bahn Cyberservice

- 6.4.18 Signal Iduna Cyber Protect

- 6.4.19 Airbus Defence & Space Cybersecurity

- 6.4.20 Rohde & Schwarz Cybersecurity

- 6.4.21 IONOS Cloud Security

- 6.4.22 CGI Deutschland

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment