|

市场调查报告书

商品编码

1911816

人力资源咨询:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Human Resource Consulting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

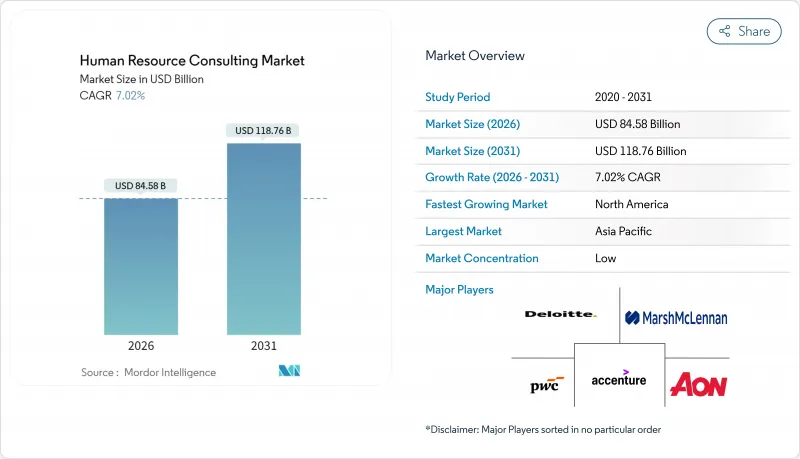

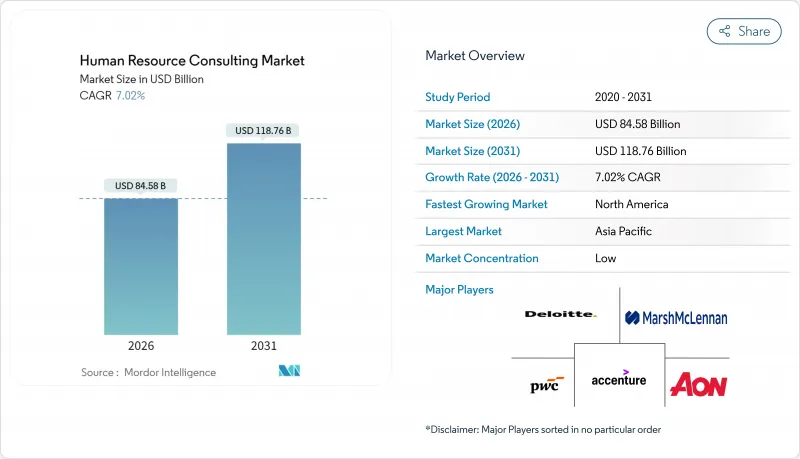

预计人力资源咨询市场将从 2025 年的 790.3 亿美元成长到 2026 年的 845.8 亿美元,到 2031 年将达到 1,187.6 亿美元,2026 年至 2031 年的复合年增长率为 7.02%。

人力资源咨询市场受益于许多因素,例如数位化人力资源技术的快速普及、日益严格的全球合规要求以及为适应混合模式而迫切需要重新设计营运模式。北美目前是人力资源咨询市场的基础,但随着中小企业推动人力资源流程数位化以及区域监管机构协调劳动法规,亚太地区正在迅速缩小与北美的差距。併购活动的活性化、分析技术的深入应用以及身临其境型技能发展技术的普及,都推动了咨询业务范围的扩大。同时,随着日常工作日益商品化,企业正转向更高附加价值的业务活动。由于前五大公司总合仅占市场份额的四分之一,市场竞争依然适中,这为细分领域的专业公司留下了广阔的发展空间。

全球人力资源咨询市场趋势与洞察

数位化人力资源技术实施与分析集成

全球企业正将人工智慧、机器学习和预测分析融入人力资源流程,从而推动更高水准的数据驱动型人才决策。当经营团队缺乏将数据讯号转化为可执行人才策略的内部能力时,对咨询服务的需求就会激增。仅有21%的人力资源主管认为他们已经弥补了这一差距。从本地部署套件转向云端人力资本管理(HCM)和单点解决方案生态系统的转变,为顾问公司创造了大规模应用和变革管理的机会。在亚太地区,中小企业中的首次采用者正在加速平台部署,推动二线城市人力资源咨询市场的扩张。顾问公司越来越多地将培训与託管分析服务相结合,使客户能够自主管理其仪錶板,从而持续获取策略洞察。利用分析技术提高员工留存率的企业不仅获得了可衡量的财务收益,还加强了与客户的长期咨询关係。这些成功案例凸显了数据驱动决策在建立客户忠诚度和推动永续业务成长方面的策略价值。

监管复杂性日益增加(多元化、公平性和包容性、薪酬透明度、ESG)

涵盖薪酬公平、包容性招聘和永续发展资讯揭露的法规结构正在迅速演变,重塑成熟经济体和新兴经济体的人力资源咨询市场。欧盟薪资透明指令要求企业公布性别薪资差距指标,美国多个州已实施薪资范围公示制度,全球跨国公司也正在实施严格的审核程序。投资者和监管机构对10-K报告中人力资本指标的审查日益严格,推动了对资料收集和叙述性设计咨询服务的需求。人力资源部门也必须遵守欧盟人工智慧法中关于演算法应用的「人机互动」保障措施,这项要求也推动了对专业风险评估的需求。频繁的立法变更促使具有前瞻性的客户采用持续咨询模式与外部合作伙伴合作,而非进行一次性的差距评估。

常规人力资源咨询服务的商品化

人工智慧驱动的工作流程引擎能够自动产生政策提案、提案和仪錶板,而这些内容过去都需要初级顾问手动建立。这种自动化降低了标准交付成果的差异化程度,为整个人力资源咨询市场带来了价格下行压力。现有企业正透过转型到人工智慧伦理、气候友善劳动力规划和跨境监管协调等高价值领域来应对这项挑战。而小型顾问公司则透过将专业智慧财产权融入订阅式软体来应对,从而以更低的单价确保持续收入。虽然策略性工作受到的影响相对较小,但商品化工作量的成长预计将在中期内推动整个产业实现1.3%的复合年增长率。

细分市场分析

到2025年,人才管理将占据人力资源咨询市场26.02%的最大份额,这反映出企业迫切需要获取稀缺技能人才并建立继任人才储备。儘管人力资源分析的基数较小,但预计其复合年增长率将达到12.18%,这表明市场对数据驱动型人才策略的需求旺盛。随着客户认识到强大的洞察力有助于降低员工流失成本并提升员工敬业度指标,与分析相关的人力资源咨询市场规模预计将稳步成长。薪资福利工作正在经历重塑,因为薪资透明度法规迫使企业实施即时基准测试并推动跨境薪资协调计划。对学习与发展咨询服务的需求正朝着利用扩增实境(XR)和自适应学习的身临其境型发展,以缩短技能习得週期。

将预测模型整合到招募流程中的企业报告称,招募时间缩短了30%,凸显了分析的策略重要性。随着技能分类和零工经济模式的不断演变,即使对于经验丰富的HR部门而言,人才管理服务也变得日益复杂,人才规划也变得更加困难。同时,随着客户寻求打破财务、IT和业务领导层之间障碍的无边界人力资源营运模式,人力资本策略计划的重要性日益凸显。根据年中评估,仅有8%的公司认为其分析能力“强大”,这意味着咨询需求仍有巨大的未开发空间。因此,能够将专业知识与可扩展的技术方案结合的服务供应商,预计将在人力资源咨询市场中占据重要地位。

人力资源咨询市场按服务类型(人力资本策略、薪资福利、人才管理、组织转型、学习与发展、人力资源职能和人力资源分析)、最终用户(IT和电信、银行、金融服务和保险、医疗保健及其他行业)以及地区(亚太地区、北美地区、欧洲地区、南美地区以及中东和非洲地区)进行细分。市场预测以美元以金额为准。

区域分析

预计到2025年,北美将占据人力资源咨询市场39.88%的份额,巩固其作为该行业最成熟地区的地位。这主要得益于先进分析技术的应用和全面的薪酬透明化法律。咨询业务主要集中在人工智慧管治、以永续性发展为导向的劳动力规划以及全面薪酬个性化,但联邦预算紧缩限制了近期成长。受美国加协定(USMCA)下跨国劳动力流动计画的推动,加拿大和墨西哥的需求正在上升,这为人才策略计划增添了区域差异化。服务供应商正透过为受监管产业开发专有的人工智慧加速器来实现差异化,从而强化了北美的高端定价优势。儘管短期内可能出现疲软,但该地区客户的高度成熟度确保了人力资源咨询市场的长期永续发展。

欧洲蕴藏着多元化的机会,欧盟人工智慧法和薪酬透明指令等广泛的监管变革促使企业持续进行合规工作。从德国的举报人保护改革到荷兰的残障人士就业计划,多个国家正在为2025年推出新的保护措施,这进一步凸显了在地化的重要性。北欧和比荷卢经济联盟的客户正优先考虑与环境、社会和治理(ESG)挂钩的薪酬,并积极推动高级薪酬战略计划。同时,数位化劳动力转型是南欧中型企业的优先事项。併购活动正在强劲反弹,这主要得益于交易后整合工作的推动,这些工作侧重于文化融合和领导力保留。西欧人口老化进一步推动了对继任计画的需求,从而增强了人力资本咨询市场的前景。

亚太地区预计将以8.78%的复合年增长率成长,并继续成为推动人力资源咨询市场未来扩张的引擎,这主要得益于微企业数位化计画和日益增长的跨境贸易。东南亚人力资本管理(HCM)软体的快速成长,为本地和全球咨询顾问带来了强劲的实施和管理服务需求。从人工智慧驱动的招聘到监管合规等大型计划正在中国和印度陆续推出,而澳洲和日本则在卓越分析中心方面投入巨资。政府为提升中小企业能力提供的资金支持,正在扩大区域城市的咨询需求,并创造新的客户群。这些趋势使亚太地区有望挑战西欧的主导地位,并在2030年前重新定义全球收入份额。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 数位化人力资源技术实施与分析集成

- 混合/远距办公转型的必要性

- 监管复杂性日益增加(多元化、公平性和包容性、薪酬透明度、ESG)

- 併购主导的重组浪潮

- 利用身临其境型XR技术进行劳动力技能发展的需求

- 新兴市场中小企业加速器计划

- 市场限制

- 常规人力资源咨询服务的商品化

- 景气衰退期间,客户预算缩减。

- 提升内部人力资源分析能力

- 资料隐私/人工智慧伦理合规障碍

- 价值/供应链分析

- 技术展望

- 监管环境

- 波特五力模型

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 透过服务

- 人力资本策略

- 薪资福利

- 人力资源管理

- 组织变革

- 学习与发展

- 人力资源职能

- 人力资源分析

- 最终用户

- 资讯科技/通讯

- BFSI

- 卫生保健

- 零售与电子商务

- 其他最终用户

- 按组织规模

- 大公司

- 中型公司

- 小规模企业

- 按地区

- 北美洲

- 加拿大

- 美国

- 墨西哥

- 南美洲

- 巴西

- 秘鲁

- 智利

- 阿根廷

- 南美洲其他地区

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 比荷卢经济联盟

- 北欧国家

- 其他欧洲地区

- 亚太地区

- 印度

- 中国

- 日本

- 澳洲

- 韩国

- 东南亚

- 亚太其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Deloitte

- PwC

- KPMG

- EY

- McKinsey & Company

- Boston Consulting Group

- Bain & Company

- Accenture

- Mercer

- Aon

- Willis Towers Watson

- Korn Ferry

- Randstad

- Adecco

- Hay Group

- Oliver Wyman

- IBM Consulting

- SAP SuccessFactors Services

- Workday Advisory Services

- Tata Consultancy Services

- Infosys

- Capgemini

- HCLTech

第七章 市场机会与未来展望

The Human Resource Consulting market is expected to grow from USD 79.03 billion in 2025 to USD 84.58 billion in 2026 and is forecast to reach USD 118.76 billion by 2031 at 7.02% CAGR over 2026-2031.

The human resource consulting market is benefiting from rapid digital HR-tech adoption, stricter global compliance demands, and the urgent need to redesign work for hybrid models. North America presently anchors the human resource consulting market, yet Asia-Pacific is closing the gap quickly as SMEs digitize HR processes and regional regulators harmonize employment rules. Intensifying M&A activity, deeper analytics penetration, and immersive up-skilling technologies are widening advisory scopes, while commoditization of routine tasks pushes firms toward higher-value engagements. Competition remains moderate because the top-five firms command just one-fourth of the combined revenue, leaving ample white space for niche specialists.

Global Human Resource Consulting Market Trends and Insights

Digital HR-tech Adoption & Analytics Integration

Companies worldwide are embedding AI, machine learning, and predictive analytics in people processes, which raises the bar for data-driven workforce decisions. Advisory demand spikes when leadership teams lack internal capability to translate data signals into actionable talent strategies, a gap that only 21% of HR heads believe they have bridged . The shift from on-premises suites to cloud HCM and point-solution ecosystems is generating sizeable implementation and change-management opportunities for consultancies. In the Asia-Pacific region, first-time buyers among SMEs accelerate platform rollouts, extending the human resource consulting market footprint in tier-two cities. Consultants increasingly bundle managed analytics services with training so clients can self-serve dashboards, yet still buy strategic insight. Organizations that have leveraged analytics to enhance retention times demonstrate measurable financial gains while reinforcing enduring advisory relationships. These success stories underscore the strategic value of data-driven decision-making in fostering customer loyalty and driving sustainable business growth.

Regulatory Complexity (DEI, Pay Transparency, ESG)

A fast-evolving rulebook covering equal pay, inclusive hiring, and sustainability disclosure is reshaping the human resource consulting market across mature and emerging economies. The EU Pay Transparency Directive obliges companies to publish gender pay-gap metrics, while several U.S. states enforce salary-range postings, nudging global multinationals toward rigorous audit programs. Heightened scrutiny by investors and regulators on human-capital metrics in 10-K filings fuels consulting around data collection and narrative design. HR teams must also align with the EU AI Act's human-in-the-loop safeguards for algorithmic hiring, a requirement propelling demand for specialized risk reviews . Because legislatures revise statutes frequently, forward-looking clients engage external partners on ongoing retainer models rather than one-off gap assessments.

Commoditization of Routine HR Advisory Tasks

AI-driven workflow engines now draft policies, draft proposals, and prepare dashboards that junior consultants once produced manually. This automation lowers perceived differentiation for standard deliverables and exerts downward pricing pressure across the human resource consulting market. Established firms respond by pivoting toward premium domains such as AI ethics, climate workforce planning, and cross-border regulatory orchestration. Boutique providers counter by embedding domain IP into subscription software, locking in annuity revenue despite lower ticket sizes. Although strategic work remains insulated, the volume of commoditized tasks reduces the sector CAGR by 1.3% in medium-term forecasts.

Other drivers and restraints analyzed in the detailed report include:

- Hybrid/Remote Work Transformation Needs

- M&A-led Organizational Restructuring Wave

- In-house HR Analytics Capabilities Rising

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, talent management held the largest slice of the human resource consulting market at 26.02%, reflecting organizations' urgent need to secure scarce skills and craft succession pipelines. HR Analytics, although representing a smaller base, is on course to expand at a 12.18% CAGR, indicating outsized appetite for data-backed talent strategies. The human resource consulting market size for analytics-related engagements is projected to climb steadily, propelled by clients' recognition that robust insights cut turnover costs and lift engagement metrics. Compensation & Benefits work is undergoing a redesign as pay-transparency rules force firms into real-time benchmarking, prompting cross-border harmonization projects. Advisory demand in Learning & Development tilts toward immersive formats that capitalize on XR and adaptive learning to shorten skill cycles.

Organizations that integrated predictive models into hiring processes reported time-to-fill reductions of 30%, underscoring analytics' strategic relevance. Talent Management services remain resilient because evolving skills taxonomies and gig-style labour models complicate workforce planning for even sophisticated HR departments. Meanwhile, Human Capital Strategy projects rise in prominence as clients pursue boundaryless HR operating models that break down silos across finance, IT, and line leadership. Mid-cycle reviews show that only 8% of enterprises rate their analytics muscle as "strong," unlocking a sizeable advisory backlog. Consequently, service providers that couple domain expertise with scalable tech playbooks is positioned to capture disproportionate value in the human resource consulting market.

The Human Resource Consulting Market Segments by Service (Human Capital Strategy, Compensation and Benefits, Talent Management, Organizational Change, Learning and Development, HR Function, HR Analytics), by End User (IT and Telecom, BFSI, Healthcare, and Other), and by Geography (Asia-Pacific, North America, Europe, South America, Middle East & Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America's 39.88% human resource consulting market share in 2025 underscores its status as the sector's most mature region, supported by advanced analytics adoption and comprehensive pay-transparency statutes. Advisory pipelines focus on AI governance, sustainability workforce planning, and total-rewards personalization, although federal budget tightening has tempered short-term growth. Canadian and Mexican demand rises on the back of cross-border labour-mobility programs under USMCA, adding regional nuance to talent-strategy projects. Providers are differentiating through proprietary AI accelerators targeted at regulated industries, reinforcing North America's premium-pricing profile. Despite near-term softness, the region's high client sophistication ensures sustained long-run relevance for the human resource consulting market.

Europe represents a multifaceted opportunity, buoyed by sweeping regulatory changes such as the EU AI Act and Pay Transparency Directive that generate consistent compliance work. In 2025, several countries introduced fresh protections, from Germany's whistle-blower reforms to the Netherlands' disability-hiring incentives, intensifying localization needs. Nordic and BENELUX clients emphasize ESG-linked pay, driving sophisticated reward-strategy projects, while Southern Europe prioritizes digital workforce transformation for mid-cap firms. M&A activity rebounded sharply, sparking post-deal integration assignments centred on cultural harmonization and leadership retention. Aging demographics across Western Europe further boost succession-planning mandates, reinforcing the human resource consulting market outlook.

Asia-Pacific, projected to register an 8.78% CAGR, remains the engine of future expansion for the human resource consulting market, propelled by MSME digitalization programs and rising cross-border trade. Southeast Asia's HCM software boom leads to strong implementation and managed-services contracts for local and global advisers . China and India anchor scale projects, ranging from AI-enabled recruitment to regulatory remediation, while Australia and Japan invest heavily in analytics centers of excellence. Government funds targeting SME capability building spread advisory demand into second-tier cities, creating new client pools. These dynamics position Asia-Pacific to challenge Western dominance and redefine global revenue shares before 2030.

- Deloitte

- PwC

- KPMG

- EY

- McKinsey & Company

- Boston Consulting Group

- Bain & Company

- Accenture

- Mercer

- Aon

- Willis Towers Watson

- Korn Ferry

- Randstad

- Adecco

- Hay Group

- Oliver Wyman

- IBM Consulting

- SAP SuccessFactors Services

- Workday Advisory Services

- Tata Consultancy Services

- Infosys

- Capgemini

- HCLTech

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Digital HR-tech adoption & analytics integration

- 4.2.2 Hybrid/remote work transformation needs

- 4.2.3 Regulatory complexity (DEI, pay transparency, ESG)

- 4.2.4 M&A-led organizational restructuring wave

- 4.2.5 Immersive XR-based workforce up-skilling demand

- 4.2.6 SME accelerator programs in emerging markets

- 4.3 Market Restraints

- 4.3.1 Commoditization of routine HR advisory tasks

- 4.3.2 Client budget compression during downturns

- 4.3.3 In-house HR analytics capabilities rising

- 4.3.4 Data-privacy / AI-ethics compliance hurdles

- 4.4 Value / Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Landscape

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Service

- 5.1.1 Human Capital Strategy

- 5.1.2 Compensation & Benefits

- 5.1.3 Talent Management

- 5.1.4 Organizational Change

- 5.1.5 Learning & Development

- 5.1.6 HR Function

- 5.1.7 HR Analytics

- 5.2 By End-User

- 5.2.1 IT & Telecom

- 5.2.2 BFSI

- 5.2.3 Healthcare

- 5.2.4 Retail and E-Commerce

- 5.2.5 Other End-Users

- 5.3 By Organization Size

- 5.3.1 Large Enterprises

- 5.3.2 Medium Enterprises

- 5.3.3 Small Enterprises

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 Canada

- 5.4.1.2 United States

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Peru

- 5.4.2.3 Chile

- 5.4.2.4 Argentina

- 5.4.2.5 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Spain

- 5.4.3.5 Italy

- 5.4.3.6 BENELUX

- 5.4.3.7 NORDICS

- 5.4.3.8 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 India

- 5.4.4.2 China

- 5.4.4.3 Japan

- 5.4.4.4 Australia

- 5.4.4.5 South Korea

- 5.4.4.6 South-East Asia

- 5.4.4.7 Rest of Asia-Pacific

- 5.4.5 Middle East & Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Nigeria

- 5.4.5.5 Rest of Middle East & Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Deloitte

- 6.4.2 PwC

- 6.4.3 KPMG

- 6.4.4 EY

- 6.4.5 McKinsey & Company

- 6.4.6 Boston Consulting Group

- 6.4.7 Bain & Company

- 6.4.8 Accenture

- 6.4.9 Mercer

- 6.4.10 Aon

- 6.4.11 Willis Towers Watson

- 6.4.12 Korn Ferry

- 6.4.13 Randstad

- 6.4.14 Adecco

- 6.4.15 Hay Group

- 6.4.16 Oliver Wyman

- 6.4.17 IBM Consulting

- 6.4.18 SAP SuccessFactors Services

- 6.4.19 Workday Advisory Services

- 6.4.20 Tata Consultancy Services

- 6.4.21 Infosys

- 6.4.22 Capgemini

- 6.4.23 HCLTech

7 Market Opportunities & Future Outlook

- 7.1 Generative-AI talent-intelligence advisory

- 7.2 Climate-transition workforce planning services