|

市场调查报告书

商品编码

1801915

海洋蛋白水解物市场机会、成长动力、产业趋势分析及2025-2034年预测Marine Protein Hydrolysate Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

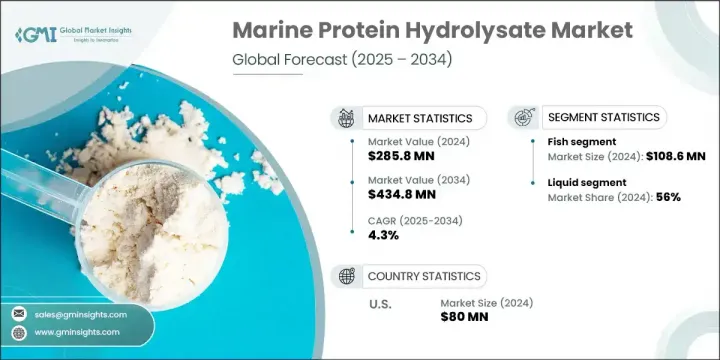

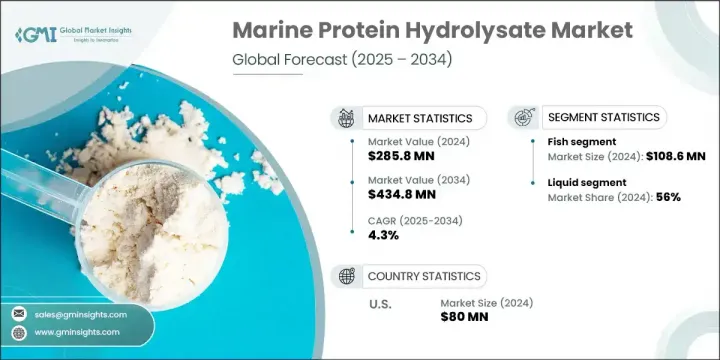

2024 年全球海洋蛋白水解物市场价值为 2.858 亿美元,预计到 2034 年将以 4.3% 的复合年增长率增长,达到 4.348 亿美元。这一增长主要得益于食品饮料、水产饲料、营养保健品和製药行业日益增长的需求。随着对清洁标籤成分和永续采购的日益关注,海洋蛋白水解物因其功能性和营养价值而越来越受欢迎。它们作为天然添加剂的使用正在增加,尤其是在欧洲等对成分监管严格的地区。全球加工技术的不断进步和注重健康的消费者群体的不断扩大,正在推动创新和市场扩张。此外,向永续原材料的转变以及对环保生产解决方案的需求也支持市场成长,尤其是在健康驱动型经济体中。

儘管取得了这些进展,但该行业仍面临供应方面的挑战。海洋蛋白水解物严重依赖鱼类、甲壳类和藻类作为基础原料。环境变化、过度捕捞和监管限制往往会扰乱供应并导致成本波动。这些因素导致生产和定价不稳定,影响整个供应链,并可能阻碍市场的持续成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2.858亿美元 |

| 预测值 | 4.348亿美元 |

| 复合年增长率 | 4.3% |

2024年,鱼类产品市场产值达1.086亿美元,这得益于其丰富的蛋白质成分、易消化性以及与动物饲料、补充剂和功能性食品的兼容性。成熟的采购和加工基础设施使鱼类水解物成为动物营养和饮食领域的首选。甲壳类动物也因其富含生物活性化合物以及在成本效益高、减少浪费的水解物生产中日益重要的作用而具有重要意义。由于其营养优势,这些变异在水产养殖和营养保健品中的应用日益广泛。

2024年,液体製剂市场占56%的份额。其优异的溶解性和便捷的使用方式使其特别适用于水产养殖饲料和液体膳食补充剂。液体製剂可轻鬆与其他製剂混合,进而提高饲料转换率和营养吸收率,尤其是在水生环境中。这些特性使液体海洋蛋白水解物在营养保健品和功能性饮料行业都极具吸引力。

2024年,美国海洋蛋白水解物市场规模达8,000万美元。该地区对先进保健产品的重视以及强大的食品和补充剂生产基础设施持续推动市场需求。随着人们对清洁标籤营养和永续性的日益关注,海洋成分越来越多地被应用于运动营养、功能性食品和健康配方中。创新和对高监管标准的严格遵守推动了美国各行业市场的持续成长。

全球海洋蛋白水解物市场的主要参与者包括 Copalis、Hofseth BioCare、Aker BioMarine、SAMPI、Scanbio、Bio-Marine Ingredients、Socropole、Marutham Bio Ages Innovations 和 Symrise。为了巩固市场地位,海洋蛋白水解物领域的公司正致力于扩大原料采购网络,以减少对不稳定海洋生态系统的依赖。对加工技术的策略性投资有助于提高产量、纯度和产品一致性。各大品牌也针对特定的终端产业(例如水产饲料、运动营养和临床营养)定製配方。与研究机构的合作使参与者能够在开发具有成熟功能益处的生物活性化合物方面保持领先地位。为了挖掘日益增长的健康意识消费群体,企业正在推广清洁标籤和可追溯的供应链声明。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 科技与创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按来源

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利态势

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考虑

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按来源,2021-2034

- 主要趋势

- 鱼

- 甲壳类动物

- 藻类

第六章:市场估计与预测:依形式,2021-2034

- 主要趋势

- 液体

- 粉末

第七章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 食品和饮料

- 动物饲料

- 製药

- 其他的

第八章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- Copalis

- Symrise

- Hofseth BioCare

- Scanbio

- Socropole

- Bio-Marine Ingredients

- Aker BioMarine

- Marutham Bio Ages Innovations

- SAMPI

The Global Marine Protein Hydrolysate Market was valued at USD 285.8 million in 2024 and is estimated to grow at a CAGR of 4.3% to reach USD 434.8 million by 2034. This growth is being driven by rising demand across food and beverage, aquafeed, nutraceutical, and pharmaceutical sectors. As the focus on clean-label ingredients and sustainable sourcing intensifies, marine protein hydrolysates are gaining popularity for their functional and nutritional benefits. Their use as a natural additive is increasing, especially in regions with strict ingredient regulations, such as Europe. Ongoing advancements in processing technologies and expanding health-conscious consumer bases globally are fueling innovation and market expansion. Additionally, the transition toward sustainable raw materials and the need for eco-friendly production solutions support market growth, especially in health-driven economies.

Despite this progress, the industry remains challenged by supply-side issues. Marine protein hydrolysates heavily depend on fish, crustaceans, and algae as base materials. Environmental changes, overfishing, and regulatory limits often disrupt availability and lead to cost fluctuations. These factors contribute to instability in production and pricing, affecting the overall supply chain and posing a potential barrier to consistent growth in the market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $285.8 Million |

| Forecast Value | $434.8 Million |

| CAGR | 4.3% |

The fish segment generated USD 108.6 million in 2024 backed by its rich protein profile, digestibility, and compatibility with animal feed, supplements, and functional foods. The established sourcing and processing infrastructure make fish-based hydrolysates a preferred option in both animal nutrition and dietary sectors. Crustaceans are also significant due to their concentration of bioactive compounds and their growing role in cost-efficient, waste-reducing hydrolysate production. These variants are increasingly utilized in aquaculture and nutraceuticals due to their nutritional advantages.

The liquid formulations segment held 56% share in 2024. Their superior solubility and easy application make them particularly suitable for aquaculture feeds and liquid dietary supplements. Liquids blend effortlessly with other formulations, improving feed conversion and nutrient absorption, especially in aquatic environments. These properties make liquid marine protein hydrolysates highly attractive in both nutraceutical and functional beverage industries.

U.S. Marine Protein Hydrolysate Market was valued at USD 80 million in 2024. The region's emphasis on advanced health products and strong food and supplement manufacturing infrastructure continues to boost demand. With increasing attention to clean-label nutrition and sustainability, marine-based ingredients are being incorporated more frequently into sports nutrition, functional foods, and wellness formulations. Innovation and adherence to high regulatory standards drive the market's upward trajectory across U.S.-based industries.

Key players operating in the Global Marine Protein Hydrolysate Market include Copalis, Hofseth BioCare, Aker BioMarine, SAMPI, Scanbio, Bio-Marine Ingredients, Socropole, Marutham Bio Ages Innovations, and Symrise. To strengthen their market presence, companies in the marine protein hydrolysate space are focusing on expanding raw material sourcing networks to reduce dependency on volatile marine ecosystems. Strategic investments in processing technologies are helping improve yield, purity, and product consistency. Brands are also tailoring formulations for specific end-use industries such as aquafeed, sports nutrition, and clinical nutrition. Collaborations with research institutions allow players to stay ahead in developing bioactive compounds with proven functional benefits. To tap into growing health-conscious consumer segments, businesses are marketing clean-label and traceable supply chain claims.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Source trends

- 2.2.2 Form trends

- 2.2.3 Application trends

- 2.2.4 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By Source

- 3.9 Future market trends

- 3.10 Technology and Innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent Landscape

- 3.12 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Source, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Fish

- 5.3 Crustaceans

- 5.4 Algae

Chapter 6 Market Estimates and Forecast, By Form, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Liquid

- 6.3 Powder

Chapter 7 Market Estimates and Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food and beverages

- 7.3 Animal feed

- 7.4 Pharmaceuticals

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Copalis

- 9.2 Symrise

- 9.3 Hofseth BioCare

- 9.4 Scanbio

- 9.5 Socropole

- 9.6 Bio-Marine Ingredients

- 9.7 Aker BioMarine

- 9.8 Marutham Bio Ages Innovations

- 9.9 SAMPI