|

市场调查报告书

商品编码

1876645

免疫调节蛋白水解物市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Immunomodulatory Protein Hydrolysates Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

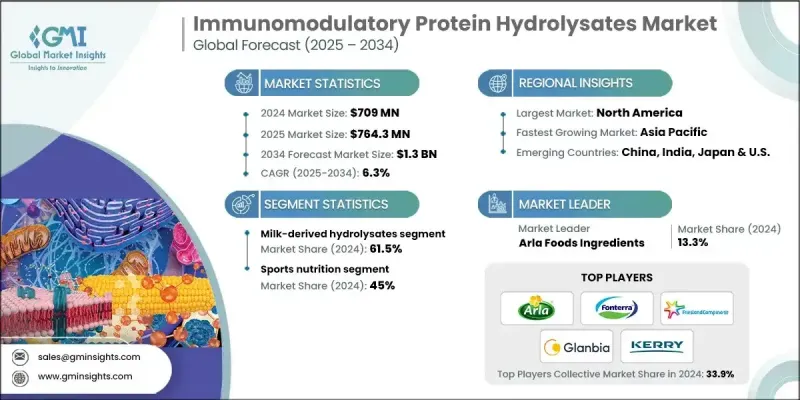

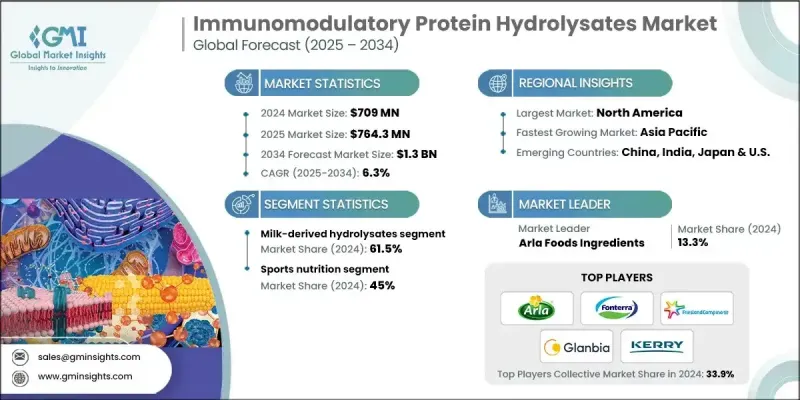

2024 年全球免疫调节蛋白水解物市值为 7.09 亿美元,预计到 2034 年将以 6.3% 的复合年增长率增长至 13 亿美元。

随着消费者对免疫健康的日益关注以及对免疫相关疾病的深入了解,该行业正经历强劲的发展势头。这些水解物是透过酶促反应将蛋白质转化为短链生物活性胜肽而製成的,它们在调节免疫活性方面发挥积极作用,既能支持防御反应,又能缓解发炎。由于它们能够增强免疫力、降低感染风险并促进康復,因此其价值涵盖功能性食品、膳食补充剂和药物製剂。此外,它们的高生物利用度、安全性、针对性的免疫益处以及极低的副作用也推动了市场需求。消费者对天然和功能性成分日益增长的兴趣持续推动着这些产品的普及,而个人化营养和预防保健的兴起也带来了巨大的市场机会。老年人口的成长及其面临的更高免疫风险进一步促进了市场的发展。专注于开发具有增强免疫调节潜力的新型胜肽的研究工作不断刺激着产品创新,食品、饮料和治疗领域的製造商正在将这些成分应用于各种配方中,包括那些在临床环境中用于免疫支持的研究。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 7.09亿美元 |

| 预测值 | 13亿美元 |

| 复合年增长率 | 6.3% |

由于强大的科学支持、成熟的生产能力以及长期以来公认的免疫调节功能,乳基水解物在2024年占据了61.5%的市场。主要的乳製品生产商已投资于先进的酶法工艺,以提供稳定、高品质且具有可靠生物活性的水解物。

2024年,临床和医学营养品市场份额预计将达到21%,这主要得益于市场对免疫力低下或有特殊医疗需求人群的客製化解决方案的需求。此细分市场包括为接受强化治疗的患者、免疫力下降的老年人以及自体免疫疾病患者设计的营养方案。

北美免疫调节蛋白水解物市场占据42.1%的市场份额,预计到2034年将以6.4%的复合年增长率增长,这主要得益于消费者对功能性营养品的强劲接受度以及完善的创新环境。该地区的企业正投入大量资源进行研发,致力于开发具有更强免疫支持特性的新一代水解物。

全球免疫调节蛋白水解物市场的主要参与者包括Arla Foods Ingredients、Azelis Group、Cargill, Incorporated、DSM-Firmenich、Fonterra (NZMP)、FrieslandCampina Ingredients、Glanbia PLC、Hilmar Cheese Company, Inc.、Kerry Group、PB Leiner、RoquetteTatua。这些企业正采取多项策略性倡议,以增强其竞争优势。许多企业优先投资酵素技术,以提高产品的一致性、纯度和生物活性。此外,各公司也正在拓展合作研究项目,以发现新的胜肽功能并加速临床验证。透过开发针对特定消费群体(包括老年人群和具有特定免疫需求的人群)的客製化水解物,各企业正在不断丰富其产品组合。同时,各企业也加强供应链建设,以确保可靠的采购和高效的全球分销。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 按产品类别

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品划分,2021-2034年

- 主要趋势

- 乳源蛋白水解物

- 乳清蛋白水解物

- 酪蛋白水解物

- 乳铁蛋白水解物

- 植物源蛋白水解物

- 大豆蛋白水解物

- 米蛋白水解物

- 豌豆蛋白水解物

- 其他的

- 海洋来源蛋白质水解物

- 鱼蛋白水解物

- 藻类和微藻水解物

- 海洋无脊椎动物水解物

- 动物源性蛋白质水解物

- 蛋清蛋白水解物

- 肉类蛋白水解物

- 胶原蛋白水解物

- 其他来源水解物

- 昆虫蛋白质水解物

- 微生物蛋白水解物

- 单细胞蛋白水解物

第六章:市场估算与预测:依应用领域划分,2021-2034年

- 主要趋势

- 运动营养应用

- 运动前免疫支持

- 运动后恢復和抗发炎

- 耐力运动应用

- 临床/医学营养应用

- 免疫功能低下患者的支持

- 癌症治疗辅助剂

- 自体免疫疾病管理

- 伤口癒合与组织修復

- 婴儿营养应用

- 低致敏配方研发

- 免疫系统发育支持

- 早产儿特殊营养

- 功能性食品和饮料

- 增强免疫力的饮料

- 功能性乳製品

- 烘焙和零食应用

- 药物应用

- 药物输送系统

- 免疫疗法组合

- 疫苗佐剂

第七章:市场估算与预测:依加工方式划分,2021-2034年

- 关键趋势

- 酵素水解

- 酸/碱水解

- 发酵衍生的水解物

- 先进处理技术

第八章:市场估算与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- Arla Foods Ingredients

- Azelis Group

- Cargill

- DSM-Firmenich

- Fonterra (NZMP)

- FrieslandCampina Ingredients

- Glanbia PLC

- Hilmar Cheese Company, Inc.

- Kerry Group

- PB Leiner

- Roquette

- Tatua

The Global Immunomodulatory Protein Hydrolysates Market was valued at USD 709 million in 2024 and is estimated to grow at a CAGR of 6.3% to reach USD 1.3 billion by 2034.

The industry is experiencing strong momentum as consumers become more aware of immune health and gain a clearer understanding of immune-related conditions. These hydrolysates, created by enzymatically converting proteins into short, bioactive peptides, play an active role in helping regulate immune activity by either supporting defensive responses or moderating inflammation. Their value spans functional foods, dietary supplements, and pharmaceutical formulations because they promote immune resilience, help reduce vulnerability to infections, and contribute to recovery processes. Demand is also shaped by their high bioavailability, safety profile, targeted immune benefits, and minimal side effects. Rising interest in natural and functional ingredients continues to elevate adoption, while the growth of personalized nutrition and preventive wellness adds substantial opportunity. An expanding older population that faces higher immune risks is further contributing to market progression. Research efforts focusing on new peptides with enhanced immunomodulatory potential continue to stimulate product innovation, and manufacturers across food, beverage, and therapeutic categories are incorporating these ingredients into a wide range of formulations, including those explored for immune support in clinical settings.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $709 Million |

| Forecast Value | $1.3 Billion |

| CAGR | 6.3% |

The milk-based hydrolysates segment held 61.5% share in 2024 owing to strong scientific support, established production capabilities, and long-recognized immune modulation functions. Major dairy-linked producers have invested in advanced enzymatic processes to deliver consistent, high-quality hydrolysates with reliable bioactive characteristics.

The clinical and medical nutrition segment held a 21% share in 2024, driven by demand for specialized solutions tailored to individuals with compromised immunity or unique medical requirements. This segment includes nutritionally designed options for people undergoing intensive treatments, older adults with age-related immune decline, and individuals managing autoimmune-related challenges.

North America Immunomodulatory Protein Hydrolysates Market held 42.1% share and is projected to grow at a 6.4% CAGR through 2034, supported by strong consumer acceptance of functional nutrition and a well-developed innovation environment. Companies in the region are devoting substantial resources to research geared toward developing next-generation hydrolysates with enhanced immune-support properties.

Prominent companies participating in the Global Immunomodulatory Protein Hydrolysates Market include Arla Foods Ingredients, Azelis Group, Cargill, Incorporated, DSM-Firmenich, Fonterra (NZMP), FrieslandCampina Ingredients, Glanbia PLC, Hilmar Cheese Company, Inc., Kerry Group, PB Leiner, Roquette, and Tatua. Companies in the Immunomodulatory Protein Hydrolysates Market are pursuing several strategic actions to secure a stronger competitive position. Many are prioritizing large-scale investment in enzymatic technology to improve consistency, purity, and bioactivity. Firms are also expanding collaborative research programs to identify new peptide functionalities and accelerate clinical validation. Product portfolios are widening through the development of tailored hydrolysates designed for specific consumer groups, including aging populations and individuals with targeted immune needs. Businesses are reinforcing supply chains to ensure reliable sourcing and efficient global distribution.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Application

- 2.2.4 Processing method

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product category

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product, 2021-2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 Milk-derived protein hydrolysates

- 5.2.1 Whey protein hydrolysates

- 5.2.2 Casein protein hydrolysates

- 5.2.3 Lactoferrin hydrolysates

- 5.3 Plant-derived protein hydrolysates

- 5.3.1 Soy protein hydrolysates

- 5.3.2 Rice protein hydrolysates

- 5.3.3 Pea protein hydrolysates

- 5.3.4 Others

- 5.4 Marine-derived protein hydrolysates

- 5.4.1 Fish protein hydrolysates

- 5.4.2 Algae & microalgae hydrolysates

- 5.4.3 Marine invertebrate hydrolysates

- 5.5 Animal-derived protein hydrolysates

- 5.5.1 Egg protein hydrolysates

- 5.5.2 Meat protein hydrolysates

- 5.5.3 Collagen hydrolysates

- 5.6 Other source hydrolysates

- 5.6.1 Insect protein hydrolysates

- 5.6.2 Microbial protein hydrolysates

- 5.6.3 Single-cell protein hydrolysates

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 Sports nutrition applications

- 6.2.1 Pre-workout immune support

- 6.2.2 Post-exercise recovery & anti-inflammatory

- 6.2.3 Endurance sports applications

- 6.3 Clinical/medical nutrition applications

- 6.3.1 Immunocompromised patient support

- 6.3.2 Cancer therapy adjuvants

- 6.3.3 Autoimmune disease management

- 6.3.4 Wound healing & tissue repair

- 6.4 Infant nutrition applications

- 6.4.1 Hypoallergenic formula development

- 6.4.2 Immune system development support

- 6.4.3 Preterm infant specialized nutrition

- 6.5 Functional foods & beverages

- 6.5.1 Immune-boosting beverages

- 6.5.2 Functional dairy products

- 6.5.3 Bakery & snack applications

- 6.6 Pharmaceutical applications

- 6.6.1 Drug delivery systems

- 6.6.2 Immunotherapy combinations

- 6.6.3 Vaccine adjuvants

Chapter 7 Market Estimates and Forecast, By Processing Method, 2021-2034 (USD Million & Kilo Tons)

- 7.1 Key trend

- 7.2 Enzymatic hydrolysis

- 7.3 Acid/alkaline hydrolysis

- 7.4 Fermentation-derived hydrolysates

- 7.5 Advanced processing technologies

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Million & Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Arla Foods Ingredients

- 9.2 Azelis Group

- 9.3 Cargill

- 9.4 DSM-Firmenich

- 9.5 Fonterra (NZMP)

- 9.6 FrieslandCampina Ingredients

- 9.7 Glanbia PLC

- 9.8 Hilmar Cheese Company, Inc.

- 9.9 Kerry Group

- 9.10 PB Leiner

- 9.11 Roquette

- 9.12 Tatua