|

市场调查报告书

商品编码

1876648

婴儿配方奶粉蛋白水解物市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Infant Formula Protein Hydrolysates Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

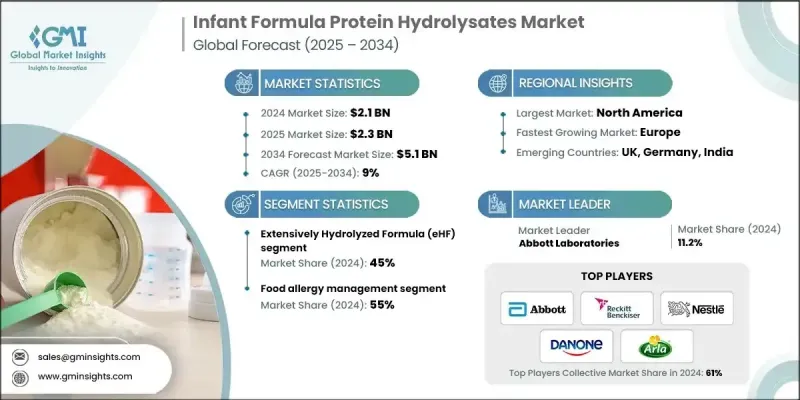

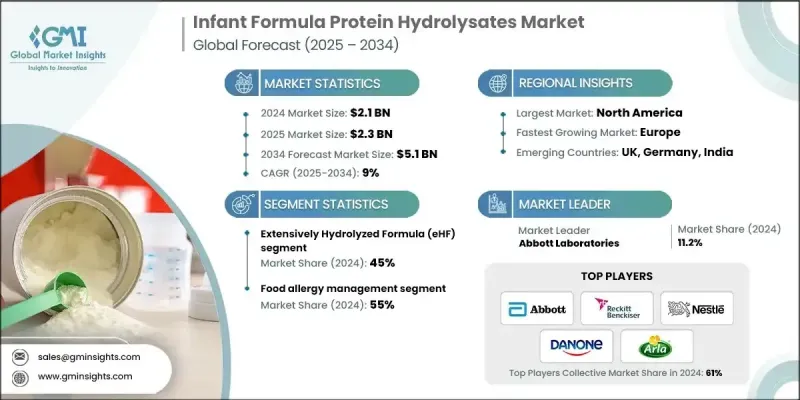

2024 年全球婴儿配方奶粉蛋白水解物市场价值为 21 亿美元,预计到 2034 年将以 9% 的复合年增长率增长至 51 亿美元。

持续成长凸显了市场对水解蛋白配方奶粉的快速成长需求,这类配方奶粉正成为因过敏或饮食不耐症而需要特殊营养的婴儿的首选。市场的扩张与食物不耐受婴儿数量的增加密切相关,促使人们持续采用改良蛋白配方奶粉。长期评估表明,随着产品创新加速,以及製造商根据新兴临床需求和不断变化的消费者期望调整解决方案,市场将继续发展。由于水解蛋白的生产涉及复杂的加工步骤、严格的安全评估以及对全球市场监管标准的严格遵守,因此高价仍然是该品类的显着特征。先进的水解技术,包括酵素法和热法,有助于生产更容易婴儿消化且不易引发不良反应的蛋白质。临床指引支持使用深度水解配方奶粉作为对不耐受标准牛奶蛋白的婴儿的有效营养选择。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 21亿美元 |

| 预测值 | 51亿美元 |

| 复合年增长率 | 9% |

2024年,深度水解配方奶粉占了45%的市场份额,凸显了其在解决牛奶蛋白过敏问题上的重要作用。这些配方奶粉采用胜肽链大小低于3 kDa的深度水解蛋白,有助于降低引发过敏反应的风险,同时满足关键营养需求。

2024年,食物过敏管理领域占了55%的市场。如此高的市场份额反映了水解蛋白在解决与食物不良反应和持续营养问题相关的疾病方面的临床意义。水解蛋白能够提高餵食耐受性并降低反应风险,这项特性持续影响医疗保健建议,并推动了医疗和零售通路需求的成长。

2024年,美国婴儿配方奶粉蛋白水解物市场规模预计将达5.893亿美元。儿童食物过敏病例的增加推动了市场成长,而临床指导和保险认可的支持也促进了产品的普及。该地区对专业营养品的投资意愿也支撑了市场的强劲发展势头。

婴儿配方奶粉蛋白水解物市场的主要品牌包括 Perrigo 公司、ByHeart、达能、雅培、Arla Foods Ingredients、Else Nutrition、森永乳业、HiPP、雀巢、Bellamy's Organic、利洁时、Kendamil 和 Biostime International。这些公司专注于多种核心策略以巩固其竞争地位。许多公司大力投资研发,致力于开发更易消化、蛋白质分解更有效率的配方。此外,各公司也重视临床验证,以赢得医疗保健专业人员和照护人员的信任。扩大生产能力和优化供应链有助于确保产品供应稳定,而与儿科专家的合作则有助于提升品牌信誉。领导品牌积极进行精准行销,突显水解蛋白的益处,并提高消费者认知度。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场规模及预测:依产品类型划分,2021-2034年

- 主要趋势

- 深度水解配方(eHF)

- 基于酪蛋白的eHF

- 乳清基eHF

- 部分水解配方(pHF)

- 基于酪蛋白的pHF

- 乳清基pHF

- 胺基酸配方(AAF)

- 米蛋白水解物配方

- 其他的

第六章:市场规模及预测:依应用领域划分,2021-2034年

- 主要趋势

- 食物过敏管理

- 牛奶蛋白过敏症(CMPA)

- 多种食物蛋白不耐症(MFPI)

- 食物蛋白诱发性肠炎症候群(FPIES)

- 嗜酸性粒细胞性胃肠道疾病

- 胃肠道疾病

- 功能性胃肠疾病

- 吸收不良症候群

- 发炎性肠道疾病

- 结构性胃肠道疾病

- 生长和营养支持

- 生长发育不良

- 代谢紊乱

- 胰臟功能不全

- 重症监护和医院应用

- 新生儿加护病房(NICU)

- 儿科加护病房(PICU)

- 急诊申请

- 其他的

- 免疫缺乏疾病

- 神经系统疾病

- 遗传症候群

- 肿瘤学应用

第七章:市场规模及预测:依最终用途产业划分,2021-2034年

- 主要趋势

- 医院和医疗保健系统

- 政府和公共项目

- 其他的

第八章:市场规模及预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- Abbott Laboratories

- Reckitt Benckiser

- Nestle

- Danone

- Arla Foods Ingredients

- Morinaga Milk Industry

- Biostime International

- Bellamy's Organic

- HiPP GmbH

- ByHeart

- Else Nutrition

- Perrigo Company

- Kendamil

The Global Infant Formula Protein Hydrolysates Market was valued at USD 2.1 billion in 2024 and is estimated to grow at a CAGR of 9% to reach USD 5.1 billion by 2034.

The steady increase highlights the fast-growing demand for hydrolyzed protein formulas, which are becoming a preferred option for infants who require specialized nutrition due to allergies or dietary sensitivities. The expansion of this market is closely linked to the rising number of infants experiencing food-related intolerances, encouraging consistent adoption of formulas with modified proteins. Long-term assessments indicate that the market will continue advancing as product innovation accelerates and manufacturers tailor solutions to emerging clinical needs and shifting consumer expectations. Premium pricing remains a defining characteristic of this category because producing hydrolyzed proteins involves complex processing steps, rigorous safety evaluations, and strict adherence to regulatory standards across global markets. Advanced hydrolysis technologies, including enzymatic and thermal techniques, help create proteins that are easier for infants to digest and less likely to trigger reactions. Clinical guidance supports the use of extensively hydrolyzed formulas as an effective nutritional option for infants who do not tolerate standard cow's milk proteins.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.1 Billion |

| Forecast Value | $5.1 Billion |

| CAGR | 9% |

The extensively hydrolyzed formula products held a 45% share in 2024, underscoring their strong role in addressing cow's milk protein sensitivity. These formulas use deeply broken-down proteins with peptide sizes below 3 kDa to help lower the chance of triggering reactions while still meeting key nutritional needs.

In 2024, the food allergy management segment represented a 55% share. This large share reflects the clinical relevance of hydrolyzed proteins in addressing conditions linked to adverse food responses and ongoing nutritional concerns. Their ability to support feeding tolerance while lowering reaction risk continues to shape healthcare recommendations, contributing to rising demand across medical and retail channels.

United States Infant Formula Protein Hydrolysates Market generated USD 589.3 million in 2024. The increase in food allergy cases among children has influenced growth, with supportive clinical guidance and insurance recognition helping strengthen adoption. The region's readiness to invest in specialized nutrition also supports strong market momentum.

Key brands active in the Infant Formula Protein Hydrolysates Market include Perrigo Company, ByHeart, Danone, Abbott Laboratories, Arla Foods Ingredients, Else Nutrition, Morinaga Milk Industry, HiPP, Nestle, Bellamy's Organic, Reckitt Benckiser, Kendamil, and Biostime International. Companies in the Infant Formula Protein Hydrolysates Market focus on several core strategies to reinforce their competitive position. Many invest heavily in research to create formulas with improved digestibility and enhanced protein breakdown profiles. Firms also emphasize clinical validation to build trust among healthcare professionals and caregivers. Expanding production capabilities and optimizing supply chains help support consistent product availability, while collaborations with pediatric experts enhance credibility. Leading brands pursue targeted marketing to highlight the benefits of hydrolyzed proteins and widen consumer awareness.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product type

- 2.2.2 Application

- 2.2.3 End Use Industry

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Size and Forecast, By Product Type, 2021-2034 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Extensively hydrolyzed formula (eHF)

- 5.2.1 Casein-based eHF

- 5.2.2 Whey-based eHF

- 5.3 Partially hydrolyzed formula (pHF)

- 5.3.1 Casein-based pHF

- 5.3.2 Whey-based pHF

- 5.4 Amino acid-based formula (AAF)

- 5.5 Rice protein hydrolysate formula

- 5.6 Others

Chapter 6 Market Size and Forecast, By Application, 2021-2034 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Food allergy management

- 6.2.1 Cow's milk protein allergy (CMPA)

- 6.2.2 Multiple food protein intolerance (MFPI)

- 6.2.3 Food protein-induced enterocolitis syndrome (FPIES)

- 6.2.4 Eosinophilic gastrointestinal disorders

- 6.3 Gastrointestinal disorders

- 6.3.1 Functional gastrointestinal disorders

- 6.3.2 Malabsorption syndromes

- 6.3.3 Inflammatory bowel conditions

- 6.3.4 Structural gastrointestinal disorders

- 6.4 Growth & nutritional support

- 6.4.1 Failure to thrive

- 6.4.2 Metabolic disorders

- 6.4.3 Pancreatic insufficiency

- 6.5 Critical care & hospital applications

- 6.5.1 Neonatal intensive care unit (NICU)

- 6.5.2 Pediatric intensive care unit (PICU)

- 6.5.3 Emergency department applications

- 6.6 Others

- 6.6.1 Immunodeficiency disorders

- 6.6.2 Neurological conditions

- 6.6.3 Genetic syndromes

- 6.6.4 Oncological applications

Chapter 7 Market Size and Forecast, By End Use Industry, 2021-2034 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Hospital & healthcare systems

- 7.3 Government & public programs

- 7.4 Others

Chapter 8 Market Size and Forecast, By Region, 2021-2034 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East & Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 Reckitt Benckiser

- 9.3 Nestle

- 9.4 Danone

- 9.5 Arla Foods Ingredients

- 9.6 Morinaga Milk Industry

- 9.7 Biostime International

- 9.8 Bellamy's Organic

- 9.9 HiPP GmbH

- 9.10 ByHeart

- 9.11 Else Nutrition

- 9.12 Perrigo Company

- 9.13 Kendamil