|

市场调查报告书

商品编码

1885875

蛋清蛋白水解物市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Egg Protein Hydrolysates Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

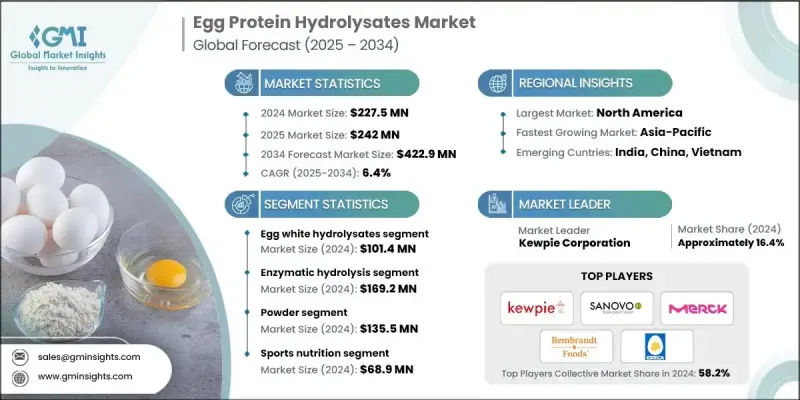

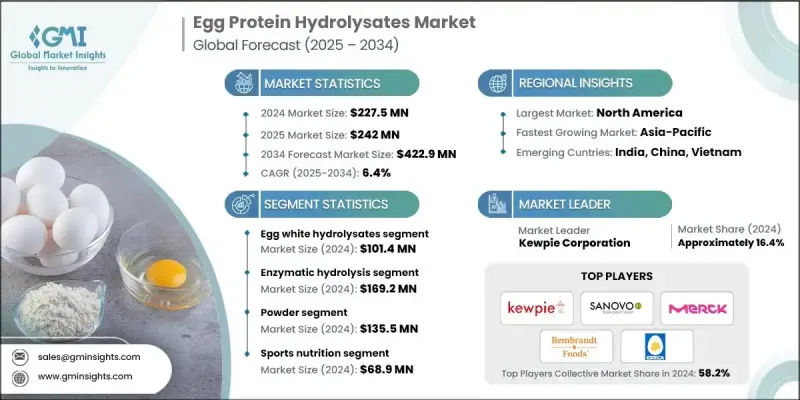

2024 年全球蛋清蛋白水解物市场价值为 2.275 亿美元,预计到 2034 年将以 6.4% 的复合年增长率增长至 4.229 亿美元。

市场扩张的驱动力在于消费者对天然和低加工蛋白质日益增长的偏好,以及对不含人工成分和过敏原的「清洁标籤」产品需求的不断增长。蛋清蛋白水解物越来越受到健身爱好者和注重健康的消费者的青睐,这与全球成分透明化的趋势以及「食疗」理念的兴起相契合。酵素水解技术的进步使得对胜肽组成、消化率和生物活性成分的精确控製成为可能,从而满足了临床营养和运动营养补充剂市场对优化吸收率和生物利用度的需求。蛋清蛋白水解物在功能性食品和营养保健品中的应用也是重要的成长动力,已被添加到蛋白棒、代餐粉、能量饮料和胶囊等产品中。东亚市场的需求尤其强劲,强化食品和便利的高蛋白食品已成为当地居民日常饮食的一部分,这进一步推动了蛋白水解物在功能性配方中的持续应用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2.275亿美元 |

| 预测值 | 4.229亿美元 |

| 复合年增长率 | 6.4% |

2024年,蛋清水解物市场规模达到1.014亿美元,预计2025年至2034年间将以6.1%的复合年增长率成长。蛋清蛋白具有高品质、高纯度和易消化等优点,推动了该市场的成长。低致敏性蛋白水解物因其安全易消化的蛋白质,在註重健康的消费者中越来越受欢迎,可用于运动营养、临床应用和日常营养补充。

2024年,酵素水解领域创造了1.692亿美元的市场规模,预计到2034年将以6.4%的复合年增长率成长。该方法因其精确性、温和的加工过程以及能够保留生物活性胜肽而备受青睐。像赛诺沃科技集团这样的公司正在推动酵素法技术的进步,以提高产量和成本效益,从而进一步推动市场成长。

2024年美国蛋清蛋白水解物市场规模为5,700万美元,预计2025年至2034年将以6.2%的复合年增长率成长。功能性饮料的创新以及注重健身的消费者对富含蛋白质产品的高需求是推动市场成长的主要因素。加拿大是北美市场成长的第二大贡献者,其国内蛋清加工商正在提高水解产能,以支持本地健康产品和出口市场。

全球蛋清蛋白水解物市场的主要参与者包括丘比株式会社 (Kewpie Corporation)、IGRECA、赛诺沃科技集团 (Sanovo Technology Group)、默克集团 (Merck KGaA) 和伦勃朗食品 (Rembrandt Foods)。各公司正透过投资先进的酵素水解技术来巩固其市场地位,以提高生物活性物质的产量和消化率。与营养保健品和功能性食品公司建立合作关係有助于扩大产品整合范围和市场覆盖范围。此外,各公司也着重研发清洁标籤配方、减少过敏原的产品以及优质蛋白混合物,以吸引註重健康的消费者。策略性的地域扩张、产能提升以及在便捷的高蛋白应用领域的创新,在满足区域营养趋势和监管标准的同时,增强了企业的竞争力,提升了品牌知名度。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基准估算和计算

- 基准年计算

- 市场估算的关键趋势

- 初步研究和验证

- 原始资料

- 预测模型

- 研究假设和局限性

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(註:仅提供重点国家的贸易统计)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依来源类型划分,2025-2034年

- 主要趋势

- 蛋清水解物

- 高纯度蛋白质配方

- 减少过敏原的变体

- 蛋黄水解物

- 富含磷脂的胜肽

- 脂蛋白功能混合物

- 全蛋水解物

- 均衡的胺基酸谱

- 通用配方

第六章:市场估算与预测:依製程划分,2025-2034年

- 主要趋势

- 酵素水解

- 酸水解

- 其他方法

第七章:市场估计与预测:依形式划分,2025-2034年

- 主要趋势

- 粉末

- 液体

- 胶囊/片剂

第八章:市场估算与预测:依应用领域划分,2025-2034年

- 主要趋势

- 营养保健品

- 消化系统健康

- 免疫支持

- 抗发炎功能

- 运动营养

- 运动前配方

- 运动后恢復配方

- 肌肉恢復胜肽

- 婴幼儿及老年人营养

- 低致敏性蛋白质混合物

- 易于消化的氨基酸谱

- 临床营养

- 管饲溶液

- 恢復饮食

- 功能性食品和饮料

- 烘焙混合料

- 乳製品及非乳製品饮料

- 化妆品及个人护理

- 抗衰老护肤

- 保湿应用

- 屏障修復配方

第九章:市场估计与预测:依地区划分,2025-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十章:公司简介

- Kewpie Corporation

- Bouwhuis Enthoven BV

- Merck KGaA

- Rose Acre Farms

- Rembrandt Foods

- Sanovo Technology Group

- Ovostar Union

- Pulviver

- IGRECA

- Taiyo Kagaku Co., Ltd.

- Bioseutica

- Deb-El Food Products

- AgroAlta

- EW Group

- Ballas Egg

- Eurovo Srl

- Crystal Lake Farms

- Farm Pride Foods

- Dalian Hanovo Foods

- SOVIMO HELLAS SA

The Global Egg Protein Hydrolysates Market was valued at USD 227.5 million in 2024 and is estimated to grow at a CAGR of 6.4% to reach USD 422.9 million by 2034.

Market expansion is driven by a rising consumer preference for natural and minimally processed proteins, with demand growing for clean-label products free from artificial ingredients and allergens. Egg protein hydrolysates are increasingly favored by fitness enthusiasts and wellness-focused consumers, aligning with the global trend of ingredient transparency and the growing "food-as-medicine" movement. Technological advancements in enzymatic hydrolysis allow precise control over peptide composition, digestibility, and bioactive content, catering to clinical nutrition and sports supplementation markets that require optimized absorption and bioavailability. Integration into functional foods and nutraceutical products is also a key growth driver, with hydrolysates being incorporated into protein bars, meal replacements, energy drinks, and capsules. Demand is particularly strong in East Asian markets, where fortified foods and convenient high-protein options are part of daily diets, fueling continued adoption of egg protein hydrolysates in functional formulations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $227.5 Million |

| Forecast Value | $422.9 Million |

| CAGR | 6.4% |

The egg white hydrolysates segment generated USD 101.4 million in 2024 and is expected to grow at a CAGR of 6.1% between 2025 and 2034. This segment benefits from the high protein quality, purity, and digestibility of egg white proteins. Allergen-reduced egg white hydrolysates are gaining traction among health-conscious consumers, offering safe, easily digestible protein for sports nutrition, clinical applications, and everyday supplementation.

The enzymatic hydrolysis segment generated USD 169.2 million in 2024 and will grow at an expected CAGR of 6.4% through 2034. This method is preferred for its precision, gentle processing, and ability to preserve bioactive peptides. Companies such as Sanovo Technology Group are advancing enzymatic techniques to enhance yield and cost-efficiency, further supporting market growth.

U.S. Egg Protein Hydrolysates Market was valued at USD 57 million in 2024 and is projected to grow at a CAGR of 6.2% from 2025 to 2034. Growth is driven by innovation in functional beverages and the high demand for protein-rich products among fitness-focused consumers. Canada serves as a secondary contributor to North American growth, with domestic egg processors increasing hydrolysis capacity to support local wellness products and export markets.

Key players in the Global Egg Protein Hydrolysates Market include Kewpie Corporation, IGRECA, Sanovo Technology Group, Merck KGaA, and Rembrandt Foods. Companies are pursuing strategies to solidify their position by investing in advanced enzymatic hydrolysis technologies that increase bioactive yield and digestibility. Partnerships with nutraceutical and functional food firms help expand product integration and market reach. Firms are also emphasizing clean-label formulations, allergen-reduced products, and premium protein blends to attract health-conscious consumers. Strategic geographic expansion, capacity enhancements, and innovation in convenient, high-protein applications strengthen competitiveness and brand recognition while addressing regional nutritional trends and regulatory standards.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Source Type

- 2.2.3 Process

- 2.2.4 Form

- 2.2.5 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Source Type, 2025 - 2034 (USD Million, Kilo Tons)

- 5.1 Key trends

- 5.2 Egg white hydrolysates

- 5.2.1 High-purity protein formulations

- 5.2.2 Allergen-reduced variants

- 5.3 Egg yolk hydrolysates

- 5.3.1 Phospholipid-rich peptides

- 5.3.2 Lipoprotein-functional blends

- 5.4 Whole egg hydrolysates

- 5.4.1 Balanced amino acid profile

- 5.4.2 General-purpose formulations

Chapter 6 Market Estimates and Forecast, By Process, 2025 - 2034 (USD Million, Kilo Tons)

- 6.1 Key trends

- 6.2 Enzymatic hydrolysis

- 6.3 Acid hydrolysis

- 6.4 Other methods

Chapter 7 Market Estimates and Forecast, By Form, 2025 - 2034 (USD Million, Kilo Tons)

- 7.1 Key trends

- 7.2 Powder

- 7.3 Liquid

- 7.4 Capsules/Tablets

Chapter 8 Market Estimates and Forecast, By Application, 2025 - 2034 (USD Million, Kilo Tons)

- 8.1 Key trends

- 8.2 Nutraceuticals

- 8.2.1 Digestive health

- 8.2.2 Immune support

- 8.2.3 Anti-inflammatory functionality

- 8.3 Sports nutrition

- 8.3.1 Pre-workout formulations

- 8.3.2 Post-workout recovery formulations

- 8.3.3 Muscle recovery peptides

- 8.4 Infant & elderly nutrition

- 8.4.1 Hypoallergenic protein blends

- 8.4.2 Easily digestible amino profiles

- 8.5 Clinical nutrition

- 8.5.1 Tube-feeding solutions

- 8.5.2 Recovery diets

- 8.6 Functional food & beverages

- 8.6.1 Bakery mixes

- 8.6.2 Dairy and non-dairy beverages

- 8.7 Cosmetics & personal care

- 8.7.1 Anti-aging skincare

- 8.7.2 Moisturizing applications

- 8.7.3 Barrier-repair formulations

Chapter 9 Market Estimates and Forecast, By Region, 2025 - 2034 (USD Million, Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East & Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 Kewpie Corporation

- 10.2 Bouwhuis Enthoven BV

- 10.3 Merck KGaA

- 10.4 Rose Acre Farms

- 10.5 Rembrandt Foods

- 10.6 Sanovo Technology Group

- 10.7 Ovostar Union

- 10.8 Pulviver

- 10.9 IGRECA

- 10.10 Taiyo Kagaku Co., Ltd.

- 10.11 Bioseutica

- 10.12 Deb-El Food Products

- 10.13 AgroAlta

- 10.14 EW Group

- 10.15 Ballas Egg

- 10.16 Eurovo Srl

- 10.17 Crystal Lake Farms

- 10.18 Farm Pride Foods

- 10.19 Dalian Hanovo Foods

- 10.20 SOVIMO HELLAS S.A.