|

市场调查报告书

商品编码

1636235

电动汽车电池材料:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Electric Vehicle Battery Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

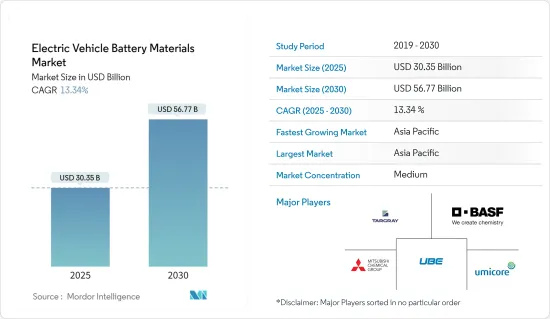

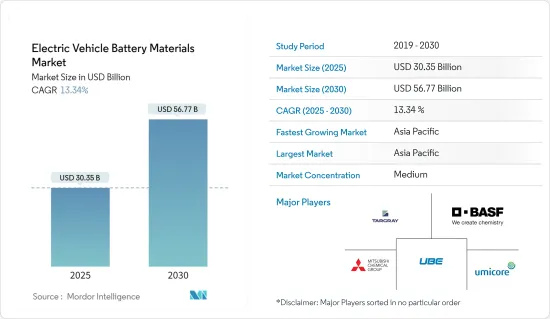

预计2025年电动车电池材料市场规模为303.5亿美元,2030年预计将达567.7亿美元,预测期内(2025-2030年)复合年增长率为13.34%。

主要亮点

- 从中期来看,电动车渗透率的提高和锂离子电池价格的下降预计将在预测期内推动市场发展。

- 另一方面,一些国家的垄断造成的电池材料供应链的差异预计将抑制未来市场的成长。

- 然而,针对更永续的阴极和阳极以及高效电解的各种电池材料的持续研究和进展可能会为市场成长提供机会。

- 亚太地区由于电动车产业应用的扩大而占据市场主导地位,这增加了对电池材料的需求。

电动车电池材料市场趋势

锂离子电池预计将占较大份额

- 电动车用锂离子电池材料包括电池正极用的锂金属氧化物(Li(NixMnyCoz)O2、LiMn2O4、LiCoO2等)、橄榄石(LiFePO4等)、氧化钒、二次氧化锂等。用于负极的材料包括锂合金材料、石墨、硅和金属间化合物。

- 由于锂离子电池组价格的下降以及能量密度高、相对较长的循环寿命和效率等优点,电动车对锂电池材料的需求不断增加。

- 2023年,锂离子电池组价格将年减与前一年同期比较13%至139美元/kWh。除了这些好处之外,我们还在努力生产更有效、更有效率的电动车锂电池材料。

- 例如,2024年2月,仁川大学的科学家设计了一种提高锂离子电池隔膜稳定性和性能的方法。他们透过结合二氧化硅层和其他功能分子来实现这一目标。这些进展预计将改善电动车应用中锂离子分离器的功能。

- 此外,随着锂离子电动车需求的不断增加,多家公司正在投资生产锂离子电动车电池,对锂离子电池材料的需求预计将增加。例如,松下位于堪萨斯州迪索託的汽车电池工厂预计到 2025 年将提高电动车用 2170 圆柱形锂离子电池的产量。这些目标为未来锂电池材料带来了积极的环境。

- 因此,由于上述价格下降和锂离子电池技术发展等因素,预计预测期内锂离子电池材料的需求将会成长。

亚太地区预计将主导市场

- 亚太地区预计将主导电动车电池材料市场,因为它占据了电池需求和生产的大部分,特别是在中国。中国的电池生产满足了电动车电池的大部分需求。

- 根据国际能源总署(IEA)预测,2023年中国电动车电池需求量将为417GWh,高于去年的314GWh。欧洲为 185GWh,美国为 99GWh。因此,电动车电池需求的增加导致中国产量增加,预计在预测期内对电动车电池材料的需求将增加。

- 此外,中国是全球最大的电动车电池出口国,预计2023年约12%的电动车电池将用于出口。由于大多数电池材料在国内生产,该国拥有更一体化和永续的电动车电池製造供应链。

- 此外,到2023年,中国将占全球正极活性材料产能的近90%、负极活性材料产能的97%以上。韩国占了 9% 的市场份额,其次是日本,占 3%,使其成为正极活性材料领域唯一重要的非中国参与企业。

- 由于投资增加和政府支持,预计该地区电动车电池材料市场将显着成长。例如,2024年5月,中国宣布将投资8.45亿美元开发下一代电池技术,为电动车提供动力。预计这些投资将在预测期内增加对电动车电池材料的需求。

- 因此,由于上述发展,亚太地区预计将主导市场。

电动汽车电池材料产业概况

电动车电池材料市场处于半瓜分状态。该市场的主要企业包括(排名不分先后)Targray Technology International Inc.、 BASF SE、Mitsubishi Chemical Group Corporation、UBE Corporation 和 Umicore。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 电动车的扩张

- 锂离子电池价格下降

- 抑制因素

- 供应链缺口

- 促进因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品/服务的威胁

- 竞争公司之间的敌对关係

- 投资分析

第五章市场区隔

- 电池类型

- 锂离子

- 铅酸电池

- 其他的

- 材料

- 负极

- 正极

- 分隔符

- 电解

- 其他的

- 2029 年之前的市场规模和需求预测(按地区)

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 北欧的

- 俄罗斯

- 土耳其

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 澳洲

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 奈及利亚

- 埃及

- 卡达

- 南非

- 其他中东/非洲

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 北美洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Targray Technology International Inc.

- BASF SE

- Mitsubishi Chemical Group Corporation

- UBE Corporation

- Umicore

- Sumitomo Chemical Co. Ltd

- Nichia Corporation

- ENTEK International LLC

- Arkema SA

- Kureha Corporation

- 其他知名公司名单

- 市场排名分析

第七章 市场机会及未来趋势

- 加大其他电池材料的研发力度

简介目录

Product Code: 50003503

The Electric Vehicle Battery Materials Market size is estimated at USD 30.35 billion in 2025, and is expected to reach USD 56.77 billion by 2030, at a CAGR of 13.34% during the forecast period (2025-2030).

Key Highlights

- Over the medium period, the growing adoption of electric vehicles and the decreasing price of lithium-ion batteries are expected to drive the market during the forecast period.

- On the other hand, the supply chain gap in battery materials created by the monopoly of some countries is expected to restrain market growth in the future.

- However, the ongoing research and advancement in different battery materials for more sustainable cathode and anode, as well as efficient electrolytes, may offer opportunities for market growth.

- Asia-Pacific dominates the market, owing to the growing application in the electric vehicle industry, which augments the demand for battery material.

Electric Vehicle Battery Materials Market Trends

Lithium-ion Battery is Expected to Have a Major Share

- Lithium-ion battery materials used in electric vehicles include batteries cathode include lithium-metal oxides (such as Li(NixMnyCoz)O2, LiMn2O4, and LiCoO2), olivines (such as LiFePO4), vanadium oxides, and rechargeable lithium oxides. The materials used in anodes include lithium-alloying materials, graphite, silicon, or intermetallics.

- The demand for lithium battery materials is increasing in electric vehicles owing to the decreasing price of lithium-ion battery packs and several advantages such as high energy density, relatively long cycle life, and efficiency.

- In 2023, the price of lithium-ion battery packs decreased by around 13% compared to the previous year to USD 139/kWh. In addition to these advantages, research and development are being conducted to manufacture more effective and efficient lithium battery materials for electric vehicles.

- For instance, in February 2024, scientists at the Incheon National University devised a method to enhance the stability and characteristics of lithium-ion battery separators. They achieved this by incorporating a layer of silicon dioxide and other functional molecules. Such developments will improve the functionality of lithium-ion separators in electric vehicle applications.

- Further, with the increasing demand for lithium-ion electric vehicles, several companies are investing in manufacturing lithium-ion electric vehicle batteries, and the demand for lithium-ion battery materials is expected to increase. For instance, Panasonic's automotive battery plant in De Soto, Kansas, is expected to increase production of the 2170 cylindrical lithium-ion batteries for electric vehicles by 2025. Such an aim depicts a positive environment for lithium battery materials in the future.

- Thus, owing to the factors mentioned above, such as the decreasing price of lithium-ion batteries and technological developments, the demand for lithium-ion battery materials is expected to be significant during the forecast period.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific is expected to dominate the electric vehicle battery materials market for electric vehicles, as the region accounts for the majority of battery demand and production, especially in China. China's battery production fulfills the majority of the demand for electric vehicle batteries.

- According to the International Energy Agency, in 2023, the demand for electric vehicle batteries in China accounted for 417 GWh, up from 314 GWh last year. Europe produced 185 GWh, and the United States produced 99 GWh in 2023. Thus, the increasing demand for electric vehicle batteries is leading China to produce more, and the demand for electric vehicle battery materials is expected to rise during the forecast period.

- Further, China is the world's largest exporter of electric vehicle batteries, with around 12% of its electric vehicle batteries exported in 2023. The country has a more integrated and sustainable supply chain for manufacturing electric vehicle batteries due to the majority of battery materials being produced domestically.

- Moreover, as of 2023, China accounted for almost 90% of the world's cathode-active material manufacturing capacity and over 97% of anode-active material production. Korea holds a notable 9% share, with Japan following at 3%, making them the only significant players outside China in the cathode active material segment.

- The region is expected to grow significantly in the electric vehicle battery materials market due to the increasing investments and government support. For instance, in May 2024, China announced it would invest USD 845 million in developing next-generation battery technology that powers electric vehicles. Such investments will boost the demand for electric vehicle battery material during the forecast period.

- Thus, owing to the above-mentioned developments, Asia-Pacific is expected to dominate the market.

Electric Vehicle Battery Materials Industry Overview

The electric vehicle battery materials market is semi-fragmented. Some of the major players in the market (in no particular order) include Targray Technology International Inc., BASF SE, Mitsubishi Chemical Group Corporation, UBE Corporation, and Umicore.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 The Growing Adoption of Electric Vehicles

- 4.5.1.2 Decreasing Price of Lithium-ion Batteries

- 4.5.2 Restraints

- 4.5.2.1 The Supply Chain Gap

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion

- 5.1.2 Lead-acid

- 5.1.3 Other Battery Types

- 5.2 Material

- 5.2.1 Anode

- 5.2.2 Cathode

- 5.2.3 Separator

- 5.2.4 Electrolyte

- 5.2.5 Other Materials

- 5.3 Geography [Market Size and Demand Forecast till 2029 (for regions only)]

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 NORDIC

- 5.3.2.7 Russia

- 5.3.2.8 Turkey

- 5.3.2.9 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Australia

- 5.3.3.4 Japan

- 5.3.3.5 South Korea

- 5.3.3.6 Malaysia

- 5.3.3.7 Thailand

- 5.3.3.8 Indonesia

- 5.3.3.9 Vietnam

- 5.3.3.10 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 Saudi Arabia

- 5.3.4.2 United Arab Emirates

- 5.3.4.3 Nigeria

- 5.3.4.4 Egypt

- 5.3.4.5 Qatar

- 5.3.4.6 South Africa

- 5.3.4.7 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Colombia

- 5.3.5.4 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Targray Technology International Inc.

- 6.3.2 BASF SE

- 6.3.3 Mitsubishi Chemical Group Corporation

- 6.3.4 UBE Corporation

- 6.3.5 Umicore

- 6.3.6 Sumitomo Chemical Co. Ltd

- 6.3.7 Nichia Corporation

- 6.3.8 ENTEK International LLC

- 6.3.9 Arkema SA

- 6.3.10 Kureha Corporation

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Increasing Research and Development of Other Battery Materials

02-2729-4219

+886-2-2729-4219