|

市场调查报告书

商品编码

1636271

南美洲电动汽车电池材料:市场占有率分析、产业趋势、成长预测(2025-2030)South America Electric Vehicle Battery Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

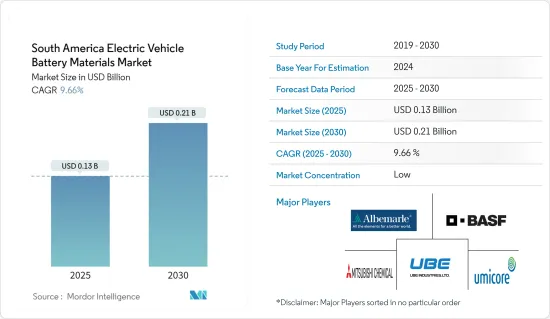

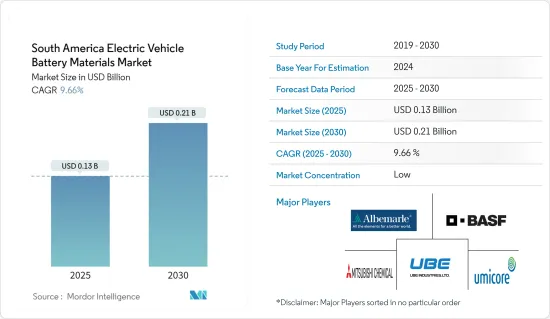

南美洲电动车电池材料市场规模预计2025年为1.3亿美元,预计2030年将达2.1亿美元,预测期内(2025-2030年)复合年增长率为9.66%。

主要亮点

- 中期来看,电动车销量增加以及政府支持措施和措施等因素预计将成为预测期内南美电动车电池材料市场的最大推动力之一。

- 另一方面,由于缺乏电池材料生产设施,对进口的高度依赖对预测期内南美电动车电池材料市场构成威胁。

- 开发先进电池技术的努力仍在继续。预计这一因素将在未来几年在市场上创造一些机会。

- 预计巴西将出现显着成长,并可能在预测期内实现最高成长。这是由于该地区拥有庞大的汽车製造和销售行业。

南美洲电动汽车电池材料市场趋势

锂离子电池占市场主导地位

- 南美洲电动车(EV)电池材料市场严重依赖锂离子电池。锂离子电池是电动车领域最受欢迎的电池,兼具能量密度、效率和耐用性,使其成为现代电动车技术的基石。

- 在过去的十年中,电池技术和製造的进步不仅降低了成本,而且提高了性能和可靠性,增加了锂离子电池对製造商和消费者的吸引力。

- 近年来,锂离子电池和电池组的价格不断下降,对终端用户更具吸引力。继2022年小幅上涨后,2023年价格再次下跌,锂离子电池组价格创历史新低139美元/kWh,跌幅14%。

- 该电池部分由多种材料组成,每种材料对电池的整体性能都起着重要作用。选择这些材料是因为它们能够提高能量密度、循环寿命和热稳定性。特别是,含有大量镍的正极材料是优选的,因为它们具有大的能量容量并且与延长续航里程直接相关。

- 该地区对电动车日益增长的需求引发了对锂离子电池的需求激增,促使电池製造商投资材料生产设施。这项策略转变旨在满足国内和全球对锂电池不断增长的需求。随着电动车变得越来越流行,加上电池技术的不断进步,市场有望持续成长。

- 例如,2023年4月,全球领先的电动车(EV)製造商之一中国比亚迪计划投资2.9亿美元在智利安託法加斯塔地区建造锂阴极工厂。智利经济发展机构 CORFO 宣布了这项消息。 CORFO证实,比亚迪智利已被智利政府指定为授权锂生产商。此认证使公司有权优先配置碳酸锂。

- 因此,在预测期内,预计市场将由锂离子电池领域主导。

巴西正在经历显着的成长

- 巴西凭藉其丰富的自然资源和不断增长的工业能力,在南美电动车(EV)电池材料市场中发挥着举足轻重的作用。巴西拥有丰富的关键电池材料蕴藏量,尤其是锂、镍和石墨,因此被定位为区域和全球电动车零件供应链中的潜在强国。

- 巴西的锂矿床集中在米纳斯吉拉斯州和塞阿拉州,吸引了国内和国际矿业公司的极大关注,这些公司希望利用这种重要电池金属不断增长的需求。

- 根据能源研究所《世界能源统计回顾》预测,2023年锂蕴藏量为4,900吨。这比 2022 年记录的 2,600 吨显着增加,成长率高达 88.5%。这种激增凸显了该国庞大的锂蕴藏量,这对于快速成长的电池材料市场(尤其是与电动车相关的电池材料市场)来说是个好兆头。

- 巴西的镍蕴藏量主要位于戈亚斯州,进一步增加了其在电动车电池材料方面的战略重要性。此外,巴西在米纳斯吉拉斯州、巴伊亚州和塞阿拉州拥有大量石墨矿床,在锂离子电池负极材料的生产中发挥重要作用。

- 巴西政府认识到电动车电池材料领域的战略重要性,并采取了各种倡议来促进其发展。这些倡议包括投资激励、研究和开发支援以及促进永续采矿实践和当地增值的法规结构。

- 例如,2024年4月,Sigma Lithium在一项策略性倡议中决定为其位于巴西的绿色科技工业工厂二期投资1亿美元的资本支出。这项投资将使喷他零绿色锂的年产能从27万吨增加到2025年的52万吨。此次扩建得到了 Sigma 董事会的核准,使该公司能够生产足够的锂精矿,为估计 180 万辆电动车 (EV) 提供燃料。

- 国家矿业局(ANM)简化了电池材料计划的许可流程。同时,巴西开发银行(BNDES)制定了一项融资计划,以支持参与电动车供应链的公司。这些措施开始吸引国内外投资,主要矿业公司和电池製造商在巴西探索商机。

- 因此,巴西预计在上述预测期内将出现强劲成长。

南美洲电动汽车电池材料产业概况

南美洲电动车电池材料市场较为分散。该市场的主要企业(排名不分先后)包括BASF SE)、三菱化学集团公司(Mitsubishi Chemical Group Corporation)、UBE Corporation、Albemarle Corporation 和 Umicore SA。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 电动车销量成长

- 政府扶持措施及措施

- 抑制因素

- 缺乏电池材料生产设施

- 促进因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品/服务的威胁

- 竞争公司之间的敌对关係

- 投资分析

第五章市场区隔

- 电池类型

- 锂离子电池

- 铅酸电池

- 其他的

- 材料

- 正极

- 负极

- 电解

- 分隔符

- 其他的

- 地区

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- BASF SE

- Mitsubishi Chemical Group Corporation

- UBE Corporation

- Umicore SA

- Sumitomo Chemical Co., Ltd.

- Albemarle Corporation

- YOUME

- BYD Co., Ltd.

- Arkema SA

- Nichia Corporation

- 其他知名公司名单

- 市场排名/份额(%)分析

第七章 市场机会及未来趋势

- 电池技术的进步

简介目录

Product Code: 50003558

The South America Electric Vehicle Battery Materials Market size is estimated at USD 0.13 billion in 2025, and is expected to reach USD 0.21 billion by 2030, at a CAGR of 9.66% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as rising growth in electric vehicle sales and supportive government policies and regulations are expected to be among the most significant drivers for the South America Electric Vehicle Battery Materials Market during the forecast period.

- On the other hand, the lack of battery material production facilities, leading to heavy reliance on imports, poses a threat to the South America Electric Vehicle Battery Materials Market during the forecast period.

- Nevertheless, continued efforts are being made to develop advanced battery technology. This factor is expected to create several opportunities for the market in the future.

- Brazil is expected to witness significant growth and will likely register the highest growth during the forecast period. This is due to the presence of a significant vehicle manufacturing and sales industry in the region.

South America Electric Vehicle Battery Materials Market Trends

Lithium-ion Batteries to Dominate the Market

- The South American electric vehicle (EV) battery materials market hinges significantly on lithium-ion batteries. These batteries, being the most prevalent in the electric vehicle realm, stand out for their blend of energy density, efficiency, and durability, making them a linchpin in modern electric vehicle technology.

- Over the past decade, strides in battery technology and manufacturing have not only cut costs but also amplified performance and reliability, heightening the appeal of lithium-ion batteries to manufacturers and consumers.

- In recent years, there has been a downward trend in lithium-ion battery and cell pack prices, enhancing their allure to end-users. After a slight uptick in 2022, prices dipped again in 2023, with lithium-ion battery packs hitting a historic low of USD 139/kWh, marking a 14% drop.

- This battery segment comprises a range of materials, each playing a vital role in the battery's overall performance. These materials are selected for their ability to boost energy density, cycle life, and thermal stability, which are crucial factors for the automotive sector. Notably, nickel-rich cathode materials are favored for their high energy capacity, directly translating to extended driving ranges-a key selling point for consumers and market competitiveness.

- The region's growing electric vehicle appetite has triggered a surge in lithium-ion battery demand, prompting battery manufacturers to invest in material production facilities. This strategic shift aims to meet the rising demand for lithium batteries, both domestically and globally. Coupled with ongoing battery tech advancements, the market is poised for sustained growth as electric vehicle adoption climbs.

- For instance, in April 2023, China's BYD Co Ltd, the world's leading electric vehicle (EV) manufacturer, is set to construct a lithium cathode factory in Chile's Antofagasta region with an investment of USD 290 million. This announcement was made by Chile's economic development agency, CORFO. BYD Chile has been designated as a recognized lithium producer by the Chilean government, as confirmed by CORFO. This recognition grants the company privileged access to preferential rates for lithium carbonate allocations.

- Given these factors, the dominance of the lithium-ion battery segment in the market is projected for the forecast period.

Brazil to Witness Significant Growth

- Brazil plays a pivotal role in the South American electric vehicle (EV) battery materials market, leveraging its abundant natural resources and growing industrial capabilities. The country's vast reserves of critical battery materials, particularly lithium, nickel, and graphite, position it as a potential powerhouse in the regional and global supply chain for electric vehicle components.

- Brazil's lithium deposits, concentrated in the states of Minas Gerais and Ceara, have attracted significant attention from both domestic and international mining companies seeking to capitalize on the growing demand for this crucial battery metal.

- The Energy Institute Statistical Review of World Energy reported that in 2023, the country's lithium reserves stood at 4.9 thousand tonnes of lithium content. This marked a significant increase from the 2.6 thousand tonnes recorded in 2022, reflecting an impressive growth rate of 88.5%. Such a surge underscores the nation's substantial lithium reserves, a factor that bodes well for the burgeoning battery material market, especially in the context of electric vehicles.

- The country's nickel reserves, primarily found in the state of Goias, further enhance its strategic importance in the electric vehicle battery materials landscape. Additionally, Brazil boasts substantial graphite resources, with significant deposits located in Minas Gerais, Bahia, and Ceara, positioning the country as a critical player in the production of anode materials for lithium-ion batteries.

- The Brazilian government has recognized the strategic importance of the electric vehicle battery materials sector and has implemented various initiatives to foster its development. These efforts include investment incentives, research and development support, and regulatory frameworks aimed at promoting sustainable mining practices and local value addition.

- For instance, in April 2024, Sigma Lithium, in a strategic move, has greenlit a USD 100 million capital expenditure for Phase 2 of its Greentech Industrial Plant in Brazil. By 2025, this investment aims to ramp up the annual production capacity of its Quintuple Zero Green Lithium from 270,000 tons to an impressive 520,000 tons. With the expansion, sanctioned by Sigma's board, the company is poised to churn out sufficient lithium concentrate to fuel an estimated 1.8 million electric vehicles (EVs).

- The National Mining Agency (ANM) has streamlined licensing processes for battery material projects. At the same time, the Brazilian Development Bank (BNDES) has established financing programs to support companies involved in the electric vehicle supply chain. These measures have begun to attract both domestic and foreign investments, with several major mining companies and battery manufacturers exploring opportunities in the country.

- Therefore, Brazil is expected to witness significant growth during the forecast period, as mentioned above.

South America Electric Vehicle Battery Materials Industry Overview

The South America Electric Vehicle Battery Materials Market is semi-fragmented. Some of the key players in this market (in no particular order) are BASF SE, Mitsubishi Chemical Group Corporation, UBE Corporation, Albemarle Corporation, and Umicore SA, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Electric Vehicle Sales

- 4.5.1.2 Supportive Government Policies and Regulations

- 4.5.2 Restraints

- 4.5.2.1 Lack of Battery Material Production Facility

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-Acid Battery

- 5.1.3 Others

- 5.2 Material

- 5.2.1 Cathode

- 5.2.2 Anode

- 5.2.3 Electrolyte

- 5.2.4 Separator

- 5.2.5 Others

- 5.3 Geography

- 5.3.1 Brazil

- 5.3.2 Argentina

- 5.3.3 Colombia

- 5.3.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BASF SE

- 6.3.2 Mitsubishi Chemical Group Corporation

- 6.3.3 UBE Corporation

- 6.3.4 Umicore SA

- 6.3.5 Sumitomo Chemical Co., Ltd.

- 6.3.6 Albemarle Corporation

- 6.3.7 YOUME

- 6.3.8 BYD Co., Ltd.

- 6.3.9 Arkema SA

- 6.3.10 Nichia Corporation

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advancements in Battery Technology

02-2729-4219

+886-2-2729-4219