|

市场调查报告书

商品编码

1636281

义大利电动汽车电池材料:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Italy Electric Vehicle Battery Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

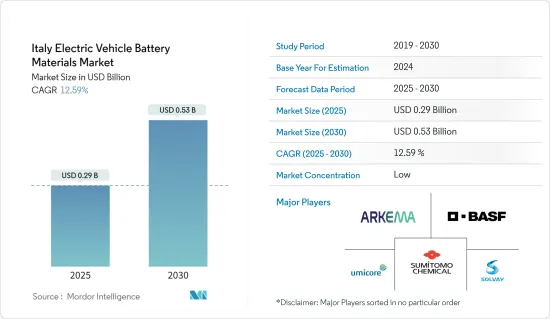

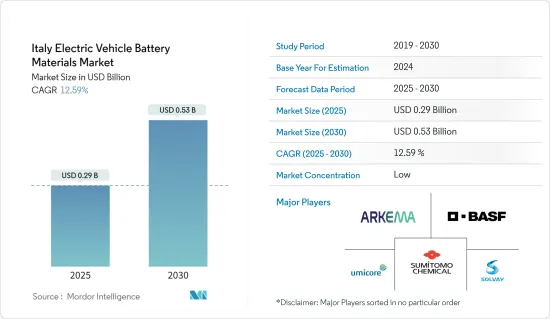

预计2025年义大利电动车电池材料市场规模为2.9亿美元,2030年将达5.3亿美元,预测期内(2025-2030年)复合年增长率为12.59%。

主要亮点

- 从中期来看,电动车(EV)销售的成长以及政府的支持性措施和法规预计将在预测期内推动电动车电池材料的需求。

- 另一方面,蕴藏量短缺可能会明显抑制电动车电池材料市场的成长。

- 电池技术的进步,如提高能量密度、缩短充电时间、提高安全性和延长使用寿命等,预计将在不久的将来为电动车电池材料市场的参与企业提供重大商机。

义大利电动汽车电池材料市场趋势

电动车 (EV) 销量的成长推动市场

- 义大利电动车(EV)销量的增加正在推动该地区对电动车电池材料的需求。随着电动车销量的增加,对锂、钴、镍和石墨等关键电池组件的需求也在增加。这种不断增长的需求不仅促进了当地生产,还吸引了投资并加强了义大利的电池材料供应链。

- 义大利正在协调一致地转向清洁能源,重点是电动车。近年来,义大利电动车销量激增。例如,根据国际能源总署(IEA)的报告,2023年义大利电动车销量为13.6万辆,较2022年成长19.29%。由于近期欧洲政府的多项计划和倡议,电动车销售量预计将大幅成长,对电池材料的需求也相应增加。

- 义大利政府正积极培育电动车市场,推出补贴和税收优惠,并实施更严格的排放法规。这些支援措施不仅增强了电动车市场,也有利于电池材料产业。政府制定了雄心勃勃的目标,旨在在未来几年内将电动车销量翻两番。

- 例如,2023 年,义大利承诺在 2023 年和 2024 年每年拨款 6.5 亿欧元(7.09 亿美元)。这笔资金旨在鼓励购买电动低排放气体。奖励针对插电式混合动力汽车和混合动力汽车汽车,补贴最高可达 4,000 欧元(4,368 美元)。这些强有力的倡议不仅将促进电动车的生产和销售,还将增加未来几年对电池材料的需求。

- 义大利充满活力的电动车市场正在推动电池技术的创新。当地公司正在与全球领导者合作开发下一代材料,预计将提高电动车的能量密度、延长使用寿命并提高安全性。该地区的主要企业齐聚一堂,预计先进电动车电池的需求将大幅增加。

- 例如,2024 年 2 月,StoreDot 推出了一款革命性的电池,只需 5 分钟即可充电 100 英里。他们雄心勃勃的计画目标是到 2028 年将这一时间减少到三分钟,到 2032 年减少到惊人的两分钟。透过策略合作伙伴关係,StoreDot 将向 Italvolt 授权这项创新技术并开始在义大利生产。这些进步不仅将推动对复杂电动车电池的需求,还将扩大该地区对电池材料的需求。

- 考虑到这种发展形势,很明显,电动车的销售势头以及支持它的电池材料的需求将继续增加。

锂离子电池占市场主导地位

- 电动车(EV)锂离子电池产量的增加正在显着影响电池材料市场。製造业的激增正在推动对锂的需求,其区域发现对原材料成本有直接影响。

- 为了因应这一趋势,主要市场参与企业正在加大对锂蕴藏量的投资和研发倡议。其目的是双重的。目的是扩大锂离子电池的产量,并满足快速成长的电池原料需求。随着新蕴藏量的发现,锂离子电池的价格已大幅下降。

- 例如,预计2023年电池价格将降至139美元/kWh,降幅为13%。鑑于目前的技术进步和製造效率,专家预测2025年价格可能进一步降至113美元/千瓦时,到2030年降至80美元/度。

- 此外,为了应对日益严重的环境问题,义大利政府正在大力推动电动车锂离子电池的生产。该国政府热衷于实现净零碳排放,并已推出多项倡议来提高锂离子电池产量,以满足该地区对电动车日益增长的需求。

- 例如,2024年2月,Automotive Cells公司获得47亿美元资金,在法国、德国和义大利建立三个锂离子电池超级工厂。该合资企业得到了 Stellantis、梅赛德斯-奔驰和帅福得(TotalEnergies 子公司)等行业巨头的支持,强调了其对锂离子电池作为能源来源的承诺,并将有助于推动未来对电池材料的需求。

- 近年来,义大利已成为锂离子电池回收先进技术的先驱。公司和研究机构都在创新方法,以有效地从这些电池中提取锂、钴和镍等有价值的材料。

- 例如,2024年1月,义大利卡车和巴士製造商依维柯集团与德国化学巨头BASF合作,回收电动车(BEV)的锂离子电池。该合作伙伴关係的财务细节尚未披露,但它与依维柯的循环经济愿景相呼应,该愿景的重点是延长电池寿命和最大限度地减少对环境的影响。这种合作不仅促进了锂离子原料的生产,而且预计将增加电动车电池原料的产量。

- 因此,这些进步和倡议有望提高锂离子电池的产量,并在未来几年显着增加对电动车电池材料的需求。

义大利电动汽车电池材料产业概况

义大利电动汽车电池材料市场已减半。主要参与企业(排名不分先后)包括住友化学、BASF、阿科玛、索尔维和优美科。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 至2029年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 电动车销量成长

- 政府扶持措施及措施

- 抑制因素

- 对原料供应的依赖

- 促进因素

- 供应链分析

- PESTLE分析

- 投资分析

第五章市场区隔

- 电池类型

- 锂离子电池

- 铅酸电池

- 其他的

- 材料

- 正极

- 负极

- 电解

- 分隔符

- 其他的

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Sumitomo Chemical Co., Ltd.

- BASF SE

- Arkema SA

- Solvay SA

- Umicore SA

- Midac Batteries

- FIB SpA

- Ferroglobe

- SGL Carbon

- Fiamm Energy Technology

- 其他知名公司名单

- 市场排名/份额分析

第七章 市场机会及未来趋势

- 电池技术的进步

简介目录

Product Code: 50003568

The Italy Electric Vehicle Battery Materials Market size is estimated at USD 0.29 billion in 2025, and is expected to reach USD 0.53 billion by 2030, at a CAGR of 12.59% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, growing electric vehicle (EV) sales and supportive government policies and regulations are expected to drive the demand for electric vehicle battery materials during the forecast period.

- On the other hand, the lack of raw material reserves can significantly restrain the growth of the electric vehicle battery materials market.

- Nevertheless, technological advancements in batteries like higher energy density, faster charging times, improved safety, and longer lifespan are expected to create significant opportunities for electric vehicle battery materials market players in the near future.

Italy Electric Vehicle Battery Materials Market Trends

Growing Electric Vehicle (EVs) Sales Drives the Market

- Rising electric vehicle (EV) sales in Italy are driving up the demand for EV battery materials in the region. As sales of EVs climb, so does the need for key battery components like lithium, cobalt, nickel, and graphite. This heightened demand is not only boosting local production but also attracting investments, thereby strengthening Italy's battery material supply chain.

- Italy is making a concerted shift towards clean energy, with electric vehicles taking center stage. Over recent years, EV sales in Italy have seen a remarkable surge. For instance, the International Energy Agency (IEA) reported that in 2023, Italy sold 136,000 electric vehicles, marking a 19.29% increase from 2022. With numerous projects and initiatives recently rolled out by the European government, EV sales are poised for significant growth, subsequently driving up the demand for battery materials.

- The Italian government is actively nurturing the EV market, rolling out subsidies, tax incentives, and enforcing stricter emission regulations. These supportive measures not only bolster the EV market but also extend their benefits to the battery material industry. The government has set ambitious targets, aiming for a fourfold increase in EV sales in the coming years.

- For instance, in 2023, Italy pledged an annual allocation of EUR 650 million (USD 709 million) for both 2023 and 2024. This funding is aimed at incentivizing the purchase of electrified and low-emission vehicles. The incentives cover plug-in hybrids and hybrids, with potential subsidies reaching up to EUR 4,000 (USD 4,368). Such robust initiatives are set to not only boost EV production and sales but also elevate the demand for battery materials in the coming years.

- Italy's dynamic EV market is driving innovations in battery technology. Local firms are collaborating with global leaders to develop next-gen materials that promise better energy density, longer lifespans, and enhanced safety for EVs. Major players in the region are uniting efforts, anticipating a significant uptick in demand for advanced EV batteries.

- For instance, in February 2024, StoreDot showcased a groundbreaking battery that can achieve a 100-mile charge in just five minutes. Their ambitious timeline aims to reduce this to three minutes by 2028 and an impressive two minutes by 2032. In a strategic collaboration, StoreDot has licensed this innovative technology to Italvolt, which is set to kick off production in Italy. Such advancements are poised to not only boost the demand for sophisticated EV batteries but also amplify the need for battery materials in the region.

- Given these developments, it's clear that the momentum in EV sales and the corresponding demand for battery materials is set to continue its upward trajectory.

Lithium-Ion Battery Type Dominate the Market

- The rising production of lithium-ion batteries for electric vehicles (EVs) has significantly shaped the battery materials market. This surge in manufacturing has heightened the demand for lithium, with its regional discoveries directly influencing raw material costs.

- In response to this trend, major market players are intensifying their investments in lithium reserves and R&D initiatives. Their objective is twofold: to amplify lithium-ion battery production and to satisfy the surging demand for battery raw materials. As new reserves are discovered, prices for lithium-ion batteries are experiencing a marked decline.

- For example, in 2023, battery prices notably dropped to USD 139/kWh, a 13% decrease. Given the current pace of technological advancements and manufacturing efficiencies, experts forecast prices could further decline to USD 113/kWh by 2025 and plummet to USD 80/kWh by 2030.

- Moreover, in response to escalating environmental concerns, the Italian government is vigorously championing lithium-ion battery production for electric vehicles. With a keen focus on achieving net-zero carbon emissions, the government has launched multiple initiatives to boost lithium-ion battery production, aiming to meet the region's growing EV demand.

- For instance, in February 2024, Automotive Cells Company secured a USD 4.7 billion fund to establish three lithium-ion battery gigafactories in France, Germany, and Italy. This venture, backed by industry giants like Stellantis, Mercedes-Benz, and Saft (a TotalEnergies subsidiary), underscores the commitment to lithium-ion batteries as a pivotal clean energy source, suggesting a surge in battery material demand in the coming years.

- In recent years, Italy has emerged as a leader in pioneering advanced technologies for recycling lithium-ion batteries. Both companies and research institutions are innovating methods to efficiently extract valuable materials-like lithium, cobalt, and nickel-from these batteries.

- For instance, in January 2024, Iveco Group, an Italian truck and bus manufacturer, partnered with BASF, a leading German chemicals firm, to recycle lithium-ion batteries for its electric vehicles (BEVs). While the financial details of the collaboration remain under wraps, it resonates with Iveco's circular economy vision, emphasizing battery lifespan extension and minimizing environmental impact. Such collaborations not only expedite the production of lithium-ion raw materials but also forecast an uptick in EV battery material production.

- Consequently, these advancements and initiatives are poised to boost lithium-ion battery production and significantly elevate the demand for EV battery materials in the coming years.

Italy Electric Vehicle Battery Materials Industry Overview

Italy's electric vehicle battery materials market is semi-fragmented. Some key players (not in particular order) are Sumitomo Chemical Co., Ltd., BASF SE, Arkema SA, Solvay SA, Umicore SA, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Electric Vehicle Sales

- 4.5.1.2 Supportive Government Policies and Regulations

- 4.5.2 Restraints

- 4.5.2.1 Dependence on Raw Material Supply

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-Acid Battery

- 5.1.3 Others

- 5.2 Material

- 5.2.1 Cathode

- 5.2.2 Anode

- 5.2.3 Electrolyte

- 5.2.4 Separator

- 5.2.5 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Sumitomo Chemical Co., Ltd.

- 6.3.2 BASF SE

- 6.3.3 Arkema SA

- 6.3.4 Solvay SA

- 6.3.5 Umicore SA

- 6.3.6 Midac Batteries

- 6.3.7 FIB S.p.A

- 6.3.8 Ferroglobe

- 6.3.9 SGL Carbon

- 6.3.10 Fiamm Energy Technology

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advancements in Battery Technology

02-2729-4219

+886-2-2729-4219