|

市场调查报告书

商品编码

1636272

印度电动汽车电池材料:市场占有率分析、产业趋势/统计、成长预测(2025-2030)India Electric Vehicle Battery Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

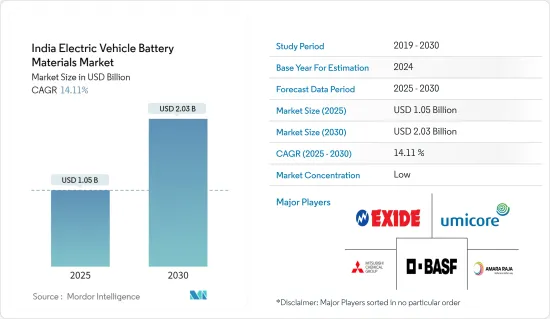

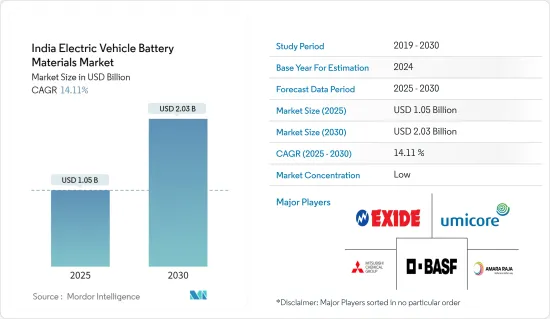

印度电动车电池材料市场规模预计到2025年为10.5亿美元,预计2030年将达到20.3亿美元,预测期内(2025-2030年)复合年增长率为14.11%。

主要亮点

- 从长远来看,电动车销量扩大以及政府政策法规等因素预计将成为预测期内印度电动车电池材料市场最重要的驱动因素之一。

- 另一方面,传统汽车市场的激烈竞争预计将对印度电动车电池销售产生负面影响。

- 也就是说,对电池技术进步的需求持续成长。预计这一因素将在未来为市场创造一些机会。

印度电动车电池材料市场趋势

锂离子电池类型主导市场

- 全球锂离子电动车电池市场是一个充满活力、机会与挑战并存的市场。由于其优越的容量重量比,锂离子二次电池比其他技术更受欢迎。延长使用寿命、减少维护、延长保质期和降低价格等优点进一步推动了锂离子二次电池的采用。

- 近年来,锂离子电池和电池组对终端用户产业的吸引力有所增强,这主要是由于价格下降。电池价格在2022年暂时上涨,2023年再次开始下降。一大亮点是锂离子电池组价格下降 14%,降至 139 美元/kWh 的历史低点。

- 此外,鑑于日益增长的环境问题,印度政府正在积极支持电动车。我们对净零碳排放的目标充满热情,而且我们的重点很明确。为了满足快速成长的锂离子电池需求,主要企业正积极开采电动车电池的关键元素锂。

- 一项引人注目的倡议是,环保电池材料和锂离子电池回收领域的领导者Lohum于2024年2月宣布,计划在2024年至2030年间回收20GWh废弃旧锂离子电池。这项倡议不仅凸显了罗姆对永续性的承诺,也使印度能够透过回收加强其锂提取工作。

- 此外,印度政府也推出了一系列支持电动车的政策和奖励。补贴、金融支持、退税等措施显着增强了全国对锂离子电池的需求。

- 总部位于美国的锂离子电池技术领导者 C4V 于 2023 年 12 月与 Hindalco Industries 签署了战略联盟谅解备忘录。这项合作关係专注于锂离子电池的电池铝箔、涂层箔和结构件的生产和供应,特别是针对印度快速成长的电动车电池材料市场。这种合作伙伴关係不仅满足了不断增长的需求,还强调了本地製造和专业知识在印度不断发展的电动车领域的重要性。

- 鑑于这些发展,锂离子电池材料产业预计将在预测期内获得成长动力。

电动车销量不断成长

- 印度电动车(EV)销售快速成长,推动了电动车电池材料市场的成长。这一增长是由政府激励措施、技术突破、环保意识增强以及行业相关人员的策略投资共同推动的。

- 根据国际能源总署的资料,印度的电动车保有量正急剧成长,从 2020 年的 3,100 辆跃升至 2023 年的 82,000 辆左右。在政策和措施的支持下,这种上升趋势可能会在未来几年持续下去。

- 印度政府处于推广电动车的最前沿,并推出了各种政策和奖励。目前处于第二阶段的混合动力汽车和电动车快速采用和製造(FAME)计划将为电动车购买提供慷慨的补贴,并支持充电基础设施的发展。此外,政府雄心勃勃的目标是到 2030 年使道路上所有车辆的 30% 为电动车,这也成为市场成长的催化剂。

- 科技进步,尤其是锂离子电池的进步,使电动车对消费者越来越有吸引力。提高能量密度、缩短充电时间和延长电池寿命等关键增强功能对于推动电动车的采用至关重要。这些进步取决于锂、镍、钴和锰等基本材料的稳定供应和成长,从而影响电池材料市场。

- 对环境问题的日益关注以及消费者对电动车好处的认识不断提高是关键的驱动因素。空气污染的有害影响,加上世界向永续能源解决方案的转变,使电动车成为传统内燃机汽车的可行替代品。随着消费者偏好转向电动车,对电池材料的需求将会飙升。

- 各大汽车製造商和高科技公司都在电动车领域进行了大量投资。塔塔汽车公司是印度汽车产业的领导者,正在为电动车生产和基础设施投入大量资源。同时,Exide Industries 和 Amara Raja Batteries 不仅提高产能,还致力于创新电池技术,以满足不断增长的需求。

- 2023 年 8 月,Ola Electric 推出了最新的电动Scooter,现代马达印度公司收购了通用汽车的塔里冈工厂,并强调了对电动车生产的承诺。

- 因此,对电动车电池基本材料的需求大幅增加,这对于加强电动车基础设施至关重要。印度热衷于培育一个生态系统来发展电动车产业,设立製造单位、建立研究中心和推出广泛的充电网路等措施就证明了这一点。

- 鑑于这些发展,预计电动车销量在预测期内将大幅成长。

印度电动汽车电池材料产业概况

印度电动车电池材料市场较为分散。该市场的主要企业(排名不分先后)包括BASF股份公司、三菱化学集团、优美科、住友化学和埃克塞德工业公司。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- 电动车销量成长

- 政府扶持政策及政策

- 抑制因素

- 与传统汽车市场竞争激烈

- 促进因素

- 供应链分析

- PESTLE分析

- 投资分析

第五章市场区隔

- 依电池类型

- 锂离子电池

- 铅酸电池

- 其他的

- 按材质

- 阴极

- 阳极

- 电解

- 分隔符

- 其他的

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- BASF SE

- Mitsubishi Chemical Group Corporation

- UBE Corporation

- Umicore SA

- Sumitomo Chemical Co., Ltd.

- Exide Industries

- Arkema SA

- Amara Raja

- 其他主要企业名单

- 市场排名/份额(%)分析

第七章 市场机会及未来趋势

- 电池技术的进步

简介目录

Product Code: 50003559

The India Electric Vehicle Battery Materials Market size is estimated at USD 1.05 billion in 2025, and is expected to reach USD 2.03 billion by 2030, at a CAGR of 14.11% during the forecast period (2025-2030).

Key Highlights

- Over the long term, factors such as growing electric vehicle sales and supportive government policies and regulations are expected to be among the most significant drivers for the India Electric Vehicle Battery Materials Market during the forecast period.

- On the other hand, high competition from the conventional vehicle market is expected to have a negative impact on EV battery sales in India.

- Nevertheless, there is continued growing demand for Advancements in Battery Technology. This factor is expected to create several opportunities for the market in the future.

India Electric Vehicle Battery Materials Market Trends

Lithium-ion Battery Type to Dominate the Market

- The global lithium-ion electric vehicle battery market is a dynamic arena, teeming with both opportunities and challenges. Lithium-ion rechargeable batteries are outpacing other technologies in popularity, due to their superior capacity-to-weight ratio. Their adoption is further fueled by advantages like extended lifespan, minimal maintenance, enhanced shelf life, and declining prices.

- In recent years, the allure of lithium-ion batteries and cell packs has intensified for end-user industries, primarily due to falling prices. After a brief uptick in 2022, battery prices resumed their downward trajectory in 2023. A significant highlight was the 14% drop in lithium-ion battery pack prices, reaching a record low of USD 139/kWh.

- Moreover, in response to escalating environmental concerns, Indian governments are fervently championing electric vehicles. With a keen eye on net-zero carbon emission goals, the focus is clear. Lithium, a cornerstone element for EV storage capacity, is being actively extracted by leading companies in India to meet the surging demand for lithium-ion batteries.

- In a notable move, Lohum, a frontrunner in eco-friendly battery materials and lithium-ion battery recycling, announced plans in February 2024 to recycle 20GWh of scrap lithium-ion batteries between 2024 and 2030. This initiative not only underscores Lohum's commitment to sustainability but also positions the country to bolster its lithium extraction efforts through recycling.

- Furthermore, the Indian government is rolling out a suite of policies and incentives to champion electric vehicles. Measures like subsidies, financial backing, and tax rebates are significantly bolstering the demand for lithium-ion batteries across the nation.

- In a strategic collaboration, C4V, a United States based leader in Li-Ion battery technology, inked a Memorandum of Understanding (MOU) in December 2023 with Hindalco Industries. This partnership focuses on producing and supplying battery-grade aluminum foils, coated foils, and structural components for Li-ion cells, specifically targeting the burgeoning EV battery materials market in India. This alignment not only addresses the escalating demand but also underscores the significance of local manufacturing and expertise in the evolving Indian EV landscape.

- Given these developments, the lithium-ion battery material industry is poised for positive momentum during the forecast period.

Growing Electric Vehicle Sales

- India's burgeoning electric vehicle (EV) sales are propelling the growth of the EV battery materials market. This upswing is driven by a confluence of factors: government incentives, technological breakthroughs, heightened environmental consciousness, and strategic investments from industry players.

- Data from the International Energy Agency reveals a dramatic rise in India's EV population, soaring from 3,100 units in 2020 to approximately 82,000 units in 2023. With supportive policies and initiatives, this upward trajectory is set to continue in the coming years.

- The Indian government is at the forefront of championing EV adoption, rolling out a slew of policies and incentives. The Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme, now in its second phase, has been instrumental, offering generous subsidies for EV purchases and bolstering the development of charging infrastructure. Furthermore, the government's ambitious target of having 30% of all vehicles on the road be electric by 2030 acts as a catalyst, propelling market growth.

- Technological strides, especially in lithium-ion batteries, have rendered EVs increasingly appealing to consumers. Key enhancements, such as improved energy density, reduced charging times, and extended battery lifespan, are pivotal in driving EV adoption. These advancements hinge on a consistent and growing supply of essential materials like lithium, nickel, cobalt, and manganese, thereby influencing the battery materials market.

- Heightened environmental concerns and a surge in consumer awareness about EV benefits are pivotal drivers. The detrimental impacts of air pollution, coupled with a global shift towards sustainable energy solutions, position EVs as a compelling alternative to conventional internal combustion engine vehicles. As consumer preference tilts towards EVs, the demand for battery materials surges correspondingly.

- Leading automotive and tech giants are pouring substantial investments into the EV arena. Tata Motors, a frontrunner in India's automotive landscape, is channeling significant resources into EV production and infrastructure. Concurrently, Exide Industries and Amara Raja Batteries are not only ramping up their production capabilities but also delving into innovative battery technologies to cater to the escalating demand.

- Highlighting the industry's aggressive expansion, August 2023 saw Ola Electric unveil its latest electric scooters, while Hyundai Motor India secured General Motors' Talegaon plant, underscoring its commitment to EV production.

- Consequently, there's been a marked uptick in the demand for materials pivotal to electric vehicle batteries, crucial for fortifying the electric mobility infrastructure. India is diligently nurturing an ecosystem to elevate its electric vehicle sector, evident from its initiatives in setting up manufacturing units, establishing research hubs, and rolling out an extensive charging network.

- Given these dynamics, the forecast period promises a robust surge in electric vehicle sales.

India Electric Vehicle Battery Materials Industry Overview

The India Electric Vehicle Battery Materials Market is semi-fragmented. Some of the key players in this market (in no particular order) are BASF SE, Mitsubishi Chemical Group Corporation, Umicore, Sumitomo Chemical Co. Ltd., and Exide Industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Electric Vehicle Sales

- 4.5.1.2 Supportive Government Policies and Regulations

- 4.5.2 Restraints

- 4.5.2.1 High Competition from Conventional Vehicle Market

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE ANALYSIS

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-Acid Battery

- 5.1.3 Others

- 5.2 Material

- 5.2.1 Cathode

- 5.2.2 Anode

- 5.2.3 Electrolyte

- 5.2.4 Separator

- 5.2.5 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BASF SE

- 6.3.2 Mitsubishi Chemical Group Corporation

- 6.3.3 UBE Corporation

- 6.3.4 Umicore SA

- 6.3.5 Sumitomo Chemical Co., Ltd.

- 6.3.6 Exide Industries

- 6.3.7 Arkema SA

- 6.3.8 Amara Raja

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advancements in Battery Technology

02-2729-4219

+886-2-2729-4219