|

市场调查报告书

商品编码

1636273

中国电动汽车电池材料:市场占有率分析、产业趋势/统计、成长预测(2025-2030)China Electric Vehicle Battery Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

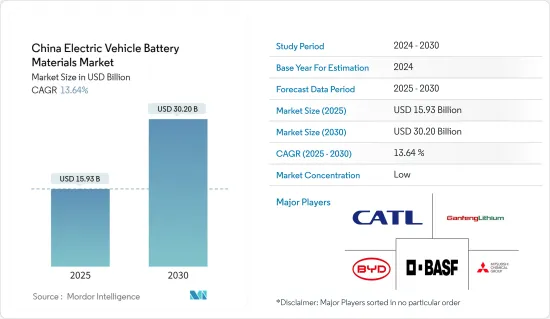

预计2025年中国电动车电池材料市场规模为159.3亿美元,预计2030年将达302亿美元,预测期间(2025-2030年)复合年增长率为13.64%。

主要亮点

- 从长远来看,扩大电动车销售以及政府措施和政策法规等因素预计将成为预测期内中国电动车电池材料市场最重要的驱动因素之一。

- 另一方面,由于我们依赖进口原材料,我们很容易受到价格波动的影响,预计这将对市场研究产生负面影响。

- 电池技术进步的需求持续成长。预计这一因素将在未来为市场创造一些机会。

中国电动汽车电池材料市场趋势

锂离子电池类型主导市场

- 全球锂离子电动车电池市场是一个充满活力、机会与挑战并存的市场。锂离子二次电池比其他电池技术更受欢迎,这主要是由于其良好的容量重量比。锂离子二次电池由于具有长寿命、低维护、使用寿命长、价格大幅下降等优异的性能特征而变得越来越受欢迎。

- 儘管锂离子电池的价格分布历来高于同类产品,但市场领导者已投入并加强研发力度,以实现规模经济。这种竞争的加剧不仅提高了电池性能,也降低了锂离子电池的价格。

- 近年来,锂离子电池和电池组的价格持续下降,对终端用户产业的吸引力越来越大。电池价格在2022年短暂上涨后,2023年持续下跌。一个关键亮点是,锂离子电池组的成本下降了 14%,降至 139 美元/kWh 的历史最低水准。

- 在环境问题日益严重的情况下,中国政府是电动车的热情支持者,并正在努力实现雄心勃勃的净零碳排放目标。对电动车储存能力至关重要的锂的需求强劲,全球各大公司都在加紧锂矿开采。

- 2024年7月,中国东部山东省宣布计画投资1,000亿元人民币(约138亿美元)。这个雄心勃勃的蓝图涵盖了电极材料、电解液、电池和组装的产业链。山东的策略不仅旨在实现消费电池的多元化和提高质量,还注重加强研发。省政府支持济南、青岛等城市发展原料生产和电池组装企业,满足当地新能源汽车生产企业的需求。

- 2024 年 2 月,CATL 推出了革命性的磷酸锂铁(LFP) 电池,一次充电的续航里程令人难以置信,超过 1,000 公里(621 英里)。这项创新可望扩大中国对原料的需求。

- 这种发展将导致锂离子电池的需求激增,从而导致未来几年对各种原料的需求增加。

扩大电动车销量

- 在电动车销售快速成长和国家对永续交通的承诺的推动下,中国电动车(EV)电池材料市场正在快速扩张。作为电动车采用的世界领导者,中国对基本电池材料(锂、镍、钴和锰)的需求正在迅速增长。这些材料对于製造锂离子电池至关重要,而锂离子电池是电动车储能的关键技术。

- 中国强劲的电动车销售已成为电池材料市场的主要催化剂。近年来,由于政府慷慨的奖励和补贴,以及旨在减少二氧化碳排放和污染防治的强有力的政策框架,中国电动车的普及迅速。政府的新能源汽车(NEV)指令要求汽车製造商生产一定比例的电动车,进一步加速了这一势头。

- 这种势头正在加速。 CATL正在提高产能,以满足快速增长的电动车电池需求。此外,宁德时代还在研发方面投入巨资,旨在降低成本,同时提高电池性能。

- 值得注意的是,宁德时代于2024年6月与特斯拉建立战略合作关係,承诺向特斯拉上海超级工厂供应锂离子电池。此次合作凸显了中国电池製造商与国际电动车製造商之间日益密切的关係。

- 2023年,中国电动车产业与前一年同期比较成长约22.7%,纯电动车销量约540万辆,较2019年的83万辆大幅成长。

- 中国政府继续透过各种措施支持电动车产业,包括税收优惠、对製造商和消费者的补贴以及对充电基础设施的投资。这些措施旨在透过使电动车变得更加实惠和方便来提高采用率,从而增加对电池材料的需求。电池技术的创新也在塑造市场。比亚迪等公司正在开发新型电池化学材料,例如磷酸锂铁(LFP)电池,其能量密度比传统锂离子电池略低,但更安全、更便宜。这些进步对于让电动车更容易进入大众市场至关重要。

- 中国电动车电池材料市场前景十分光明。凭藉政府的持续支持、技术进步和战略产业伙伴关係关係,中国有望保持在全球电动车市场的领先地位。主要电池製造商产能的持续扩张以及对永续实践的重视可能会确保基本材料的稳定供应并支持电动车产业的快速成长。

中国电动汽车电池材料产业概况

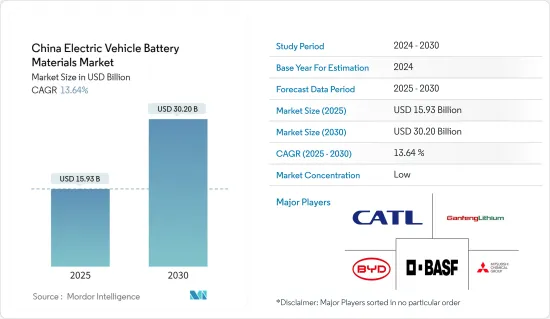

中国电动车电池材料市场已腰斩。市场的主要企业包括(排名不分先后)宁德时代新能源科技有限公司、比亚迪汽车、赣锋锂业、BASF股份公司和三菱化学集团公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 电动车销量成长

- 政府扶持措施及措施

- 抑制因素

- 对原料供应的依赖

- 促进因素

- 供应链分析

- PESTLE分析

- 投资分析

第五章市场区隔

- 电池类型

- 锂离子电池

- 铅酸电池

- 其他的

- 材料

- 正极

- 负极

- 电解

- 分隔符

- 其他的

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Contemporary Amperex Technology Co., Limited

- BYD Auto Co., Ltd.

- Ganfeng Lithium

- BASF SE

- Mitsubishi Chemical Group Corporation

- UBE Corporation

- Umicore SA

- Sumitomo Chemical Co., Ltd.

- BTR New Material Group Co. Ltd.

- Shanshan Co.

- 其他知名公司名单

- 市场排名/份额(%)分析

第七章市场机会与未来趋势

- 电池技术的进步

简介目录

Product Code: 50003560

The China Electric Vehicle Battery Materials Market size is estimated at USD 15.93 billion in 2025, and is expected to reach USD 30.20 billion by 2030, at a CAGR of 13.64% during the forecast period (2025-2030).

Key Highlights

- Over the long term, factors such as growing electric vehicle sales and supportive government policies and regulations are expected to be among the most significant drivers for the China Electric Vehicle Battery Materials Market during the forecast period.

- On the other hand, the country's reliance on imported raw materials makes the industry vulnerable to price fluctuation, which is expected to negatively impact the market studied.

- Nevertheless, there is continued growing demand for advancements in battery technology. This factor is expected to create several opportunities for the market in the future.

China Electric Vehicle Battery Materials Market Trends

Lithium-ion Battery Type to Dominate the Market

- The global lithium-ion electric vehicle battery market is a dynamic arena, teeming with both opportunities and challenges. Lithium-ion rechargeable batteries are outpacing other battery technologies in popularity, primarily due to their advantageous capacity-to-weight ratio. Their adoption is further fueled by superior performance attributes, such as longevity, low maintenance, an extended shelf life, and a notable decrease in price.

- While lithium-ion batteries traditionally commanded a higher price point than their counterparts, leading market players have been channeling investments into achieving economies of scale and bolstering R&D efforts. This intensified competition has not only enhanced battery performance but also driven down lithium-ion battery prices.

- Recent trends show a consistent decline in the prices of lithium-ion batteries and cell packs, making them increasingly attractive to end-user industries. After a brief uptick in 2022, battery prices continued their downward trajectory in 2023. A significant highlight was the 14% drop in lithium-ion battery pack costs, reaching a record low of USD 139/kWh.

- Amid rising environmental concerns, the Chinese government is fervently championing electric vehicles, aligning its efforts with ambitious net-zero carbon emission targets. Lithium, a crucial component for EV storage capacity, is in high demand, prompting leading global companies to ramp up lithium extraction.

- In July 2024, Shandong province in eastern China unveiled plans for a substantial 100 billion yuan (USD 13.8 billion) investment. The ambitious blueprint encompasses an industrial chain spanning electrode materials, electrolytes, battery cells, and assembly. Shandong's strategy not only aims to diversify and enhance the quality of consumer batteries but also emphasizes bolstering R&D. The provincial government is backing Jinan and Qingdao cities to nurture companies in raw material production and battery assembly, catering to the demands of local new energy vehicle manufacturers.

- In February 2024, CATL introduced a groundbreaking lithium iron phosphate (LFP) battery boasting an impressive driving range of over 1,000 kilometers (621 miles) on a single charge. This innovation is poised to amplify raw material demand in China.

- Given these developments, the demand for lithium-ion batteries is set to surge, subsequently driving up the need for various raw materials in the coming years.

Growing Electric Vehicle Sales

- China's electric vehicle (EV) battery materials market is expanding rapidly, fueled by soaring EV sales and a national commitment to sustainable transportation. As the global leader in EV adoption, China's appetite for essential battery materials-lithium, nickel, cobalt, and manganese-has surged. These materials are pivotal for crafting lithium-ion batteries, the primary technology for EV power storage.

- China's booming EV sales are a primary catalyst for its battery materials market. In recent years, bolstered by generous government incentives, subsidies, and a robust policy framework targeting carbon emission reductions and air pollution combat, China has witnessed a meteoric rise in EV adoption. The government's New Energy Vehicle (NEV) mandate, compelling automakers to produce a specific percentage of EVs, further amplifies this momentum.

- Contemporary Amperex Technology Co. Limited (CATL), a frontrunner in battery manufacturing, is ramping up its production capacity to cater to the surging demand for EV batteries. Additionally, CATL is channeling substantial investments into research and development, aiming to boost battery performance while curtailing costs.

- In a notable move, CATL forged a strategic alliance with Tesla in June 2024, committing to supply lithium-ion batteries for Tesla's Shanghai Gigafactory. This partnership highlights the deepening ties between Chinese battery producers and international EV manufacturers.

- In 2023, China's electric vehicle sector grew by approximately 22.7% year-on-year, with battery EV sales soaring to about 5.4 million, a significant leap from 0.83 million in 2019.

- The Chinese government continues to support the EV sector through various measures, including tax incentives, subsidies for both manufacturers and consumers and investments in charging infrastructure. These policies are designed to make EVs more affordable and convenient, thereby driving higher adoption rates and, consequently, increasing the demand for battery materials. Innovations in battery technology are also shaping the market. Companies like BYD are developing new battery chemistries, such as lithium iron phosphate (LFP) batteries, which are safer and cheaper, although with slightly lower energy density than traditional lithium-ion batteries. These advancements are crucial for making EVs more accessible to the mass market.

- The outlook for the EV battery materials market in China is highly positive. With continued support from the government, technological advancements, and strategic industry partnerships, China is well-positioned to maintain its leadership in the global EV market. The ongoing expansion of production capacities by major battery manufacturers and the emphasis on sustainable practices will likely ensure a steady supply of essential materials, supporting the rapid growth of the EV sector.

China Electric Vehicle Battery Materials Industry Overview

The China Electric Vehicle Battery Materials Market is semi-fragmented. Some of the key players in this market (in no particular order) are Contemporary Amperex Technology Co., Limited, BYD Auto Co., Ltd, Ganfeng Lithium, BASF SE, and Mitsubishi Chemical Group Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Electric Vehicle Sales

- 4.5.1.2 Supportive Government Policies and Regulations

- 4.5.2 Restraints

- 4.5.2.1 Dependence on Raw Material Supply

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE ANALYSIS

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-Acid Battery

- 5.1.3 Others

- 5.2 Material

- 5.2.1 Cathode

- 5.2.2 Anode

- 5.2.3 Electrolyte

- 5.2.4 Separator

- 5.2.5 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted byr Leading Players

- 6.3 Company Profiles

- 6.3.1 Contemporary Amperex Technology Co., Limited

- 6.3.2 BYD Auto Co., Ltd.

- 6.3.3 Ganfeng Lithium

- 6.3.4 BASF SE

- 6.3.5 Mitsubishi Chemical Group Corporation

- 6.3.6 UBE Corporation

- 6.3.7 Umicore SA

- 6.3.8 Sumitomo Chemical Co., Ltd.

- 6.3.9 BTR New Material Group Co. Ltd.

- 6.3.10 Shanshan Co.

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advancements in Battery Technology

02-2729-4219

+886-2-2729-4219