|

市场调查报告书

商品编码

1636276

德国电动汽车电池材料:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Germany Electric Vehicle Battery Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

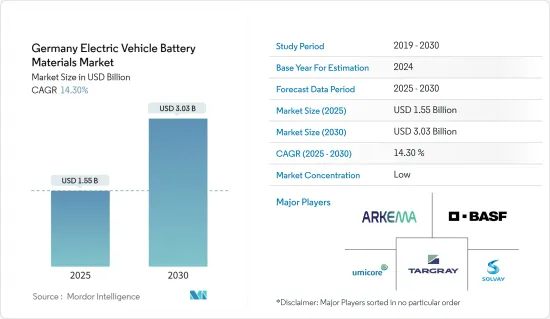

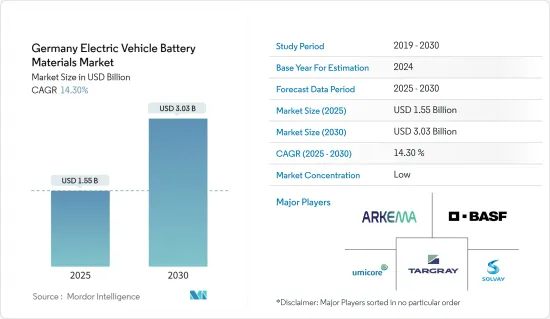

德国电动车电池材料市场规模预计2025年为15.5亿美元,预计2030年将达30.3亿美元,预测期内(2025-2030年)复合年增长率为14.3%。

主要亮点

- 从中期来看,电动车(EV)销售的成长以及政府的支持性措施和法规预计将在预测期内推动电动车电池材料的需求。

- 另一方面,与原材料供应链和价格波动相关的问题可能会对市场研究产生负面影响。

- 电池技术的进步,例如提高能量密度、缩短充电时间、提高安全性和延长使用寿命等,预计将在不久的将来为电动车电池材料市场的参与企业提供重大商机。

德国电动车电池材料市场趋势

电动车 (EV) 销量的成长推动市场

- 德国电动车(EV)销量的增加正在推动该地区对电动车电池材料的需求。随着电动车销售的快速成长,对锂、钴、镍、石墨等关键电池材料的需求也不断增加。这种不断增长的需求刺激了这些材料的本地生产和投资,支持了德国电池材料供应链的成长。

- 德国正在向清洁能源转型,重点是电动车。近年来,该国电动车销量快速成长。例如,根据国际能源总署(IEA)的报告,2023年德国电动车销量将为70万辆。这一数字与 2022 年持平,但自 2019 年以来增长了 5.5 倍。欧洲各国政府最近宣布的许多计划和倡议预计将显着增加电动车销量,进一步增加对电池材料的需求。

- 德国政府正在积极支持电动车市场的扩张,提供补贴和税收优惠,并实施更严格的排放法规。这些支援措施不仅增强了电动车市场,也延伸至电池材料产业。政府最近宣布了一项雄心勃勃的激励计划,旨在在未来几年内将电动车销量翻两番。

- 作为 2023 年倡议的一部分,政府推出了一项重大补贴计划,以鼓励电动车的普及。新电动车购买者将获得高达6,000欧元(约6,500美元)的补贴,插电式混合动力汽车购买者将获得高达4,500欧元(约4,900美元)的补贴。预计这些措施不仅将促进电动车的生产和销售,还将增加未来几年对电池材料的需求。

- 德国充满活力的电动车市场是电池创新的温床。德国领先的公司与研究机构一起投资开创性材料,以提高能量密度、更长的使用寿命和卓越的安全性。该地区主要企业之间的合作正在为先进电池技术铺平道路,并为电动车电池不断增长的需求奠定基础。

- 一项引人注目的进展是,由电池公司 VARTA主导的 15 家公司和学术研究人员组成的联盟于 2024 年 5 月宣布推出尖端钠离子电池技术。这种下一代电池有望为电动车和其他应用提供高性能、成本效益和环境友善性。该财团计划于 2027 年中期完成计划。这些突破不仅将加速对复杂电动车电池的需求,还将在可预见的未来扩大该地区对电池材料的需求。

- 鑑于这些动态,电动车需求的快速成长轨迹以及相应的电池材料需求似乎强劲且充满希望。

锂离子电池占市场主导地位

- 电动车(EV)锂离子电池产量的增加正在重塑电池材料市场。在德国,随着锂离子电池产量的飙升,对锂的需求也增加。该地区锂的发现对原料成本产生了重大影响。

- 主要市场相关人员正在投资锂蕴藏量和研发,以满足锂离子电池产量的增加和对电池原料需求的增加。随着这些蕴藏量的不断发现,从长远来看,锂离子电池的价格将呈下降趋势。

- 例如,2023年电池价格降至139美元/kWh,降幅超过13%。随着技术创新和製造流程的不断改进,预计到2025年电池组价格可能降至113美元/kWh,到2030年甚至降至80美元/kWh。

- 此外,由于对环境问题日益关注,欧洲各国政府正积极支持电动车锂离子电池的生产。这些政府热衷于实现净零碳排放,推出多项倡议来提高锂离子电池产量,以满足该地区对电动车日益增长的需求。

- 例如,2024 年 1 月,瑞典锂离子电池製造商 Northvolt 获得了欧盟核准,从德国获得了价值 9.02 亿欧元(合 9.8643 亿美元)的国家支持包装。该资金将用于在德国海德建立电动车电池生产设施。这种核准不仅将支持德国的努力,也符合欧盟整体净零排放的野心。这些努力将支持采用锂离子电池作为清洁能源解决方案,从而增加未来几年对电池材料的需求。

- 近年来,德国已成为先进锂离子电池回收技术的先驱。公司和研究机构之间的合作重点是从废弃电池中有效地再生锂、钴和镍等有价值的材料。

- 例如,2024 年 5 月,波兰的 Elemental Strategy Metals (ESM) 宣布计划与美国新兴企业Ascend Elements 合作建造锂离子电池回收设施。该厂预计年加工量为2.5万吨,预计2024年秋季动工,2026年开始营运。这些努力预计将促进原材料生产,并增加未来电动车电池材料的产量。

- 鑑于这些发展,很明显,正在进行的计划和倡议将提高电动车电池的产量,并在未来几年显着增加对电动车电池材料的需求。

德国电动车电池材料产业概况

德国电动车电池材料市场已被削减一半。主要参与企业(排名不分先后)包括 Targray Technology International Inc.、 BASF SE、Arkema SA、Solvay SA 和 Umicore SA。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 至2029年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 电动车销量成长

- 政府扶持措施及措施

- 抑制因素

- 原料需求供给缺口

- 促进因素

- 供应链分析

- PESTLE分析

- 投资分析

第五章市场区隔

- 电池类型

- 锂离子电池

- 铅酸电池

- 其他的

- 材料

- 正极

- 负极

- 电解

- 分隔符

- 其他的

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Targray Technology International Inc

- BASF SE

- Arkema SA

- Solvay SA

- Umicore SA

- Mitsubishi Chemical Group Corporation

- UBE Corporation

- Johnson Matthey

- Henkel Adhesive Technologies

- Heraeus Group

- Wacker Chemie AG

- 其他知名公司名单

- 市场排名/份额分析

第七章 市场机会及未来趋势

- 电池技术的进步

简介目录

Product Code: 50003563

The Germany Electric Vehicle Battery Materials Market size is estimated at USD 1.55 billion in 2025, and is expected to reach USD 3.03 billion by 2030, at a CAGR of 14.3% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, growing electric vehicle (EV) sales and supportive government policies and regulations are expected to drive the demand for electric vehicle battery materials during the forecast period.

- On the other hand, issues related to the raw material supply chain and price fluctuations are likely to negatively impact the market studied.

- Nevertheless, technological advancements in batteries like higher energy density, faster charging times, improved safety, and longer lifespan are expected to create significant opportunities for electric vehicle battery materials market players in the near future.

Germany Electric Vehicle Battery Materials Market Trends

Growing Electric Vehicle (EVs) Sales Drives the Market

- Rising electric vehicle (EV) sales in Germany are driving up the demand for EV battery materials in the region. As the country sees a surge in EV sales, the need for key battery materials like lithium, cobalt, nickel, and graphite is also escalating. This heightened demand is spurring local production and investment in these materials, bolstering the growth of Germany's battery material supply chain.

- Germany is pivoting towards clean energy, with electric vehicles taking center stage. Over recent years, EV sales in the country have skyrocketed. For example, the International Energy Agency (IEA) reported that in 2023, Germany sold 0.7 million electric vehicles. While this figure remained steady from 2022, it marked a 5.5-fold increase from 2019. With numerous projects and initiatives recently unveiled by the European government, EV sales are poised for significant growth, further amplifying the demand for battery materials.

- The German government actively champions the EV market's expansion, offering subsidies, tax incentives, and enforcing stricter emission regulations. These supportive measures not only bolster the EV market but also extend to the battery material industry. Recently, the government unveiled ambitious incentives, aiming for a fourfold increase in EV sales in the coming years.

- As part of its 2023 initiatives, the government rolled out a substantial subsidy scheme to bolster electric vehicle adoption. New EV buyers were entitled to a subsidy of up to EUR 6,000 (approximately USD 6,500), while those opting for plug-in hybrids could avail up to EUR 4,500 (around USD 4,900). Such measures are anticipated to not only boost EV production and sales but also elevate the demand for battery materials in the years ahead.

- Germany's vibrant EV market is a hotbed for battery technology innovation. Major German corporations, alongside research institutions, are channeling investments into pioneering materials that promise enhanced energy density, extended lifespan, and superior safety. Collaborations among leading regional companies are paving the way for advanced battery technologies, setting the stage for heightened EV battery demand.

- In a notable development, a consortium of 15 companies and academic researchers, spearheaded by battery firm VARTA, unveiled a cutting-edge sodium-ion battery technology in May 2024. This next-gen battery promises high performance, cost-effectiveness, and environmental friendliness, catering to EVs and other applications. The consortium has earmarked mid-2027 for the project's culmination. Such breakthroughs are set to not only accelerate the demand for sophisticated EV batteries but also amplify the region's appetite for battery materials in the foreseeable future.

- Given these dynamics, the trajectory of EV demand and the corresponding surge in battery material requirements appear robust and promising.

Lithium-Ion Battery Type Dominate the Market

- The growing production of lithium-ion batteries for electric vehicles (EVs) is reshaping the battery materials market. In Germany, as lithium-ion battery production has surged, so too has the demand for lithium. Discoveries of lithium in the region are notably influencing raw material costs.

- Key market players are channeling investments into lithium reserves and R&D, aiming to boost lithium-ion battery production and meet the escalating demand for battery raw materials. As these reserves are continuously discovered, the prices of lithium-ion batteries have seen a downward trend over time.

- For instance, battery prices in 2023 fell to USD 139/kWh, marking a decline of over 13%. With ongoing technological innovations and manufacturing improvements, projections suggest battery pack prices could drop to USD 113/kWh by 2025 and further to USD 80/kWh by 2030.

- Moreover, European governments are actively championing lithium-ion battery production for EVs, spurred by mounting environmental concerns. With a keen focus on achieving net-zero carbon emissions, these governments have launched multiple initiatives to boost lithium-ion battery production, aiming to meet the region's growing EV demand.

- For instance, in January 2024, Northvolt, a Swedish lithium-ion battery manufacturer, secured EU approval for a significant EUR 902 million (USD 986.43 million) state aid package from Germany. This funding is earmarked for establishing an EV battery production facility in Heide, Germany. Such endorsements not only bolster Germany's efforts but also align with the broader EU's net-zero ambitions. These initiatives are poised to bolster the adoption of lithium-ion batteries as a clean energy solution, subsequently driving up the demand for battery materials in the years ahead.

- In recent years, Germany has emerged as a leader in pioneering advanced recycling technologies for lithium-ion batteries. Collaborations between companies and research institutions are focused on efficiently reclaiming valuable materials, including lithium, cobalt, and nickel, from spent batteries.

- For instance, in May 2024, Elemental Strategic Metals (ESM), a Polish entity, in collaboration with Ascend Elements, a US start-up, unveiled plans for a lithium-ion battery recycling facility. With a projected capacity of 25,000 tonnes annually, construction is set to commence in autumn 2024, aiming for operational status by 2026. Such endeavors are anticipated to boost raw material production and elevate the output of EV battery materials in the future.

- Given these developments, it's evident that ongoing projects and initiatives are set to bolster EV battery production and significantly heighten the demand for EV battery materials in the coming years.

Germany Electric Vehicle Battery Materials Industry Overview

Germany's electric vehicle battery materials market is semi-fragmented. Some key players (not in particular order) are Targray Technology International Inc., BASF SE, Arkema SA, Solvay SA, Umicore SA, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Electric Vehicle Sales

- 4.5.1.2 Supportive Government Policies and Regulations

- 4.5.2 Restraints

- 4.5.2.1 Raw Material Demand Supply Gap

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-Acid Battery

- 5.1.3 Others

- 5.2 Material

- 5.2.1 Cathode

- 5.2.2 Anode

- 5.2.3 Electrolyte

- 5.2.4 Separator

- 5.2.5 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Targray Technology International Inc

- 6.3.2 BASF SE

- 6.3.3 Arkema SA

- 6.3.4 Solvay SA

- 6.3.5 Umicore SA

- 6.3.6 Mitsubishi Chemical Group Corporation

- 6.3.7 UBE Corporation

- 6.3.8 Johnson Matthey

- 6.3.9 Henkel Adhesive Technologies

- 6.3.10 Heraeus Group

- 6.3.11 Wacker Chemie AG

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advancements in Battery Technology

02-2729-4219

+886-2-2729-4219