|

市场调查报告书

商品编码

1643183

法国网路安全:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)France Cybersecurity - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

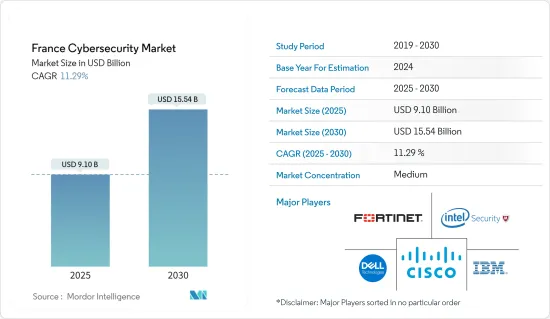

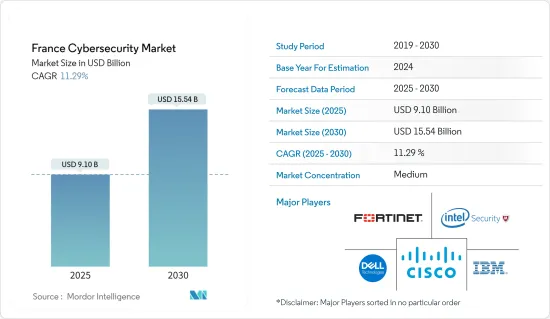

预计 2025 年法国网路安全市场规模为 91 亿美元,到 2030 年将达到 155.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 11.29%。

主要亮点

- 网路安全市场的成长主要受到网路攻击日益复杂化和频率的推动。过去十年,网路犯罪和诈骗行为急剧增加,对企业造成了巨大的经济损失。

- 物联网 (IoT) 的兴起、「自带设备」趋势以及恶意软体和网路钓鱼攻击的激增进一步推动了这一增长。此外,对云端基础的安全解决方案的不断增长的需求正在推动市场扩张。然而,这种成长面临着包括预算限制和设备安全复杂性在内的挑战。相反,行动平台的不断普及、对强大身份验证方法的需求以及传统防毒领域的转变为市场成长带来了丰厚的机会。

- 利用软体定义边界等云端技术的公司可以加强其安全基础设施。世界各国政府颁布法律和具体建议加强云端平台的安全,进一步推动了全球网路安全市场的扩张。值得注意的是,网路犯罪分子越来越多地瞄准中小型企业并利用其安全框架中的漏洞。设备防火墙等传统安全措施无法保护云端应用程式免受恶意软体、勒索软体和网路钓鱼等现代网路威胁。

- 组织越来越多地求助于各种各样的专家来保护他们的系统、员工和资料。然而,随着网路威胁的激增,企业面临着寻找能够对抗这些风险的熟练专家的挑战。

- 全球网路安全人才短缺对各行各业的企业构成了重大挑战。不断变化的情况凸显了对网路安全专业人员的需求,他们需要具备多种技术和非技术技能,以满足当今角色的多样化需求。

- 远距办公的转变,以在家工作(WFH)政策的兴起为标誌,已将资讯安全的重点从企业转移到云端和虚拟基础设施。由于员工依赖家庭 Wi-Fi 和 VPN 连接,配置错误和远端工作实践鬆懈会导致资料外洩和窃取的风险增加。此外,频宽消费量的突然增加使许多组织面临更大的 DDoS 攻击风险。

法国网路安全市场的趋势

网路安全预计将显着成长

- 法国工程顾问公司 Altran Technologies 遭受网路攻击,导致该公司的 IT 网路和应用程式关闭,扰乱了业务。

- 为了免受此类攻击,该国对其IT基础设施,特别是网路安全进行了投资。预计预测期内这项支出将会增加,从而导致对网路安全解决方案的需求。

- 5G技术的应用正在迅速增加。 5G意味着更多的频宽使用、可靠性和延迟,但也使设备能够透过改进的网路解决方案以最高的速度运行。因此,人工智慧、机器学习和工业物联网等领域在 5G 的帮助下获得了显着的发展。

- 随着 5G 技术迅速成为商业应用不可或缺的一部分,预计将有更多的资料透过网路传输,但也带来了新的资料安全风险。此外,网路用户数量预计将快速增长。网路攻击者对于用户和5G服务供应商来说都是一个问题。因此,预计全球网路安全市场将受到5G服务日益普及的刺激。

零售业可望获得最大推动力

- 数位革命改变了消费者的习惯和行为,大大增强了消费者的相对权力。透过个人电脑、智慧型手机和平板电脑等各种设备快速存取日益广泛的产品和解决方案的能力正在改变客户的购买方式。

- 同时,实体店正在拥抱技术创新,透过全通路方式实现新的经营方式。零售商结合和整合不同的管道(零售店、网站、行动应用程式等)来支援售前、购买和售后阶段的企业与消费者的互动。

- 新冠疫情迫使被困家中的消费者上网购买所需产品,迫使他们养成数位消费习惯并学习如何成为数位消费者。这使得消费者能够享受数位产品带来的好处。甚至那些之前对电子商务持怀疑态度的人们,也因安全问题在疫情期间被迫转向网上购物。

- 为了成为该地区用户的预设选择,银行和零售商需要为客户提供跨互联网和行动端的全方位体验,包括行动付款、线上零售、P2P 和跨境交易。

- 网路身分的兴起也增加了身分窃盗和相关诈骗的风险。该地区的行动通讯业者认识到需要与政府和更广泛的行业密切合作来解决这些问题。 Mobile Connect 具有快速、安全的登入系统,让您只需点击一下即可存取您的线上帐户。 Mobile Connect 是一种快速、安全的登入系统,让您一键存取您的线上帐户,提供不同等级的安全性,从低阶的网站存取到高级银行级身分验证。

法国网路安全产业概况

网路安全市场是半静态的,只有少数大型参与者。公司不断投资于策略联盟和产品开发以扩大市场占有率。

- 2024 年 5 月 Fortinet 推出新型新一代防火墙 (NGFW) 设备,可提供现代校园主干所需的业界领先的安全性和网路效能。这些功能使企业能够有效地支援和保护校园环境中不断增长的资料丰富流量和云端基础的应用程式。

- 2023 年 10 月,IBM 将推出其託管检测和响应服务的全新演进,引入人工智慧和高达 85% 警报的自动升级或自动关闭等先进技术,帮助缩短客户的安全响应时间。威胁侦测和回应服务™ 提供对客户混合云环境内所有相关技术(包括现有安全工具)的安全警报的全天候监控、调查和自动修復。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- COVID-19 市场影响

第五章 市场动态

- 市场驱动因素

- 数位化和对可扩展IT基础设施日益增长的需求

- 需要因应各种趋势带来的风险,包括第三方供应商风险、MSSP 的发展以及云端优先策略的采用

- 市场限制

- 网路安全专家短缺

- 高度依赖传统身分验证方法且缺乏准备

- 趋势分析

- 越来越多的法国组织正在使用人工智慧来加强其网路安全战略

- 随着企业转向云端基础的交付模式,云端安全将呈现指数级成长

第六章 市场细分

- 按服务

- 安全类型

- 云端安全

- 资料安全

- 身分存取管理

- 网路安全

- 消费者安全

- 基础设施保护

- 其他类型

- 按服务

- 安全类型

- 按部署

- 云

- 本地

- 按最终用户

- BFSI

- 卫生保健

- 製造业

- 政府和国防

- 资讯科技/通讯

- 其他最终用户

第七章 竞争格局

- 公司简介

- IBM Corporation

- Cisco Systems Inc.

- Dell Technologies Inc.

- Fortinet Inc.

- Intel Security(Intel Corporation)

- F5 Networks Inc.

- AVG Technologies

- IDECSI Enterprise Security

- FireEye Inc.

第八章投资分析

第九章:市场的未来

简介目录

Product Code: 70171

The France Cybersecurity Market size is estimated at USD 9.10 billion in 2025, and is expected to reach USD 15.54 billion by 2030, at a CAGR of 11.29% during the forecast period (2025-2030).

Key Highlights

- The cybersecurity market's growth is primarily fueled by the escalating sophistication and frequency of cyberattacks. Over the past decade, cybercrimes and scams have surged, inflicting significant financial losses on enterprises.

- This growth is further propelled by the rising adoption of the Internet of Things (IoT), the 'Bring Your Own Device' (BYOD) trend, and a surge in malware and phishing attacks. Additionally, a heightened demand for cloud-based security solutions is bolstering market expansion. However, this growth faces challenges from budget constraints and the intricate nature of device security. Conversely, the increasing prevalence of mobile platforms, the demand for robust authentication methods, and shifts in the traditional antivirus sector promise lucrative opportunities for market growth.

- Businesses leveraging cloud technologies, such as software-defined perimeters, can bolster their security infrastructure. The global cyber security market's expansion is further catalyzed by several governments worldwide, which are enacting legislation and specific recommendations to enhance cloud platform security. Notably, cybercriminals are increasingly targeting small and medium-sized enterprises, exploiting vulnerabilities in their security frameworks. Traditional security measures like appliance firewalls struggle to safeguard cloud applications against modern cyber threats, including malware, ransomware, and phishing.

- Organizations are increasingly relying on a diverse range of professionals to protect their systems, employees, and data. However, as cyber threats surge, organizations face a growing challenge in finding skilled professionals to combat these risks.

- A persistent global cybersecurity workforce shortage poses a significant challenge for businesses across industries. The evolving landscape underscores the need for cybersecurity professionals with a mix of technical and non-technical skills tailored to the diverse demands of today's roles.

- The shift to remote work, accentuated by the rise in work-from-home (WFH) policies, redirected the focus of information security from enterprise to cloud and virtualized infrastructures. With employees relying on home Wi-Fi and VPN connections, misconfigurations and a more relaxed approach to remote work heighten the risk of data leaks and theft. Furthermore, the surge in bandwidth consumption exposes many organizations to heightened risks of DDoS attacks.

France Cyber Security Market Trends

Network Security is Expected to Witness Major Growth

- There was a cyber attack on Altran Technologies, an engineering consultancy firm based in France, which resulted in the shutting down of its IT network and applications, leading to operations in some European countries, including France.

- In order to protect itself from such attacks, the country invested in its IT infrastructure, particularly for cybersecurity. This spending is projected to increase over the forecast period, which may lead to a demand for cybersecurity solutions.

- There is a rapid increase in the use of 5G technology. 5G implies more bandwidth usage, reliability, and latency while providing devices with the ability to run at maximum speed through improved network solutions. Consequently, areas such as AI, ML, and the Industrial Internet of Things have gained significant traction with 5G.

- As 5G technology is rapidly becoming integral to business applications and presenting new data security risks, more data are expected to be transmitted through the network. Furthermore, the number of internet users is expected to grow rapidly. For users and 5G service providers, cyber attackers are an issue. The global market for network security is, therefore, expected to be stimulated by the growing uptake of 5G services.

The Retail Sector is Expected to Gain Maximum Traction

- Consumer habits and behaviors changed in the context of the digital revolution, greatly strengthening the relative power of a consumer. The perception of a customer toward a purchase is changing due to the ability to quickly access an increasingly wide offering of products and solutions through various devices, such as PCs, smartphones, and tablets.

- On the other hand, brick-and-mortar stores are using technological innovation to enable new ways of business with an omnichannel approach. A retailer combines and integrates different channels (retail stores, websites, mobile applications, etc.) to support the interaction between a company and consumer in the pre-sale, purchasing, and post-sale stages.

- Due to the COVID-19 pandemic, consumers confined to their homes had to go online to access essential goods, forcing them to adopt digital consumer habits and educate themselves to become digital consumers. This allowed them to enjoy the benefits that digital products offer. People were skeptical of e-commerce in the past, and owing to security concerns, they were compelled to switch to online purchases during the pandemic.

- To become the default choice of users in this region, banks and retailers need to provide their clients with a full range of experiences on the Internet and mobile for both web and mobile payments, such as mobile payments, online retailing, P2P, or cross-border transactions.

- With the rise of online identities, there is a rising risk of identity theft and associated fraud. Mobile operators in the region recognize the need to work closely with governments and the wider industry to address these issues. Several local and international firms have taken several initiatives in the country to promote security and trust regarding mobile phone usage for e-commerce transactions, including Mobile Connect, which has a fast, secure login system that enables individuals to access their online accounts with one click. It provides different levels of security, from low-level website access to highly secure bank-grade authentication.

France Cyber Security Industry Overview

The cybersecurity market is semi-consolidated, with the presence of a few major companies. Companies are continuously investing in strategic partnerships and product developments to gain more market share.

- May 2024: Fortinet announced a new next-generation firewall (NGFW) appliance with the industry-leading security and networking performance needed to serve as the backbone of the modern campus. These features enable organizations to efficiently support and secure the growing volume of data-rich traffic and cloud-based applications within campus environments.

- October 2023: IBM launched a new evolution of its managed detection and response services with the introduction of advanced technologies, such as artificial intelligence and automatic escalation or closure of up to 85% of alerts, which help speed up client security response times. The Threat Detection and Response ServicesTM provides 24x7 monitoring, investigation, and automated remediation of security alerts from all the relevant technologies in a client's hybrid cloud environment, including existing security tools.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Digitalization and Scalable IT Infrastructure

- 5.1.2 Need to Tackle Risks from Various Trends such as Third-party Vendor Risks, the Evolution of MSSPs, and Adoption of Cloud-first Strategy

- 5.2 Market Restraints

- 5.2.1 Lack of Cybersecurity Professionals

- 5.2.2 High Reliance on Traditional Authentication Methods and Low Preparedness

- 5.3 Trends Analysis

- 5.3.1 Organizations in France Increasingly Leveraging AI to Enhance their Cyber Security Strategy

- 5.3.2 Exponential Growth to be Witnessed in Cloud Security Owing to Shift Toward Cloud-based Delivery Model

6 MARKET SEGMENTATION

- 6.1 By Offering

- 6.1.1 Security Type

- 6.1.1.1 Cloud Security

- 6.1.1.2 Data Security

- 6.1.1.3 Identity Access Management

- 6.1.1.4 Network Security

- 6.1.1.5 Consumer Security

- 6.1.1.6 Infrastructure Protection

- 6.1.1.7 Other Types

- 6.1.2 Services

- 6.1.1 Security Type

- 6.2 By Deployment

- 6.2.1 Cloud

- 6.2.2 On-premise

- 6.3 By End User

- 6.3.1 BFSI

- 6.3.2 Healthcare

- 6.3.3 Manufacturing

- 6.3.4 Government & Defense

- 6.3.5 IT and Telecommunication

- 6.3.6 Other End Users

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Cisco Systems Inc.

- 7.1.3 Dell Technologies Inc.

- 7.1.4 Fortinet Inc.

- 7.1.5 Intel Security (Intel Corporation)

- 7.1.6 F5 Networks Inc.

- 7.1.7 AVG Technologies

- 7.1.8 IDECSI Enterprise Security

- 7.1.9 FireEye Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219