|

市场调查报告书

商品编码

1683948

汽车 LED 照明:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Automotive LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

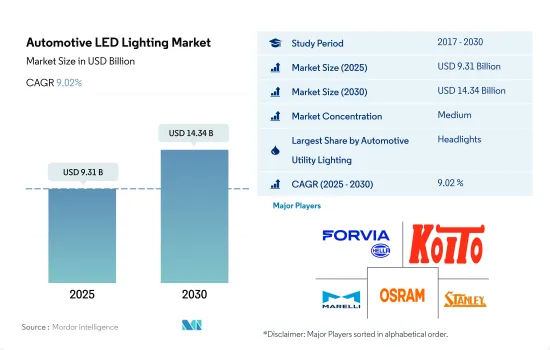

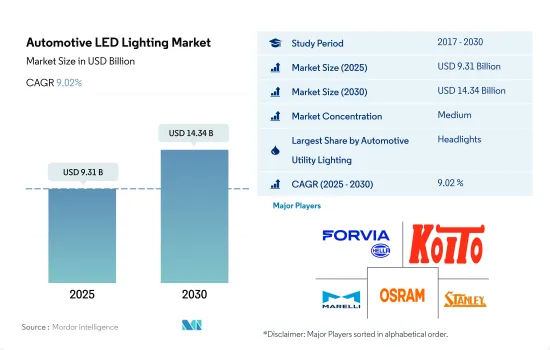

预计2025年汽车LED照明市场规模为93.1亿美元,2030年将达到143.4亿美元,预测期间(2025-2030年)的复合年增长率为9.02%。

事故率上升、电动车需求成长以及政府支持政策正在推动市场成长

- 就金额份额而言,2022 年前照灯将占据大部分市场占有率(51.8%),其次是其他 (小型 LED 灯、LED 牌照灯、雾灯、内部 LED 灯)、转向灯 (DSL)、日间行车灯和煞车灯。预计未来头灯领域将占据较高的市场占有率。随着事故数量的增加, LED灯和头灯的采用率预计也将增加。全球每年约有130万人死于道路交通事故。

- 从出货量份额来看,2023年DSL将占大部分市场占有率(27.9%),其次是头灯(17.7%)、其他(小型LED灯、LED牌照灯、雾灯、车内LED灯)(16.4%)和煞车灯。预测期内,所有细分市场的市场占有率预计将保持稳定,其他细分市场和煞车灯细分市场的份额将略有下降,而 DSL 和头灯细分市场的份额将有所增长。外部灯光(主要是信号灯)在所有类型的车辆中都可能受到影响,需要更换。

- 电动车是全球汽车LED需求快速成长的主要驱动力之一。中国将引领电动车市场,占2022年全球电动车销量的60%,其次是欧洲和美国,分别达到15%和55%的强劲成长。

- 欧盟的「Fit for 55」计画和美国的「抑制通膨法案」等主要国家的雄心勃勃的政策计画预计将提升电动车的市场占有率。市场主要参与者也正致力于在已开发国家扩建电动车工厂。

电动车、自动驾驶汽车的成长以及政府奖励预计将推动汽车产业对 LED 灯的采用。

- 从金额份额来看,2022年亚太地区将占据汽车LED照明市场的主导地位,其次是北美和欧洲。预计 2029 年亚太地区的市场份额将会增加,因为大多数亚洲国家(即中国、日本、泰国、台湾、马来西亚和印度)都推出了保护国内市场占有率和为汽车製造商提供优惠待遇等激励奖励来促进汽车行业的发展。

- 从销售份额来看,2022年亚太地区将占据汽车LED照明市场的大部分份额,其次是欧洲和北美。在欧洲,电动车的兴起和车辆所用燃料类型的技术进步正在改变该地区的汽车工业。目前,欧盟电池式电动车销量正在快速成长。例如,2022年欧盟市场上销售的910万辆汽车中,有12.1%是纯电动车。相较之下,2019 年这一比例仅 1.9%,2021 年则为 9.1%。

- 电气化是全球汽车产业正在经历的最大转型。另一个趋势是自动驾驶汽车。重要的是,该技术有助于汽车公司实现碳中和目标。中东是日产的重要市场。许多现代汽车变得更聪明、更互联。它将配备与日产 Ariya 类似的智慧移动和自动驾驶功能。该地区的其他地区也正在发生类似的转变。因此,该地区汽车产业的成长可能会推动LED市场的渗透。

全球汽车LED照明市场趋势

电动车需求增加预计将推高市场价值

- 预计 2022 年全球汽车产量将达到 1.4396 亿辆,2023 年将达到 1.5092 亿辆。收集到的资料显示,2020 年全球汽车产量将下降 16%,而 2019 年全球汽车产量已下降了约 5%。欧洲平均降幅超过21%。所有主要生产国的降幅均约11%至40%。欧洲製造业约占总产量的22%。 2020年,美洲地区的汽车产量占全球产量的20%。美洲大陆的製造业已暴跌35%以上。同时,亚洲表现良好,降幅仅 10%。根据提供的数据,COVID-19 疫情对汽车产业产生了重大影响,减少了对 LED 的需求。

- 大众集团、Stellantis、梅赛德斯-奔驰、宝马、保时捷、Hurtan、GTA Motors、奥迪、塔塔汽车、马恆达、上汽汽车、现代汽车、起亚汽车、KG Mobility 和雷诺韩国汽车是世界上一些主要的汽车製造公司。预计2022年全球电动车销量将突破1,000万辆,2023年将成长35%,达到1,400万辆。这种快速扩张使得电动车的市场占有率从2020年的4%上升到2022年的14%。此外,随着电动车越来越受欢迎,每辆车将拥有比传统汽车更多的处理器,这将推动对车载半导体晶片的需求。预计LED照明市场将受益于汽车产业对半导体日益增长的需求。

电池更换站和电池回收服务店的增加以及对电动车的需求不断增长预计将推动市场成长。

- 电动车市场正在迅速扩张,预计到 2022 年销量将超过 1,000 万辆。 2022 年,电动车将占所有新车销量的 14%,高于 2021 年的 9% 左右和 2020 年的不到 5%。全球销售由三个市场推动。中国处于领先地位,占全球电动车销量的近60%。中国占全球电动车保有量的一半以上,政府已超额完成了2025年新能源车销售目标。

- 至2022年,全国将拥有换电站1973座(其中2022年建成675座),动力电池回收服务门市将超过10,000家。因此,充电设施的快速增加表明该国新能源汽车(NEV)产业的蓬勃发展。 2022年10月,德国政府宣布了加强电动车充电基础设施的计画。该计划包括一项耗资 63 亿欧元(61.7 亿美元)的提案,旨在到 2030 年将全国充电站的数量增加到 100 万个。

- 在主要市场中,2022 年的电动车销量处于典型的低水平,但印度、泰国和印尼却经历了成长的一年。这些国家的电动车销量自2021年以来成长了两倍多,达到8万辆。在美国,通货膨胀削减法案(IRA)加上许多州采用加州的《高级清洁汽车 II》法规,很可能会使电动车的市场占有率到 2030 年达到 50%,与国家目标一致。考虑到上述案例,预计全球各大厂商将进一步增加对车用LED研发和生产的投资。

汽车 LED 照明产业概况

汽车LED照明市场格局适度整合,前五大厂商占51.31%。该市场的主要企业有:HELLA GmbH & Co. KGaA (FORVIA)、KOITO MANUFACTURING、Marelli Holdings、OSRAM GmbH。以及史丹利电气(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 汽车产量

- 人口

- 人均收入

- 汽车贷款利率

- 充电站数量

- 行驶车辆数

- LED进口总量

- 家庭数量

- 道路网络

- 渗透率

- 法律规范

- 阿根廷

- 巴西

- 中国

- 法国

- 德国

- 波湾合作理事会

- 印度

- 日本

- 南非

- 韩国

- 西班牙

- 英国

- 美国

- 价值链与通路分析

第五章 市场区隔

- 汽车实用照明

- 日间行车灯 (DRL)

- 转向指示灯

- 头灯

- 倒车灯

- 红绿灯

- 尾灯

- 其他的

- 汽车照明

- 二轮车

- 商用车

- 搭乘用车

- 地区

- 亚太地区

- 欧洲

- 中东和非洲

- 北美洲

- 南美洲

第六章 竞争格局

- 主要策略趋势

- 市场占有率分析

- 业务状况

- 公司简介(包括全球概况、市场层级概况、主要业务部门、财务状况、员工人数、关键资讯、市场排名、市场占有率、产品和服务、最新发展分析)

- GRUPO ANTOLIN IRAUSA, SA

- HELLA GmbH & Co. KGaA(FORVIA)

- Hyundai Mobis

- KOITO MANUFACTURING CO., LTD.

- Marelli Holdings Co., Ltd.

- Nichia Corporation

- OSRAM GmbH.

- Signify(Philips)

- Stanley Electric Co., Ltd.

- Valeo

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源和进一步阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 50001646

The Automotive LED Lighting Market size is estimated at 9.31 billion USD in 2025, and is expected to reach 14.34 billion USD by 2030, growing at a CAGR of 9.02% during the forecast period (2025-2030).

The rising accident rates, growing demand for EVs, and supportive government policies drive the market's growth

- In terms of value share, in 2022, headlights accounted for most of the market share (51.8%), followed by others (miniature LED lights, LED license plate lights, fog Lights, and interior LED lights), directional signal lights (DSLs), day time running lights, and stop lights. The headlights segment is expected to gain a higher market share in the future. Along with the rising number of accidents, the penetration rate of fog LED lamps and headlamps is anticipated to rise. Approximately 1.3 million people die each year as a result of road traffic crashes globally.

- In terms of volume share, in 2023, DSLs accounted for most of the market share (27.9%), followed by headlights (17.7%), others (miniature LED lights, LED license plate lights, fog Lights, and interior LED lights) (16.4%), and stop lights. The market share is expected to remain the same for all the segments during the forecast period, with a slight reduction in the others and stop lights segment and an increase in the DSLs and headlights segments. External lights (primarily signal lights) are highly likely to be affected in minor to major accidents in all types of vehicles and require replacement.

- EVs are one of the primary drivers for the surging demand for automotive LEDs globally. China led the EV market, accounting for 60% of global electric car sales in 2022, followed by Europe and the United States, which saw strong sales growth of 15% and 55%, respectively.

- The ambitious policy programs in major economies, such as the Fit for 55 package in the European Union and the Inflation Reduction Act in the United States, are expected to boost the market share of EVs. Key players in the market are also focusing on expanding their EV plants in developed nations.

Growth in EVs, autonomous vehicles, and government incentives are expected to boost the adoption of LED lights in the automotive industry

- In terms of value share, the Asia-Pacific automotive LED lighting market accounted for the majority share in 2022, followed by North America and Europe, respectively. The market share is expected to increase for Asia-Pacific in 2029, as most of the six Asian countries, such as China, Japan, Thailand, Taiwan, Malaysia, and India, have introduced incentives such as protecting their domestic markets and giving preferential treatment to automakers in promoting their automobile industries.

- In terms of volume share, the Asia-Pacific automotive LED lighting market accounted for the majority share in 2022, followed by Europe and North America. In Europe, the rise of electric vehicles and technological advances in the types of fuels used in vehicles are transforming the region's automotive industry. Sales of battery electric vehicles in the European Union are still growing rapidly. For example, 12.1% of the 9.1 million cars sold on the EU market in 2022 were pure battery electric vehicles. By contrast, in 2019, this share was just 1.9%, and in 2021 it was 9.1%.

- Electrification is the most significant transformation the industry is undergoing worldwide. Another trend rising is autonomous vehicles. It is important to note that technology contributes to auto companies' carbon-neutral goals. The Middle East is an important market for Nissan. Many modern vehicles are getting smarter and more connected. It will be equipped with intelligent mobility and autonomous driving, similar to the Nissan Ariya. Such transformations are undertaken in other parts of the region. Thus, growth in the regional automotive segment may increase the penetration of LEDs in the market.

Global Automotive LED Lighting Market Trends

The increasing demand for EVs is anticipated to raise the market value

- The total automobile production globally was 143.96 million units in 2022, and it was expected to reach 150.92 million units in 2023. The gathered data indicated a 16% reduction in the manufacturing of automotive cars in 2020, following a dismal 2019, which already showed a noticeable decline of roughly 5% in global auto output. The average decline across all of Europe was more than 21%. Sharp decreases in all major producing nations ranged from 11% to roughly 40%. Manufacturing in Europe accounted for roughly 22% of the total production. Vehicle manufacturing in the Americas accounted for 20% of global production in 2020. The African continent had a severe decrease of more than 35% in manufacturing. Asia, on the other hand, held up very well, with a decline of only 10%. According to the numbers provided, the COVID-19 pandemic had a tremendous impact on the automotive industry, which decreased the demand for LEDs.

- Volkswagen Group, Stellantis, Mercedes-Benz, BMW, Porsche, Hurtan, GTA Motors, Audi, TATA Motors, Mahindra & Mahindra, SAIC Motor, Hyundai Motor Company, Kia Corporation, KG Mobility, and Renault Korea Motors are the major automotive manufacturing companies globally. In 2022, there were more than 10 million electric vehicle sales worldwide, and the sales in 2023 were anticipated to increase by another 35% to a total of 14 million. Due to this rapid expansion, the market share of electric automobiles increased from 4% in 2020 to 14% in 2022. In addition, as more electric vehicles are being used, there is a rising demand for automotive semiconductor chips because they require more processors per vehicle than conventional cars. The market for LED lighting is expected to benefit from the increase in semiconductor demand in the automobile industry.

The increasing number of battery swapping stations and battery recycling service outlets and the rising demand for EVs are expected to drive the growth of the market

- The EV markets are expanding at an exponential rate, with sales exceeding 10 million in 2022. In 2022, electric vehicles accounted for 14% of all new vehicle sales, up from roughly 9% in 2021 and less than 5% in 2020. Global sales were led by three markets. China was the leader, accounting for almost 60% of global electric vehicle sales. China accounts for more than half of all the electric vehicles on the road worldwide, and the government has already exceeded its 2025 target for new energy vehicle sales.

- By 2022, China had 1,973 battery swapping stations, including 675 built in 2022 and over 10,000 power battery recycling service outlets. Thus, the rapid growth of charging facilities indicates the booming new energy vehicle (NEV) sector in the country. In October 2022, the German government unveiled plans to boost charging infrastructure for electric vehicles. The plan consisted of a EUR 6.3 billion (USD 6.17 billion) proposal that would increase the number of charging points across the country to 1 million by 2030.

- In major markets, electric car sales were normally low in 2022, but it was a growth year in India, Thailand, and Indonesia. Sales of electric vehicles in these countries more than tripled since 2021, reaching 80,000 units. In the United States, the Inflation Reduction Act (IRA), combined with a number of states adopting California's Advanced Clean Cars II rule, is likely to produce a 50% market share for electric cars in 2030, in line with the national target. Considering the abovementioned instances, key manufacturers across the world are expected to invest more in developing and producing automotive LEDs.

Automotive LED Lighting Industry Overview

The Automotive LED Lighting Market is moderately consolidated, with the top five companies occupying 51.31%. The major players in this market are HELLA GmbH & Co. KGaA (FORVIA), KOITO MANUFACTURING CO., LTD., Marelli Holdings Co., Ltd., OSRAM GmbH. and Stanley Electric Co., Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Automotive Production

- 4.2 Population

- 4.3 Per Capita Income

- 4.4 Interest Rate For Auto Loans

- 4.5 Number Of Charging Stations

- 4.6 Number Of Automobile On-road

- 4.7 Total Import Of Leds

- 4.8 # Of Households

- 4.9 Road Networks

- 4.10 Led Penetration

- 4.11 Regulatory Framework

- 4.11.1 Argentina

- 4.11.2 Brazil

- 4.11.3 China

- 4.11.4 France

- 4.11.5 Germany

- 4.11.6 Gulf Cooperation Council

- 4.11.7 India

- 4.11.8 Japan

- 4.11.9 South Africa

- 4.11.10 South Korea

- 4.11.11 Spain

- 4.11.12 United Kingdom

- 4.11.13 United States

- 4.12 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Automotive Utility Lighting

- 5.1.1 Daytime Running Lights (DRL)

- 5.1.2 Directional Signal Lights

- 5.1.3 Headlights

- 5.1.4 Reverse Light

- 5.1.5 Stop Light

- 5.1.6 Tail Light

- 5.1.7 Others

- 5.2 Automotive Vehicle Lighting

- 5.2.1 2 Wheelers

- 5.2.2 Commercial Vehicles

- 5.2.3 Passenger Cars

- 5.3 Region

- 5.3.1 Asia-Pacific

- 5.3.2 Europe

- 5.3.3 Middle East and Africa

- 5.3.4 North America

- 5.3.5 South America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 GRUPO ANTOLIN IRAUSA, S.A.

- 6.4.2 HELLA GmbH & Co. KGaA (FORVIA)

- 6.4.3 Hyundai Mobis

- 6.4.4 KOITO MANUFACTURING CO., LTD.

- 6.4.5 Marelli Holdings Co., Ltd.

- 6.4.6 Nichia Corporation

- 6.4.7 OSRAM GmbH.

- 6.4.8 Signify (Philips)

- 6.4.9 Stanley Electric Co., Ltd.

- 6.4.10 Valeo

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219