|

市场调查报告书

商品编码

1906230

欧洲IT服务:市场占有率分析、产业趋势与统计、成长预测(2026-2031年)Europe IT Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

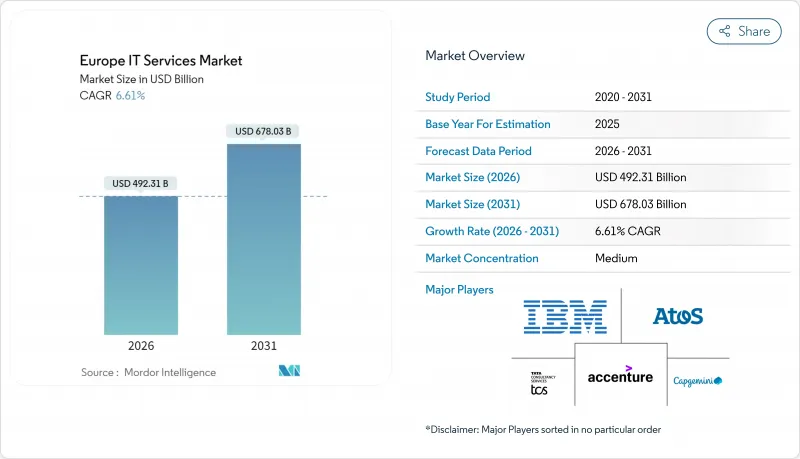

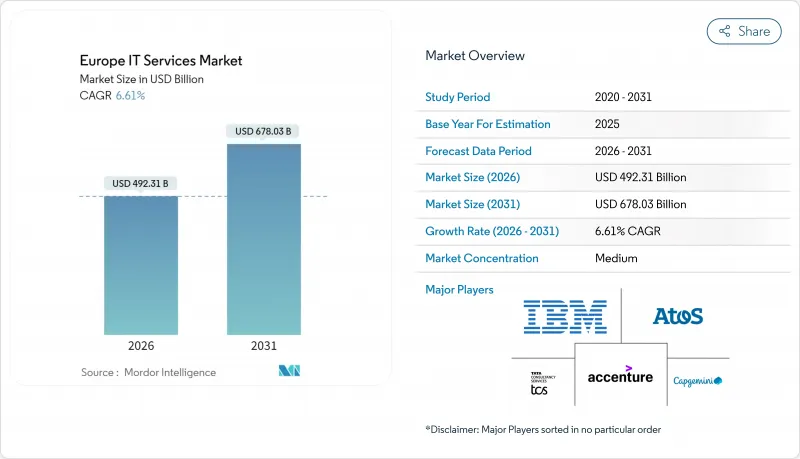

2025年欧洲IT服务市场价值4,618亿美元,预计到2031年将达到6,780.3亿美元,高于2026年的4,923.1亿美元。

预计在预测期(2026-2031 年)内,复合年增长率将达到 6.61%。

SAP 和传统 ERP 系统在 2027 年生命週期结束前进行快速现代化改造,正在加速大规模转型计画的实施,尤其是在德国、荷兰和法国。欧盟企业永续发展报告指令 (CSR) 推动了超过 51,000 家公司对 ESG 相关咨询和资讯服务的需求。人工智慧 (AI) 立法的同步实施,促使预算重新分配给 AI 驱动的供应商选择框架,该框架将资料主权管理与管理安全性和股权相结合。私募股权整合(每季宣布的交易额超过 1000 万美元)正在重塑竞争格局,推动跨国併购,并深化服务组合。

欧洲IT服务市场趋势与洞察

企业云端迁移的快速成长

超过99%的欧洲企业已将云端投资列为优先事项,显示云端采用已从成本效益转向策略必要性。人工智慧就绪是关键驱动因素,78%计划进行云端支出以支援未来机器学习工作负载的组织都提到了这一点。儘管如此紧迫,欧洲企业仅实现了既定云端转型目标的32%,这给欧洲IT服务市场的供应商留下了巨大的执行差距。遵守GDPR和人工智慧相关法律法规需要现代化的资料管治框架,这促使客户转向具有自主云端选项(例如GAIA-X)的云端原生架构。因此,与超大规模资料中心业者云端服务供应商的伙伴关係在于区域可用区和联合合规蓝图,以在满足自主规则的同时加速迁移。

对成本优化的ITO和BPO合约的需求

宏观经济压力正促使经营团队将工作重心从创新转向可衡量的成本节约,导致外包合约的投资回收期缩短至18个月或更短。瑞典的薪资成长率已达12%,其他地区也实现了两位数的成长,企业正将交付业务转移到中欧和东欧成本更低的近岸地区。建设-营运-移交(BOT)模式是一种混合模式,既能即时节省成本,又能实现未来的所有权转移,因此在规避风险的欧洲财务高管中越来越受欢迎。私募股权基金抓住了这一趋势,在管理服务收购中占据了60%的份额,在确保成本结构稳健的同时,也为欧洲IT服务市场带来了规模效应。那些展现出合约柔软性(短期合约、基于绩效的定价和协作管治)的供应商正在赢得不成比例的新客户份额。

主要服务场所面临劳动力短缺和薪资上涨的问题

约58%的欧盟企业表示难以招募资讯通信技术(ICT)专业人员,这项短缺状况在过去十年中加剧了20%。光是德国就需要额外31万名STEM(科学、技术、工程和数学)人才,而瑞典软体工作的起薪预计到2022年将上涨12%,达到每月4,000欧元(约4,520美元)。劳动市场紧张推高了交付成本,并挤压了严重依赖本土能力的欧洲IT服务供应商的利润空间。供应商正透过投资大规模技能提升专案来应对这项挑战(例如,Infosys正在为27.5万名员工提供人工智慧培训)。然而,技能提升週期比客户需求落后几季。除非近岸和离岸人才库扩大,否则持续的薪资压力可能会抵消高达1.4个百分点的预期复合年增长率。

细分市场分析

至2025年,IT咨询和实施服务将占欧洲IT服务市场的27.32%,凸显其在应对SAP S/4HANA迁移和监管要求的重要性。随着客户依赖咨询顾问设计目标营运模式、供应商选择标准和变更管理蓝图,咨询服务的需求将保持稳定成长。同时,受特定产业要求(例如NIS2和持续合规性监控)的推动,资安管理服务将以8.27%的复合年增长率实现最快成长。在预测期内,云端平台服务将提升对多学科技能的需求,使服务提供者能够将迁移、现代化和安全性整合到单一合约中。这种整合将增强现有企业的市场份额,同时也将吸引专注于人工智慧伦理审核等高成长细分市场的专业精品新参与企业。

当IT外包与自动化措施结合,且这些措施能将成本服务比降低两位数时,其价值将得以维持。在欧洲IT服务市场,人工智慧辅助文件处理正对业务流程外包的市场规模产生影响,该技术已将错误率降低至1%以下,并增加了对流程重组专家的需求。策略性收购——Capgemini SA以33亿美元收购WNS以及CGI收购Apside——显示了企业旨在深化垂直领域专业知识,并巩固其在价格主导中抵御竞争对手的优势。

到2025年,大型企业将占据欧洲IT服务市场64.23%的份额,其主导地位源自于多年期的现代化蓝图和严格的合规义务,这些义务要求其选择一流的合作伙伴。这些客户持续签署巨额合同,例如Wipro与Phoenix Group达成的6.5亿美元交易,便充分体现了其规模和购买力。然而,中小企业市场正以每年8.74%的速度成长,并透过云端优先订阅模式带来的更快价值实现速度,缩小与大型企业在能力上的差距。

政府补贴,例如「数位欧洲计画」代金券,可为符合条件的中小企业覆盖高达 50% 的转型成本,进一步加速了转型进程。北欧国家正在扩大网路安全审核的税额扣抵,引导更多支出流向託管服务。服务提供者正在客製化模组化产品,例如收费套餐、按需付费的基础设施和共享首席资讯安全长 (CISO) 服务,以适应有限的预算。随着这一领域的成熟,预计到 2031 年,中小企业在欧洲 IT 服务市场的渗透率将占总收入的 3.95 个百分点。

欧洲IT服务报告按服务类型(IT咨询、实施及其他)、最终用户公司规模(中小企业、大型企业)、实施模式(境内、近岸及其他)、最终用户行业(金融、保险、证券、製造、政府、公共部门及其他)和国家(英国、德国、法国及其他)进行细分。市场预测以以金额为准。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 企业云端迁移的快速成长

- 对成本优化的ITO和BPO合约的需求

- 欧盟范围内的《网路威胁指令》过渡到託管安全

- 人工智慧驱动的供应商选择平台加速外包

- 在SAP和传统ERP系统于2027年停止服务之前,对其进行现代化改造的需求日益增长。

- 与欧盟企业永续性报告指令 (CSRD) 相关的 ESG 报告服务正在推动咨询服务的需求。

- 市场限制

- 主要配送地点劳动力短缺和工资上涨

- 地缘政治资料主权障碍(Schrems II,人工智慧法)

- 宏观经济的不确定性延长了消费者的决策週期

- 加强对高能耗资料中心的碳足迹处罚

- 产业价值链分析

- 宏观经济因素的影响

- 重要法规结构评估

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 产业间竞争

第五章 市场规模与成长预测

- 按服务类型

- IT咨询与实施支持

- IT外包(ITO)

- 业务流程外包(BPO)

- 资安管理服务

- 云端和平台服务

- 按最终用户公司规模划分

- 中小企业

- 大公司

- 按部署模式

- 陆上交付

- 近岸交付

- 离岸交付

- 按最终用户行业划分

- BFSI

- 製造业

- 政府/公共部门

- 医疗保健和生命科学

- 零售和消费品

- 通讯与媒体

- 物流/运输

- 能源与公共产业

- 其他终端用户产业

- 按国家/地区

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 荷兰

- 北欧国家(瑞典、丹麦、芬兰、挪威)

- 其他欧洲地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Accenture plc

- Capgemini SE

- IBM Consulting

- Atos SE

- Tata Consultancy Services Limited

- Cognizant Technology Solutions Corporation

- Infosys Limited

- Wipro Limited

- CGI Inc.

- Sopra Steria Group SA

- DXC Technology Company

- NTT DATA Europe and LATAM

- Tietoevry Oyj

- EVRYTHNG Group AB

- Fujitsu Services Ltd

- Orange Business Services

- Swisscom Ltd(Enterprise Services)

- Telefonica Tech

- GFT Technologies SE

- Reply SpA

- Endava plc

- Luxoft(DXC Technology)

- Kyndryl Holdings, Inc.

- HCLTech Ltd

- NCC Group plc

第七章 市场机会与未来展望

The European IT services market was valued at USD 461.80 billion in 2025 and estimated to grow from USD 492.31 billion in 2026 to reach USD 678.03 billion by 2031, at a CAGR of 6.61% during the forecast period (2026-2031).

Rapid SAP and legacy ERP modernization ahead of the 2027 support sunset is accelerating large-scale transformation programs, especially in Germany, the Netherlands, and France. The EU Corporate Sustainability Reporting Directive is expanding demand for ESG-linked consulting and data services across more than 51,000 companies. Parallel enforcement of the AI Act is redirecting budgets toward managed security and AI-driven vendor-selection frameworks that integrate transparency and data-sovereignty controls. Private-equity-backed consolidation, with disclosed deals exceeding USD 10 million each quarter, is reshaping competitive dynamics and stimulating cross-border M&A that deepens service portfolios.

Europe IT Services Market Trends and Insights

Surging Enterprise-Wide Cloud Migration

More than 99% of European enterprises prioritize cloud investment, signaling that cloud adoption has moved from cost efficiency to strategic necessity. AI readiness is the leading motivator, cited by 78% of organizations planning cloud spend that aligns with future machine-learning workloads. Despite this urgency, European firms have achieved only 32% of their stated cloud-transformation goals, leaving a sizable execution gap for providers in the European IT services market. GDPR and AI Act compliance require modern data-governance frameworks, pushing clients toward cloud-native architectures with sovereign-cloud options such as GAIA-X. As a result, hyperscaler partnerships now emphasize regional availability zones and joint compliance blueprints that accelerate migration while satisfying sovereignty rules.

Demand for Cost-Optimized ITO and BPO Contracts

Macroeconomic pressure has shifted boardroom priorities from innovation to measurable savings, driving a wave of renegotiated outsourcing deals that aim for payback within 18 months. Salary inflation reached 12% in Sweden and double-digit levels elsewhere, encouraging enterprises to rebalance delivery footprints toward lower-cost nearshore hubs in Central and Eastern Europe. Build-Operate-Transfer models are gaining favor because they combine immediate savings with eventual captive ownership, a hybrid that resonates with risk-averse European finance chiefs. Private-equity funds have noticed this pattern and now account for 60% of managed-services acquisitions, adding scale to the European IT services market while guaranteeing disciplined cost structures. Providers that demonstrate contractual flexibility-shorter tenures, outcome-based pricing, and joint governance-win a disproportionate share of new logos.

Talent Scarcity and Wage Inflation in Key Delivery Hubs

Nearly 58% of EU businesses report difficulty hiring ICT specialists, and shortages have risen 20% in the past decade. Germany alone needs 310,000 additional STEM professionals, while Sweden's entry-level software salaries touched EUR 4,000 (USD 4,520) per month after a 12% rise since 2022. Tight labor markets inflate delivery costs, squeezing margins for providers heavily weighted toward onshore capacity in the European IT services market. Vendors respond by investing in large-scale upskilling programs-Infosys, for example, has trained 275,000 employees in AI-but reskilling cycles lag client demand by several quarters. Persistent wage pressure could offset as much as 1.4 percentage points from forecast CAGR unless nearshore and offshore talent pools expand.

Other drivers and restraints analyzed in the detailed report include:

- Shift to Managed Security Amid EU-Wide Cyber-Threat Directives

- AI-Driven Vendor-Selection Platforms Accelerating Outsourcing

- Geopolitical Data-Sovereignty Barriers (Schrems II, AI Act)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

IT Consulting and Implementation opened 2025 with a 27.32% share of the European IT services market, underscoring its role in navigating SAP S/4HANA migrations and regulatory mandates. The advisory portfolio remains sticky because clients depend on consultants for target-operating-model design, vendor-selection criteria, and change-management roadmaps. Managed Security Services, however, records the fastest 8.27% CAGR, propelled by NIS2 and sector-specific directives that push continuous compliance monitoring. Over the forecast horizon, cloud-platform services amplify demand for multi-disciplinary skills, enabling providers to bundle migration, modernization, and security under one contract. This convergence reinforces wallet share for incumbents but also invites specialized boutique entrants that target high-growth niches such as AI-ethics audits.

IT outsourcing retains value when coupled with automation commitments that improve cost-to-serve ratios by double digits. The European IT services market size attached to business-process outsourcing is now influenced by AI-assisted document processing, which reduces error rates below 1% and elevates demand for process-re-engineering experts. Strategic acquisitions-Capgemini buying WNS for USD 3.3 billion, CGI absorbing Apside-signal intent to deepen vertical specialization and secure defensive moats against price-led challengers.

Large Enterprises controlled 64.23 of % European IT services market share in 2025, a dominance rooted in multi-year modernization roadmaps and exhaustive compliance obligations that necessitate tier-one partners. These clients continue to ink mega-deals-Wipro's USD 650 million Phoenix Group contract exemplifies scale and buying power. Yet the Small and Medium Enterprise segment is growing 8.74% annually, closing capability gaps through cloud-first subscriptions that compress time-to-value.

Government subsidies, such as Digital Europe Programme vouchers, subsidize up to 50% of qualified SME transformation costs, further accelerating adoption. Nordic programs extend tax credits for cybersecurity audits, funneling incremental spend toward managed services. Providers tailor modular offerings-bundled SaaS, pay-as-you-grow infrastructure, and fractional CISO services-to suit constrained budgets. As this cohort matures, SME penetration of the European IT services market is expected to add 3.95 percentage points to the aggregate revenue mix by 2031.

The Europe IT Services Report is Segmented by Service Type (IT Consulting and Implementation, and More), End-User Enterprise Size (Small and Medium Enterprises, and Large Enterprises), Deployment Model (Onshore, Nearshore, and More), End-User Vertical (BFSI, Manufacturing, Government and Public Sector, and More), and Country (United Kingdom, Germany, France, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Accenture plc

- Capgemini SE

- IBM Consulting

- Atos SE

- Tata Consultancy Services Limited

- Cognizant Technology Solutions Corporation

- Infosys Limited

- Wipro Limited

- CGI Inc.

- Sopra Steria Group SA

- DXC Technology Company

- NTT DATA Europe and LATAM

- Tietoevry Oyj

- EVRYTHNG Group AB

- Fujitsu Services Ltd

- Orange Business Services

- Swisscom Ltd (Enterprise Services)

- Telefonica Tech

- GFT Technologies SE

- Reply SpA

- Endava plc

- Luxoft (DXC Technology)

- Kyndryl Holdings, Inc.

- HCLTech Ltd

- NCC Group plc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging enterprise-wide cloud migration

- 4.2.2 Demand for cost-optimized ITO and BPO contracts

- 4.2.3 Shift to managed security amid EU-wide cyber-threat directives

- 4.2.4 AI-driven vendor selection platforms accelerating outsourcing

- 4.2.5 Corporate urgency to modernise SAP and legacy ERP before 2027 support sunset

- 4.2.6 EU CSRD-linked ESG reporting services boosting consulting demand

- 4.3 Market Restraints

- 4.3.1 Talent scarcity and wage inflation in key delivery hubs

- 4.3.2 Geopolitical data-sovereignty barriers (Schrems II, AI Act)

- 4.3.3 Prolonged client decision cycles due to macro-uncertainty

- 4.3.4 Rising carbon-footprint penalties on energy-intensive data centres

- 4.4 Industry Value Chain Analysis

- 4.5 Impact of Macroeconomic Factors

- 4.6 Evaluation of Critical Regulatory Framework

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Suppliers

- 4.8.3 Bargaining Power of Buyers

- 4.8.4 Threat of Substitutes

- 4.8.5 Industry Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service Type

- 5.1.1 IT Consulting and Implementation

- 5.1.2 IT Outsourcing (ITO)

- 5.1.3 Business Process Outsourcing (BPO)

- 5.1.4 Managed Security Services

- 5.1.5 Cloud and Platform Services

- 5.2 By End-User Enterprise Size

- 5.2.1 Small and Medium Enterprises (SMEs)

- 5.2.2 Large Enterprises

- 5.3 By Deployment Model

- 5.3.1 Onshore Delivery

- 5.3.2 Nearshore Delivery

- 5.3.3 Offshore Delivery

- 5.4 By End-User Vertical

- 5.4.1 BFSI

- 5.4.2 Manufacturing

- 5.4.3 Government and Public Sector

- 5.4.4 Healthcare and Life-Sciences

- 5.4.5 Retail and Consumer Goods

- 5.4.6 Telecom and Media

- 5.4.7 Logistics and Transport

- 5.4.8 Energy and Utilities

- 5.4.9 Other End-User Verticals

- 5.5 By Country

- 5.5.1 United Kingdom

- 5.5.2 Germany

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Netherlands

- 5.5.7 Nordics (Sweden, Denmark, Finland, Norway)

- 5.5.8 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Accenture plc

- 6.4.2 Capgemini SE

- 6.4.3 IBM Consulting

- 6.4.4 Atos SE

- 6.4.5 Tata Consultancy Services Limited

- 6.4.6 Cognizant Technology Solutions Corporation

- 6.4.7 Infosys Limited

- 6.4.8 Wipro Limited

- 6.4.9 CGI Inc.

- 6.4.10 Sopra Steria Group SA

- 6.4.11 DXC Technology Company

- 6.4.12 NTT DATA Europe and LATAM

- 6.4.13 Tietoevry Oyj

- 6.4.14 EVRYTHNG Group AB

- 6.4.15 Fujitsu Services Ltd

- 6.4.16 Orange Business Services

- 6.4.17 Swisscom Ltd (Enterprise Services)

- 6.4.18 Telefonica Tech

- 6.4.19 GFT Technologies SE

- 6.4.20 Reply SpA

- 6.4.21 Endava plc

- 6.4.22 Luxoft (DXC Technology)

- 6.4.23 Kyndryl Holdings, Inc.

- 6.4.24 HCLTech Ltd

- 6.4.25 NCC Group plc

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment